Trading Signals: How to Read and Understand Them

Signals, Trading

Sometimes, the trading market can be overwhelming since there is no way to confirm whether you make the right investment decisions. On the one hand, this uncertainty may be part of what makes trading appealing. On the other hand, however, there are some tools that you can use to guide your trading activities, like, for example, trading signals.

What are Trading Signals?

To sum up, those are triggers that send suggestions to alert you about trading opportunities arising on forex, indices, and commodities markets, telling you to buy or sell a security or other asset generated by analysis.

Such analysis is human-generated using technical indicators, or they can be delivered through mathematical algorithms. Those are based on market action, combined with other market factors like economic indicators and features.

In this article, you will learn what forex trading signals are, what are crypto trading signals and how you can read and understand them.

What are Forex Signals?

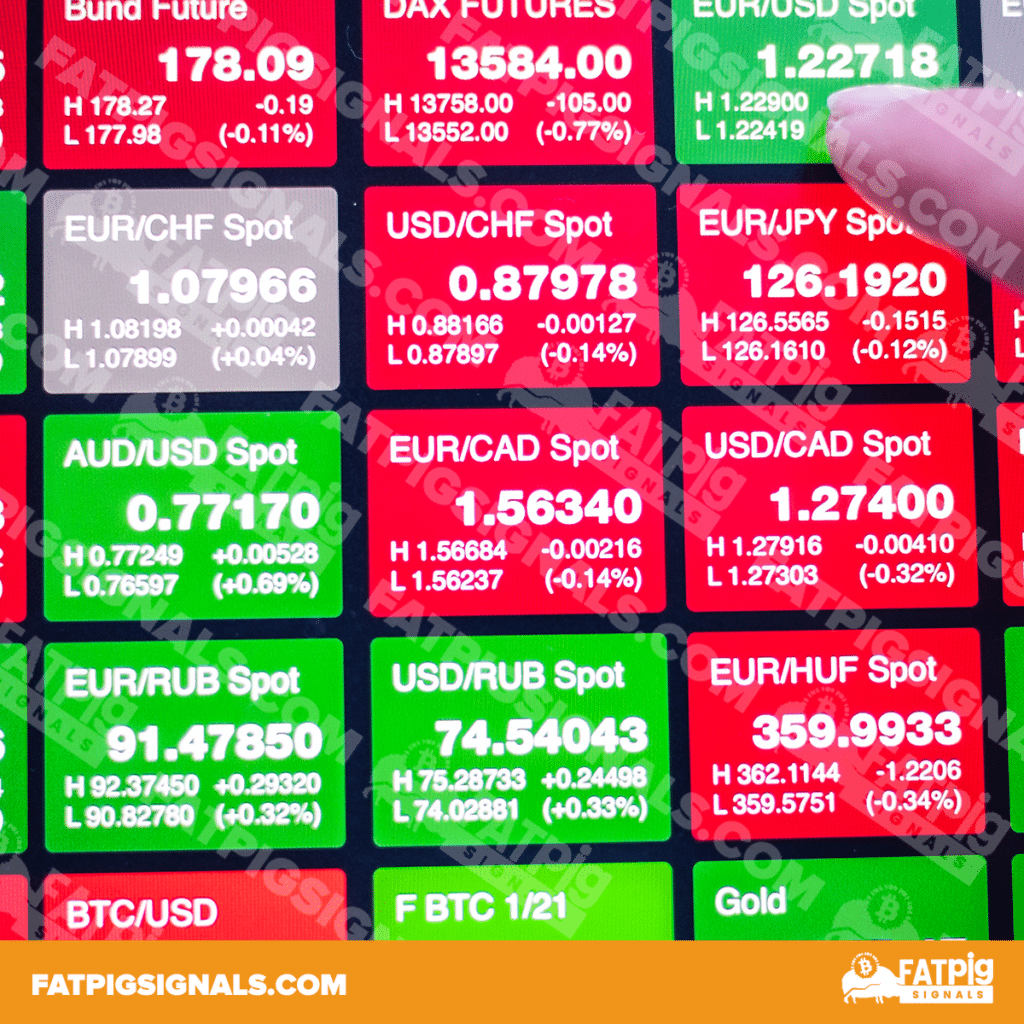

Forex trading signals are used to determine the right forex trading opportunities at the right moment. But what exactly are forex exchanges?

To summarize, forex exchange is when people change one currency into another for several reasons like commerce, trading, and tourism. So, it is a global marketplace where people change national currencies.

Forex markets are the largest and the most liquid assets market due to the worldwide reach of commerce, trade, and finance. Currencies are traded against each other as exchange rate pairs.

EUR/USD, for instance, is the currency pair for trading euros against U. S. dollars. Trades often use forex to hedge against interest rate risks and international currencies, diversify their portfolios, and speculate on geopolitical events, besides other reasons.

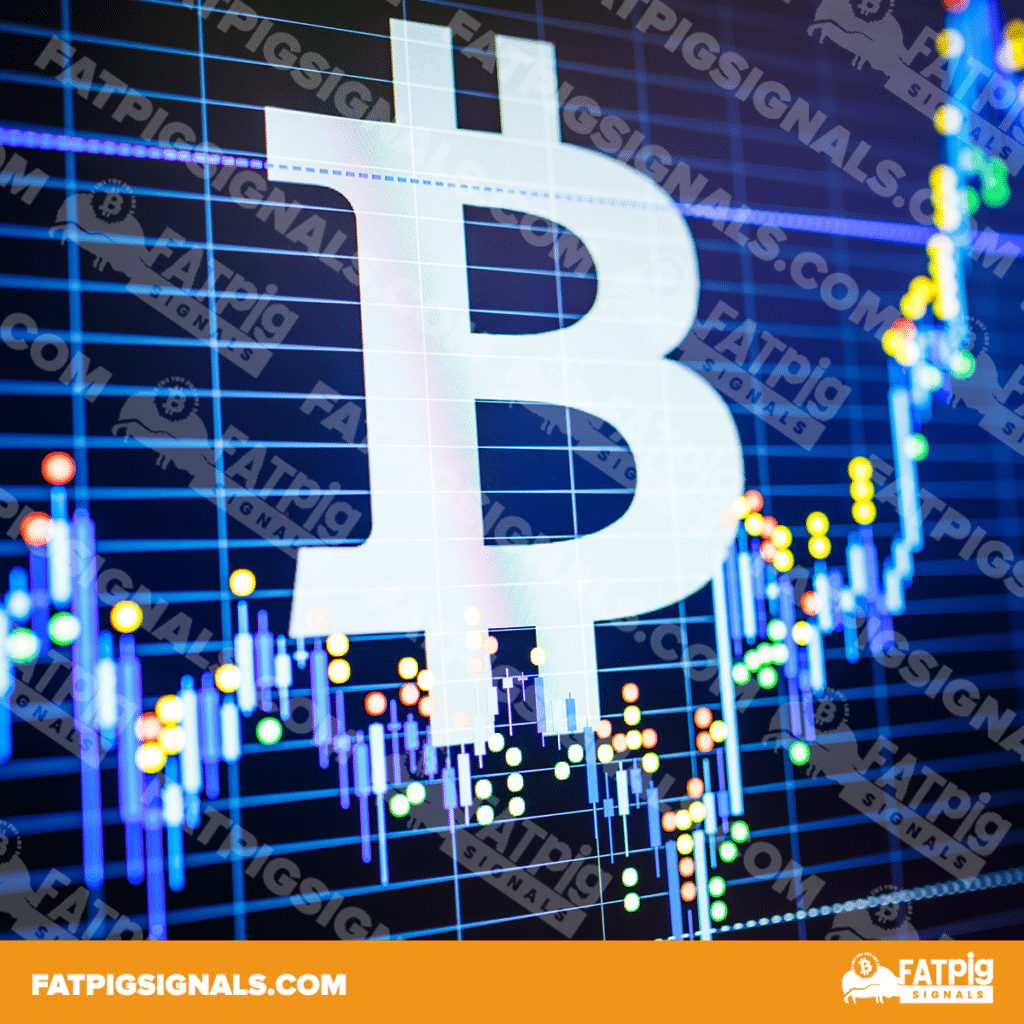

What are Crypto Trading Signals?

Crypto trading signals consist of trading ideas from expert traders who tell us to buy or sell a specific cryptocurrency. For example, Bitcoin aims to increase traders' profits and stop losses at a particular price or time.

Crypto trading signals are based on several factors like:

- News;

- Actual market environment;

- And technical analysis.

There are several crypto trading signals providers. Some are free, while others are paid through a monthly, quarterly, or yearly fee.

A reputable crypto trading signals provider will deliver information about taking profit and stopping losses.

How Exactly Can You Read Crypto Trading Signals?

When you receive the crypto trading signal, you can make a trade from that signal. When you know what the signals consist of, it is simple to read and interpret them.

Typically, the crypto trading signal consists of:

- Cryptocurrency – which cryptocurrency should you be buying;

- Buy – the price you are supposed to be buying;

- Sell – when you should sell/exit your position to make a profit;

- Stop Loss – the trade stop loss, for you to know when to exit the position if the trade is not well succeeded.

Hire a Good Crypto Signal Provider

As we mentioned before, there are several crypto trading signals providers. If you are not safe about reading trading signals, we advise you to hire a good provider.

- Sure, some providers offer free crypto signals on their crypto trading Telegram groups, but they usually do not have the same level of accuracy as the paid ones.

Fat Pig Signals

Fat Pig Signals provide a detailed technical analysis of the market and create reports that are sent via Telegram. This allows you to make trades based on expert suggestions.

The cryptocurrency market is 24 hours open. As a result, the value of several cryptocurrencies may shift up or down at any time. Using these small fluctuations, traders tend to make most of their profits.

- Traders need to scrutinize the past through technical analysis to anticipate these fluctuations. Technical analysis uses charts and graphs to examine the value of a currency during a particular time period.

It is necessary to use the correct time to detect statistical trends for short-term trading.

One may need to analyze trends across hours, days, weeks, or months. And what about you? Do you know how to read trading signals? Leave your comments below!