Swing Trading vs Day Trading: Which Strategy Is Right for You?

Bitcoin, Cryptocurrencies, Investment, Technology, Trading

Swing Trading vs Day Trading: Which Strategy Is Right for You?

Do I Need to Watch Charts All Day to Make Money?

If you’re new to crypto trading, you’ve probably asked yourself this: “Do I need to stare at charts all day, or can I trade more casually?”

That question usually leads beginners to two popular styles: day trading and swing trading. Both are valid ways to trade crypto, but they are very different in terms of time, stress, and skill level.

This topic matters right now because crypto markets move fast, trade 24/7, and attract beginners who often choose a strategy that doesn’t fit their lifestyle. By the end of this article, you’ll clearly understand what swing trading and day trading really mean, how they work in practice, and—most importantly—which one makes sense for you.

An Illustration showing the difference between Day Trading and Swing Trading.

What Is Day Trading?

Day trading means opening and closing a trade within the same day. You never hold a position overnight.

Think of it like food delivery work. You pick up an order, deliver it quickly, get paid, and move on. Everything happens fast, and timing matters a lot.

In crypto, a day trader might open a trade on Bitcoin at 10:00 AM and close it at 10:30 AM or 2:00 PM—always before the day ends

How Day Trading Works

Here’s the basic flow:

- You watch short timeframes (charts like 5-minute or 15-minute charts).

- You look for small price movements.

- You enter and exit quickly—sometimes within minutes.

- You repeat this multiple times in one day.

Example With Real Numbers

Imagine Bitcoin is trading at $60,000.

- You buy at $60,050

- You sell at $60,200

- Profit: $150 (before fees)

That might not sound huge, but day traders aim to do this many times, not just once.

Why People Choose Day Trading

Day trading attracts traders who like action and fast feedback:

- You don’t hold trades overnight

- You see results quickly

- You’re active and engaged every day

But here’s the honest truth… Day trading is mentally demanding and not beginner-friendly for most people.

What Is Swing Trading?

Swing trading means holding a trade for several days or even weeks to capture a bigger price move.

Think of it like planting a seed. You don’t dig it up every hour. You let it grow.

Instead of trying to catch every small move, swing traders focus on bigger trends in the market

How Swing Trading Works

Here’s the typical process:

- You analyze higher timeframes (4-hour, daily charts).

- You identify a trend (up or down).

- You enter a trade and let it run for days.

- You exit when the trend completes or your target is hit.

Example With Real Numbers

Let’s say Ethereum is trading at $3,000.

- You buy at $3,050

- You hold the trade for 7 days

- You sell at $3,400

- Profit: $350 per coin

Fewer trades—but larger moves.

Why Beginners Prefer Swing Trading

Swing trading is popular with beginners because:

- You don’t need to watch charts all day

- You have time to think and plan

- It’s less stressful than day trading

If you have a job, school, or other responsibilities, swing trading fits much better.

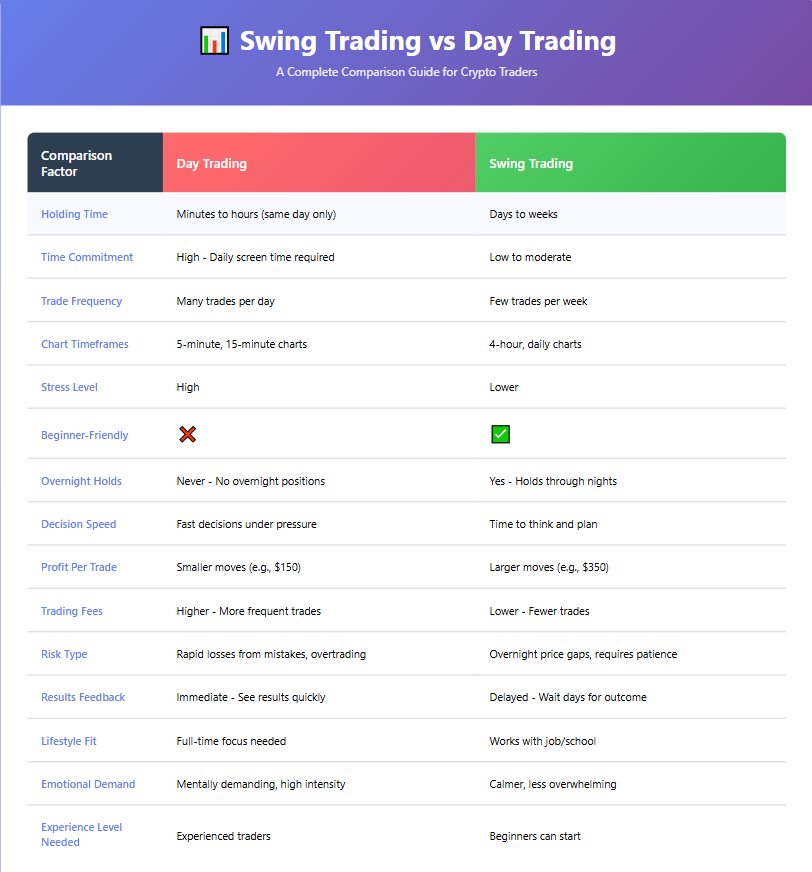

Key Differences Between Swing Trading and Day Trading

Let’s make this super clear.

At a Glance Comparison

- Holding time

- Day trading: Minutes to hours

- Swing trading: Days to weeks

- Time commitment

- Day trading: High (daily screen time)

- Swing trading: Low to moderate

- Trade frequency

- Day trading: Many trades per day

- Swing trading: Few trades per week

- Stress level

- Day trading: High

- Swing trading: Lower

- Beginner-friendly

- Day trading: More Beginner-Friendly

- Swing trading: More Advanced

Think of It Like This

- Day trading is like sprinting repeatedly

- Swing trading is like jogging at a steady pace

Both can get you fit—but only if the pace matches your ability.

Risk, Capital, and Emotional Reality

No matter which style you choose, trading involves risk. You can lose money. That’s not fear-mongering—it’s honesty.

Risk Differences You Should Know

- Day traders

- Face rapid losses if they make mistakes

- Often overtrade due to boredom or emotions

- Pay more fees because of frequent trades

- Swing traders

- Face overnight price gaps

- Must tolerate waiting and patience

- Risk larger moves but trade less often

Never risk money you can’t afford to lose.

Common Beginner Mistake

Trying to day trade because it “looks more profitable” on social media. Many beginners burn accounts because they copy fast traders without the skills or discipline.

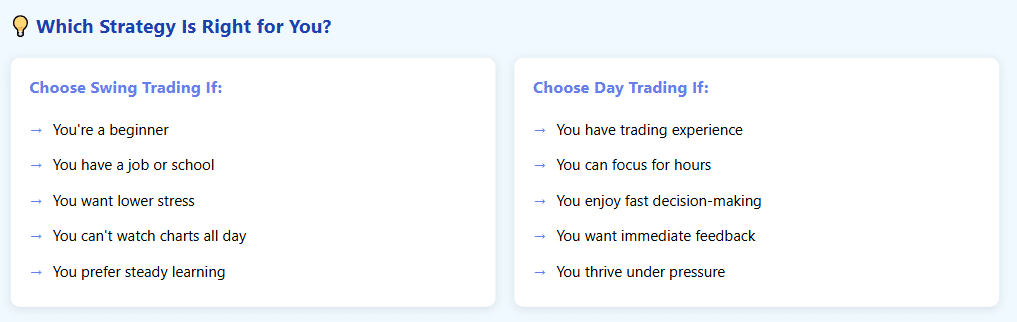

Which Strategy Is Right for You?

Ask yourself these honest questions:

- Do I have time to watch charts daily?

- Can I make fast decisions under pressure?

- Am I okay holding trades overnight?

- Do I want steady learning or instant action?

A Simple Guide

- Choose swing trading if:

- You’re a beginner

- You have a job or school

- You want lower stress

- Choose day trading if:

- You have experience

- You can focus for hours

- You enjoy fast decision-making

At Fat Pig Signals, most beginners start with swing-style signals because they’re easier to manage and less overwhelming. You’ll see this clearly when you join the Telegram community and observe how trades play out in real time.

Pro Tip Box

Start slow. Master one style before touching the other. Trying to swing trade and day trade at the same time usually leads to confusion and losses.

Quick Recap

Here’s what to remember:

- Day trading = fast, stressful, time-intensive

- Swing trading = slower, calmer, beginner-friendly

- Both styles involve risk and discipline

- Your lifestyle matters more than hype

- There is no “better” strategy—only a better fit

Conclusion & Next Steps

Swing trading and day trading are simply tools. One isn’t superior—the right one is the one you can actually follow consistently.

If you’re just starting out, swing trading is usually the safest and smartest entry point. You’ll learn market behavior, manage emotions, and build confidence without burning out.

What You Can Do Today

- Choose one style to focus on

- Start with small position sizes

- Follow structured signals and learn why trades work

If you want guided examples and real-time trade breakdowns, join the Fat Pig Signals Telegram community. You’ll see how disciplined trading looks in practice—and you won’t feel like you’re learning alone.

Trading is a journey. Go at a pace you can sustain. You’ve got this.