Why 90% Win Rate “Success” Is Unrealistic

Cryptocurrencies

If you’ve spent even a few minutes in crypto Twitter, Telegram, or YouTube, you’ve probably seen it:

“🔥 90% WIN RATE SIGNALS 🔥”

“Never lose again!”

“Just follow my trades!”

And naturally, you might be thinking: “If someone really wins 9 out of 10 trades, why wouldn’t I follow them?”

That question makes total sense — especially if you’re new to trading.

Right now, more beginners are entering crypto than ever before. Markets are fast, social media is loud, and everyone seems to be chasing perfect accuracy. That’s exactly why this topic matters now.

By the end of this article, you’ll understand:

- What a win rate really means (in simple terms)

- Why a 90% win rate sounds amazing but often hides danger

- The math that actually determines if you make or lose money

- What realistic, professional trading looks like

- What you should focus on instead as a beginner

Let’s clear up one of the biggest myths in crypto trading — calmly, honestly, and without hype.

What Is a Win Rate?

A win rate is just the percentage of trades that end in profit. For example:

- You take 10 trades

- 9 trades make money

- 1 trade loses money

That’s a 90% win rate. Sounds incredible, right?

But here’s the part beginners often don’t hear: Win rate alone does NOT tell you if a strategy is profitable

Think of it like this…

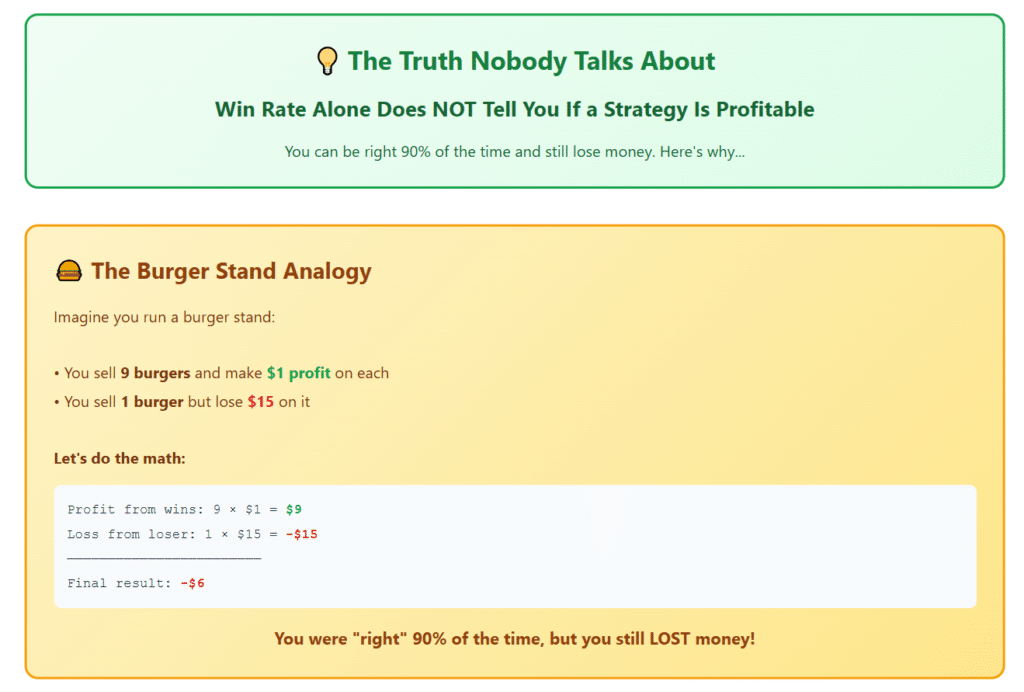

Think of It Like a Restaurant Business

Imagine you run a small burger stand.

- You sell 9 burgers and make $1 profit on each

- You sell 1 burger but lose $15 on it

Let’s do the math:

- Profit from wins: 9 × $1 = $9

- Loss from loser: –$15

- Final result: –$6

You were “right” 90% of the time, but you still lost money.

Trading works the same way.

Why 90% Win Rates Are So Attractive to Beginners

There’s nothing wrong with wanting a high win rate. It’s human.

High win rates appeal to beginners because they:

- Feel safe

- Reduce fear of being wrong

- Create confidence (sometimes false confidence)

- Look amazing in screenshots

Social media makes this worse. Traders post:

- Long green streaks

- Short-term results

- Selective trade history

But what you usually don’t see are:

- Account blow-ups

- One massive losing trade

- Long-term performance over months

As one professional trading analysis explains, win rate is one of the least important metrics for long-term success.

So what actually matters?

The Missing Piece: Risk vs Reward

Let’s define an important term. Risk-to-Reward Ratio This compares:

- How much you risk losing

- Versus how much you aim to make

Example:

- Risk $10 to make $30

- That’s a 1:3 risk-to-reward ratio

Now let’s compare two traders.

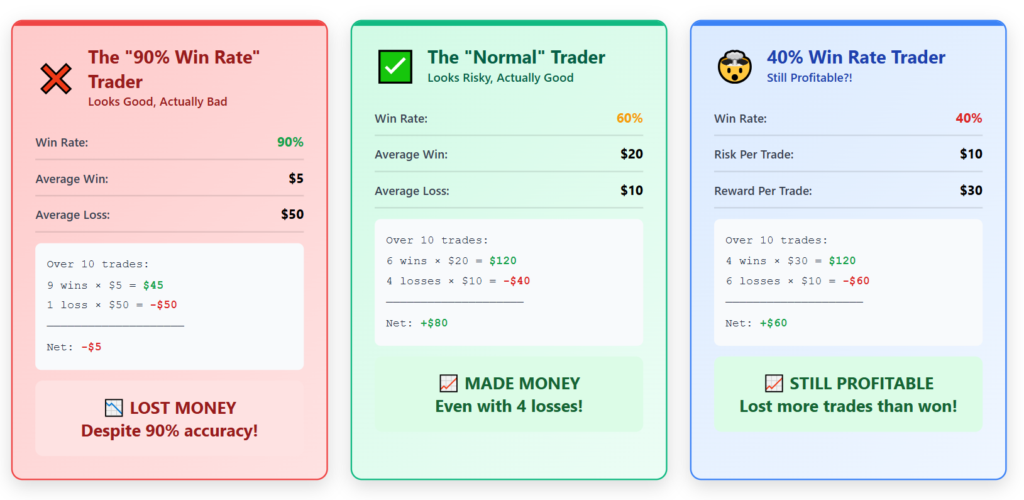

Practical Example #1: The “90% Win Rate” Trader

Trader A:

- Win rate: 90%

- Average win: $5

- Average loss: $50

Over 10 trades:

- 9 wins × $5 = $45

- 1 loss × $50 = –$50

Final result: –$5 (a loss)

Even though they were right almost every time, one loss erased everything. This is extremely common with “high win rate” strategies.

Practical Example #2: The “Normal” Trader

Trader B:

- Win rate: 60%

- Average win: $20

- Average loss: $10

Over 10 trades:

- 6 wins × $20 = $120

- 4 losses × $10 = –$40

Final result: +$80 (a profit)

They were wrong 4 times, but still made money. This is how many professional traders actually trade.

Why High Win Rate Strategies Often Blow Accounts

Here’s the uncomfortable truth. To keep win rates extremely high, traders often:

- Take tiny profits quickly

- Avoid closing losing trades

- Move stop-losses farther away

- “Hope” losses recover

Stop-loss = a preset exit that limits how much you can lose

This creates a dangerous situation:

- Many small wins

- Rare but huge losses

Eventually, one loss wipes out weeks or months of progress.

Common Beginner Mistake

Chasing accuracy instead of profitability Many beginners think:

- “If I can just be right more often, I’ll win”

But trading isn’t a school exam. You don’t get rewarded for being right — you get rewarded for managing risk.

What Professional Traders Actually Focus On

Here’s what experienced traders care about much more than win rate:

- Risk management – controlling losses

- Position size – how much money is used per trade

- Consistency – repeating the same process

- Expectancy – average profit per trade over time

Expectancy means: “If I take this trade setup 100 times, do I make money overall?”

Many successful strategies win only 40–60% of the time — and that’s completely normal.

Practical Example #3: 40% Win Rate… Still Profitable?!

Imagine this setup:

- Win rate: 40%

- Risk: $10

- Reward: $30

Out of 10 trades:

- 4 wins × $30 = $120

- 6 losses × $10 = –$60

Final result: +$60

You lost more trades than you won — and still made money. Mind-blowing at first, right?

Why This Matters for Fat Pig Signals Members

At Fat Pig Signals, the goal isn’t to look impressive with flashy percentages. The goal is:

- Sustainable trading

- Clear risk levels

- Realistic expectations

- Long-term survival

In our Telegram community, you’ll often see:

- Trades that lose (and that’s okay)

- Risk clearly defined before entry

- Focus on structure, not hype

That mindset protects beginners from the biggest mistake of all: thinking trading should be perfect.

Risk Reminder (Important 🚨)

Let’s be clear:

- Trading involves real risk

- Losses are part of the process

- No strategy wins all the time

- Never trade money you can’t afford to lose

Starting small isn’t weak — it’s smart.

Quick Recap: The Truth About 90% Win Rates

- High win rate ≠ profitable

- Small wins + big losses = danger

- Risk-to-reward matters more than accuracy

- Professionals accept being wrong

- Long-term thinking beats short-term hype

Conclusion & Next Steps: What Should You Do Now?

Here’s a simple, beginner-friendly plan:

Step 1: Stop chasing perfect win rates

They don’t exist in real trading.

Step 2: Focus on risk management

Always know how much you can lose before entering a trade.

Step 3: Think in series, not single trades

One trade means nothing. 100 trades tell the truth.

Step 4: Learn with a community

Being around traders who trade realistically (like in the Fat Pig Signals Telegram) helps you stay grounded and calm.

Final Encouragement

You don’t need to win all the time to succeed in crypto.

You just need to:

- Protect your capital

- Stay consistent

- Keep learning

That’s how real traders survive — and eventually thrive.

You’re already on the right path by asking the right questions.