What is a Bid-Ask Spread and How Does It Affect Your Trades?

Cryptocurrencies, Trading

Every time you open or close a trade, you are paying a hidden fee you might not even realize exists. It's not a commission, and it's not a direct charge, but it can significantly eat into your profits, especially for short-term traders. This invisible cost is known as the bid-ask spread.

Understanding the bid-ask spread is one of the most fundamental lessons for anyone in the crypto or forex markets. Grasping this simple concept can transform your approach to trading, helping you make smarter entry and exit decisions.

What Is the Bid-Ask Spread?

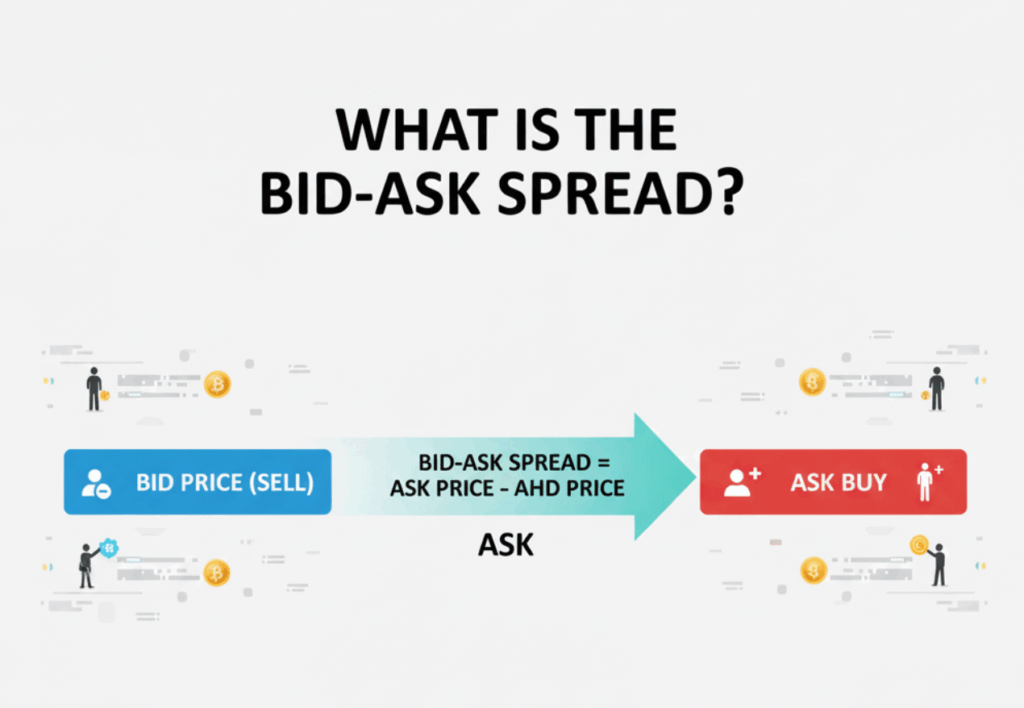

At any given moment, every financial asset has two prices: a bid and an ask.

- The Bid Price is the highest price a buyer is willing to pay for an asset. This is the price you can sell at.

- The Ask Price (or offer price) is the lowest price a seller is willing to accept. This is the price you can buy for.

Formula: Bid-Ask Spread = Ask Price - Bid Price

The bid-ask spread is simply the difference between the bid and the ask prices. It's the gap between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept. This difference is how market makers and brokers make a profit for facilitating trades.

Why the Spread Is Your First Transaction Cost

Imagine you walk into a foreign exchange office to buy some euros. The clerk offers to sell you euros at a specific price, say $1.10. That’s the ask price. When you want to sell those euros back, the office will buy them from you at a lower price, say $1.09. That’s the bid price. The $0.01 difference is their profit and your transaction cost.

In trading, this works the same way. When you open a long position (buying), you do so at the higher ask price. The very second your trade is executed, the market price for selling (the bid price) is already lower. This means your position is immediately at a slight loss, equal to the size of the spread.

For your trade to become profitable, the asset's price must move in your favor by at least the amount of the spread.

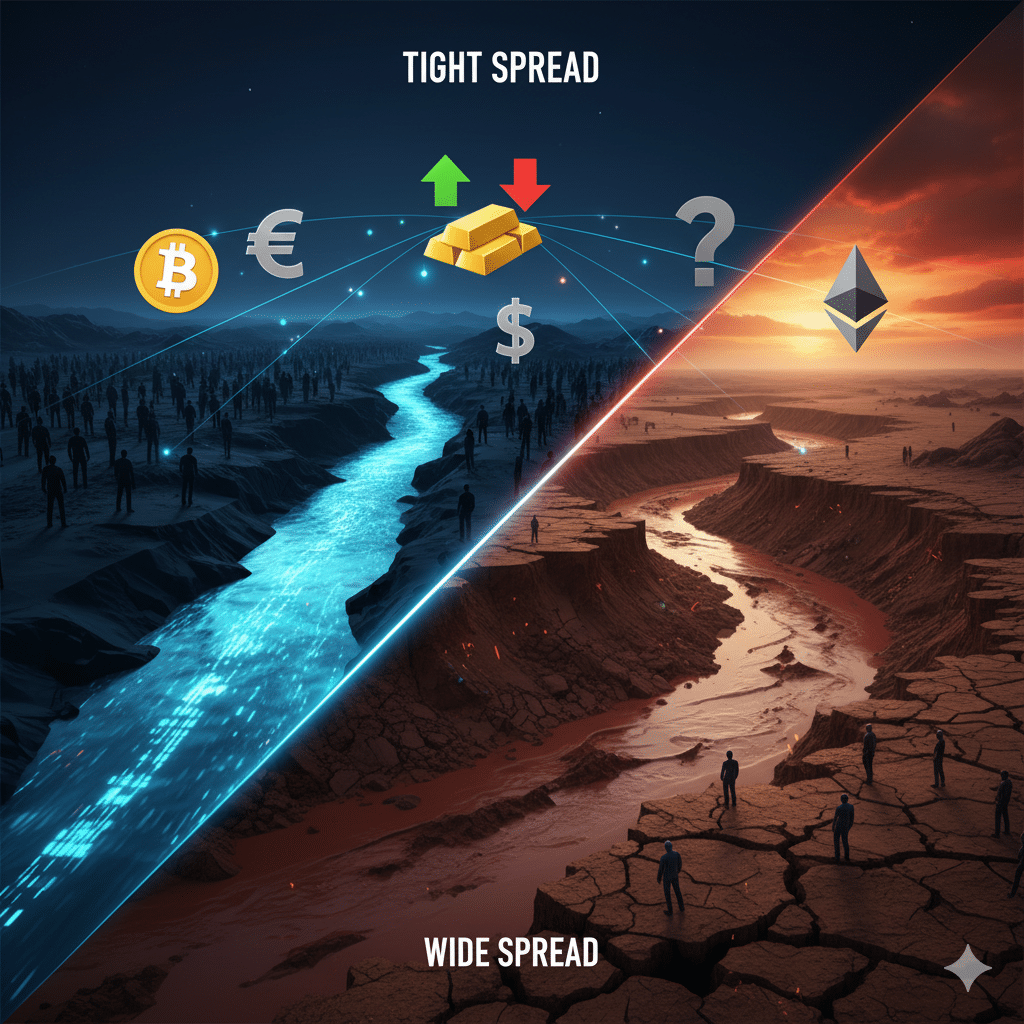

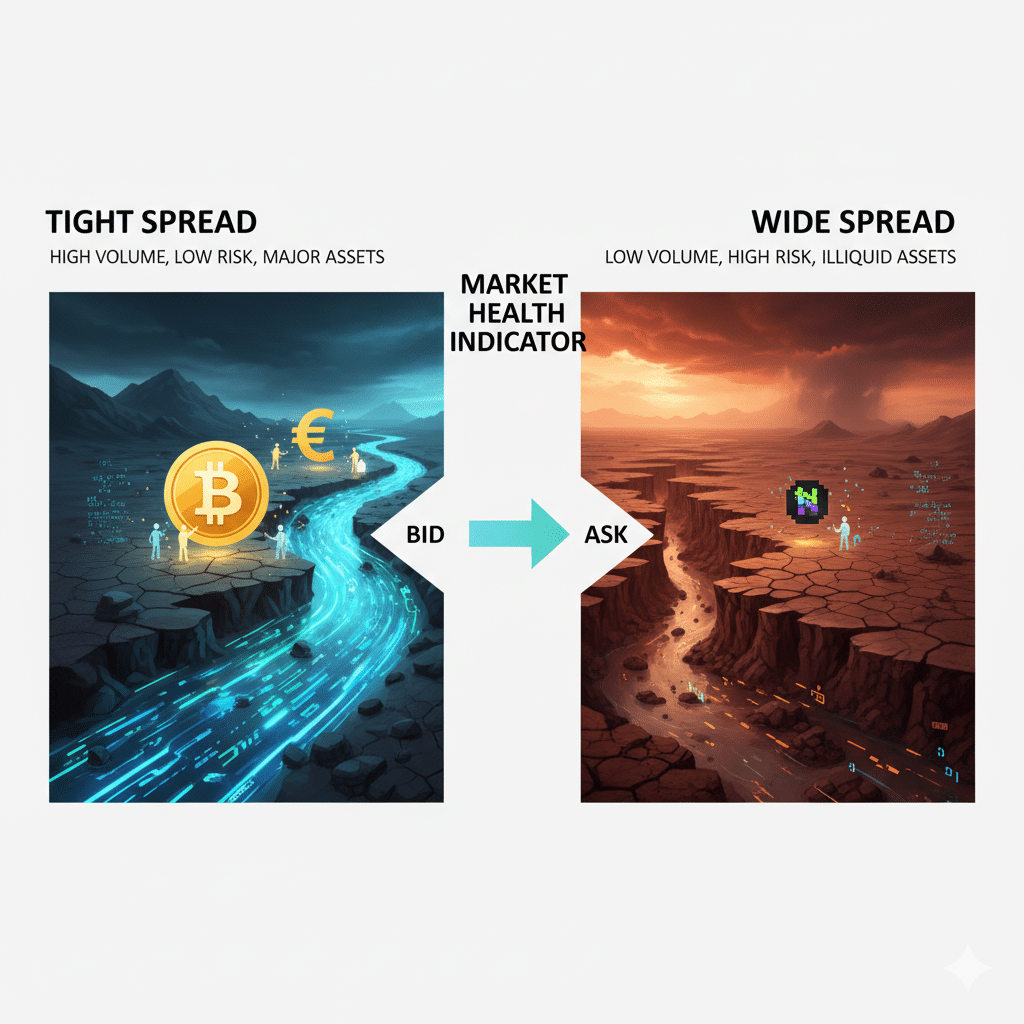

The Spread as a Market Health Indicator

Beyond being a cost, the size of the spread is a powerful technical indicator of a market's health and liquidity.

A Tight (Narrow) Spread: A small spread signifies a highly liquid market with high trading volume. When there are many buyers and sellers, competition forces the bid and ask prices closer together. This is typical for major assets like Bitcoin (BTC) and the EUR/USD currency pair.

A Wide (Large) Spread: A big spread indicates low liquidity and a less active market. This can happen with less popular cryptocurrencies or forex pairs, especially during off-peak trading hours. A wide spread also suggests higher volatility and more risk.

Check out The Basics of Technical Analysis for Crypto Trading

How the Spread Impacts Different Trading Styles

The bid-ask spread's importance varies depending on your trading strategy.

For Scalpers and Day Traders

The spread is a critical factor. Since these traders aim to make small profits from many quick trades, a wide spread can quickly wipe out any potential gains. They must prioritize trading assets with very tight spreads to maintain profitability.

For Swing and Position Traders

For swing trading, spread is a minor concern. These traders are looking for much larger price movements over days or weeks. Compared to their significant profit targets, the initial cost of the spread is almost negligible.

In Summary

The bid-ask spread is a non-negotiable part of trading. It's your first cost of entry, a tell-tale sign of market liquidity, and a factor that should heavily influence your choice of assets and trading strategy.

Keeping a close eye on it is a habit that separates successful traders from those who find their profits mysteriously vanishing.

Let our expert analysts do the heavy lifting. Get instant, high-probability signals and trade like a pro. Stop Guessing, Start Gaining. Learn more about Fat Pig Signals here.