Stablecoins as the Backbone of Global Payments

Cryptocurrencies

Ever tried to send money to a friend in another country? If you have, you probably remember the frustration. The fees. The waiting. That feeling of watching your money disappear into some banking black hole for three to five days.

Now imagine doing that same transfer in seconds, for pennies instead of dollars. That's what stablecoins are making possible right now.

Stablecoins have quietly become one of crypto's most practical innovations. While Bitcoin and Ethereum grab headlines with their price swings, stablecoins are doing something far more boring—and far more useful. They're moving trillions of dollars around the world, faster and cheaper than traditional banks ever could.

In 2025 alone, stablecoins processed over $9 trillion in payments. That's an 87% jump from the year before. And while that's still a small slice of the $2 quadrillion moving through global payments each year, stablecoins are winning where it actually matters: remittances to families overseas, invoices between companies, and payroll for international workers.

By the end of this article, you'll understand exactly what stablecoins are, why they're reshaping global finance, and how you can start using them in your own life.

What exactly is Stablecoin?

Let's start with the basics.

A stablecoin is a cryptocurrency that's designed to keep a steady value. Unlike Bitcoin, which can swing 10% in a single day, stablecoins are "pegged" to something stable—usually the US dollar.

Think of it like this: if Bitcoin is a rollercoaster, stablecoins are the merry-go-round. Still moving, but predictable.

Here's how it works. When you buy one USDC (one of the most popular stablecoins), you're essentially holding a digital dollar. One USDC always aims to equal one US dollar. The company behind it, Circle, keeps actual dollars or short-term US Treasury bills in a bank to back every single token.

There are a few different types of stablecoins:

- Fiat-backed stablecoins: Backed 1:1 by real dollars in a bank. Examples: USDT (Tether), USDC

- Crypto-backed stablecoins: Backed by other cryptocurrencies locked in smart contracts. Example: DAI

- Algorithmic stablecoins: Try to maintain their peg through supply adjustments (these are riskier and less common after some spectacular failures)

For beginners, fiat-backed stablecoins like USDC and USDT are the safest starting point. They're the most widely used and the easiest to understand.

💡 Pro Tip: Stick with well-established stablecoins like USDC or USDT when you're starting out. They have the largest market caps and the most transparency about their reserves.

Why Are Stablecoins Changing Global Payments?

Here's where things get interesting.

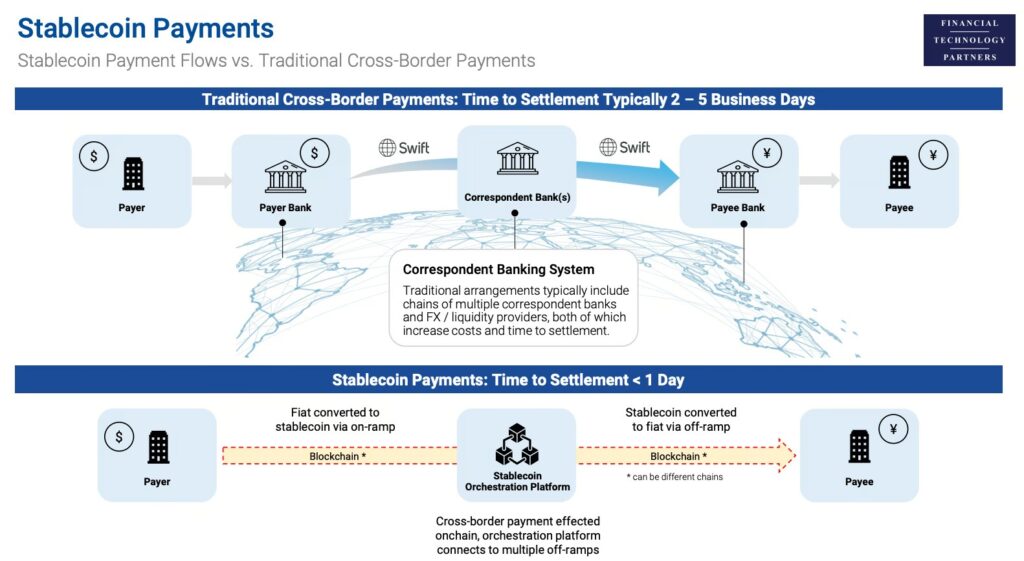

The traditional banking system was built decades ago. Sending money internationally still works like it did in the 1970s—your money hops from bank to bank, each one taking a cut and adding delays.

Stablecoins bypass all that.

Speed: Traditional international transfers take 1-3 business days (sometimes longer). Stablecoin transfers? Minutes. Sometimes seconds.

Cost: Bank wires can cost $25-50. Credit card fees run 1.7-3.5%. Sending stablecoins on networks like Solana or Polygon? Often less than $1. Sometimes less than a penny.

Availability: Banks have business hours. They close on weekends and holidays. Stablecoins work 24/7/365.

Let's put some real numbers to this.

Say you're a freelancer in the Philippines getting paid by a US company. The traditional way might cost you $13 in fees and take several days. With stablecoins? The transfer happens in seconds, and you might pay $0.20.

That's not a small difference—that's life-changing for millions of people.

In 2024, Turkey alone processed over $63 billion in stablecoin cross-border payments. Argentina and Nigeria saw massive increases too. When your local currency is losing value by the day, holding digital dollars suddenly makes a lot of sense.

Image Source: Fintech

Real People Using Stablecoins Right Now

This isn't just theory. Real people are using stablecoins to solve real problems.

The Filipino Nurse: A nurse working overseas can now send money home to her family in seconds, paying $0.20 instead of losing $13 to fees. For families depending on those remittances, that extra money adds up fast.

The Mexican Worker: Instead of waiting days for a bank transfer, workers are sending earnings home in minutes through platforms like Bitso, which processed $6.5 billion last year in the US-Mexico corridor alone.

The Nigerian Freelancer: In Nigeria, where the naira has been volatile and traditional banking can be slow and expensive, stablecoin transactions hit nearly $22 billion between July 2023 and June 2024. Freelancers and traders are moving funds globally without banks.

The Argentine Family: With inflation over 200% annually, Argentine families are protecting their savings by holding stablecoins instead of watching their pesos lose value by the week.

These aren't crypto enthusiasts looking to get rich. They're everyday people using stablecoins as a practical tool for saving and moving money.

⚠️ Common Mistake: Don't think stablecoins are only for "crypto people." They're increasingly being used by regular folks who just want a better way to move money across borders.

The Big Players Are Getting Involved

Here's what should really get your attention: stablecoins aren't just for crypto exchanges anymore.

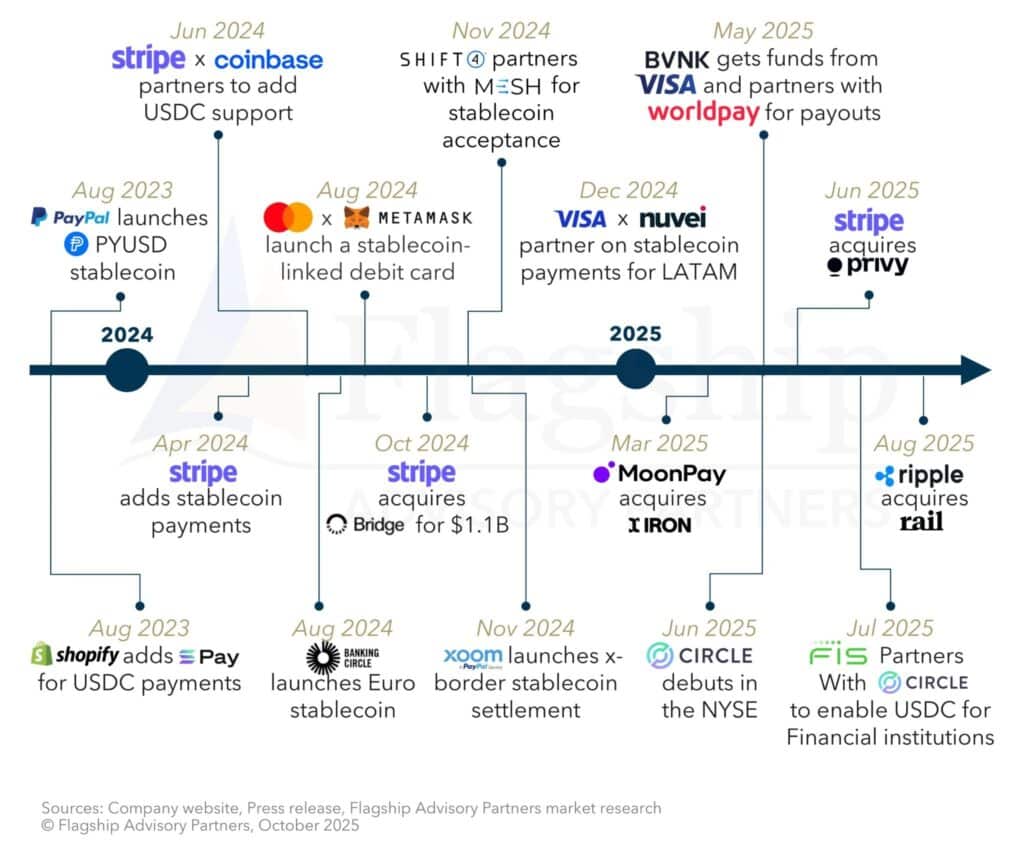

The world's biggest financial institutions are jumping in:

- Visa and Mastercard have launched stablecoin settlement rails. Mastercard even released a self-custody debit card that lets you spend USDC directly from your wallet.

- Stripe (which processes hundreds of billions in payments yearly) acquired a stablecoin company for $1.1 billion and now accepts USDC for US merchants.

- PayPal launched its own stablecoin, PYUSD, and expanded it to 13 different blockchains.

- JPMorgan has its own digital token for corporate settlements, processing over $1.5 trillion.

- Shopify integrated stablecoin payments for merchants across 34 countries.

The message is clear: this isn't a fringe technology anymore. The companies you already use are building stablecoin infrastructure right now.

And in 2025, the US passed the GENIUS Act, creating the first comprehensive federal framework for stablecoins. This requires issuers to hold 1:1 reserves, publish monthly reports, and guarantee redemption rights. That regulatory clarity is opening the floodgates for institutional adoption.

Stablecoins' Timeline of Key Events. Image Source: Flagship

How You Can Start Using Stablecoins

Ready to try this yourself? Here's how to get started safely.

Step 1: Choose a Wallet or Exchange

You'll need somewhere to hold your stablecoins. Options include:

- Centralized exchanges like Coinbase, Kraken, or Binance

- Digital wallets like MetaMask (for more advanced users)

- Fintech apps that now support stablecoins

For beginners, a regulated exchange like Coinbase is the easiest starting point.

Step 2: Buy Stablecoins

Once you have an account, you can buy stablecoins directly with your bank account or card. Since they're pegged to the dollar, there's no timing the market—$100 gets you roughly 100 USDC (minus small fees).

Step 3: Start Small

Don't move your entire savings into stablecoins right away. Start with a small amount to learn how transfers work. Send a few dollars to a friend or another wallet you own.

Step 4: Understand the Fees

Different blockchain networks have different costs. Sending USDC on Ethereum might cost a few dollars. Sending it on Solana or Polygon might cost less than a penny. Learn which networks your exchange supports.

Step 5: Know the Risks

Stablecoins are much more stable than Bitcoin, but they're not risk-free:

- Depegging risk: In rare cases, a stablecoin might lose its peg

- Regulatory risk: Rules are still evolving in many countries

- Platform risk: Make sure you're using reputable exchanges and wallets

💡 Pro Tip: Always use stablecoins from reputable issuers that publish regular reserve reports. USDC publishes monthly attestations from independent accountants. Transparency matters.

Quick Recap

Here's what we covered:

- Stablecoins are cryptocurrencies pegged to stable assets like the US dollar, combining crypto speed with traditional currency stability

- They're reshaping global payments—faster, cheaper, and available 24/7 compared to traditional banking

- Real people are already benefiting—from Filipino nurses to Nigerian freelancers to Argentine families protecting savings

- Major institutions are on board—Visa, Mastercard, PayPal, Stripe, and banks are all building stablecoin infrastructure

- Regulation is catching up—the US GENIUS Act provides a clear framework for institutional adoption

- You can start using them today—through exchanges and wallets, with small amounts to learn safely

What This Means for You

Stablecoins aren't just a crypto trend—they're becoming fundamental infrastructure for how money moves around the world.

Whether you're sending money to family overseas, getting paid for freelance work, or just looking for a better way to hold dollars digitally, stablecoins offer real advantages over traditional banking.

Your Next Steps:

- Today: Download a reputable exchange app (Coinbase is beginner-friendly) and explore their stablecoin options. You don't have to buy anything yet—just familiarize yourself with how it works.

- This Week: Try buying a small amount of USDC or USDT—maybe $20-50. Practice sending it between wallets or to a friend who also has an account. Notice how fast it is.

- Ongoing: Stay informed about stablecoin developments by joining communities like Fat Pig Signals, where we discuss practical crypto applications and help each other navigate this evolving landscape.

Remember: You don't have to become a crypto expert overnight. Stablecoins are one of the most beginner-friendly entry points into the crypto world because they remove the volatility that makes other cryptocurrencies stressful.

The financial system is evolving. Banks that took three days to move your money are being outpaced by technology that does it in three seconds. You don't need to understand every technical detail to benefit from this shift.

Start small. Stay curious. And welcome to the future of money.

The Fat Pig Signals community is here to help you navigate this journey. Join our Telegram group to connect with fellow learners, get updates on practical crypto tools, and ask questions in a supportive environment.

You've got this.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Cryptocurrency, including stablecoins, involves risk. Stablecoins may lose their peg in extreme circumstances, and regulations vary by country. Always do your own research and consider consulting with a financial advisor before making any financial decisions. Never invest more than you can afford to lose.