How to Set Stop Losses and Take Profit Targets

Signals, Trading

Ever watched your crypto profit evaporate because you didn't know when to sell? Or worse—held on during a crash, hoping it would bounce back, only to lose half your investment?

Most beginner traders lose money because they don't have an exit plan. They buy Bitcoin or Ethereum, watch the price move, and then freeze. Should they sell now? Wait longer? What if it goes higher? What if it crashes?

That's where stop losses and take profit targets come in. By the end of this article, you'll know exactly how to set these powerful tools to protect your money and lock in profits. No more sleepless nights watching prices. No more panic selling. Just clear, automated trading that works while you sleep.

What Are Stop Losses and Take Profit Targets?

Understanding Stop Losses

A stop loss (an order that automatically sells your crypto if the price drops to a certain level) is like your safety net. It's your emergency exit.

Imagine you're at a casino with $100. You decide beforehand: "If I lose $20, I'm walking away." That's exactly what a stop loss does—it forces you to walk away before things get worse.

Here's how it works in practice:

You buy Bitcoin at $45,000. You set a stop loss at $43,000. If Bitcoin drops to $43,000, your exchange automatically sells it for you. You lose $2,000 rather than potentially $10,000 if it continues to decline.

Understanding Take Profit Targets

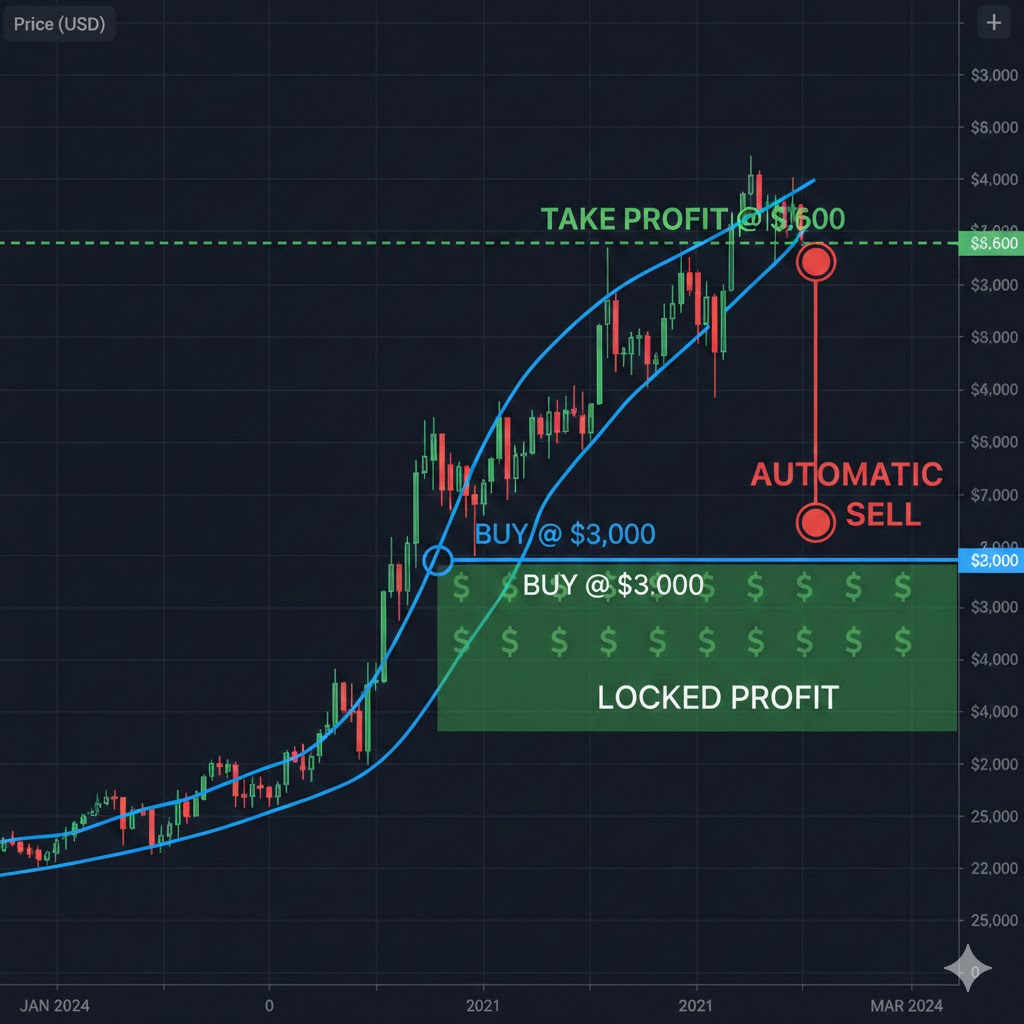

A take profit target (an order that automatically sells your crypto when it reaches your desired profit level) is your victory lap. It locks in your gains.

Example: You're playing a game where you can cash out anytime. You decide upfront: "When I double my money, I'm taking it and running." That's your take-profit target.

Real example:

You buy Ethereum at $3,000. You set a take profit at $3,600. When Ethereum hits $3,600, your exchange automatically sells it. You pocket a 20% profit without having to watch the price all day.

Why You Need Both

The market doesn't care about your hopes and dreams. It moves based on the decisions of millions of traders.

Using both stop losses and take-profit targets creates a risk-reward ratio. You're defining exactly how much you're willing to lose and how much profit you want to make before you even enter the trade.

Common Mistake: Many beginners only use stop losses (to prevent losses) but forget about take profit targets. Then they watch their 50% profit turn into a 10% loss because they got greedy waiting for more.

The Psychology Behind Exit Strategies

Let's be honest—your brain is terrible at trading. Here's what happens without exit strategies:

When prices rise, greed sets in. "It's up 30%... but what if it goes to 50%? Or 100%?" So you hold. Then it crashes back down.

When prices drop, fear takes over. But it's not the good kind of fear that makes you sell. It's the paralyzing fear that whispers: "What if it bounces back right after I sell?" So you hold through the entire crash.

How Automation Saves You From Yourself

Stop losses and take-profit targets remove emotion from the equation. You make the decision when you're calm and thinking clearly—before you buy. Then the exchange executes your plan automatically.

It's like writing yourself a note when you're sober about what to do when you're drunk. Except in trading, "drunk" means emotional, and emotions lose money.

Pro Tip: Write down your stop-loss and take-profit levels before you buy. If you find yourself wanting to change them later, that's usually emotion talking, not logic.

How to Calculate Your Stop Loss

The Percentage Method (Simplest)

The easiest way to set a stop loss is to use a fixed percentage below your entry price. Most beginners start with 5-10% stop losses.

Here's the formula: Stop Loss Price = Entry Price × (1 - Percentage/100)

Example:

- You buy Bitcoin at $50,000

- You want a 5% stop loss

- Stop Loss = $50,000 × 0.95 = $47,500

The Support Level Method (Smarter)

Support levels (price points where the asset historically stops falling and bounces back up) make natural stop loss points. It's like parking your stop loss right below a safety floor.

Look at the chart and find where the price has bounced multiple times before. Set your stop loss slightly below that level.

Example: Bitcoin has been bouncing at $44,000 over the past month. You buy at $45,000 and set your stop loss at $43,800 (just below the support).

The Volatility Method (Advanced but Worth Learning)

Different cryptocurrencies move different amounts daily. Bitcoin might move 3% on average, while a smaller altcoin moves 15%. Your stop-loss should match this volatility (i.e.,how much a price typically moves).

For volatile coins, use wider stop-losses (10-15%). For stable coins: Use tighter stop losses (3-7%). If you use a 3% stop loss on a coin that regularly moves 10% daily, you'll get stopped out constantly from normal price movement.

Setting Smart Take Profit Targets

The Risk-Reward Ratio

Professional traders never enter a trade unless the potential profit is at least 2x the potential loss. This is called a 2:1 risk-reward ratio.

Here's what that looks like:

- Risk: $100 (your stop loss)

- Reward: $200 (your take profit target)

- Ratio: 2:1

Even if you're wrong half the time, you still make money. Lose $100, lose $100, win $200 = break even. Win one more time = $200 profit.

The Resistance Level Method

Resistance levels (price points where the asset historically stops rising and drops back down) are perfect take-profit targets. It's where sellers usually show up in force.

Look for price levels where Bitcoin or your chosen crypto has peaked multiple times before. That's your target.

Example calculation:

- Entry: $45,000

- Recent resistance: $48,000

- Take profit: $47,800 (slightly below resistance)

The Multiple Target Strategy

Here's a secret: You don't have to sell everything at once. Smart traders use multiple take profit levels.

Example setup: You buy 1 ETH at $3,000

- Take profit #1: Sell 0.33 ETH at $3,300 (10% gain)

- Take profit #2: Sell 0.33 ETH at $3,600 (20% gain)

- Take profit #3: Sell 0.34 ETH at $4,000 (33% gain)

This way, you lock in some profits early but still benefit if price keeps climbing.

Platform-Specific Instructions

Setting Orders on Major Exchanges

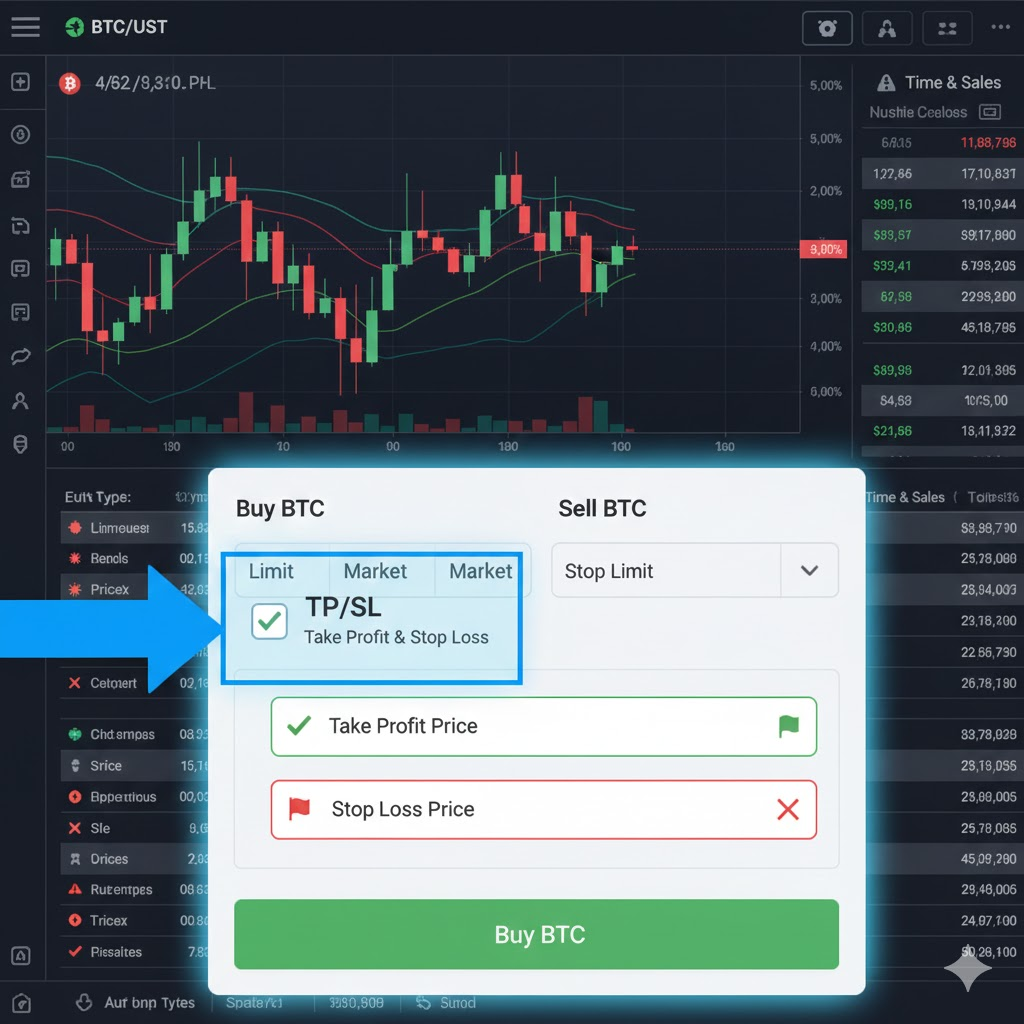

Every exchange is slightly different, but the concept is the same. Here's what to look for:

Binance: Use "OCO" orders (One-Cancels-Other) to set both stop loss and take profit together.

Coinbase Pro: Set "Stop" orders for stop losses and "Limit" orders for take profits.

Kraken: Use "Take Profit Limit" and "Stop Loss" order types.

Most exchanges let you set these when you place your buy order. Look for "Advanced" options if you don't see them immediately.

The Trailing Stop Loss (Bonus Feature)

Some exchanges offer trailing stop losses (stop losses that move up with the price but never down). It's like having a safety net that rises as you climb higher.

Example:

- You set a 5% trailing stop

- Bitcoin rises from $45,000 to $50,000

- Your stop loss automatically moves from $42,750 to $47,500

- If Bitcoin drops 5% from its highest point, you're out

This lets you ride trends while protecting profits.

Common Mistakes to Avoid

- Setting Stop Losses Too Tight

The #1 beginner mistake? Setting stop losses so close that normal price movement triggers them.

Example of too tight: Buying Bitcoin at $45,000 with a stop at $44,500 (1.1% drop). Bitcoin regularly moves 3-5% daily. You'll get stopped out from normal volatility.

Common Mistake: "I'll set a super tight stop loss so I barely lose any money." This guarantees you'll lose money because crypto prices naturally fluctuate. Give your trades room to breathe.

- Moving Stop Losses Down

Never, ever move your stop loss lower after setting it. That defeats the entire purpose.

Your brain will try to convince you: "Just give it a little more room." That "little more room" turns into massive losses.

- Ignoring the Overall Trend

Setting take profits against the trend is like trying to swim upstream. If Bitcoin is in a strong uptrend, your take-profit targets can be more ambitious. If it's in a downtrend, take profits quickly when you get them.

- Forgetting About Fees

Exchange fees eat into your profits. Factor them into your calculations.

Example with fees:

- Buy at $1,000

- 0.5% fee = $5

- Sell at $1,050

- 0.5% fee = $5.25

- Actual profit = $39.75, not $50

Quick Recap

Here's what we covered:

- Stop losses protect your capital by automatically selling if price drops to your predetermined level

- Take profit targets lock in gains by automatically selling when you hit your profit goal

- Your brain is your enemy in trading—automation removes emotional decisions

- Calculate stop losses using percentage, support levels, or volatility methods

- Set take profits using risk-reward ratios, resistance levels, or multiple targets

- Platform features vary but all major exchanges support these order types

- Avoid common mistakes like too-tight stops or moving stop losses down

- Fees matter—factor them into your profit calculations

Your Next Steps

Stop losses and take profit targets aren't just theories—they're practical tools you need to start using immediately. Here's your action plan:

Your Next Steps:

- Today: Open your exchange and locate where to set stop-loss and take-profit orders. Place a practice trade with $10-20 just to learn the interface. Set a 5% stop loss and 10% take profit target.

- This Week: On your next real trade, calculate your levels BEFORE you buy. Use the simple percentage method: 5-7% stop-loss, 10-15% take-profit. Write these numbers down and stick to them no matter what.

- Ongoing: Start a trading journal. For every trade, record your entry, stop loss, and take profit levels. After 10 trades, review what worked and what didn't. Adjust your percentages based on real results.

Remember: Every professional trader uses stop-loss and take-profit targets. The only traders who don't are beginners who haven't blown up an account yet.

You don't have to learn this the hard way. Our Fat Pig Signals community shares daily setups with specific stop-loss and take-profit levels, so you can see exactly how experienced traders plan their exits.

Join our Telegram group here and start trading with a safety net today.

Trading isn't about being right every time—it's about protecting your capital when you're wrong and maximizing gains when you're right. Stop losses and take profit targets do exactly that. You're already ahead of 90% of beginners just by reading this. Now go set those stops and targets!

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Cryptocurrency trading involves substantial risk of loss. Always do your own research and consider consulting with a financial advisor before making investment decisions.