Complete Guide to Reading Crypto Trading Signals

Signals, Trading

Have you ever opened a crypto signals channel—maybe even the Fat Pig Signals Telegram—and thought: “Okay… what does BUY 0.000022 – TP1 0.000028 – SL 0.000020 even mean?”

If yes, don’t worry. Every beginner has felt this way. Crypto signals can look confusing at first glance, but once you understand them, they become as easy to read as text messages.

Crypto moves fast. Prices rise and fall within minutes, so clear trading signals help you avoid emotional decisions and trade with confidence. With more beginner traders entering the market every day, understanding signals gives you an important advantage.

What you’ll learn in this guide:

- What crypto signals really are

- How to read each part of a trading signal

- What entry, stop-loss, and take-profit mean

- Real examples that show you exactly how signals work

- Mistakes to avoid

- How to use signals safely1o0-kml

What Crypto Trading Signals Actually Are (Explained Simply)

Crypto signals are suggested trades created by experienced analysts. They tell you:

- Which coin to buy

- At what price to buy it (entry)

- Where to take profit

- Where to place your stop-loss

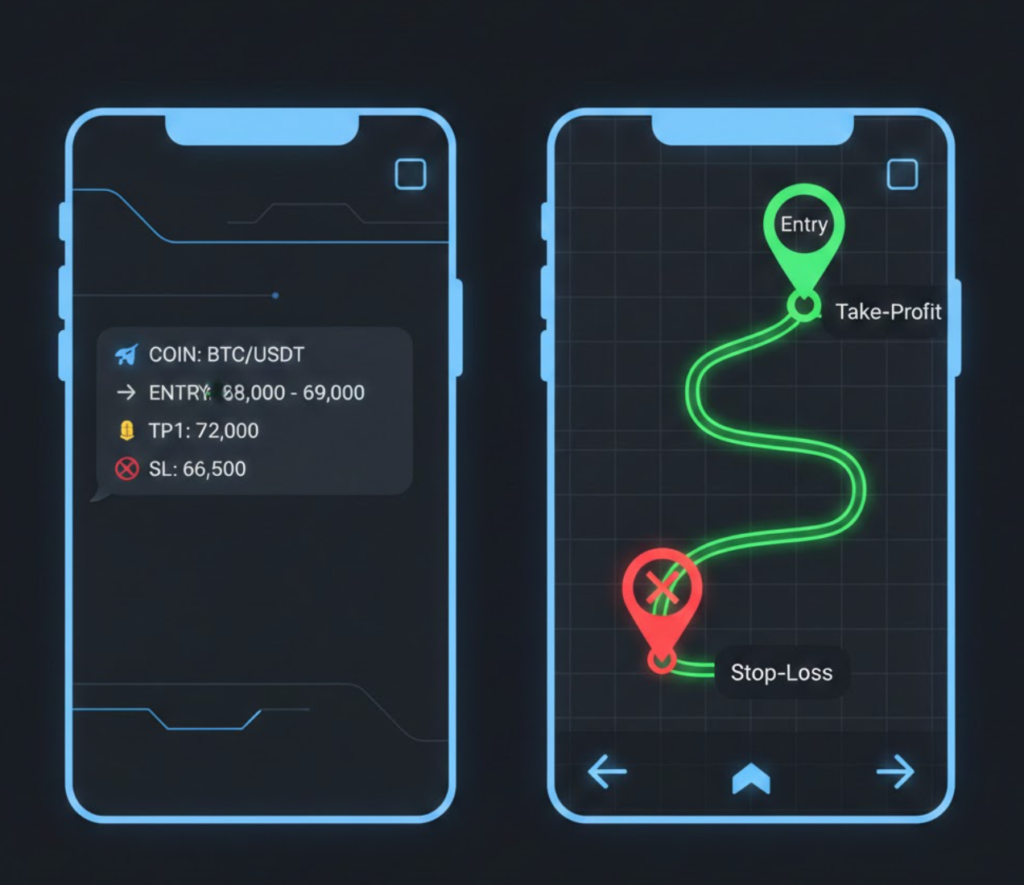

Think of a crypto signal like Google Maps for trading. You still decide whether to drive, but the signal gives you the clearest route.

Most signals usually include:

- The coin (BTC, ETH, XRP, etc.)

- Entry price

- Profit targets

- Stop-loss

- Optional market analysis

They’re often sent through Telegram because delivery is instant and easy to manage.

What a Typical Crypto Signal Looks Like

Example:

COIN: XRP/USDT

ENTRY: 0.520 – 0.540

TARGETS:

TP1: 0.560

TP2: 0.580

TP3: 0.620

STOP LOSS: 0.495

Once you know what each part means, everything becomes simple. So let’s break it down step by step.

Understanding Every Part of a Trading Signal

Crypto signals always contain four important elements. If you understand these, you understand everything.

1. ENTRY PRICE — Where You Start the Trade

Your entry price is where you're supposed to buy the coin.

If the signal says : ENTRY: 0.520 – 0.540 . It means:

- Anywhere between $0.520 and $0.540 is a good buy.

- Buying nearer the bottom gives you more profit potential.

Think of it like buying a pair of shoes during a sale. The deal is best if you buy in the recommended window.

2. STOP-LOSS — Your Safety Net

A stop-loss (SL) is the price where your trade automatically closes if the market drops. It’s your seatbelt: You hope you never need it, but it protects you when things go wrong.

Example: If SL = 0.495, and the price falls to 0.495, the trade closes automatically.

Skipping stop-loss is the #1 beginner mistake that leads to heavy losses.

3. TAKE-PROFIT (TP) — Where You Secure Gains

Signals usually have 2–4 targets:

- TP1 – easiest to hit, smaller profit

- TP2 – stronger move, better profit

- TP3 – bigger move, bigger profit

Example:

Entering at 0.530…

- TP1 = 0.560 → +5.6% profit

- TP2 = 0.580 → +9.4% profit

- TP3 = 0.620 → +17% profit

You can choose to:

- Sell everything at TP1 (safer)

- Sell partially at each TP (balanced)

- Hold for TP3 (riskier)

4. MARKET ANALYSIS — The “Why” Behind the Signal

Signal providers sometimes include a brief explanation such as:

- The coin is oversold

- A bullish pattern is forming

- Market sentiment is improving

- Volume is increasing

This isn’t necessary to follow the signal, but it helps you learn how professional analysts think.

Why Crypto Signals Work (The Psychology Behind Them)

Crypto signals rely on:

- Historical price patterns

- Market psychology

- Support and resistance zones

- Technical indicators (RSI, MACD, moving averages)

- Trend direction

Because human behavior repeats, these patterns often repeat too. Signals help beginners remove:

- Panic

- FOMO

- Emotional reactions

- Overthinking

Trading becomes more structured, less stressful, and more predictable. Think of signals as bowling with the bumpers up. You still bowl—but it’s a lot easier to hit the pins.

Step-by-Step: How to Read a Crypto Signal Correctly

Here’s a simple checklist you can follow for every signal.

STEP 1: Check the Coin Pair

Example: ETH/USDT or SOL/USDT. Make sure you’re trading the correct pair.

STEP 2: Look at the Entry Range

Ask: Is the current price inside the entry zone?

- If yes → You can enter.

- If no → Don’t chase it. Wait for the price to return.

STEP 3: Set the Stop-Loss Immediately

Never enter without first placing the stop-loss. Protect your account every time.

STEP 4: Set Your Take-Profit Targets

Choose one of these styles:

✔ Conservative . Sell all at TP1.

✔ Balanced . Sell 30% at TP1, 50% at TP2, 20% at TP3.

✔ Aggressive . Hold for TP3 or beyond.

STEP 5: Monitor the Trade

Watch:

- Market behavior

- Momentum

- News

- Bitcoin movement (affects everything)

You don’t need to stare at charts, but check in regularly.

Real-World Examples to Make It Clear

Example 1 — A Bullish Buy Signal

COIN: AVAX

ENTRY: 28.00 – 29.00

TP1: 30.00

TP2: 32.50

TP3: 35.00

SL: 26.80

Imagine: AVAX dips into the 28–29 range. Analysts expect a bounce from strong support.

If you enter at 28.50:

- TP1 → 5.3% gain

- TP2 → 14% gain

- TP3 → 22% gain

Example 2 — Selling in Stages

If you sell 30% at each target:

- You lock in profit early

- You let the rest grow

- You reduce risk as price rises

This is one of the safest strategies beginners can use.

Example 3 — How Stop-Loss Protects You

ENTRY: 1.20 – 1.25

SL: 1.15

If breaking news causes a sudden dump:

- Without SL → You may lose 20–40%

- With SL → Loss limited to around 4–8%

This is why stop-loss is essential.

Common Beginner Mistakes (Avoid These!)

Entering after the price already pumped

If the price is above TP1, don’t enter.

Ignoring stop-loss

A single bad trade can wipe out weeks of gains.

Risking too much capital

Only risk 1–3% of your account per trade.

Trying to follow too many signals

More trades do not equal more profit. Quality > quantity.

Pro Tip

Take a screenshot of the signal and mark the levels on your chart. This reduces confusion and makes your plan crystal clear.

Risk Management — The Real Secret to Long-Term Success

Even the best signals fail sometimes. That’s normal. Follow these rules:

Always use stop-loss

No exceptions.

Start with small trade sizes

Practice before scaling up.

Avoid trading during extreme volatility

Big Bitcoin crashes affect every coin.

Only trade with money you can afford to lose

This keeps stress low and decisions clearer.

QUICK RECAP

Here’s a fast summary of everything you learned:

- Crypto signals give you entry, exit, and risk levels

- Entry = where you buy

- Stop-loss = where you limit losses

- Take-profit = where you secure gains

- Good signals include analysis so you learn as you trade

- Use risk management every single time

- Don’t enter late or skip SL

- Use signals to learn and grow as a trader

Conclusion & Next Steps

Reading crypto trading signals doesn’t need to be confusing. With a little practice, you'll understand entries, targets, and stop-loss levels instantly.

Signals won’t guarantee profits but they will help you trade smarter, learn faster, and avoid the biggest beginner mistakes.

- Join the Fat Pig Signals Telegram community —so you can practice reading real signals daily.

- Start with very small trade sizes —focus on learning, not gambling.

- Mark your charts with entry, SL, and TP —this makes your trading clearer and calmer.

You’re now ready to understand crypto signals like a confident beginner trader.