Comparing Bitcoin Dominance and Altcoin Seasons

Altcoins, Bitcoin, Cryptocurrencies, Investment, Signals, Technology, Trading

Comparing Bitcoin Dominance and Altcoin Seasons

Why Is Bitcoin Up but My Altcoins Are Down?

If you’ve ever held altcoins while Bitcoin is pumping and thought, “Why isn’t everything going up together?” — you’re not alone.

This confusion usually comes from not understanding Bitcoin dominance and altcoin seasons. These two ideas explain where money is flowing in the crypto market at any given time. And right now, with capital rotating faster than ever, this knowledge matters more than ever for beginners.

By the end of this article, you’ll understand what Bitcoin dominance is, what an altcoin season really means, and how to use both to make smarter trading decisions without guessing.

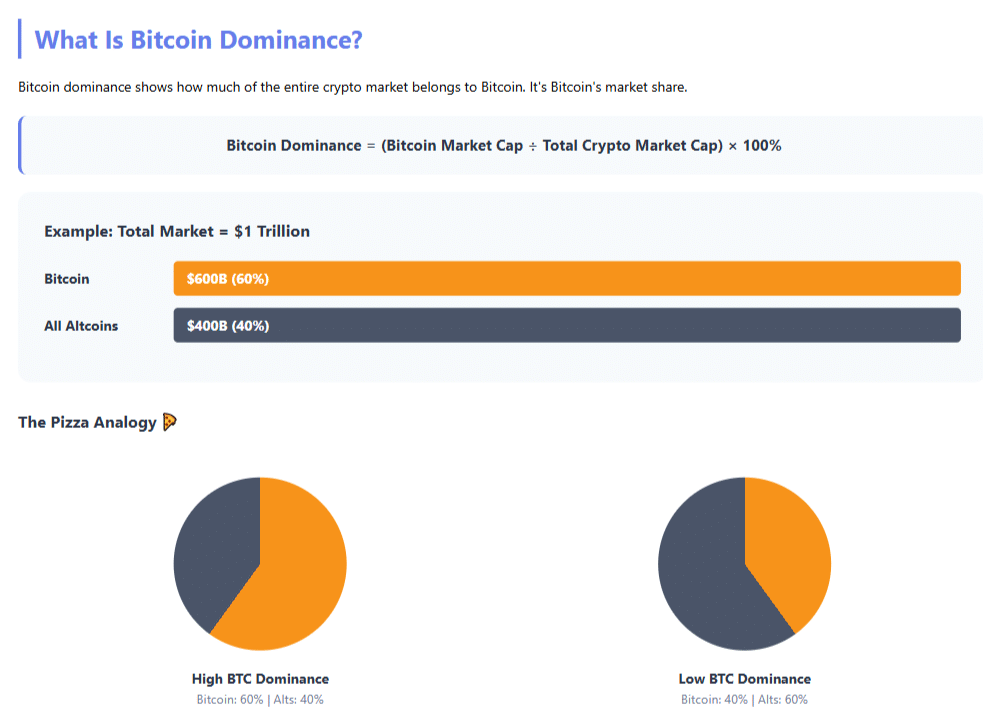

An illustration of a Bitcoin Dominance and the Pizza Analogy.

What Is Bitcoin Dominance?

Bitcoin dominance is a metric that shows how much of the entire crypto market belongs to Bitcoin. In simple terms, it’s Bitcoin’s market share.

Let’s Define the Term Clearly

- Market capitalization (market cap) = price × total coins in circulation

- Bitcoin dominance = Bitcoin’s market cap ÷ total crypto market cap

Simple Example With Numbers

Imagine this:

- Total crypto market value: $1 trillion

- Bitcoin’s market cap: $600 billion

Bitcoin dominance = 60%

That means Bitcoin alone makes up 60% of the entire crypto market.

Think of It Like This

Think of the crypto market like a pizza 🍕.

- Bitcoin dominance tells you how many slices Bitcoin has

- Altcoins share whatever slices are left

When Bitcoin takes more slices, altcoins get fewer. When Bitcoin gives up slices, altcoins get more.

Why Bitcoin Dominance Goes Up or Down

Bitcoin dominance doesn’t move randomly. It changes because of investor behavior.

When Bitcoin Dominance Goes UP

This usually happens when:

- Investors want safety

- The market is uncertain or fearful

- Big money prefers Bitcoin over smaller coins

In these moments, money flows from altcoins into Bitcoin, even if prices are falling overall.

When Bitcoin Dominance Goes DOWN

This usually means:

- Investors are taking more risk

- Confidence in the market is growing

- Money is flowing from Bitcoin into altcoins

This is often when people start talking about altcoin season.

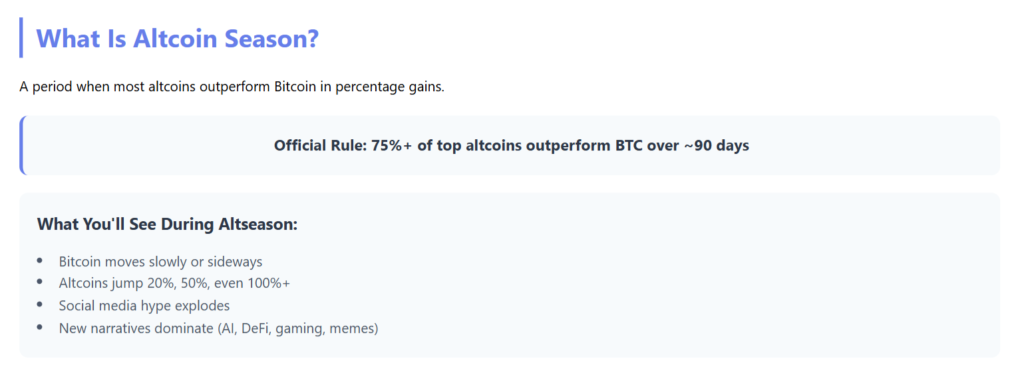

An Illustration of an Altcoin Season and What you’ll see during Altseason.

What Is an Altcoin Season?

An altcoin is any cryptocurrency that is not Bitcoin. An altcoin season (often called altseason) is a period when most altcoins outperform Bitcoin in terms of percentage gains.

The Official Definition

Many traders use this rule of thumb:

- If 75% or more of top altcoins outperform Bitcoin over ~90 days, the market is in altcoin season

What Altcoin Season Looks Like in Real Life

During altseason, you’ll notice:

- Bitcoin moves slowly or sideways

- Altcoins suddenly jump 20%, 50%, even 100%+

- Social media hype explodes

- New narratives (AI coins, DeFi, gaming, memes) take turns pumping

Imagine If…

Imagine Bitcoin goes up 10%, but your altcoin goes up 60% in the same period. That’s not luck — that’s capital rotation into altcoins.

The Relationship: Bitcoin Dominance vs Altcoin Season

Here’s the key idea you must remember: Bitcoin dominance and altcoin performance usually move in opposite directions.

How They Interact

- Rising Bitcoin dominance → Bitcoin leading, altcoins lagging

- Falling Bitcoin dominance → Altcoins catching up or outperforming

But here’s the part beginners often miss…

Important Warning

A falling Bitcoin dominance does NOT always mean altcoins are winning.

Sometimes dominance falls because:

- Bitcoin is dropping faster

- Money is moving into stablecoins (like USDT)

- The whole market is weak

That’s why context matters.

Practical Examples You Can Relate To

Example 1: Bitcoin Leads the Rally

- Bitcoin price: +30%

- Most altcoins: +10% or flat

- Bitcoin dominance: rising

Market message: Bitcoin is the main focus. Altcoins are not ready yet.

Example 2: Classic Altcoin Season Signal

- Bitcoin price: +5% (slow and steady)

- Altcoins: +40% to +100%

- Bitcoin dominance: falling

Market message: Risk appetite is high. Altcoins are in play.

Example 3: Fake Altseason Trap (Common Beginner Mistake)

- Bitcoin price: −15%

- Altcoins: −10%

- Bitcoin dominance: falling

Market message: This is NOT altseason. Everything is bleeding.

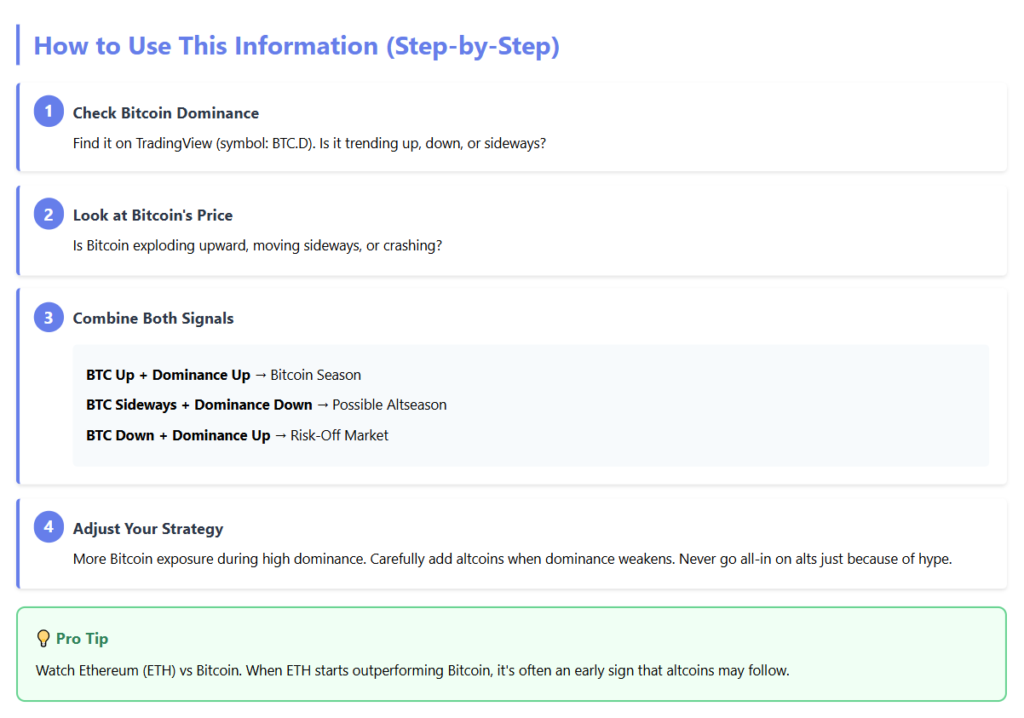

An Illustration on How to use the information above (Step-by-Step).

How Beginners Can Use This Information (Step by Step)

You don’t need fancy tools or advanced charts to apply this.

Step 1: Check Bitcoin Dominance

You can find it on charting platforms like TradingView (symbol: BTC.D).

Ask:

- Is it trending up?

- Trending down?

- Moving sideways?

Step 2: Look at Bitcoin’s Price Behavior

Ask:

- Is Bitcoin exploding upward?

- Moving sideways?

- Crashing?

Step 3: Combine Both Signals

Use this simple logic:

- BTC up + dominance up → Bitcoin season

- BTC sideways + dominance down → Possible altseason

- BTC down + dominance up → Risk-off market

Step 4: Adjust Your Strategy

- More Bitcoin exposure during high dominance

- Carefully add altcoins when dominance weakens

- Never go “all-in” on alts just because of hype

At Fat Pig Signals, this is exactly why signals are timed around market structure, not emotions. You’ll often see guidance on when to focus on BTC and when altcoins make sense inside the Telegram community.

Common Beginner Mistake

Buying altcoins just because Bitcoin dominance dropped slightly. Small dips don’t mean altseason. Sustained trends matter more than one-day moves.

Pro Tip

Watch Ethereum (ETH) vs Bitcoin. When ETH starts outperforming Bitcoin, it’s often an early sign that altcoins may follow.

Quick Recap

Here’s what you should remember:

- Bitcoin dominance = Bitcoin’s share of the total crypto market

- Altcoin season = when most altcoins outperform Bitcoin

- Falling dominance can signal altseason — but context matters

- Bitcoin usually leads first, altcoins follow later

- Use dominance + price together, not alone

Conclusion & Next Steps

Bitcoin dominance and altcoin seasons are not complicated once you see them for what they are: a map of where money is flowing.

You don’t need to predict the future. You just need to understand who is leading the market right now.

What You Can Do Today

- Check the current Bitcoin dominance trend

- Observe Bitcoin’s price behavior

- Match your trades to the market phase

If you want help spotting these shifts in real time, join the Fat Pig Signals Telegram community. You’ll see how dominance, market structure, and signals come together in real trading—not theory.

Take it slow. Start small. Learn the cycle. That’s how you survive—and grow—in crypto