4 Ways Investors Use Support and Resistance Levels to Make Better Trades

Investment, Trading

The support and resistance levels of an asset are major components when it comes to making profits in the crypto market. While ideally, cryptocurrency trading should be as simple as buying low and selling high, there are a number of factors that traders need to consider before investing. Proper identification of support and resistance levels can help crypto investors mitigate significant losses and make winning trades.

Support and resistance levels enhance a trader's ability to perfect their entry and exit times in the crypto market, along with helping them during range-bound, bearish, and bullish markets. In this article, we will take a look at four ways crypto investors utilize support and resistance levels to their advantage during crypto trading. But before that, let us understand the basics of it.

What are Supports?

When a cryptocurrency is being sold within the market, but its demand is also there at the same levels to absorb the selling and prevent its price from falling further, support is said to have been created. The crypto traders that are more inclined towards bullish behaviors believe at this level that the price would not decline more. The bearish traders cease to sell a trade at this point, thinking that the market may be due to rise.

Trendlines serve as supports during uptrends, and horizontal supports are not the only way of support formation. Although, they certainly are considered to be more reliable.

What are Resistance Levels?

Resistance is pretty much the opposite of support. Resistance is formed when the up-move is brought to a halt by the selling of a trade exceeding its buying demand. Buyers start booking profits, and aggressive bears resort to shorting, believing the rally is about to pull back, having extended enough. Eventually, the rally starts reversing after stalling when demand is exceeded by supply. Just like support, it is not necessary that the resistance zone or line is always a horizontal one.

Here are ways crypto traders employ resistance levels and support to their advantage during crypto trading:

They Identify Resistance and Support During Phases of Consolidation

Traders wait for the price of crypto to rally close to the resistance after buying on a rebound off the support and instantly close the position as soon as that happens. This way, crypto investors can keep the stop-loss for the trader just below the support of the range. With that said, most of the traders do that only when the support and resistance levels are explicitly and clearly defined. However, expert traders sometimes go after these stops by hunting them. They do that by bringing the price below the support of the range.

Traders can buy on the way up and dump their positions as soon as the price closes below the support in a decisive manner.

Trading Supports During an Uptrend

Traders expect the line to hold when a crypto asset takes support on a line that is an uptrend three times. This means that taking long positions on a bounce off that line is possible, and so is keeping the trade's stops just below the trendline. One thing to keep in mind, though, is that the break below the trendline during an uptrend does not always signify a reversal of the trend. It is common for the trend to rest for a while before resuming again.

Trades often consolidate in a range for a few hours, and sometimes even for some days before they resume their up-move. They take support on the uptrend line, and after they break below it, they do not necessarily start a new downtrend. When the price diminishes and sustains below the line, professional traders sometimes close their long positions, but they actively avoid taking new short positions. They start looking for buying opportunities when after consolidation, the price resumes its uptrend.

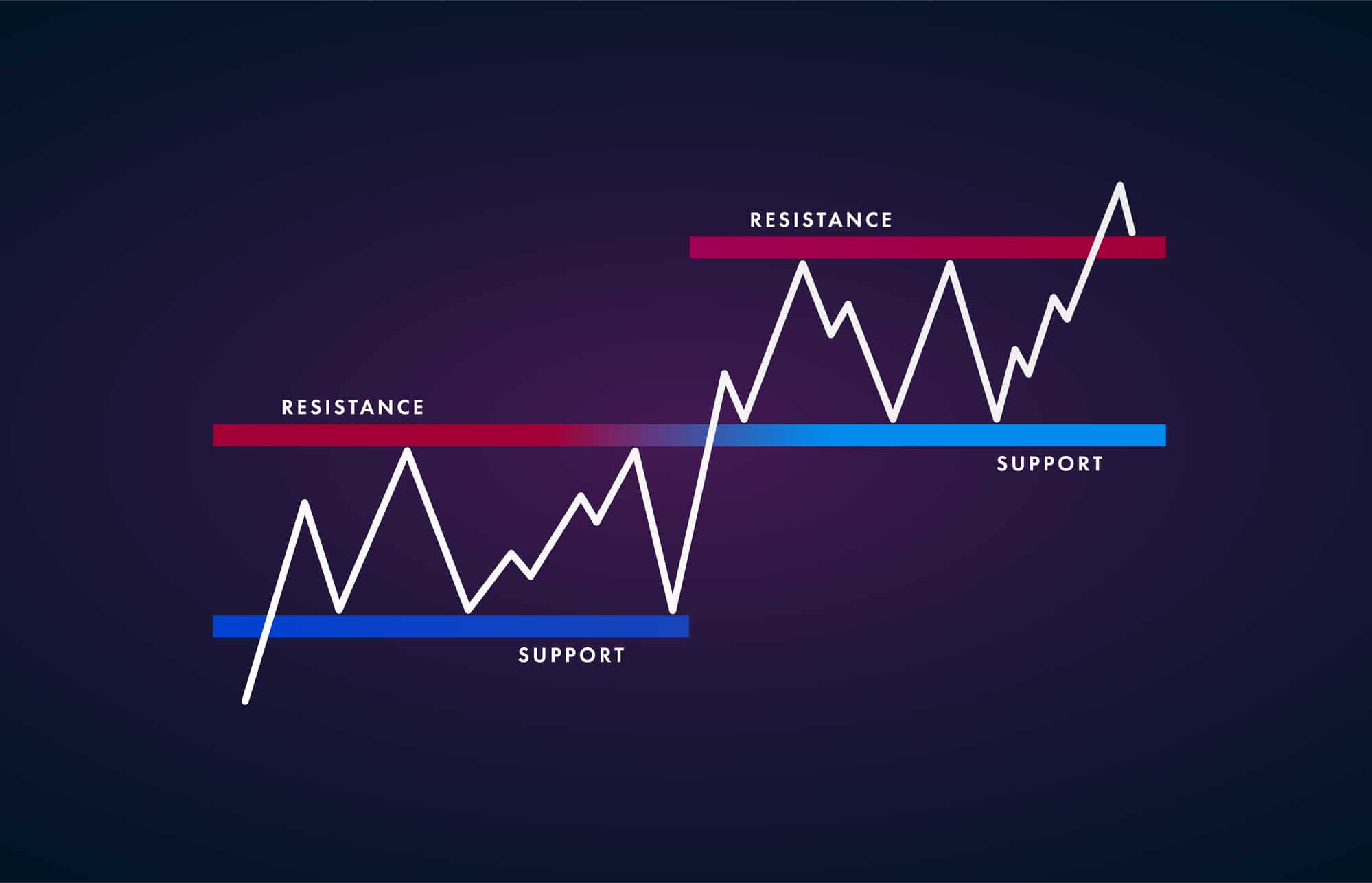

Flipping Resistance Into Support

A new uptrend is likely to resume or take off from scratch when bulls try to turn around a previous resistance into support after the price of trade breaks out of the resistance. A good buying opportunity arises if this takes place several times. The example of Bitcoin from August 2019 to July 2020 is a good one to understand this point. The cryptocurrency was stuck in a major way between the prices of $10,500 and $11,000. When it broke out from the zone of resistance, the price went down below the $10,500 point. The bullish crypto investors started buying aggressively after the dip and turned the level into support. This served as a great opportunity for buying as the new uptrend was at its initiating point.

Flipping Support Into Resistance

Likewise, traders can flip a support into resistance as well by starting to short and booking profits. As we witnessed from 14th February to 18th May last year, the zone between $26.5 to $28.9 formulated a support zone for Polkadots (DOT). The zone transformed into resistance as soon as the bearish crypto investors brought the price below the zone and then did not allow the price to break over it for a long time.

Support and resistance levels are always dynamic and demand that the decisions you make on their basis are also dynamic. During an uptrend, cryptocurrency traders need to keep an eye on the last high and the last low as a new high can confirm the uptrend, while a lower low signifies a likely change of trend.

Making beneficial decisions based on support and resistance levels requires a lot of practice, along with working on resistance, support, chart patterns, ranges, and isolating trends in a demo account. Practicing taking trades with stop-losses and targets is also recommended. Professional and expert traders try hunting for stop orders as support and resistance levels are not rigid. Therefore, crypto investors need to be careful not to be run down by the makers of the market by keeping the stops.