Psychological Traps in Following Crypto Signals: How Your Brain Can Sabotage Your Trades

Signals, Trading

You found a great signal group. The calls look solid. You're ready to make some money. But then… you buy too late, sell too early, hold a loser way too long, or panic at the first red candle. Sound familiar?

Here's the uncomfortable truth: even with the best crypto signals in the world, your own brain can be your worst enemy. Not because you're dumb — far from it. But because human brains aren't wired for trading. We're wired to survive, and survival instincts like fear, greed, and the need to follow the crowd don't play nicely with smart trading decisions.

According to a Kraken study from late 2024, 84% of crypto investors have made decisions based on emotions, with 63% saying those emotional choices hurt their portfolios. That's not a small number — that's almost everyone.

The good news? Once you can name these traps, you can start avoiding them. In this guide, you'll learn:

- The most common psychological traps that trip up signal followers

- Why these traps feel so logical in the moment (but aren't)

- Practical steps to protect your trades — and your mindset

Let's get into it.

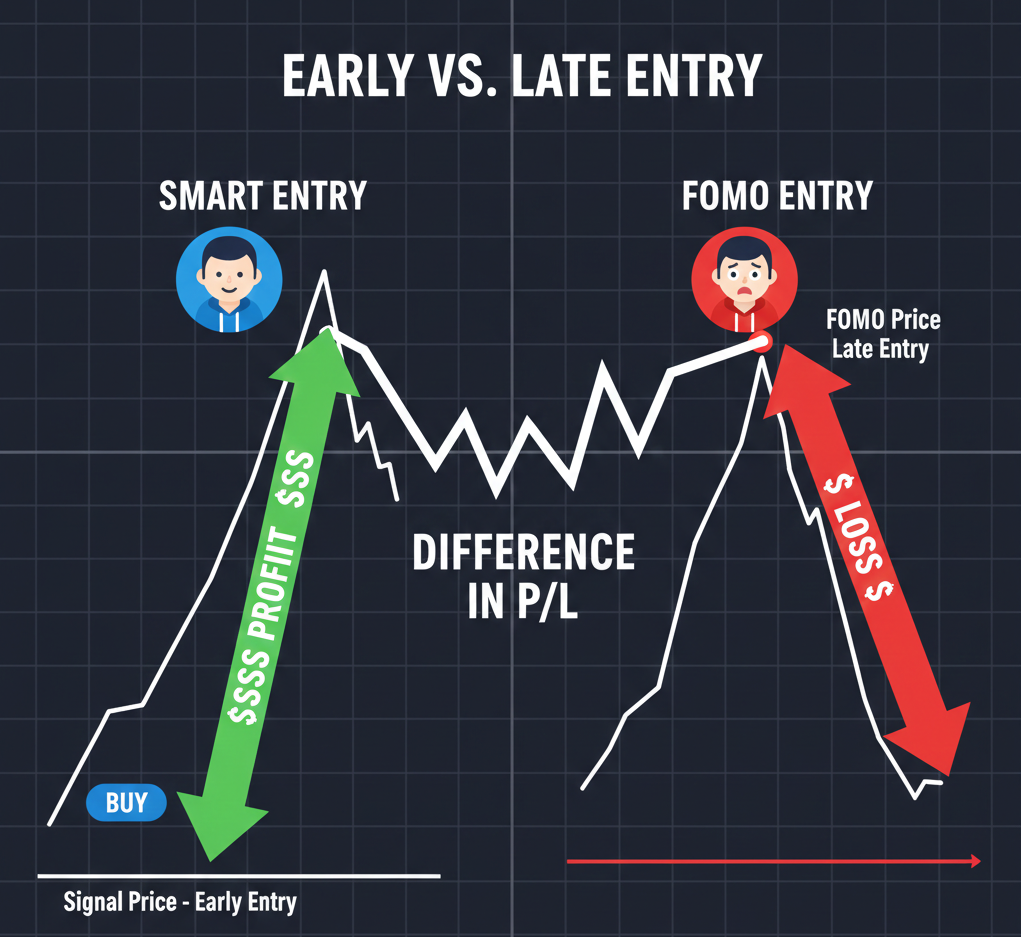

FOMO: The Trap That Gets Almost Everyone

FOMO (Fear of Missing Out) is probably the single most destructive emotion in crypto trading. It's that feeling when you see a signal, the price is already pumping, and your brain screams: "Get in NOW before it's too late!"

Here's what usually happens: a signal drops in your group. Bitcoin is running, or an altcoin just broke out. You hesitate for five minutes, then watch the price climb another 5%. Panic sets in. You buy at the top — and within hours, the price pulls back to exactly where the original signal was posted.

Why does this happen? Because FOMO hijacks your decision-making. Instead of following the signal's actual entry point, you chase the price. You're no longer trading the plan — you're trading your emotions.

Let's say a signal comes in to buy Ethereum at $3,200 with a target of $3,500. By the time you see it, ETH is already at $3,350. FOMO tells you to buy anyway. But now your risk-to-reward ratio is terrible. If it hits the $3,500 target, you only make $150 instead of $300. And if it pulls back to $3,200? You're down $150 while the patient traders are breaking even.

💡 Pro Tip: If you missed the entry on a signal, let it go. There will always be another trade. As experienced traders like to say: "Missed trades are better than bad trades." The market gives opportunities every single day.

Loss Aversion: Why You Hold Losers and Sell Winners Too Early

Here's a strange thing about the human brain: losing $100 feels about twice as painful as gaining $100 feels good. Psychologists call this loss aversion (the tendency to feel losses more intensely than equivalent gains), and it's one of the sneakiest traps in trading.

Loss aversion shows up in two ways when you're following signals:

1. Holding losing trades too long. A signal doesn't work out. The price drops below the recommended stop loss. But instead of exiting, you think: "It'll come back. I just need to wait." You refuse to accept a small, manageable loss — and it grows into a big one.

2. Cutting winning trades too short. The signal target is $75,000 for Bitcoin, but once you're up $500, fear creeps in. "What if it reverses? I should lock in this profit now." You sell early, only to watch BTC hit the target without you.

Think of it like this: imagine you're at an auction. You've bid $200 on a painting. The bidding goes against you, and the painting is clearly going to sell for more than it's worth. But you keep bidding because you've already "invested" $200 and can't bear to walk away with nothing. That's loss aversion — letting the fear of losing override logic.

The result? Your losses end up bigger than your wins, even when most of your trades are in the right direction. Over time, this quietly destroys accounts.

⚠️ Common Mistake: Many beginners ignore the stop-loss level in a signal because they "don't want to lose." But stop losses exist to protect you. A small loss today keeps you in the game for tomorrow's winning trade. Skipping stop losses is like driving without a seatbelt — you might be fine for a while, but when something goes wrong, it goes really wrong.

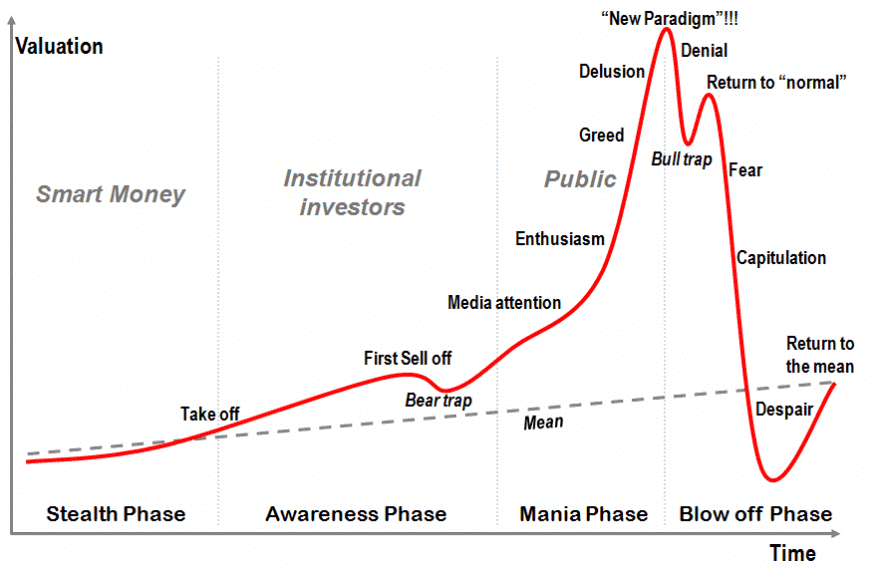

Herd Mentality: When "Everyone" Is Doing It

Crypto communities are powerful — that's why signal groups like Fat Pig Signals exist. But there's a dark side to community: herd mentality (the tendency to follow the crowd instead of thinking for yourself).

Herd mentality looks like this: an influencer tweets about a new coin. The Telegram group goes wild. Everyone is posting rocket emojis. The price starts pumping. You buy — not because you analyzed anything, but because everyone else is excited.

And here's the problem: by the time the herd is all-in, the smart money is already selling. The people who coordinated the hype? They bought earlier and cheaper. The crowd provides their exit liquidity (the ability for large sellers to offload their positions because there are enough buyers).

A real-world example: remember the altcoin mania cycles? Coins pump because social media explodes with hype. Retail traders pile in during the peak excitement phase. Then, almost like clockwork, the price crashes. The people who followed the herd are left holding bags.

This doesn't mean communities are bad — they're incredibly valuable for learning and sharing ideas. But there's a difference between learning from a community and blindly following it.

Here's a simple test before any trade: Can you explain in one sentence why this trade makes sense, without referencing what other people are doing? If the only reason is "everyone's buying it," that's a red flag.

A simple bell curve showing the cycle of hype — early buyers at the bottom, peak excitement in the middle (where the herd enters), and the crash on the other side. Image Source: foresightguide

Confirmation Bias: Seeing What You Want to See

Once you've decided you like a trade, your brain does something sneaky: it starts filtering information. You'll notice every bullish tweet, every positive chart pattern, every reason the trade should work — and you'll dismiss anything that suggests otherwise. This is confirmation bias (the tendency to seek out information that supports what you already believe while ignoring contradictory evidence).

Let's say you're holding a bag of an altcoin based on a signal. The price starts dropping. Instead of objectively reassessing, you scroll through Twitter looking for people who agree the coin will recover. You find a few bullish posts — "See? It's fine!" — and ignore the ten posts highlighting fundamental problems with the project.

This is especially dangerous in crypto because information is everywhere. No matter what you believe, you can find someone on the internet who agrees with you. But agreement doesn't equal accuracy.

Here's a powerful question to ask yourself before and during any trade: "What would prove me wrong?" If you can't answer that question, you're probably already trapped in confirmation bias.

In our Fat Pig Signals community, we encourage members to think critically about every signal — including ours. No signal is guaranteed. The best traders are the ones who evaluate signals with clear eyes, not the ones who blindly agree with everything.

Revenge Trading: The Most Expensive Emotion

You just lost money on a trade. Maybe the signal didn't work out, maybe you made an execution error. Either way, you're frustrated. And now a new thought takes over: "I need to make that back. Right now."

This is revenge trading — entering new trades not because they're good setups, but because you're angry about a loss and desperate to recover. It's one of the fastest ways to turn a bad day into a catastrophic one.

Revenge trading usually leads to:

- Taking trades that don't fit your plan or strategy

- Using larger position sizes than usual ("I'll just go bigger to make it back faster")

- Ignoring risk management entirely

- Making multiple impulsive trades in rapid succession

Think of it like a poker player who just lost a big hand. They're "on tilt" — emotions have taken over, and every decision from this point is compromised. In crypto, being on tilt with leverage available is a recipe for disaster.

What should you do instead? Walk away. Seriously. Close the app. Go for a walk. Make some food. Come back tomorrow. One of the most profitable things you can do after a loss is nothing at all.

As one reader once shared: "My best trading days are the ones where I didn't trade after a loss. My worst days are when I tried to fight the market to get my money back." That's wisdom worth remembering.

Flowchart showing the revenge trading cycle. Image Source: InnovestX

Overconfidence: When Winning Becomes Dangerous

This one might surprise you: winning streaks can be just as dangerous as losing streaks. After a few good trades, something shifts in your brain. You start thinking you've "figured it out." You increase your position sizes, skip your usual analysis, maybe start ignoring stop losses because "you know what you're doing."

This is overconfidence bias — and it's a trap that has blown up accounts of both beginners and experienced traders alike.

Here's how it plays out: You follow five signals in a row and they all hit their targets. You feel invincible. The sixth signal comes in, and instead of your usual careful approach, you go big — maybe 3x or 5x your normal position size. But this time, the trade goes against you. And because your position was so large, one bad trade wipes out the profits from those five winners.

The market doesn't care about your winning streak. Every single trade is an independent event with its own risks. Just because the last five worked doesn't mean the sixth will.

💡 Pro Tip: After a winning streak, consider actually trading smaller for a few days. This sounds counterintuitive, but it protects you during the period when overconfidence is most likely to cloud your judgment. The goal isn't to avoid winning — it's to keep winning consistently over months and years.

Quick Recap

Here's what we covered:

- FOMO makes you chase entries — buying after a signal has already moved leads to bad risk-reward ratios and unnecessary losses

- Loss aversion flips your results — you hold losers too long and cut winners too short, slowly bleeding your account

- Herd mentality bypasses your brain — following the crowd feels safe, but the crowd often buys the top and sells the bottom

- Confirmation bias creates blind spots — you see what you want to see and ignore warning signs that could save you money

- Revenge trading turns bad days into disasters — the urge to "make it back" after a loss leads to impulsive, emotion-driven trades

- Overconfidence after winning is a hidden risk — feeling invincible usually comes right before the market humbles you

The common thread? Every single one of these traps feels logical in the moment. That's what makes them so dangerous.

Your Next Steps

Now that you can name these traps, you're already ahead of most traders. Here's how to start protecting yourself:

1. Today: Before your next trade, pause for 30 seconds and ask yourself: "Am I trading this because it's a good setup, or because of an emotion?" Just that one question can save you from FOMO, revenge trading, and herd mentality.

2. This week: Start a simple trading journal. For each trade, write down your emotional state — were you calm, anxious, excited, frustrated? After 10-15 trades, you'll start seeing patterns that reveal which traps you're most vulnerable to.

3. Ongoing: Join the Fat Pig Signals Telegram community where we don't just share signals — we talk about the mental side of trading too. Having a community that encourages discipline (not just hype) makes a real difference when emotions run hot.

Remember: the best traders aren't the ones who never feel these emotions. They're the ones who feel them and choose not to act on them. That skill takes practice, but it's the single most valuable thing you can develop as a crypto trader.

You're already on the right track by learning this. Keep going. Stay patient. Trust the process. And always, always protect your capital — because if you stay in the game long enough, the opportunities will come.

[Join our Telegram group here] to trade smarter alongside a community that values discipline over hype.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Cryptocurrency trading involves substantial risk of loss. Always do your own research and consider consulting with a financial advisor before making investment decisions.