Top Emerging Blockchain Projects Worth Watching

Technology

Every week, dozens of new crypto projects launch, each promising to "revolutionize" something. Most fade into obscurity. But a handful actually deliver real technological breakthroughs that could shape the future of finance, gaming, and digital ownership.

In this article, we're going to cut through the noise and look at five emerging blockchain projects that are doing something genuinely different. We'll explain what makes each one unique, why it matters, and what to watch for—all in plain language.

By the end, you'll understand not just what these projects do, but how to evaluate any new blockchain project you come across. Let's dive in.

Why "Emerging" Projects Matter

The biggest gains in crypto often come from identifying solid projects before the mainstream catches on. But new projects also carry the highest risk—many won't survive.

Here's what separates promising projects from noise:

- Real technology solving real problems

- Experienced teams with proven track records

- Actual adoption and usage

- Strong funding and institutional backing

Keep these criteria in mind as we explore each project.

1. Sui (SUI) – The Speed Champion

Sui is a high-performance blockchain developed by Mysten Labs. The team includes former Meta (Facebook) engineers who worked on the failed Diem blockchain project. They took what they learned and built something better.

Why it matters: Sui achieves consensus in approximately 390 milliseconds—that's faster than Solana's roughly 800ms. For context, that's nearly instant transaction confirmation. The project uses a programming language called Move, designed specifically to enhance the security of smart contracts and reduce common coding vulnerabilities.

The numbers: As of late 2025, Sui's total value locked (TVL) has surpassed $2 billion. Monthly active developers grew 219% year over year to 1,300, far outpacing Solana's 83% growth. In 2025 alone, developers ran over 1.16 billion programmable transaction blocks on Sui.

In December 2025, Bitwise filed for a spot SUI ETF with the SEC—joining 21Shares and Canary Capital in seeking regulatory approval. This signals that institutional investors see Sui as "infrastructure-grade" technology, similar to Bitcoin and Ethereum.

Pro Tip: ETF filings don't guarantee approval, but they indicate serious institutional interest. Watch for SEC decisions on these applications as potential catalysts.

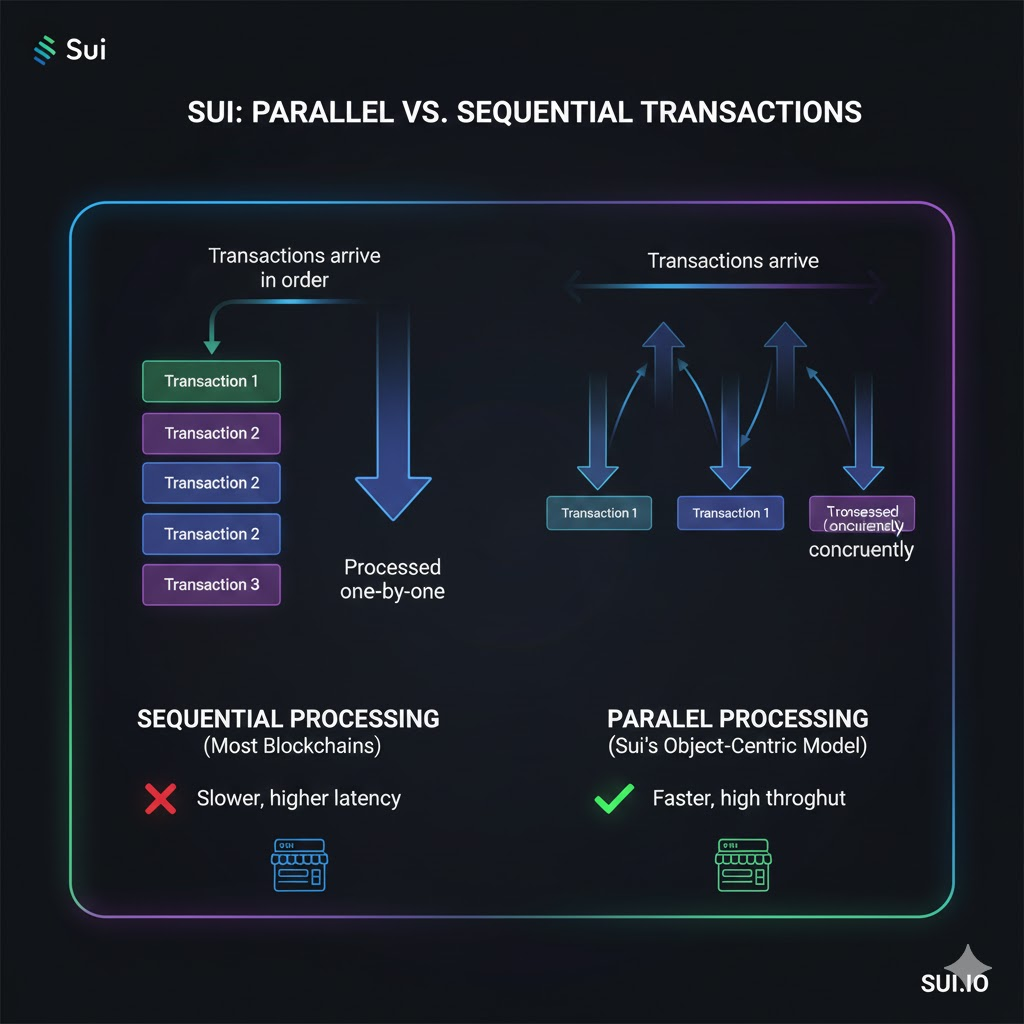

What makes Sui unique: Unlike most blockchains that process transactions sequentially, Sui uses an "object-centric" model that enables parallel processing—like multiple checkout lanes at a grocery store rather than one.

2. Celestia (TIA) – The Modular Pioneer

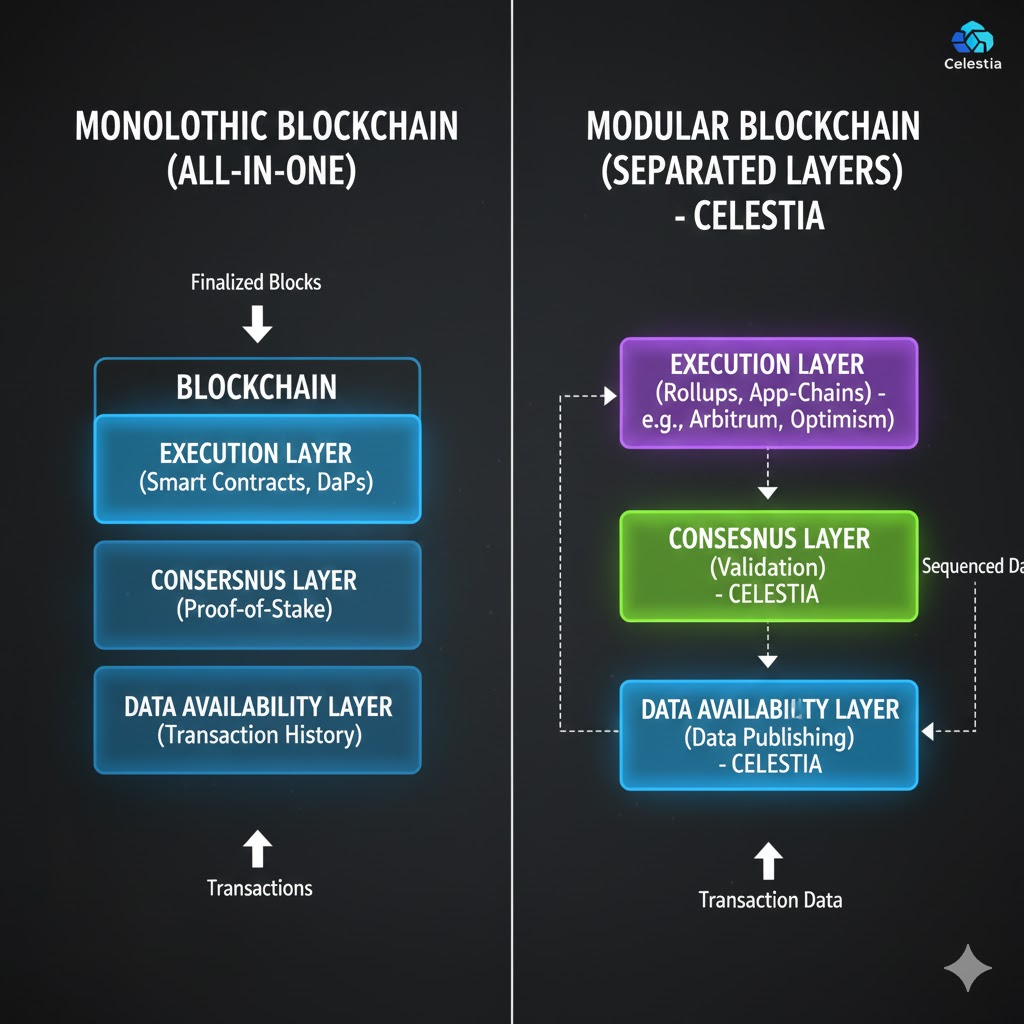

Celestia is the first "modular" blockchain network. While traditional blockchains (often called "monolithic") handle everything—consensus, data availability, and execution—in a single layer, Celestia separates these functions.

Why it matters: By focusing solely on consensus and data availability, Celestia enables other blockchains and rollups (scaling solutions that bundle transactions) to build on it. Think of it like this: instead of every restaurant building its own farm, delivery service, and dining room, Celestia provides the infrastructure so restaurants can focus on cooking great food.

Monolithic blockchain (all-in-one) vs modular blockchain (separated layers)

The problem it solves: On traditional Proof-of-Stake (PoS) blockchains (a consensus mechanism where validators lock up tokens to secure the network), those tokens are locked and can't be used elsewhere. This creates a tension between security and liquidity. Celestia's approach enables developers to launch their own blockchains without bootstrapping an entire validator network from scratch.

By early 2025, more than 20 independent chains and rollups were using Celestia's data availability layer, including projects such as Arbitrum Orbit, Optimism, and various Cosmos SDK-based chains. The project raised $100 million in September 2024 from Bain Capital Crypto.

The roadmap: Celestia is working toward 1GB block sizes—massive data capacity compared to current blockchain standards. They're also developing "lazy bridging" for seamless cross-rollup transactions.

Many beginners confuse "modular" blockchains with Layer-2 solutions. They're related but different. Layer-2s add scalability to existing chains such as Ethereum. Modular blockchains like Celestia provide foundational infrastructure that any blockchain can use.

3. Berachain (BERA) – The Liquidity Solution

Berachain launched its mainnet in February 2025 with a completely new approach to blockchain consensus. Berachain is an EVM-identical Layer-1 blockchain that uses Proof-of-Liquidity (PoL)—a novel consensus mechanism that aligns incentives among users, validators, and decentralized applications (dApps).

The problem it solves: Traditional PoS blockchains have a fundamental conflict. Users earn rewards by staking (locking) their tokens for security. But DeFi applications need liquidity—tokens actively being used, not locked away. These two goals are in conflict.

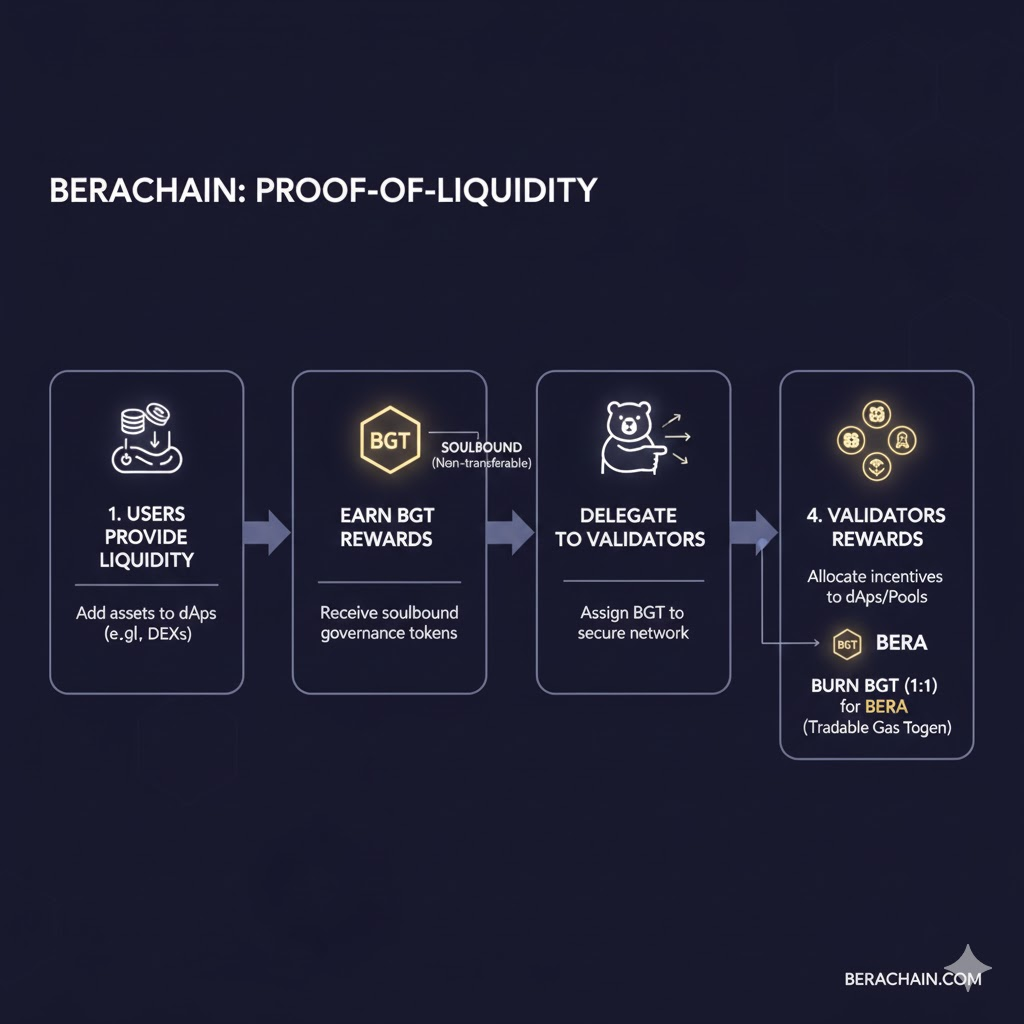

How Proof-of-Liquidity works: Instead of just staking tokens for security, Berachain rewards users who provide liquidity to applications. When you provide liquidity (for example, adding funds to a decentralized exchange), you earn BGT (Berachain Governance Token). Validators then direct these rewards to the applications they believe deserve them most.

Here's the clever part: BGT is "soulbound"—meaning you can't transfer it to someone else. However, you can burn it 1:1 to BERA (the tradable gas token). This creates an interesting dynamic where long-term participants accumulate governance power, while those who want to exit can convert to BERA.

The launch numbers: Before the mainnet launch, Berachain's pre-launch liquidity platform, Boyco, attracted $3.1 billion in deposits, making Berachain the 8th-largest chain by TVL before it even launched. That's extraordinary for a new blockchain.

Berachain was founded by three pseudonymous developers—Smokey the Bear, Homme Bera, and Dev Bear—and raised over $100 million from investors including Polychain Capital and Framework Ventures.

Pro Tip: Berachain's multi-token model (BERA, BGT, and HONEY stablecoin) can be confusing at first. Focus on understanding how BGT accumulates through liquidity provision—that's the core innovation.

4. Sonic (S) – The Fantom Evolution

Sonic is the next-generation Layer-1 blockchain that emerged from the Fantom network. In January 2025, Fantom rebranded as Sonic Labs, with the FTM token converting 1:1 to the new S token.

Why the rebrand?: The Fantom team realized their breakthrough technology couldn't be integrated into the existing network through a simple upgrade. They needed a fresh start to deliver their full vision of speed and scalability.

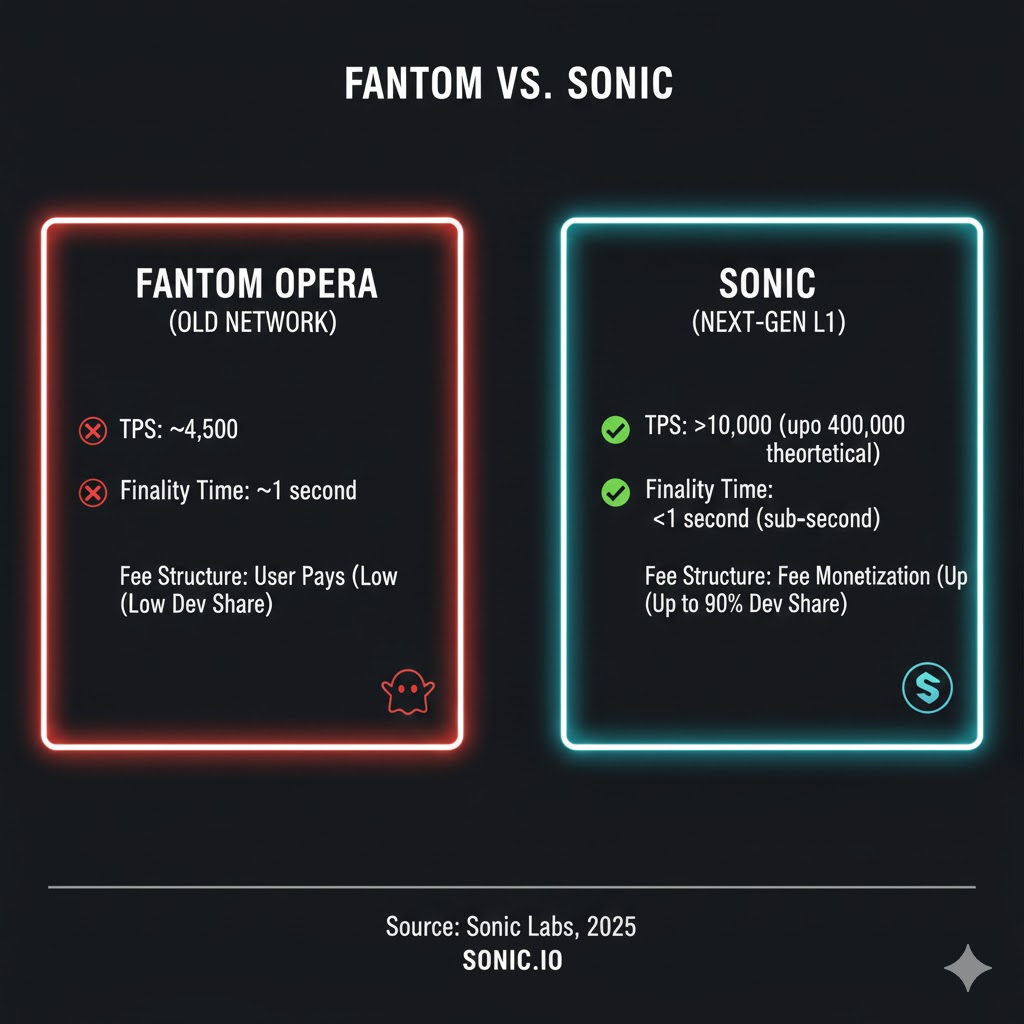

Sonic targets over 10,000 transactions per second with sub-second finality—significantly faster than the original Fantom network's approximately 4,500 TPS. The network claims a theoretical capacity of up to 400,000 TPS.

What's genuinely interesting: Sonic's Fee Monetization (FeeM) program rewards developers with up to 90% of the fees their applications generate. This is similar to how content creators on YouTube or TikTok earn revenue based on views. It's a model designed to attract and retain developers by directly tying their compensation to their app's success.

The Ethereum bridge: Sonic Gateway provides a native, secure bridge to Ethereum, allowing seamless access to Ethereum's vast liquidity. This addresses one of the biggest challenges for alternative Layer-1s—being isolated from the largest DeFi ecosystem.

Recent developments: In 2025, Sonic received community approval for a $150 million token issuance to fund U.S. expansion, including a $50 million ETF initiative. Sonic Labs also invested $40 million in a strategy to pursue a Nasdaq listing.

Don't assume a rebrand automatically improves a project. Look at what's actually different. In Sonic's case, the new database architecture (SonicDB) and virtual machine (SonicVM) represent genuine technical improvements, not just marketing.

5. Story Protocol (IP) – The Intellectual Property Blockchain

Story Protocol (IP) is a purpose-built Layer-1 blockchain designed specifically for intellectual property management. It allows creators to register, license, and monetize their IP directly on-chain.

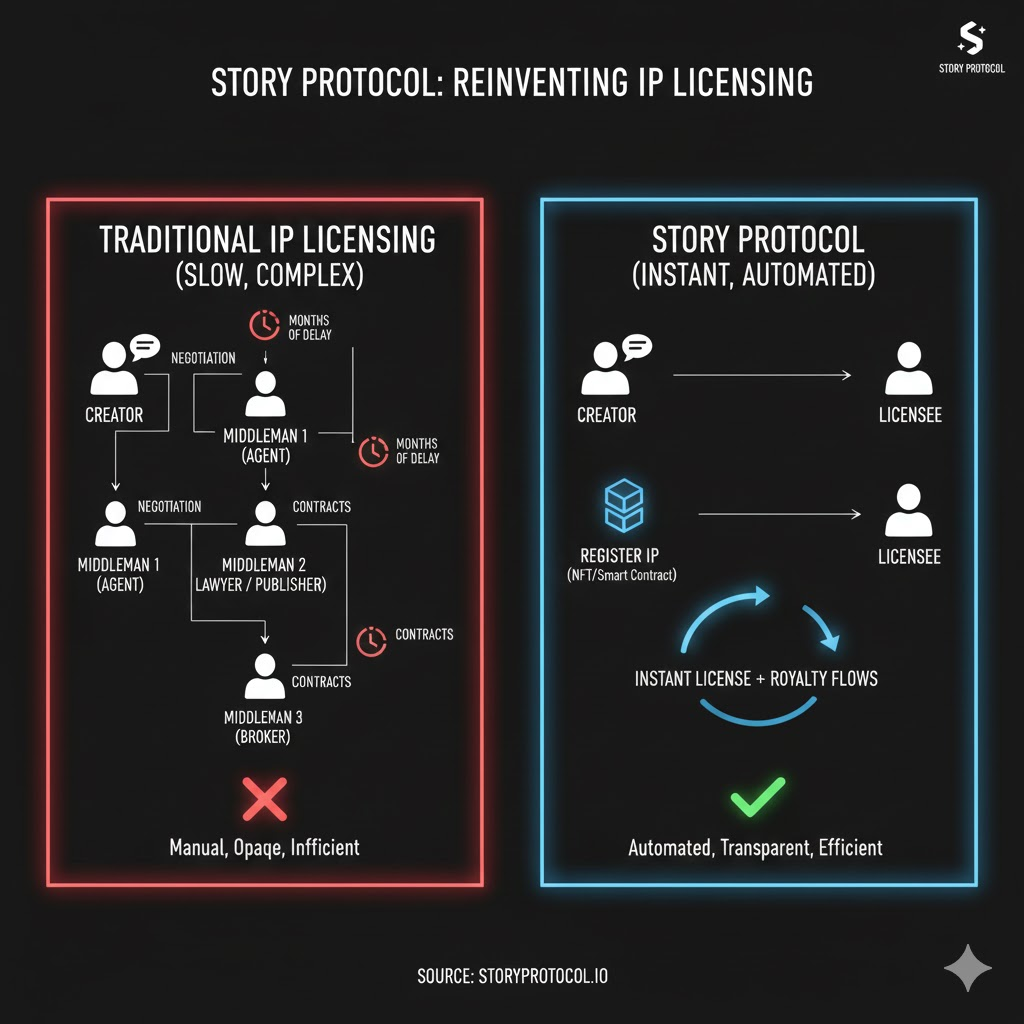

Intellectual property is a $70 trillion asset class globally—but it's incredibly inefficient. Want to license a character for merchandise? Good luck navigating lawyers, agents, and months of negotiations. Story aims to make IP licensing as simple as a smart contract interaction.

How it works: Creators register their IP as NFTs using ERC-721 and ERC-6551 standards, but with programmable licensing terms built in. These terms automatically enforce royalty payments, usage restrictions, and revenue sharing. No lawyers required for every transaction.

Example: An artist uploads a character design. They specify: "$1,000 upfront license fee, plus 20% of any revenue generated from commercial use." Anyone can license that character instantly by paying the fee, and royalties flow automatically when revenue is generated.

Team and funding: Story was founded by Seung Yoon "SY" Lee (who sold his mobile fiction app Radish for $440 million and was a Forbes 30 Under 30) and Jason Zhao (former Google DeepMind). The project has raised $140 million across three rounds led by a16z crypto—making it the first blockchain company a16z has led three rounds for since Coinbase.

As AI-generated content proliferates, the question of ownership becomes critical. Story Protocol provides infrastructure for AI models to license training data fairly, and for creators to prove ownership of their work.

Mainnet launch: Story launched its mainnet ("Homer") in February 2025, with the IP token immediately available on major exchanges.

Story Protocol is a "pick and shovel" play in the AI revolution. Instead of betting on which AI wins, you're betting on the infrastructure that all AI-generated content might need.

How to Evaluate Any Emerging Project

Here's a framework for evaluating any new blockchain project:

1. What problem does it solve? Each project above solves a specific problem. Be skeptical of projects that can't clearly articulate their purpose.

2. Who's building it? Look for teams with relevant experience. Track records matter.

3. Is anyone using it? TVL, daily transactions, developer activity—these tell you if a project has real traction.

4. How is it funded? Projects backed by tier-one investors like a16z or Polychain have passed some due diligence.

5. What could go wrong? Token unlocks, competition, regulatory issues—understanding downside is as important as upside.

Quick Recap

Here's what we covered:

- Sui (SUI): High-speed Layer-1 with 390ms finality, built by former Meta engineers, ETF filings signal institutional interest

- Celestia (TIA): First modular blockchain, separates consensus from execution, enables scalable rollups

- Berachain (BERA): Proof-of-Liquidity consensus mechanism aligns security with DeFi activity, launched with $3.1 billion pre-launch liquidity

- Sonic (S): Fantom's evolution, 10,000+ TPS, Fee Monetization rewards developers with 90% of generated fees

- Story Protocol (IP): Intellectual property blockchain, enables automated licensing and royalties, $140 million raised from a16z

Your Next Steps

Ready to start researching emerging blockchain projects? Here's your action plan:

Your Next Steps:

1. Today: Pick one project from this list. Visit their official documentation and read the whitepaper.

2. This Week: Track metrics that matter. For Layer-1s, watch TVL, transactions, and developer activity on sites like DefiLlama and Messari.

3. Moving Forward: Join the Fat Pig Signals community where we discuss emerging projects and share research. Having a community makes research more effective.

Remember: emerging projects carry a higher risk than established cryptocurrencies. Never invest more than you can afford to lose, and always do your own research. The crypto space moves fast. Stay curious, stay skeptical, and keep learning.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Cryptocurrency trading involves substantial risk of loss. The projects mentioned are examples for educational purposes—their inclusion does not constitute an endorsement or recommendation. Always do your own research and consider consulting with a financial advisor before making investment decisions.