Risk Management 101: How Much Should You Invest Per Trade?

Trading

Ever looked at a promising trade and thought, "Should I go all in?" If so, you're not alone. It's one of the most common questions beginners ask—and getting it wrong can empty your account faster than a bad market crash.

Here's the truth: successful trading isn't just about picking winners. It's about protecting yourself when trades go south. And they will. Even the best traders lose regularly. The difference? They know exactly how much to risk on each trade.

By the end of this article, you'll understand the simple rules that separate traders who survive from those who blow up their accounts.

The Golden Rule: Never Risk More Than 1-2% Per Trade

Let's start with the most important number in trading: 1-2%.

That's the maximum amount of your total trading account you should risk on any single trade. Not 10%. Not 5%. Just 1-2%.

Here's why that matters. Let's say you have $1,000 in your account:

- At 1% risk: You can lose $10 per trade. That means you'd need 100 consecutive losing trades to wipe out your account.

- At 10% risk: You can lose $100 per trade. Now you only need 10 bad trades in a row.

Which scenario gives you more room to learn and recover? The math is clear.

Pro Tip: Start with 1% risk when you're learning. You can always increase it later once you've proven you can trade consistently.

Position Sizing: How to Calculate Your Trade Size

Now here's where beginners get confused. Risking 1% doesn't mean investing only 1% of your account. It means your potential loss should be 1%.

Here's a simple formula:

Position Size = (Account Balance × Risk %) ÷ Distance to Stop Loss

Let's break that down with an example.

You have $1,000. You want to buy Bitcoin at $50,000, and you'll set your stop loss (an automatic sell order that limits your loss) at $49,000. That's a $1,000 drop, or 2% below your entry.

Your 1% risk = $10 maximum loss.

Since Bitcoin needs to drop 2% to hit your stop loss, and you can only lose $10, you'd buy $500 worth of Bitcoin. If it drops 2%, you lose $10—exactly 1% of your account.

Sound complicated? It gets easier with practice. Most exchanges even have position size calculators built in.

More on: Position Sizing: How to Calculate Your Trade Size

Why This Approach Works

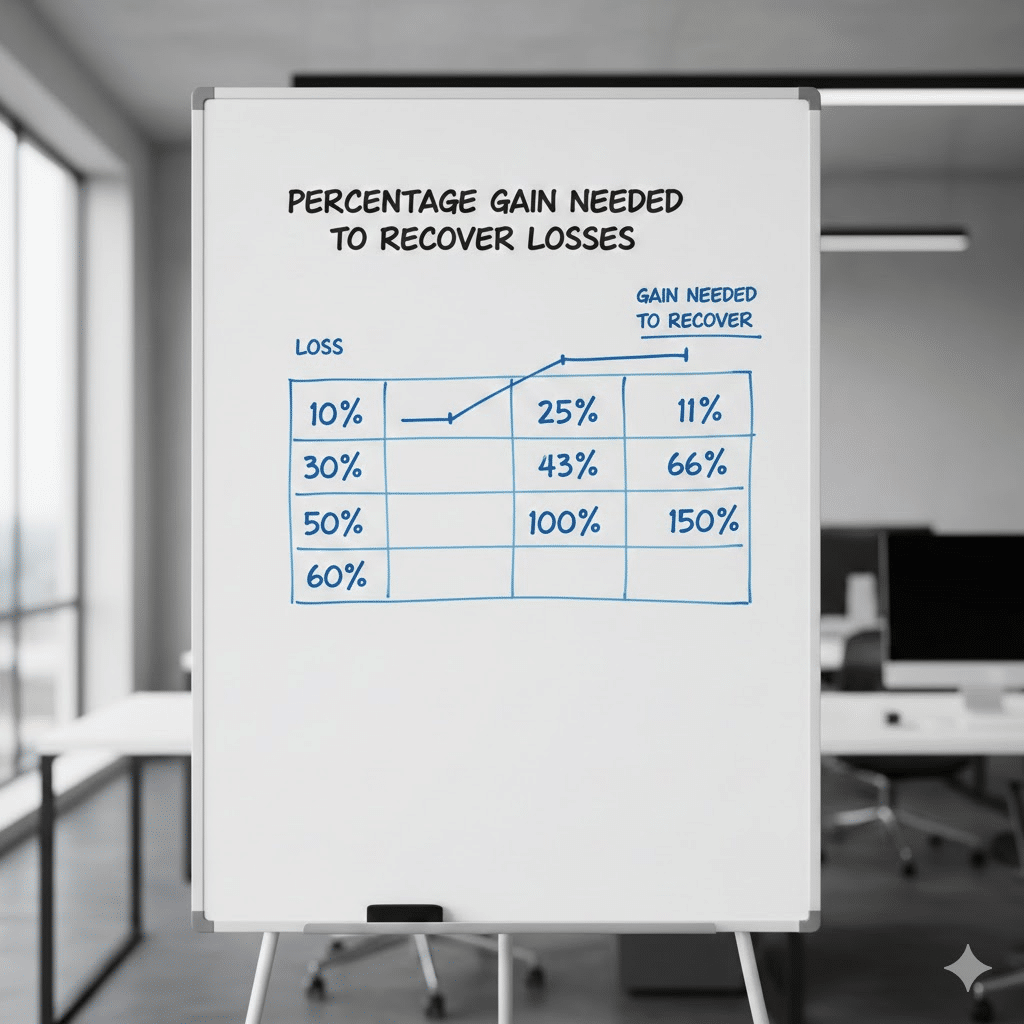

A 10% loss requires an 11% gain to recover. But a 50% loss? You need a 100% gain just to break even. The deeper the hole, the harder it is to climb out.

Percentage gains needed to recover from different loss levels—10% loss needs 11% gain, 50% loss needs 100% gain

By limiting each trade to 1-2% risk, you're building a sustainable approach. You'll have bad days. Bad weeks, even. But you'll still have an account to trade with tomorrow.

Common Mistake: Increasing position size after a winning streak. Overconfidence kills more accounts than bad analysis. Stick to your rules whether you're up or down.

The Portfolio Rule: Don't Put All Your Eggs in One Basket

Beyond individual trades, watch your overall exposure. A good rule: never have more than 5-10% of your account riding on correlated trades.

What does that mean? If you're long on Bitcoin, Ethereum, and Solana, those trades often move together. If crypto dumps, they all dump. You might think you've spread your risk, but you've actually concentrated it.

Proper diversification means trading assets that don't always move in the same direction.

Quick Recap

Here's what we covered:

- The 1-2% rule: Never risk more than this amount on any single trade

- Position sizing matters: Calculate your trade size based on where your stop loss sits

- Losses compound: Small losses are recoverable; big losses can be account-ending

- Watch correlation: Multiple similar trades can multiply your risk unexpectedly

Check this out Best Practices for Using Telegram Signals

Your Next Steps

1. Today: Calculate 1% of your current trading balance. Write it down. That's your maximum risk per trade starting now.

2. This Week: Before entering any trade, calculate your position size using the formula above. Practice this until it becomes automatic.

3. Ongoing: Join the Fat Pig Signals Telegram community, where we share properly sized trade signals and help each other stay disciplined. Having a community keeps you accountable.

You don't need to hit home runs to be profitable. Singles and doubles—consistent, well-managed trades—win over time. The traders who last aren't the ones who make the biggest wins. They're the ones who survive long enough to keep compounding small gains.

Start small. Stay disciplined. Trust the process.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Cryptocurrency trading involves substantial risk of loss. Always do your own research and consider consulting with a financial advisor before making investment decisions.