How Traders Can Get Rich With Crypto

Signals, Trading

The crypto secret to successful trading - no, there is not THE secret to how traders can reliably make money with cryptocurrency. However, several significant parts can contribute to profitable trading.

Important components to being able to make money with crypto signals include:

- Developing and following an investment strategy

- Sound price analysis

- trading, emotions, and risk management

Making money with cryptocurrency can also be done by investors without previous trading experience but with basic experience in the crypto market.

They can also start with the crypto signals from Fatpigsignals to gradually familiarize themselves with the opportunities and risks in the crypto market.

Anyone who wants to make money with cryptocurrency has countless opportunities because cryptocurrencies amount to many thousands. Fatpigsignals filters profitable and reliable opportunities so that you have time for other things.

But what makes for trading success, and how can traders make the most of the crypto market? We have compiled some important tips on how to make money with cryptocurrency that go even better.

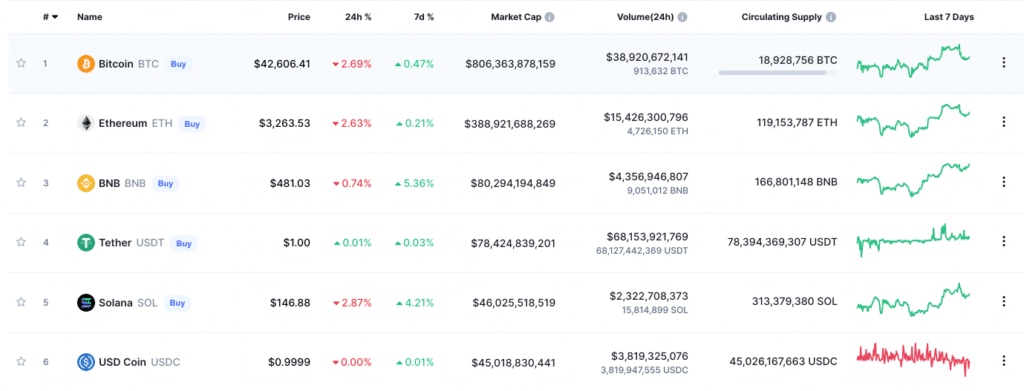

Trade Coins with High Marketcap

When it comes to how traders can make money with cryptocurrency, there are several possible strategies. One of them is looking for a currency with the highest market capitalization possible.

The price of a coin does not determine its profitability but the forces of supply and demand. And scarce coins with limited supply (like Bitcoin) have a high value.

Therefore, market capitalization is an important indicator of profitable currencies, as it gives investors an idea of the overall value and reflects the actual worth of the project. A cryptocurrency with a high market capitalization also means that many other investors are trading the coin.

To calculate the market capitalization, the coin's current price is multiplied by the number of coins in circulation.

Low Risk With Cryptocurrencies With High Market Cap

If traders choose a cryptocurrency with a high market capitalization, this can mitigate the risk. The high market capitalization clearly shows that there is potential demand regarding cryptocurrency.

Some traders prioritize trading visually cheap coins, such as the Shiba Inu Coin, due to a lack of experience, thinking that they would have to buy as many coins as possible with their equity. Theoretically, this assumption is not entirely wrong, but what good are many Coins in the crypto wallet if there is hardly any demand for the cryptocurrency and the associated increase in value?

- Market capitalization can be an indication of increased demand for that coin.

- Visually cheap coins have high potential returns, but they also carry the risk of total loss.

- Volatility tends to be lower for coins with high market capitalization.

Better Assess The Potential Of Coins With The Help Of The Market Reports

Of course, traders may also strike based on low market capitalization and buy the coins at a low price. However, for traders to know whether the forecast for their cryptocurrency is optimistic or not, it is recommended to look at current market news.

For example, if there are new collaborations for a crypto project or the technology is made available to the general public, this can increase demand. Those who previously bought coins cheaply thus have the chance to sell more expensively and become rich with cryptocurrency.

The best example is Bitcoin: when it was introduced in 2009, there were almost only skeptics, and no one knew what to do with this new currency. That's why the price was extremely low initially, moving in the single to double-digit euro range. Today, the Bitcoin price is known to be in entirely different spheres.

How Much can You Earn with Paid Cryptocurrency Signals?

Trading with crypto is risky but very rewarding. The Crypto signals from Fatpigsignals are a guide so that traders do not go in randomly. The amount of profit a user can make will depend on the crypto signal service provider, their signals' accuracy, and the money they put into each trade.

Conclusion

Joining the Fatpig Signals community is a guaranteed way for traders to learn from experienced traders which assets they should and should not choose. They are the solution for a trader looking for stable guidance on how to operate the market.

When choosing a crypto signal channel, one must pay attention to the frequency and quality of a signal sending and the quality of their customer support.