How to Spot Correction Warning Signs to Protect Your Portfolio

Cryptocurrencies, Trading

Market corrections are an inevitable part of investing. While they can be unsettling, understanding their warning signs and having a plan can help you protect your investments and even find opportunities.

A market correction is generally defined as a decline of 10% or more from a recent peak in a market index, like the S&P 500. Knowing what to look for can give you a significant advantage.

Key Warning Signs of an Impending Correction

The key to protecting your portfolio is being proactive, not reactive. Paying attention to these signals can help you prepare before a downturn hits:

1. Prices Get Too High

When stock prices rise far more quickly than corporate earnings, it's a classic sign of an overheated market. One way to gauge this is by looking at the price-to-earnings (P/E) ratio. A P/E ratio that is significantly higher than its historical average suggests that investors might be paying too much for a company's earnings. This often signals that a correction is needed to bring valuations back in line with reality.

2. Increased Market Volatility

A sudden increase in daily price swings, both up and down, can be a major red flag. This can be measured by the VIX (Volatility Index), often called the "fear index." When the VIX spikes, it means that investors are becoming more uncertain and nervous, which can be a precursor to a sharp market decline.

3. Interest Rates Go Up

Central banks, like the U.S. Federal Reserve, often raise interest rates to combat inflation. While this is a healthy action for the economy long-term, it can be a headwind for the stock market. Higher interest rates make borrowing more expensive for companies and individuals, which can slow economic growth and reduce corporate profits, leading to a market correction.

4. Economic Slowdown

A weakening economy is a major factor in market downturns. Watch for signs like declining corporate profits, a slowdown in manufacturing activity, rising unemployment rates, or a drop in consumer confidence. These indicators suggest that the economic fundamentals supporting the market may be deteriorating.

5. Only a Few Stocks Are Doing Well

This refers to the number of stocks participating in a market rally. If a major index, like the S&P 500, is still hitting new highs, but only a small handful of large-cap stocks are driving the rally while the majority of stocks are falling or treading water, it's a sign of a fragile market. This lack of broad participation suggests the rally is not sustainable.

How to Protect Your Portfolio Before a Correction

A well-prepared investor can mitigate the impact of a correction. Here’s what you can do:

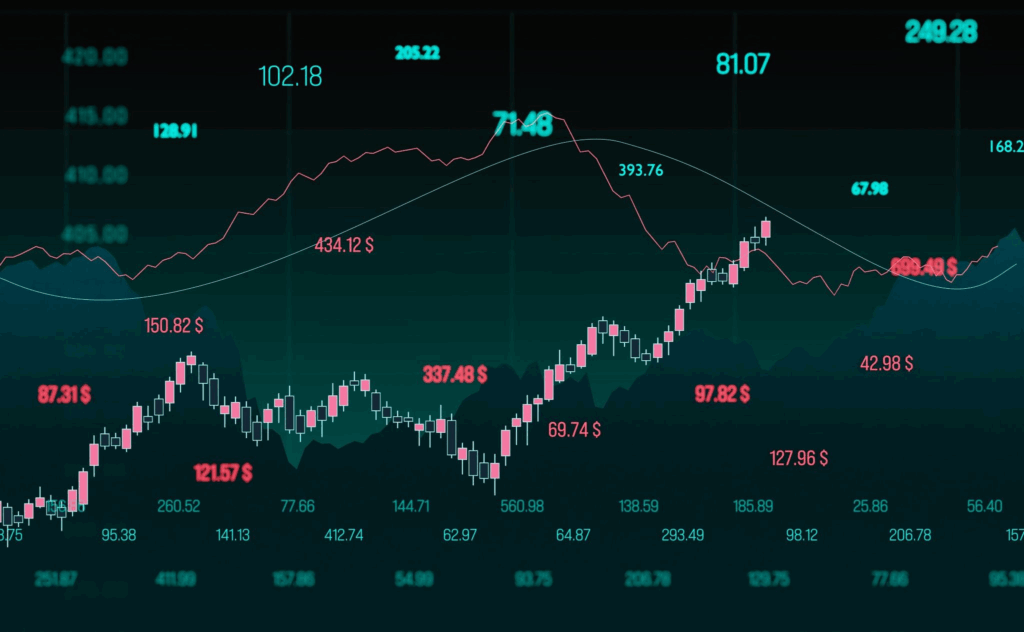

1. Rebalance Your Portfolio

If you've had significant gains in certain asset classes, a market rally may have shifted your portfolio's balance. Rebalancing involves selling off some of your top-performing assets and reinvesting in underperforming ones to return to your target asset allocation. This forces you to sell high and buy low.

2. Increase Your Cash Position

Having some cash on the sidelines provides a safety net and gives you the flexibility to buy assets at a discount when a correction occurs. Slowly increasing your cash position as the market becomes frothy can be a smart move.

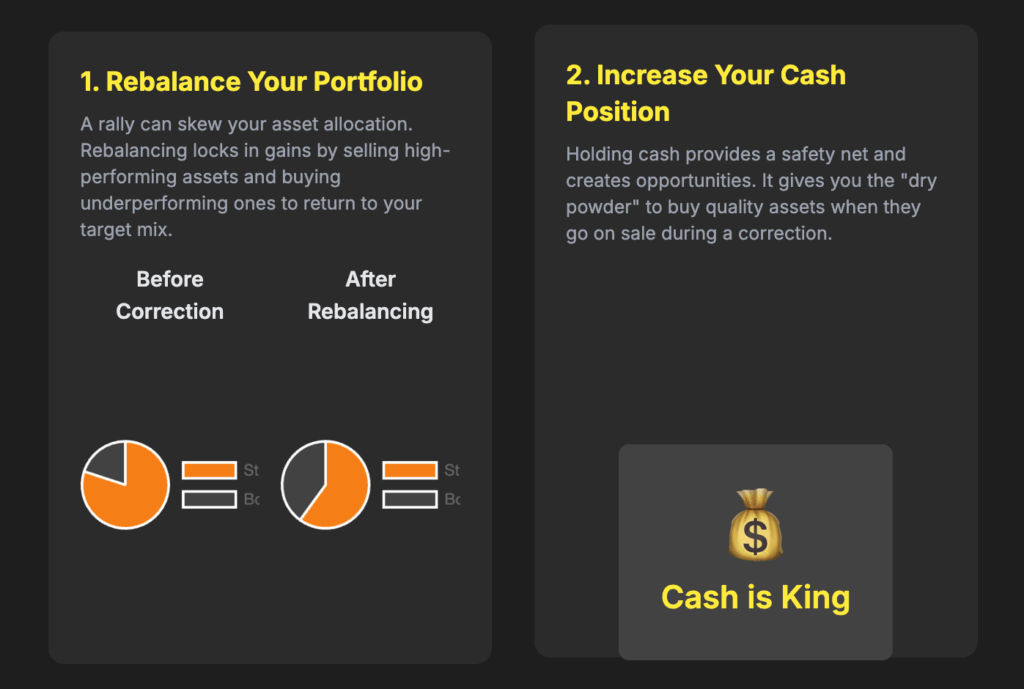

3. Diversify Your Assets

Don’t put all your eggs in one basket. Diversifying across different asset classes—such as stocks, bonds, real estate, and commodities—can help smooth out returns during a downturn. When one asset class falls, another may hold its value or even rise.

4. Review and Adjust Your Stop-Loss Orders

A stop-loss order is an order to sell a security when it reaches a certain price. While not foolproof, it can help limit your potential losses if a stock starts to plummet. Make sure your stop-loss levels are set at a point you're comfortable with.

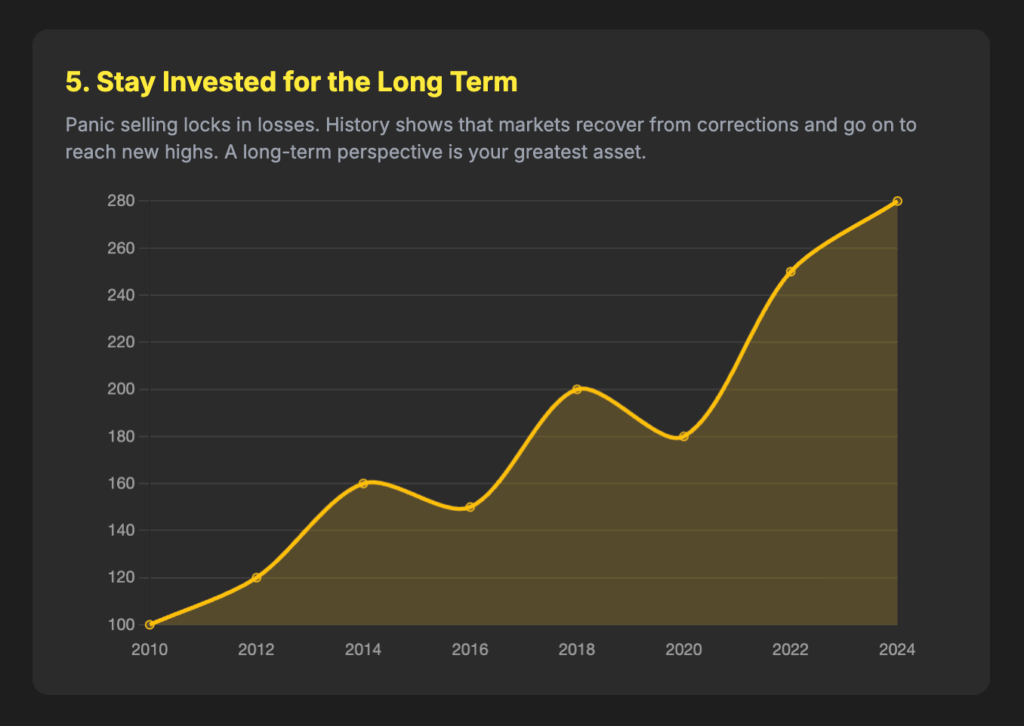

5. Stay Invested for the Long Term

While the signs of a correction can be scary, remember that markets almost always recover and go on to set new highs. Panicking and selling all your assets can lock in losses and cause you to miss out on the eventual recovery. A long-term perspective is a powerful tool against short-term market anxiety.

Also check out Top 7 Best Indicators for Crypto Trading

Conclusion

Market corrections are a natural part of investing, not a reason to panic. Paying attention to simple warning signs and having a plan to protect your money, can help you face them with confidence.

Remember, a correction can also be a great chance to buy good investments at a lower price, setting you up for bigger gains in the future.