How to Follow Trading Signals Effectively

Signals, Trading

Why Did This Signal Win for Others… But Not for Me?

Have you ever followed a trading signal, watched the price move, and thought: “Wait… why did I lose when the signal looked right?”

If that’s you, don’t worry—you’re not alone. Most beginners don’t lose money because signals are “bad,” but because they don’t know how to follow trading signals properly.

In today’s fast-moving crypto market, trading signals can be incredibly helpful—if you know how to use them correctly. By the end of this guide, you’ll understand what trading signals really are, how to follow them step by step, and how to avoid the most common beginner mistakes.

What Are Trading Signals (In Simple Terms)?

A trading signal is a clear instruction that tells you what to trade, where to enter, where to exit, and where to protect yourself if things go wrong.

Think of it like Google Maps for trading. You still drive the car, but the signal helps guide you so you don’t take random turns.

A typical crypto trading signal includes:

- Asset (example: BTC/USDT)

- Direction (Buy or Sell)

- Entry price (where you open the trade)

- Take profit (where you lock in gains)

- Stop loss (where you exit to limit losses)

Signals don’t guarantee profits. They simply give you a structured plan, which is far better than guessing.

Why Following Signals Correctly Matters

Crypto markets are more volatile than ever. Prices can move 5–10% in minutes based on news, liquidations, or whale activity.

For beginners, this creates two big problems:

- Emotional trading (panic buying and selling)

- Overthinking every decision

Trading signals help remove that stress—but only if you follow them with discipline. When used correctly, signals help you:

- Avoid emotional decisions

- Stick to a clear plan

- Learn how experienced traders think

- Protect your capital while learning

That’s why communities like Fat Pig Signals’ Telegram focus not just on signals—but on how to follow them properly.

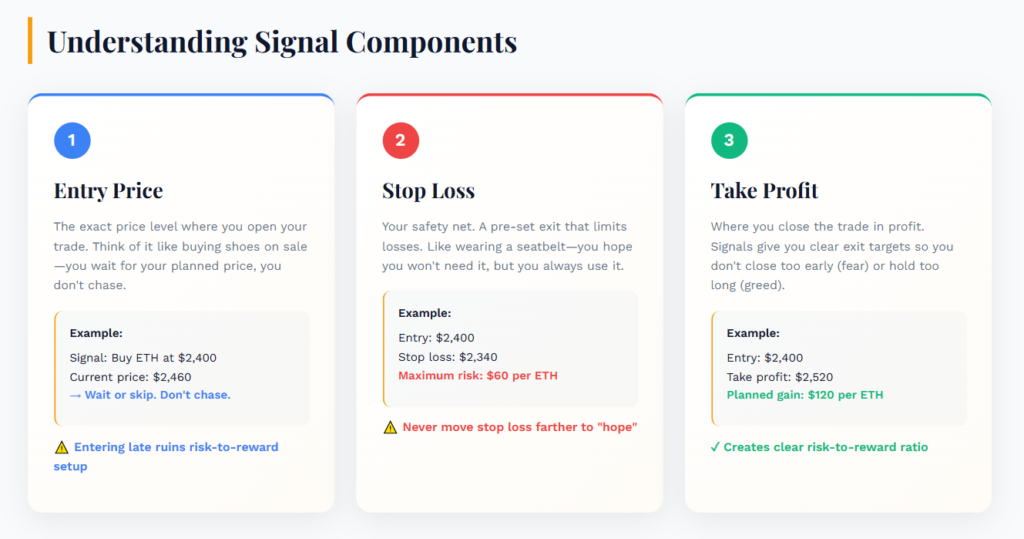

Understanding Each Part of a Trading Signal

Let’s break this down step by step so nothing feels intimidating.

1. Entry Price (Where You Get In)

The entry price is the price level where you open your trade. Think of it like buying shoes on sale. You don’t buy anywhere—you wait for the price you planned.

Example:

- Signal: Buy ETH at $2,400

- If ETH is already at $2,460, you don’t chase it.

- You wait or skip the trade.

Why this matters: Entering late can ruin the entire risk-to-reward setup.

2. Stop Loss (Your Safety Net)

A stop loss is a pre-set exit that limits how much you can lose. Think of it like wearing a seatbelt. You hope you won’t need it—but you always use it.

Example:

- Entry: $2,400

- Stop loss: $2,340

- Maximum risk: $60 per ETH

Common Mistake Box: Never move your stop loss farther just to “hope” the trade comes back. Hope is not a strategy.

3. Take Profit (Where You Get Paid)

A take profit is where you close the trade in profit. Beginners often make the mistake of:

- Closing too early out of fear

- Or holding too long out of greed

Signals solve this by giving you clear exit targets.

Example:

- Entry: $2,400

- Take profit: $2,520

- Planned gain: $120 per ETH

This creates a risk-to-reward ratio, which simply compares how much you risk vs. how much you aim to gain.

How to Follow Trading Signals Step by Step

Here’s a simple process you can repeat every time.

Step 1: Check the Market Context

Before entering, ask:

- Is the signal still valid?

- Has the price already moved too far?

- Is there major news coming?

If the price already ran away, skipping the trade is a win.

Step 2: Use Proper Position Size

Position size means how much money you put into a trade. Beginner rule of thumb:

- Risk 1–2% of your account per trade

- Never go “all-in” on one signal

Example:

- Account size: $500

- Risk per trade (2%): $10

- If stop loss is $50 away → trade smaller size

Pro Tip Box: Professional traders survive by protecting capital first. Profits come later.

Step 3: Place the Trade Exactly as Given

Once you commit:

- Enter at the planned price

- Set stop loss immediately

- Set take profit

- Walk away

Over-managing trades is how beginners lose good setups.

Spot Trading vs Futures Signals: What Beginners Should Know

Spot trading means you buy the actual coin. Futures trading uses leverage (borrowed money).

For beginners:

- Spot = slower, safer, easier to learn

- Futures = faster, riskier, requires discipline

If you’re new, it’s okay to start with spot signals until you understand risk better.

Fat Pig Signals often explains which signals are beginner-friendly and which require more experience—use that guidance.

Common Beginner Mistakes When Following Signals

Let’s be honest—most losses come from these mistakes:

- Entering late because of FOMO

- Ignoring stop losses

- Risking too much on one trade

- Taking every signal without a plan

- Revenge trading after a loss

Remember: Even the best traders lose trades. Winning comes from consistency, not perfection.

How Trading Signals Help You Learn Faster

Signals aren’t just about profits—they’re a learning tool. When you review past signals, ask:

- Why was this entry chosen?

- What trend was forming?

- How did price react at key levels?

This is why being active in a Telegram community like Fat Pig Signals helps. You see real-time explanations, not just numbers.

Risk Reminder (Please Read This)

Trading crypto involves real financial risk.

- Never trade money you can’t afford to lose

- Start small

- Focus on learning, not getting rich fast

- Signals help—but they don’t remove risk

There are no guaranteed profits in trading. Anyone promising that is lying.

Quick Recap: What You Should Remember

- Trading signals are guides, not guarantees

- Always respect entry, stop loss, and take profit

- Use small position sizes

- Avoid emotional decisions

- Skip trades that don’t fit your plan

- Learning consistency beats chasing wins

Conclusion & Next Steps: Trade Smarter, Not Harder

Following trading signals effectively isn’t about being perfect—it’s about being disciplined.

If you:

- Protect your capital

- Follow the plan

- Stay patient

You give yourself the best chance to grow as a trader.

Your next steps:

- Practice following signals on a small account

- Review every trade (win or lose)

- Stay engaged with experienced traders

If you want structured signals, clear risk levels, and a supportive learning environment, consider joining the Fat Pig Signals Telegram community.

You don’t need to rush. You just need to stay consistent.