Fat Pig Signals: Yellow & Red Algo Signals for Smart Trading

Signals

What if you could see your crypto portfolio move while you sleep without panic, constant chart-checking, or second-guessing yourself?

That is Algorithmic trading in action.

For 8 years, Fat Pig Signals have continuously fine-tuned their algorithm trading, first in stocks and now in crypto to highlight opportunities with clarity and precision. Instead of overwhelming you with endless alerts, the system uses yellow and red ball buy signals.

These signals are the result of years of testing and live-market refinement, giving you a clear and visual way to see potential trading setups.

What is Algorithmic Trading?

Algorithmic trading, or “algo trading,” means using computer programs to make trades for you. Instead of clicking buy and sell yourself, the program follows rules you set—like reacting to price moves, technical indicators, or trading volume.

Why It Matters in Crypto

- 24/7 Markets: Crypto never sleeps. Algorithms can watch and trade around the clock.

- Volatility: Prices can jump or drop in minutes. Algorithms react instantly—faster than humans can.

- Backtesting: You can test your strategy on past data before risking real money.

Example: An algorithm could be set to buy Bitcoin when the 50-day moving average crosses above the 200-day moving average, and sell when it flips back. It takes hesitation and emotion out of the decision.

Read more on: Your Ultimate Crypto Algo Trading Guide to Trade Smarter

The Struggles Most Traders Face with Algo Trading

Algo trading sounds amazing. Set up a system, let it run, and watch it trade for you. But most people run into the same headaches at the start:

- There are too many platforms and bots, and it’s tough to know which ones are worth your time.

- It’s easy to overcomplicate things, adding too many indicators or chasing fancy setups that just confuse you.

- Many expect instant profits, then get frustrated when losses show up.

- Risk management often gets ignored.

And even with an algorithm, people can’t resist jumping in and tweaking trades, usually making things worse. These struggles are normal. The key is keeping it simple, managing risk, and sticking to a system long enough to see it work.

How Fat Pig Signals Helps Traders

Instead of overwhelming you with dozens of alerts or complicated dashboards, Fat Pig Signals focuses on clarity. It combines market data, technical patterns, and algorithmic experience through their Yellow Ball and Red Ball indicators.

What the Yellow Ball Means

The yellow ball marks potential entry points. It’s an early indicator of favorable market conditions, helping you identify opportunities without overcomplicating things. You can decide if it fits your plan before taking action.

What the Red Ball Means

The red ball highlights high-probability setups. When multiple factors align, this signal appears helping you focus on trades that have the best chance of success according to the algorithm.

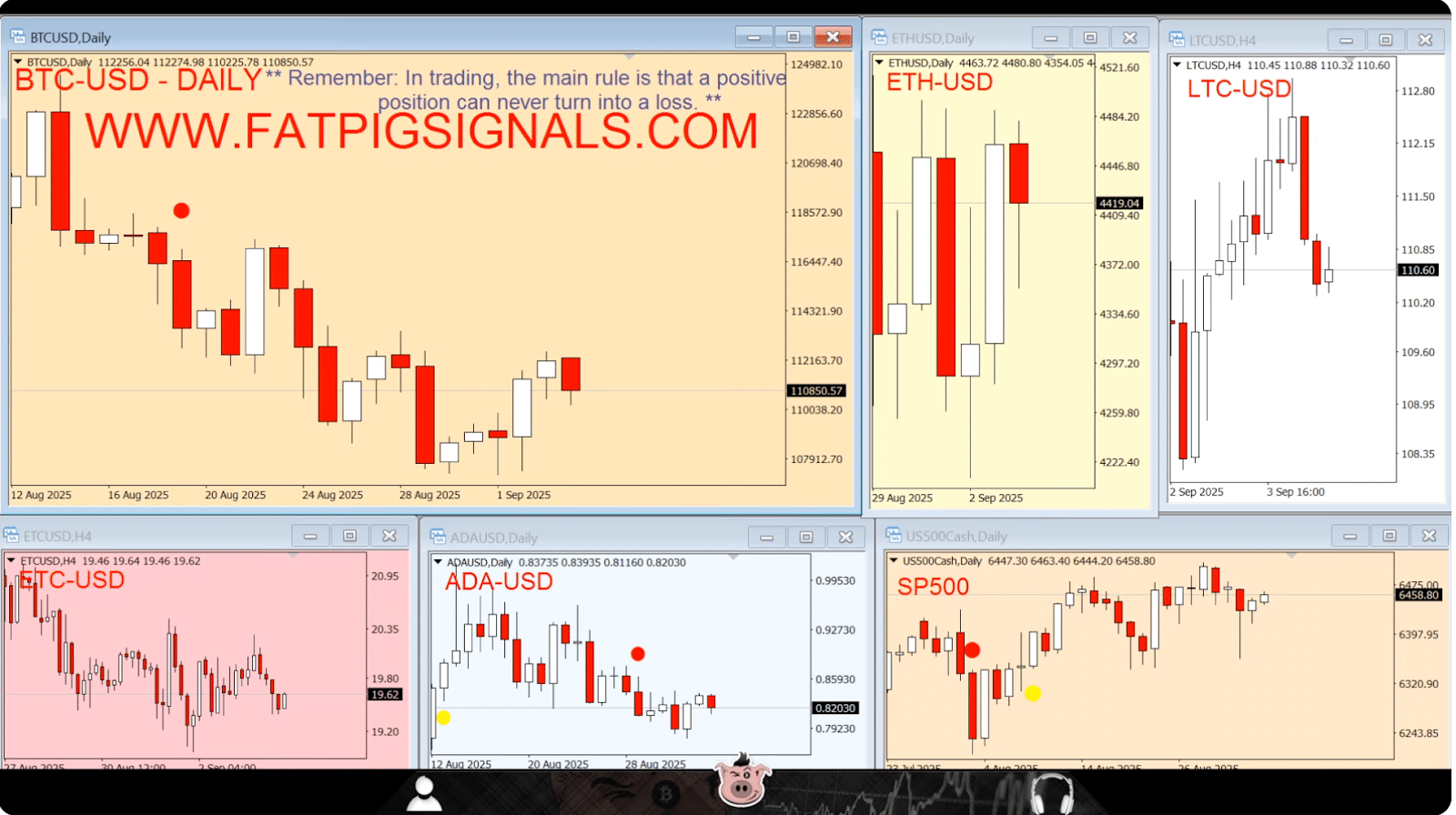

Seeing It in Action: Live Charts

One of the most practical features is the live chart, where you can see yellow and red signals in real time. This gives you a clear picture of trends, lets you validate trades, and helps you decide when to enter or exit positions.

No complicated charts, no unnecessary alerts, just a visual guide showing what’s happening in the market right now.

Join our YouTube Live to watch the yellow and red signals in action. Watch the live signals here.

Why Fat Pig Signals Stands Out

Crypto markets can be fast, volatile, and sometimes intimidating. Fat Pig Signals has a track record built on experience:

- 8 Years of Refinement: Tested in stocks, optimized for crypto’s volatility.

- Continuous Optimization: Every market cycle feeds improvements into the algorithm.

- Reliable, Not Hype: Designed to give actionable insights without flashy promises.

With this level of experience, you’re not just following signals, you’re following a system that’s been battle-tested and continuously improved.

How to Integrate Signals into Your Strategy

The signals work best when combined with your own trading plan. Here’s a practical approach:

- Use yellow signals as a heads-up to check the market. They highlight potential entries but don’t replace your analysis.

- Focus on Red Balls for stronger trades.

- Apply position sizing, stop-losses, and diversify to protect your capital.

- Use live charts to monitor trends.

- Keep a simple journal of why you entered or skipped a trade.

Signals speed up learning and highlight potential opportunities. While they aren’t perfect as no algorithm can predict every market shock, patience is key. Sometimes the market takes a while to move, so patience is key.

Final Thoughts

Fat Pig Signals is a trusted, experience-backed system. The yellow and red ball signals, combined with live chart visibility, gives traders a clear view of the market and helps them act faster, smarter, and with confidence.

See the signals in action and explore real-time yellow and red ball alerts at Fat Pig Signals. It’s designed to help you trade more insightfully, without guesswork or unnecessary noise.

Frequently Asked Questions (FAQs)

Q: What exactly do the yellow and red ball signals represent?

A: Yellow balls are early indicators of potential entry points, signaling favorable market conditions to watch. Red balls represent high-probability trade setups when multiple factors align, pointing to stronger opportunities.

Q: How reliable are these signals?

A: The signals come from algorithms refined over 8 years and tested through multiple market cycles. While no system can guarantee success, these signals help reduce guesswork and highlight statistically promising trades.

Q: Can I use Fat Pig Signals with any trading strategy?

A: Yes, the signals are designed to complement your own trading plan. Use yellow balls as alerts to evaluate opportunities, and red balls to confirm higher-confidence trades aligned with your strategy.

Q: Is Fat Pig Signals suitable for beginners?

A: The system’s simplicity and visual signals make it accessible for traders of all experience levels. Beginners are encouraged to combine the signals with sound risk management practices and ongoing learning.

Q: How do I access and interpret live charts with these signals?

A: Live charts display yellow and red balls in real time, giving you a clear visual guide to market trends and trade setups. This helps you validate and time your entries and exits with greater clarity.

Q: Does the algorithm react to all market conditions?

A: The algorithm continuously optimizes based on market cycles but no system can predict every market shock. Patience and applying risk controls are important.

Q: What risk management measures should I use?

A: It’s recommended to use position sizing, stop-losses, and portfolio diversification along with the signals to protect your capital and manage potential losses effectively.