DeFi Trading Mastery: The No-BS Guide to Decentralized Finance

Technology, Trading

Decentralized Finance (DeFi) is no longer a niche experiment—it’s a multi-billion-dollar financial system rewriting the rules of money. Most traders either get wrecked chasing unsustainable yields or paralyzed by jargon-heavy explanations.

If you want a realistic, battle-tested guide to navigating DeFi, you need both clarity and caution. This article breaks down how DeFi actually works, the traps that drain portfolios, and the strategies professionals use to survive and thrive.

Why DeFi Exists: A Response to Broken Trust

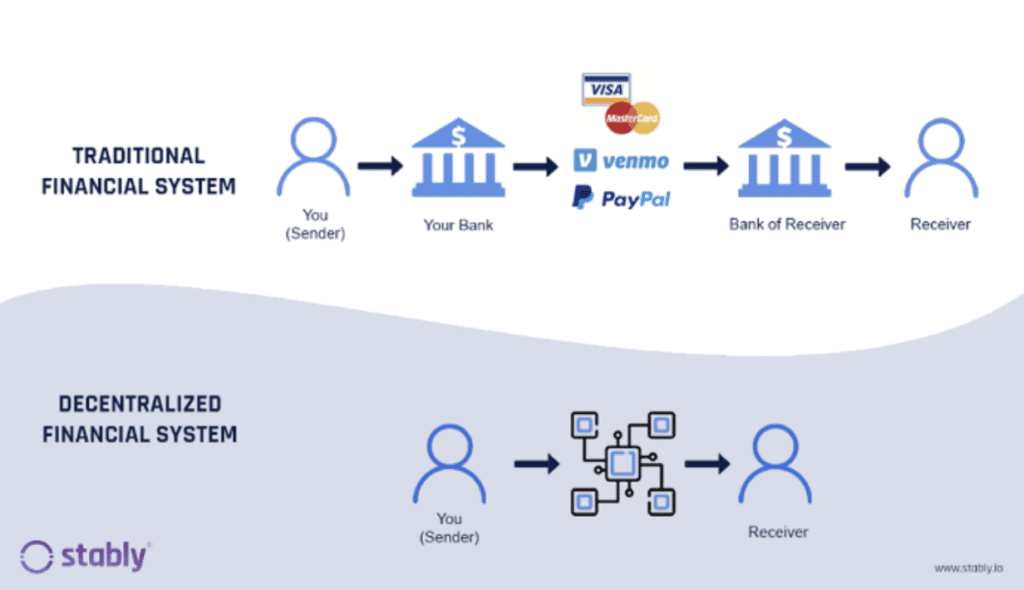

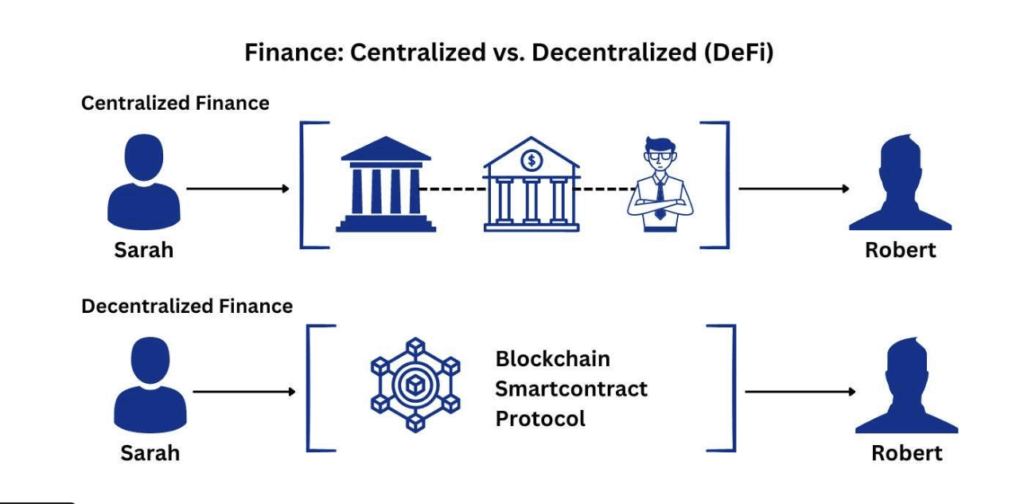

Traditional finance has repeatedly shown its flaws—banks charging hidden fees, exchanges misusing customer deposits, and crises like 2008 or FTX that left retail traders powerless.

DeFi emerged as the antidote. Instead of trusting institutions, you interact with auditable smart contracts that execute automatically. Deposit ETH into Aave, and the code—not a bank—handles interest accrual and liquidation rules. Unlike Coinbase or Binance, no one can freeze your account or touch your funds.

Data Point: Even after a brutal bear market, DeFi protocols still hold over $50 billion in Total Value Locked (TVL), a strong signal of resilience and trust across global markets.

Decentralized Exchanges: Trading Without Custodians

The first time you connect your wallet to a decentralized exchange (DEX), it feels revolutionary: no KYC, no intermediaries, just direct peer-to-peer swaps.

But the model differs radically from centralized exchanges:

- CEXs (Binance, Coinbase): Custody your funds, execute trades via order books, and promise liquidity.

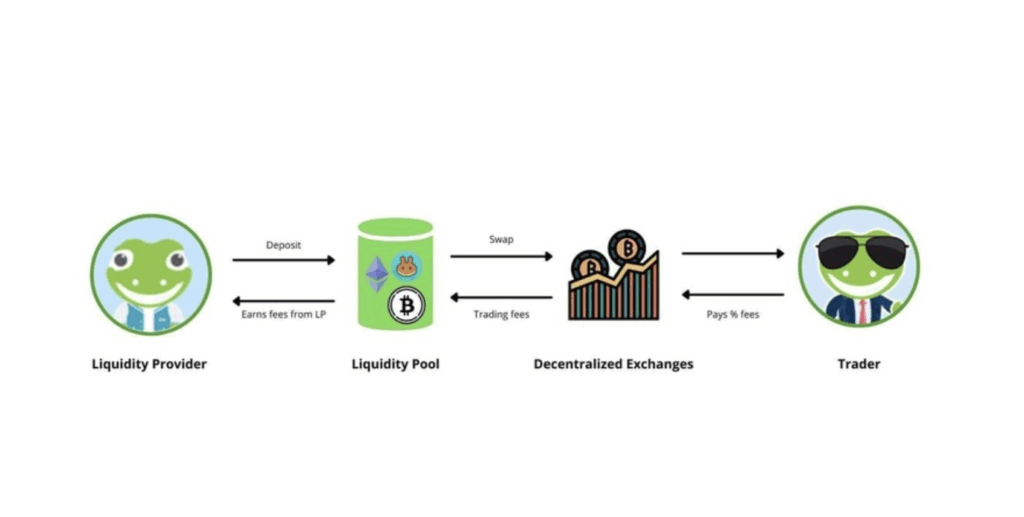

- DEXs (Uniswap, Curve, PancakeSwap): Use liquidity pools and Automated Market Makers (AMMs), where traders swap against pooled tokens.

Liquidity providers earn trading fees, but face impermanent loss—the silent risk where volatile price swings rebalance your assets unfavorably.

Pro Tip: Stablecoin pairs (e.g., USDC/DAI) minimize impermanent loss and provide steady returns, especially on Curve.

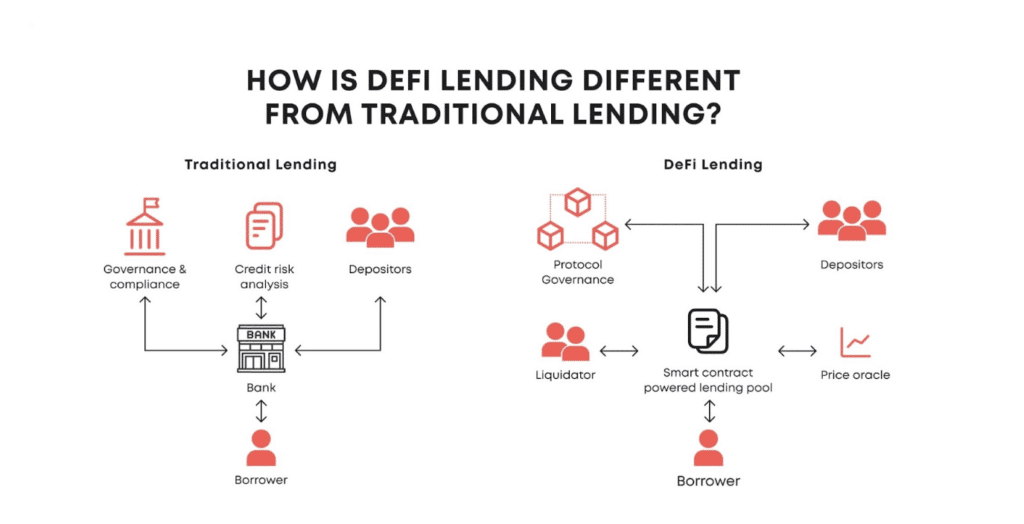

Lending, Borrowing, and Yield: The Financial Backbone of DeFi

DeFi lending mirrors banking—but removes the middleman. On Aave or Compound:

- Lenders deposit assets and earn interest via pool participation.

- Borrowers post overcollateralized crypto to unlock liquidity.

Why Borrow Against Crypto?

- Leverage: Borrow stablecoins to buy more ETH, amplifying gains (and losses).

- Liquidity without selling: Unlock capital while holding long-term positions.

- Tax efficiency: In many jurisdictions, borrowing doesn’t trigger taxable events, unlike selling.

The boom of 2020–21 came from yield farming, when protocols rewarded users not just with interest but governance tokens (e.g., COMP). This skyrocketed APYs but also created bubbles, as unsustainable token emissions collapsed under selling pressure.

Case Example: Compound’s COMP distribution spiked TVL from under $100M to over $1B within weeks in 2020—but once token inflation hit, yields dropped sharply.

The real lesson: distinguish real yield (fees, interest, genuine demand) from synthetic yield (inflated rewards that vanish overnight).

Risk Management: How Professionals Survive

Every seasoned trader will tell you: DeFi isn’t about chasing yield—it’s about surviving long enough to benefit. Risks include:

- Smart Contract Exploits: Even audited platforms like Grim Finance ($28.6M hack) fell victim.

- Impermanent Loss: Misunderstood by many liquidity providers until it drains their positions.

- Oracle Manipulation: Exploits like the 2020 bZx attack show how fragile data feeds can be.

- Rug Pulls: From small tokens to SushiSwap’s infamous $14M exit, scams are rampant.

- Liquidations: Borrowing amplifies losses. One 30% ETH drop can wipe out collateral in minutes.

- Regulatory Shocks: Sudden crackdowns on stablecoins or lending protocols can crush value.

- Human Error: Mis-clicks, fake sites, or leaving approvals unchecked can drain wallets instantly.

Survival Tactics

- The 10% Rule: Never allocate more than 10% of your portfolio to a single protocol.

- Audit First: Stick to platforms with strong audits and bug bounties.

- Test Small: Run $50–100 test transactions before committing real size.

- Wallet Segregation: Keep most funds in cold storage; use a separate wallet for DeFi.

- Revoke Permissions: Regularly clean old approvals via tools like Revoke.cash.

Building a DeFi Trading Strategy That Lasts

Without a framework, DeFi becomes chaotic. The pros build strategies around portfolio segmentation, cycles, and discipline.

Suggested Allocation Model

- Core Holdings (60–70%): BTC, ETH in cold storage.

- Active DeFi (20–30%): Yield farming, lending, swaps on audited protocols.

- Speculation (5–10%): Governance tokens, experimental plays—capital you can lose entirely.

Your First 30 Days in DeFi

- Week 1: Set up MetaMask, transfer small ETH, observe platforms.

- Week 2: Make a first swap on Uniswap.

- Week 3: Deposit stablecoins into Aave, test withdrawals.

- Week 4: Review results, adjust based on risk tolerance.

This staged approach builds confidence without risking ruin.

The Road Ahead: DeFi’s Next Frontier

Expect regulatory clarity around stablecoins and lending, but also explosive innovation as real-world assets (RWA) like real estate and bonds get tokenized. Platforms such as Centrifuge and Ondo Finance are already pioneering this.

For traders, this means:

- More opportunities to earn sustainable yield.

- More complexity in compliance and risk evaluation.

- A growing need for discipline in a 24/7 market.

DeFi is not a casino. It’s a toolkit. Done right, it can unlock yield, liquidity, and opportunities no bank can match. Done wrong, it can wipe you out in a weekend. The choice isn’t whether DeFi is risky—it’s how you manage those risks.

Take Your DeFi Trading Further with Fat Pig Signals

Mastering DeFi is about more than understanding protocols—it’s about timing, discipline, and consistent execution. That’s where Fat Pig Signals steps in. Since 2017, our team of professional traders has helped thousands of independent investors navigate volatile markets with:

- Daily trading signals for Bitcoin and altcoins

- Yield farming & portfolio strategies tailored for real-world conditions

- Market research and analysis that cuts through hype

- Proven results from signals like AAVE (+3200%), CAKE (+8700%), and BNB (+2000%)

Join our free Telegram group to get a taste of our service, or subscribe to our VIP channel for full access to signals, research, and strategies that keep you ahead of the curve.

👉 Start trading smarter today with Fat Pig Signals – your trusted partner in crypto success.