What Is Market Volatility and Why Does It Matter for Investors?

Investment

Ever opened your crypto app and thought, “Why is my balance jumping around so much?”

One minute your trade is up 8%.

The next minute it’s down 5%.

And suddenly you’re wondering if you did something wrong.

If this has happened to you, you’ve just experienced market volatility—and you’re definitely not alone.

For beginners, volatility can feel scary, confusing, and stressful. But here’s the good news: volatility isn’t the enemy. In fact, once you understand it, volatility can help you make better trading decisions instead of emotional ones.

In this article, you’ll learn:

- What market volatility actually means (in plain English)

- Why crypto prices move so fast

- How volatility affects your trades and investments

- Common beginner mistakes to avoid

- Simple, practical ways to handle volatility with confidence

By the end, you’ll know how to stop fearing price swings—and start using them wisely

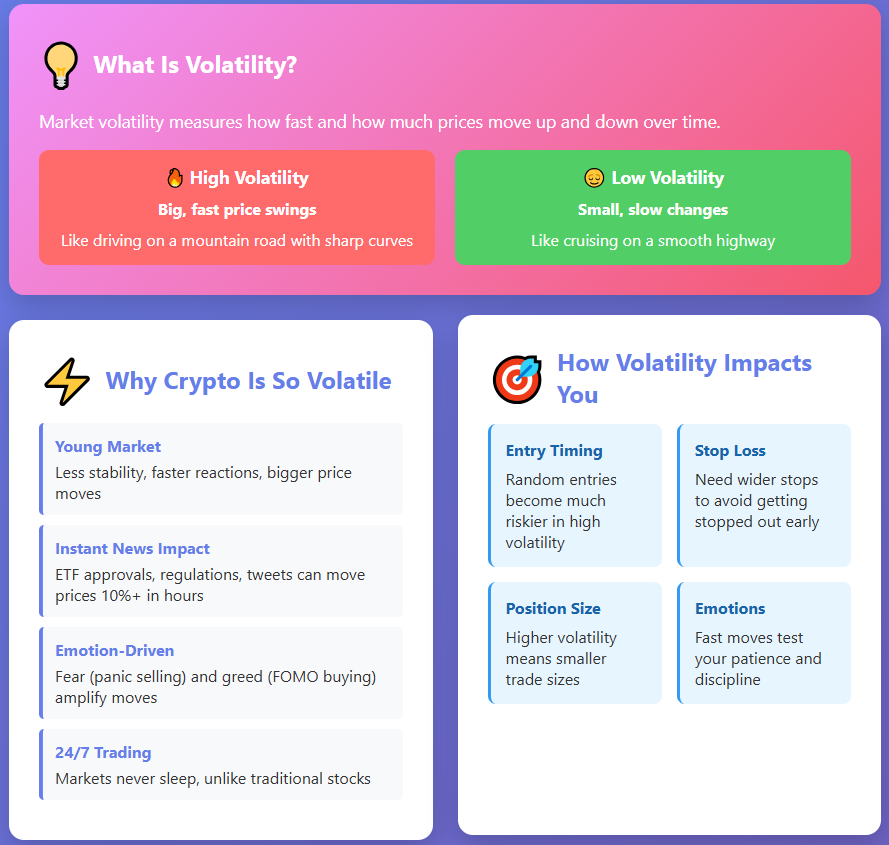

What Is Market Volatility?

Market volatility means how fast and how much prices move up and down over a period of time.

- High volatility = big, fast price swings

- Low volatility = small, slow price changes

That’s it. No complicated math needed.

Think of it like this:

Imagine you’re driving a car.

- A smooth highway with gentle turns = low volatility

- A mountain road with sharp curves = high volatility

Crypto markets spend a lot of time on that mountain road.

Why Volatility Matters for Beginner Investors

If you’re new to crypto, volatility affects everything you do, whether you realize it or not. Here’s why this matters right now:

- Crypto markets move 24/7, unlike stocks

- News spreads instantly on social media

- More beginners are entering the market during hype cycles

- Emotional trading mistakes are extremely common

Volatility impacts:

- When you enter a trade

- Where you place stop losses

- How big your position should be

- Whether you panic or stay calm

Understanding volatility helps you protect your money first, which is rule #1 in trading.

Why Crypto Is So Volatile Compared to Other Markets

Crypto is famous for wild price swings—and there are real reasons for that.

1. Crypto Is Still a Young Market

Traditional markets like stocks have been around for decades. Crypto is still growing and maturing. That means:

- Less stability

- Faster reactions

- Bigger price moves

2. News Moves Prices Fast

A single headline can move prices instantly:

- ETF approvals

- Regulation news

- Exchange issues

- Influencer tweets

Imagine if one tweet could move Apple stock 10% in an hour. That’s normal in crypto.

3. Emotions Play a Huge Role

Crypto is driven by:

- Fear (panic selling)

- Greed (FOMO buying)

These emotions increase volatility, especially during big moves.

High Volatility vs Low Volatility

Let’s make this very practical.

Example 1: Low Volatility Asset

- Price today: $100

- Price tomorrow: $102

- Daily movement: ~2%

This is low volatility.

Example 2: High Volatility Asset

- Price today: $100

- Price tomorrow: $120

- Later same day: $95

This is high volatility.

Important: Volatility doesn’t mean “bad.”

It just means bigger and faster price changes—up and down.

How Volatility Affects Your Trading Decisions

Volatility directly changes how you should trade.

Entry Timing

In high volatility:

- Entering randomly is risky

- Prices can reverse quickly

In lower volatility:

- Moves are slower

- Entries are easier to manage

Stop Loss Placement

A stop loss is a preset exit to limit losses.

- High volatility → wider stops needed

- Low volatility → tighter stops possible

Beginners often place stops too tight and get stopped out early.

Common Beginner Question: “Is Volatility Risky?”

Short answer: Yes—but only if you don’t manage it. Volatility itself isn’t dangerous. Uncontrolled risk is.

Volatility becomes risky when:

- You trade with money you can’t afford to lose

- You use position sizes that are too big

- You trade without a plan

- You panic when prices move fast

Text Box: Important Reminder

Trading always involves risk. Losses are part of the learning process. Start small and focus on consistency—not quick profits.

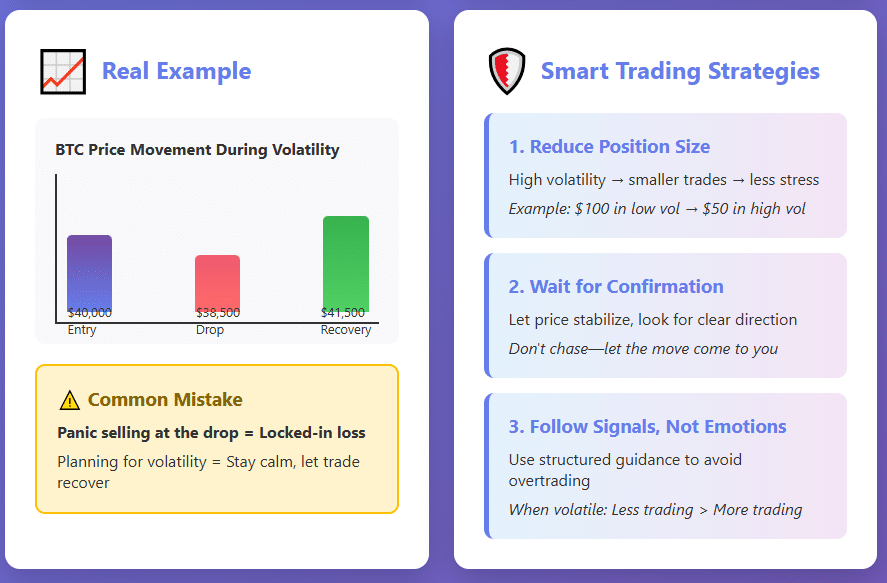

How Smart Traders Use Volatility (Beginner-Friendly)

Experienced traders don’t avoid volatility—they adjust to it. Here’s how you can do the same.

1. Reduce Position Size

Higher volatility = smaller trade size.

Example:

- Low volatility trade → $100 position

- High volatility trade → $50 position

Same strategy. Less stress.

2. Wait for Confirmation

Instead of chasing price:

- Wait for price to stabilize

- Look for clear direction

This reduces emotional entries.

3. Follow Signals, Not Emotions

This is where communities like Fat Pig Signals help beginners avoid emotional mistakes.

By following structured signals shared in the Fat Pig Signals Telegram, many traders avoid overtrading during volatile conditions.

Common Mistake Box

Mistake: Trading More During Volatility

Many beginners think: “Big moves = more trades = more profit”

In reality:

- More volatility = more mistakes

- Overtrading leads to faster losses

Pro Tip: When markets are extremely volatile, less trading is often smarter than more trading.

Practical Example: Volatility in a Real Trade

Let’s walk through a simple scenario.

- You enter BTC at $40,000

- Volatility increases due to news

- BTC drops to $38,500 (-3.75%)

- Then jumps to $41,500 (+3.75%)

If you panic-sold at the drop:

- You lock in a loss

If you planned for volatility:

- You stay calm

- Your trade recovers

Volatility tests patience more than strategy.

How Beginners Can Protect Themselves From Volatility

Here are simple, actionable steps you can apply immediately.

1. Always Use Risk Management

Never risk more than a small percentage of your capital on one trade. Common beginner rule:

- Risk 1–2% max per trade

2. Start Small

Small trades = smaller emotional reactions. Confidence grows after survival, not before profit.

3. Learn Market Behavior

Watch how prices react during:

- News

- Breakouts

- Pullbacks

The more you observe, the calmer you become.

Quick Recap

Before we wrap up, let’s lock in the key ideas.

- Market volatility means how fast and how much prices move

- Crypto is naturally more volatile than traditional markets

- Volatility affects entries, stops, and emotions

- High volatility ≠ bad market

- Poor risk management is the real danger

- Smart traders adapt instead of panicking

Conclusion & Next Steps

Market volatility can feel overwhelming at first—but now you know the truth: Volatility isn’t the problem. Trading without understanding it is.

As a beginner, your goal isn’t to predict every move. Your goal is to:

- Protect your capital

- Control your emotions

- Learn step by step

Your Next 3 Action Steps:

- Reduce trade size during high volatility

- Always set a stop loss before entering

- Learn from experienced traders instead of guessing

If you want structured guidance during volatile markets, joining the Fat Pig Signals Telegram community can help you stay disciplined and avoid emotional mistakes.

Remember: Every confident trader was once a confused beginner. You’re learning—and that already puts you ahead.