Comparing Signal Formats: Signal Trading vs Copy Trading

Signals, Trading

Have you ever joined a crypto Telegram group and thought:

“They’re telling me to buy… but how much do I buy?”

“What if I’m late?”

“What if I mess this up?”

If yes, you’re not alone.

Right now, more beginners are entering crypto than ever before. Markets move fast, emotions run high, and making decisions alone can feel overwhelming. That’s why signal trading and copy trading have become so popular.

Both are ways to trade with guidance instead of guessing, but they work very differently. Choosing the wrong one for your situation can lead to stress, mistakes, or unnecessary losses.

By the end of this article, you’ll understand:

- What signal trading and copy trading really mean (in plain English)

- The pros and cons of each for beginners

- Real examples with actual numbers

- Which option fits your time, experience, and comfort level

- How Fat Pig Signals fits into the picture naturally

Let’s start from the ground up.

Why This Matters Now for New Crypto Traders

Crypto isn’t slowing down. Bitcoin moves thousands of dollars in days. Altcoins can jump or crash in minutes. For beginners, this creates three big problems:

- Information overload – too many opinions, charts, and alerts

- Execution fear – knowing what to do, but freezing when it’s time to click

- Emotional trading – panic selling, FOMO buying, revenge trades

Signal trading and copy trading were created to solve these exact problems — but in different ways.

Think of them as two learning paths:

- One teaches you to drive with directions

- The other lets you ride with a professional driver

Let’s explore both.

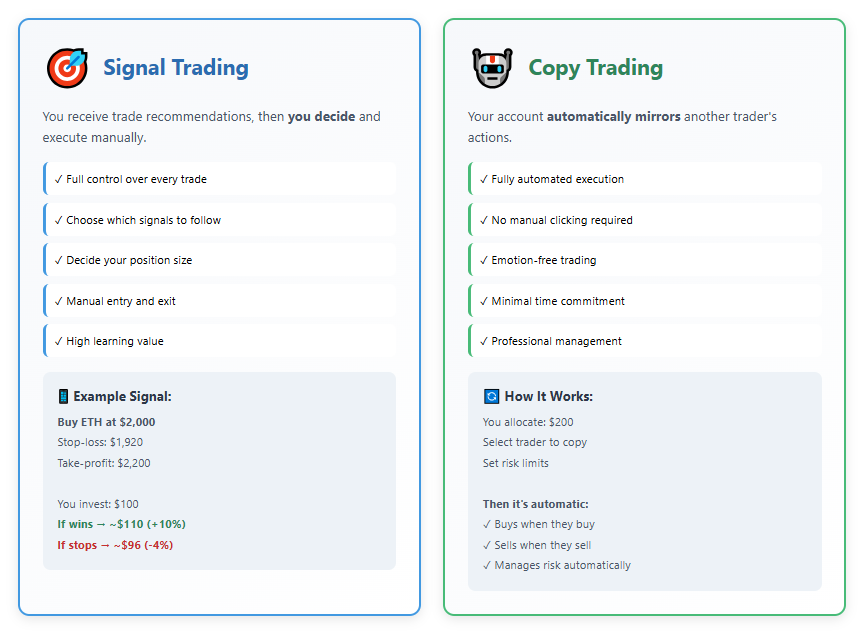

What Is Signal Trading? (Beginner Explanation)

Signal trading means you receive a trade recommendation, then you decide whether to take it.

A trading signal usually includes:

- Asset (example: BTC/USDT)

- Direction (Buy or Sell)

- Entry price (where to enter)

- Stop-loss (where to exit if wrong)

- Take-profit (where to lock profits)

Stop-loss = a safety exit that limits your loss

Take-profit = a target where profits are taken automatically

Think of it like this:

Imagine a GPS that says: “Turn left in 100 meters.”

It doesn’t turn the wheel for you — you still drive.

Example: Signal Trading in Action

You receive this signal from Fat Pig Signals:

- Buy ETH at $2,000

- Stop-loss: $1,920

- Take-profit: $2,200

You decide:

- How much money to use (say $100)

- When to enter

- Whether to follow it or skip it

If ETH goes to $2,200:

- Your $100 becomes about $110

If ETH drops to $1,920:

- You lose about $4

You are fully involved — which is both powerful and risky.

What Is Copy Trading? (Beginner Explanation)

Copy trading means your account automatically copies another trader’s trades.

Once set up:

- You don’t click Buy or Sell

- You don’t calculate position size

- You don’t watch charts all day

Think of it like this:

You sit in the back seat while a professional drives.

If they turn left — you turn left.

If they brake — you brake.

Example: Copy Trading in Action

- You allocate $200 to copy a trader

- The trader risks 2% per trade

- They buy Bitcoin

Your account automatically:

- Buys Bitcoin

- Uses the same risk percentage

- Closes when they close

You didn’t touch anything.

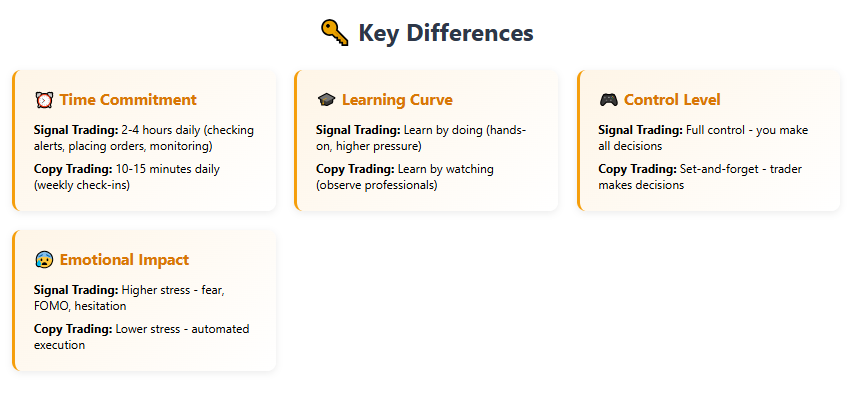

Key Difference #1: Control vs Automation

This is the biggest difference.

Signal Trading = Full Control

You choose:

- Which signals to take

- How much to risk

- When to enter or exit

Good for:

- Curious learners

- People who want to understand why trades happen

Risk:

- Hesitation

- Late entries

- Emotional decisions

Copy Trading = Automation

You choose:

- Who to copy

- How much to allocate

- Risk limits

After that, it’s automatic.

Good for:

- Busy people

- Total beginners

- Emotion-free execution

Risk:

- Less learning at first

- Results depend on who you copy

Key Difference #2: Time Commitment

Ask yourself honestly: How much time do you really have?

Signal Trading Time Needs

- Checking Telegram alerts

- Logging into exchange

- Placing orders manually

- Monitoring trades

2–4 hours a day for beginners

Copy Trading Time Needs

- One-time setup

- Weekly or monthly check-ins

10–15 minutes a day

Pro Tip: Most beginners overestimate how much time they can trade consistently.

Learning Value: Which One Teaches You More?

Signal Trading = Learning by Doing

You learn:

- How entries and exits work

- How risk management feels

- Why patience matters

But mistakes can be expensive.

Copy Trading = Learning by Watching

You learn:

- How professionals manage risk

- What consistency looks like

- How strategies behave over time

Less pressure, fewer emotional scars.

Practical Example: $500 Beginner Comparison

Let’s say you start with $500.

Using Signal Trading

- Risk 1% per trade = $5

- You take 20 trades

- Win rate: 55%

You might:

- Gain $40

- Lose $30

- End near break-even while learning

Using Copy Trading

- Copy a trader with steady returns

- Average monthly gain: 5%

After one month:

- $500 → $525

Slower, but calmer.

Common Beginner Mistake

Jumping between signal trading and copy trading too fast

Beginners often:

- Take signals emotionally

- Stop copying after one losing week

- Increase risk after one win

Consistency beats excitement — every time.

Where Fat Pig Signals Fits In

Fat Pig Signals focuses on clear, structured signals designed to help beginners:

- Understand entries and exits

- Learn proper risk management

- Avoid hype-based trades

Many traders start by:

- Following signals carefully

- Learning how trades are structured

- Gradually building confidence

Our Telegram community also helps you see how others manage the same signals, which speeds up learning without pressure.

Quick Recap: Signal Trading vs Copy Trading

- Signal Trading

- Manual execution

- High learning value

- Requires time and discipline

- Copy Trading

- Automatic execution

- Low time commitment

- Emotion-free trading

- Both involve risk

- Neither guarantees profit

- Starting small is always smart

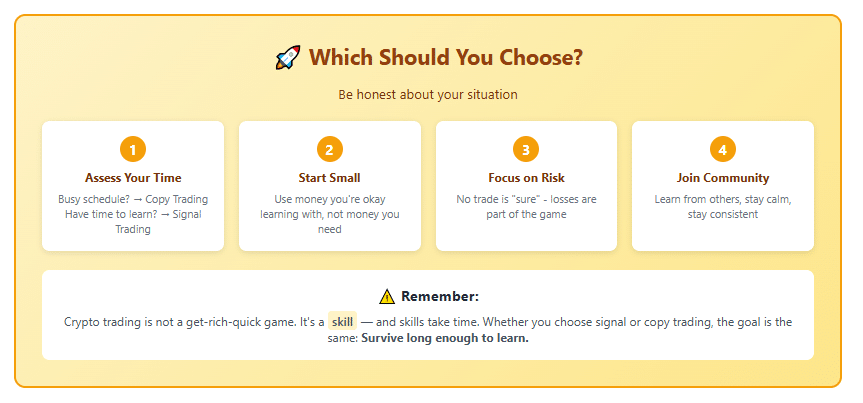

Conclusion & Next Steps: What Should You Do?

If you’re a complete beginner, here’s a simple path:

Step 1: Be honest about your time

Busy? → Copy trading

Curious and patient? → Signal trading

Step 2: Start small

Use money you’re okay learning with — not money you need.

Step 3: Focus on risk management

No trade is “sure.”

Losses are part of the game.

Step 4: Join a learning community

Being around other beginners (like in Fat Pig Signals’ Telegram) helps you stay calm, consistent, and motivated.

Final Reminder

Crypto trading is not a get-rich-quick game. It’s a skill — and skills take time. Whether you choose signal trading or copy trading, the goal is the same: Survive long enough to learn.

You’ve got this. Start slow. Stay curious. And trade smart.