How to Trade Crypto During High Volatility

Cryptocurrencies, Trading

Have you ever opened your trading app and seen a coin go up 10% in the morning… then crash 8% by dinner?

If your first reaction was confusion, fear, or panic, that’s completely normal.

Right now, crypto markets are going through frequent periods of high volatility, where prices move faster and more aggressively than usual. For beginners, this can feel like chaos. For experienced traders, it’s just another environment that requires adjustment.

This topic matters now because volatility is no longer rare in crypto — it’s becoming the norm. Learning how to trade during these conditions early can save you money, stress, and burnout.

By the end of this guide, you’ll understand:

- What high volatility really means in practice

- Why beginners lose money during volatile markets

- How to trade more calmly, safely, and intentionally when prices swing hard

Think of volatility like sudden rain while driving. You don’t abandon the car — you slow down and adjust.

What High Volatility Really Means

Let’s define volatility first

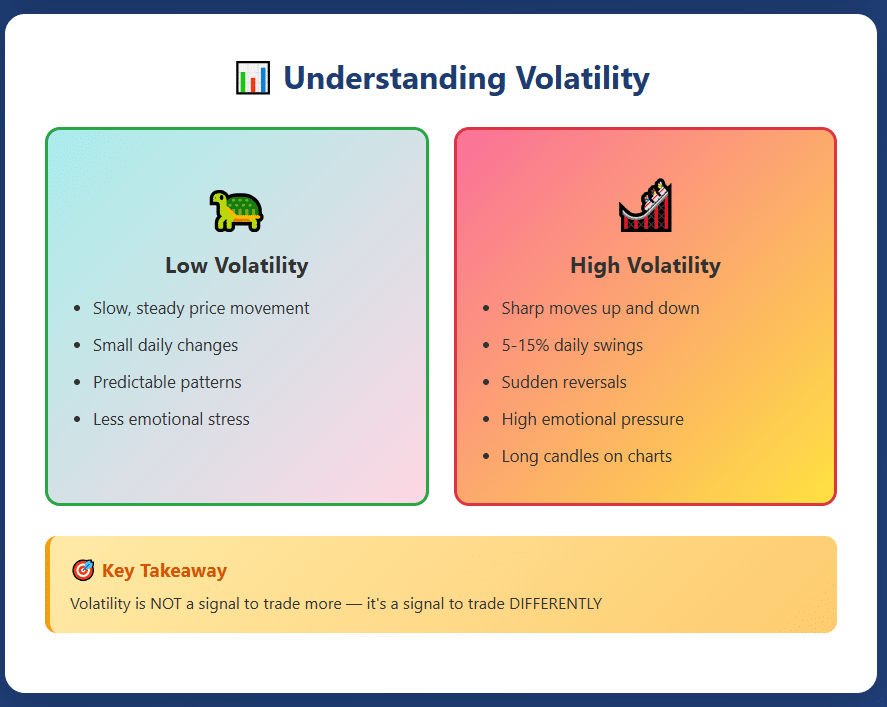

Volatility is a measure of how much and how quickly price moves over a period of time.

- Low volatility = slow, steady price movement

- High volatility = sharp moves up and down in a short time

In crypto, high volatility often looks like:

- 5–15% daily moves

- Long candles on charts

- Sudden reversals without warning

Why crypto is more volatile than other markets

Crypto markets move faster than stocks because:

- Trading happens 24/7, no closing hours

- There are fewer protections like circuit breakers

- News spreads instantly on social media

- Large traders (“whales”) can move price quickly

Unlike stocks, crypto prices are driven heavily by emotion and speculation, not company earnings. This makes price swings more extreme.

KEY TAKEAWAY : Volatility is not a signal to trade more — it’s a signal to trade differently.

Step 1: Trade Smaller When Volatility Is High

Why position size matters more than strategy

Many beginners focus on finding the perfect entry, but during volatile markets, position size matters more than accuracy. Position size means how much of your money is used in one trade.

Imagine two traders with the same setup:

- Trader A risks $20

- Trader B risks $2

When price swings violently, Trader B stays calm. Trader A panics.

Practical example with numbers

You have a $200 account.

- Normal market: risk $4 per trade (2%)

- High volatility market: risk $1–$2 per trade

This gives you:

- More room for mistakes

- Less emotional pressure

- More chances to learn

Why beginners ignore this

Beginners often think:

- “I need bigger trades to make money”

- “Small trades aren’t worth it”

In reality, small trades keep you alive long enough to improve.

PRO TIP BOX : If price swings make you nervous, your position is too big.

Step 2: Always Use Stop Losses

What a stop loss really does

A stop loss automatically exits your trade when price reaches a level that proves your idea wrong.

It does two things:

- Protects your money

- Protects your emotions

Without it, volatility turns small mistakes into disasters.

Example: With vs without a stop loss

You buy BTC at $40,000.

With stop loss:

- Stop loss at $39,400

- Loss = controlled

- You move on

Without stop loss:

- Price crashes to $38,500

- Loss doubles

- You hesitate, panic, and hope

Hope is not a strategy.

Common beginner stop-loss mistakes

- Not using one at all

- Moving it lower “just in case”

- Placing it randomly

- Cancelling it emotionally

COMMON MISTAKE BOX : A stop loss is not a prediction — it’s protection.

Step 3: Avoid Overtrading During Volatility

Why volatile markets feel addictive

High volatility creates:

- Constant movement

- Non-stop alerts

- Fear of missing out

This tricks beginners into thinking: “If I’m not trading, I’m falling behind.”. In reality, overtrading is one of the biggest account killers.

Signs you’re overtrading

- Taking trades without writing them down

- Entering immediately after a loss

- Trading out of boredom

- Trading every small price move

What to do instead

During volatile periods:

- Trade fewer setups

- Wait for clean structure

- Accept that no trade is also a decision

IMPORTANT REMINDER : You don’t get paid for activity — you get paid for discipline.

Step 4: Keep Your Strategy Simple

Why complexity fails in high volatility

When markets are wild:

- Indicators give mixed signals

- Price moves faster than analysis

- Too much information causes hesitation

Beginners often respond by adding more indicators, which makes things worse. Think of it like trying to read five maps at once.

What “simple” looks like

In volatile markets, focus on:

- Trend direction (up or down)

- Key support and resistance levels

- One or two indicators at most

At Fat Pig Signals, trades shared in the Telegram community prioritize clarity, risk control, and context, helping beginners avoid guessing when volatility spikes.

Step 5: Manage Your Emotions Before Anything Else

Why volatility hits emotions harder

Fast price movement triggers:

- Fear (panic selling)

- Greed (chasing pumps)

- Anger (revenge trading)

Your brain reacts as if you’re in danger — even though it’s just price data.

Simple emotional rules for beginners

- Never trade when emotional

- Take breaks after losses

- Review before re-entering

- Lower size if stress appears

MENTAL NOTE : Emotional control is a trading skill — not a personality trait.

Quick Recap: How to Trade Crypto During High Volatility

- Volatility = fast, aggressive price movement

- Reduce position size

- Always use stop losses

- Trade less, not more

- Keep strategies simple

- Protect your emotions and capital

Most traders fail in volatile markets not because of bad setups — but because they ignore risk.

Conclusion & Next Steps

High volatility doesn’t mean crypto is untradable.

It means you must:

- Slow down

- Reduce risk

- Focus on survival and learning

Take these actions today:

- Cut your trade size in half

- Place stop losses before entry

- Skip trades that feel rushed

If you want structured guidance during wild market conditions, consider joining the Fat Pig Signals Telegram community, where trades are shared with clear reasoning, defined risk, and beginner-friendly explanations.

You don’t need to catch every move. You just need to stay in the game long enough to get better.