Free vs Paid Crypto Signals: Is Premium Worth It?

Signals, Trading

Ever wondered if those free crypto signals you're following are actually helping—or secretly costing you money?

When you're starting out in crypto trading, free sounds pretty good. Why pay for something when you can get it for nothing, right? But in trading, "free" isn't always what it seems. And sometimes, what looks like a bargain ends up being the most expensive lesson you'll learn.

In this article, we're going to break down exactly what you get with free signals versus paid signals—no sales pitch, just honest facts. By the end, you'll know exactly what to look for in any signal service (free or paid), how to spot the red flags, and how to decide what actually makes sense for your trading journey.

Let's dig in.

What Are Crypto Signals, Anyway?

Before we compare free and paid options, let's ensure we're on the same page about what crypto signals are.

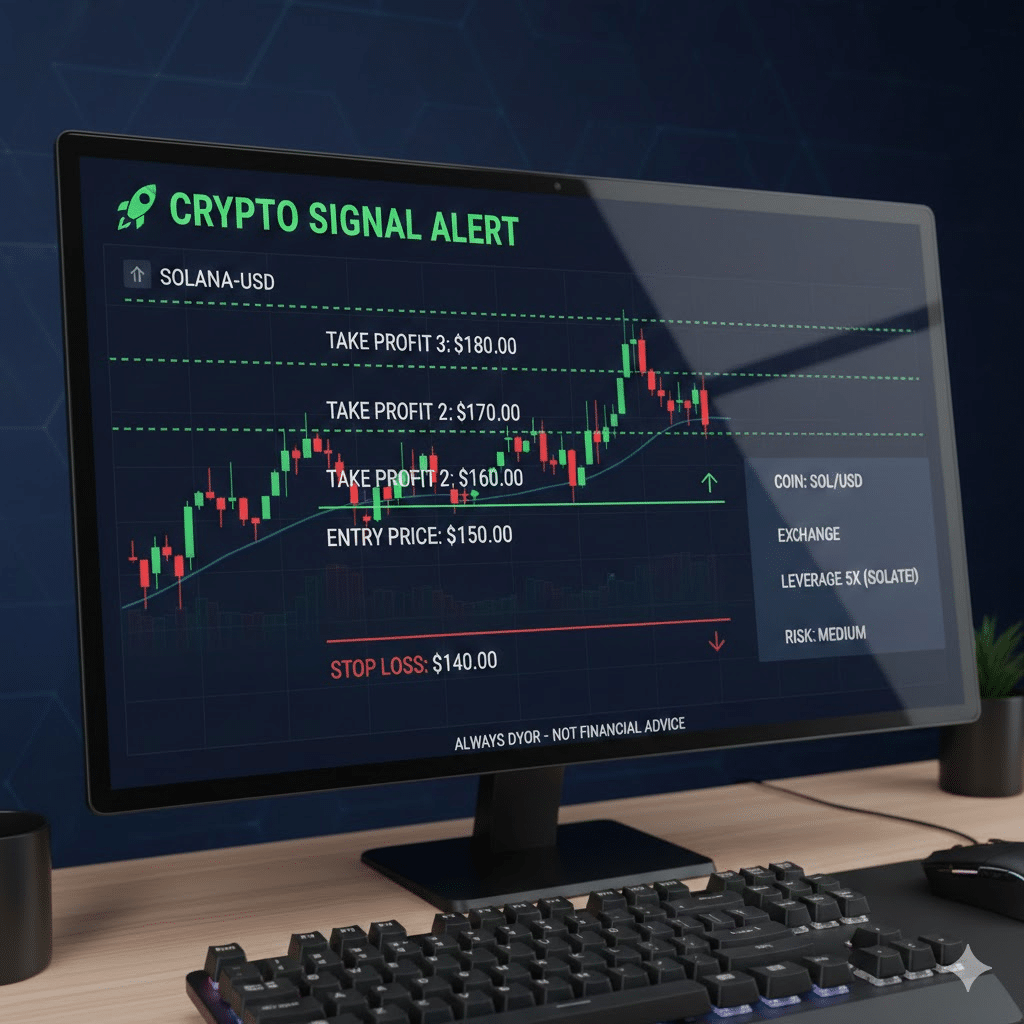

Crypto signals are trade recommendations that tell you when to buy or sell a specific cryptocurrency. A typical signal includes:

- The coin (which cryptocurrency to trade—like Bitcoin or Ethereum)

- Entry price (the price at which you should buy)

- Take profit targets (the prices where you should sell for a gain)

- Stop loss (the price at which you should exit to limit your loss)

Signals can come from experienced traders, automated algorithms, or professional analyst teams. The quality varies wildly—which is exactly why knowing the difference between free and paid matters.

Example of a crypto signal layout showing entry price, take profit levels, and stop loss with labels explaining each component.

The Reality of Free Crypto Signals

Free signals are everywhere. Telegram groups, Twitter accounts, Discord servers, YouTube channels—they're not hard to find. But here's what you need to understand about how free signals actually work.

How Free Signals Make Money

Nothing is truly free. If someone is giving away trading signals, they're making money somehow. Here are the most common ways:

- Affiliate commissions: They get paid when you sign up for an exchange using their referral link. This isn't necessarily bad—but it means their real customer is the exchange, not you.

- Upselling to paid tiers: Free signals are the "sample." They give you a taste, hoping you'll pay for the full meal later. Again, not always a problem—but the free signals might not represent their best work.

- Pump-and-dump schemes: This is where it becomes dangerous. Some "signal providers" buy a coin first, tell thousands of followers to buy it (which drives the price up), then sell their own bags at the top. You're left holding a coin that crashes. This is illegal in traditional markets, but crypto's lack of regulation makes it common.

Selling your attention: Free groups often spam you with ads, promotions for other services, and "special opportunities" that benefit them, not you.

Pro Tip: Before following any free signal, ask yourself: "How is this person making money?" If you can't figure it out, you might be the product.

What Free Signals Typically Lack

Even when free signal providers have good intentions, they're limited by one simple fact: they're not getting paid to help you succeed.

Here's what's usually missing:

- Analysis and reasoning: You get "buy BTC at $65,000" but no explanation of why. Without understanding the reasoning, you can't learn or make adjustments.

- Risk management guidance: How much should you invest? How to position size? Free signals rarely cover this.

- Updates and follow-ups: Markets change fast. Free signals are often "set and forget"—no adjustments when conditions shift.

- Support: Got a question? Good luck getting an answer in a free group with 50,000 members.

- Accountability: If signals consistently lose money, there's no consequence. They'll just keep posting.

The Hidden Cost of "Free"

Let's talk numbers. Say you follow a free signal that costs you a $200 loss on a bad trade. Then another one loses $150. A few more losses add up to $1,000 over a few months.

Meanwhile, a quality paid service might cost $50-100 per month. If it helps you avoid even half those bad trades, it's already paid for itself.

Beginners often calculate signal service value by the subscription cost alone. The real calculation is: subscription cost versus money saved from avoiding bad trades and money earned from better trades.

What Paid Crypto Signals Offer

Paid signal services charge anywhere from $30 to $300+ per month. But price alone doesn't indicate quality. Here's what separates legitimate paid services from expensive scams.

The Markers of Quality Paid Signals

- Transparent track record: Good services publish their historical performance—wins and losses. They don't cherry-pick or hide losing trades. Look for verified results, not just screenshots that can be faked.

- Detailed analysis: Each signal comes with an explanation. "We're buying ETH because it's bouncing off the $3,000 support level after testing it three times, with increasing buy volume." This teaches you while you trade.

- Clear risk management: Professional services tell you exactly how much to risk per trade. Something like "risk 1-2% of your portfolio" shows they care about protecting your capital.

- Regular updates: Markets change. Quality services adjust their signals. "Our ETH signal hit target 1, consider moving stop loss to break-even" shows they're actively managing positions.

- Accessible support: Questions get answered. Good services have communities where analysts actually participate and help members understand the reasoning behind trades.

- Realistic expectations: No one wins 100% of trades. Services that promise guaranteed profits or a "never lose" guarantee are scams. Period. Legitimate providers report win rates of 60-70% and overall positive expectations.

More on What to Look for in a Signal Provider’s Track Record

The Team Behind the Signals

Ever wonder who's actually creating these signals? It matters more than you think.

Free signals are often from anonymous accounts with no verifiable track record. Could be a 16-year-old in their bedroom. Could be a bot. It could be someone trying to manipulate you into buying their bags.

Quality paid services typically have:

- Named analysts with verifiable experience

- Transparent team information

- Years of trading history (including surviving bear markets)

- Real community engagement

At Fat Pig Signals, for example, our team has been trading crypto since 2016—through bull markets, bear markets, and everything in between. We've made mistakes (and learned from them). That experience shows in our signal quality and risk management approach.

How to Evaluate Any Signal Service (Free or Paid)

Whether you're looking at free signals or considering a paid subscription, here's your checklist.

Track Record Verification

Don't just trust screenshots. Anyone can photoshop a winning trade.

Look for:

- Third-party verified results (sites like MyFxBook for crypto signals)

- Historical archives you can verify independently

- Consistent posting over months or years (not just recent wins)

- Openly discussed losses (everyone has them)

Risk-to-Reward Ratio

Good signals have favorable risk-to-reward ratios. This means the potential profit is larger than the potential loss.

Here's what that looks like: if a signal has a stop-loss of $100 and a take-profit target of $300, that's a 1:3 risk-to-reward ratio. Even if you only win 40% of these trades, you'd still come out profitable over time.

Pro Tip: Avoid services where every signal seems to have massive profit potential with tiny stop losses. Sounds great on paper—but those tight stops usually get hit before the price moves your way.

Community Quality

Check the actual community around the service:

- Are real users sharing their results (good and bad)?

- Do analysts engage with questions?

- Is there educational content alongside signals?

- What's the overall tone—helpful or hype-driven?

A healthy trading community discusses losses openly and focuses on learning. A toxic one only celebrates wins and dismisses any criticism.

Trial Periods and Guarantees

Legitimate paid services often offer:

- Free trials or money-back guarantees

- Transparent refund policies

- Sample signals so you can evaluate quality before paying

If a service demands payment upfront with no trial and no refund option? Red flag.

The Real Question: What's Your Time Worth?

Here's something most people don't consider: the hours you spend researching, analyzing, and second-guessing trades have value too.

If you spend 15 hours a week doing your own analysis and still make mediocre trades, that time has a cost. If a quality signal service saves you 10 of those hours and produces better results, the subscription might actually be a bargain.

That said, signals shouldn't replace learning. The best approach combines:

- Following quality signals to make informed trades

- Learning why those signals work so you improve over time

- Gradually developing your own analysis skills

Quick Recap

Here's what we covered:

- Free signals aren't really free—someone is making money, and it's worth asking how

- Common issues with free signals: lack of analysis, no risk management, no accountability

- Quality paid signals offer: transparent track records, detailed analysis, proper risk management, and actual support

- Evaluate any service by checking verified track records, risk-to-reward ratios, community quality, and trial options

- Consider the full picture: your time has value too, and bad trades from poor signals cost more than subscription fees

The bottom line? Free signals can work for some traders, but they require more of your own work to filter the good from the garbage. Paid signals—when from a legitimate provider—offer structure, education, and accountability that accelerate your learning curve.

Your Next Steps

Ready to make a smart decision about crypto signals? Here's what to do:

1. Today: Evaluate any free signals you're currently following. Ask yourself: Do I know how this provider makes money? Have I tracked their actual win rate? Am I learning anything, or just blindly following?

2. This Week: Whether you choose free or paid, start tracking results. Create a simple spreadsheet: date, signal, entry price, exit price, profit/loss. After 20-30 trades, you'll have real data on whether your signal source actually works.

3. Moving Forward: Consider joining a community where you can learn alongside trading. Our Fat Pig Signals Telegram group is about education, discussion, and building real trading skills together.

Remember: the goal isn't just to follow signals forever. It's to become a better trader. You're asking the right questions by reading this article. That puts you ahead of most beginners who blindly follow the first free Telegram group they find. Keep that critical thinking sharp, and you'll do just fine.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Cryptocurrency trading involves substantial risk of loss. Always conduct your own research and consult a financial advisor before making investment decisions.