Whale Activity: How Large Holders Influence the Market

Trading

Ever wonder why Bitcoin's price suddenly drops $5,000 out of nowhere, even when there's no bad news? Or why a small coin's value skyrockets 300% in minutes, then crashes just as fast?

Crypto whales are the big players whose massive trades can send waves through the entire market. If you've been trading for even a week, you've probably felt the effects of whale activity without realizing it.

Whales are just people (or institutions) with really, really big crypto wallets. And once you understand how they operate, those sudden price moves start to make a lot more sense. Even better? You can learn to spot their activity and protect your own trades.

In this article, we'll break down everything you need to know about crypto whales: who they are, how they move the market, and most importantly, how you can trade smarter when they're swimming around.

What Exactly Is a Crypto Whale?

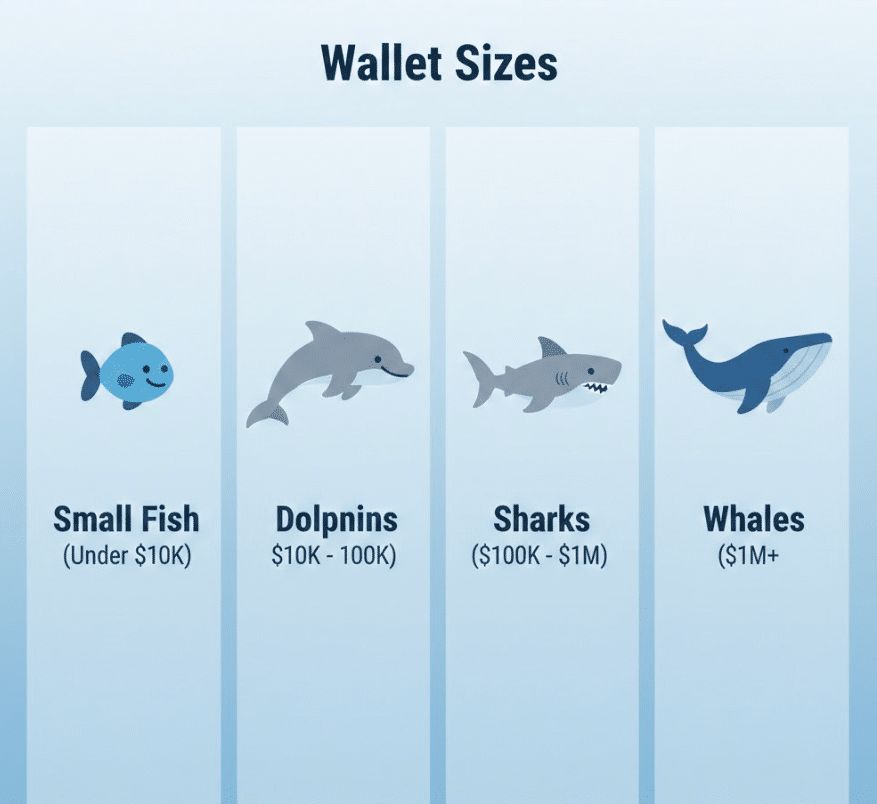

A crypto whale is simply someone who holds a massive amount of cryptocurrency. But how much crypto makes someone a whale? There's no exact number, but here's the general idea:

- Bitcoin whales: Usually hold 1,000+ BTC (that's over $60 million at current prices!)

- Ethereum whales: Typically own 10,000+ ETH

- Smaller coins: Even holding 1% of the total supply can make you a whale

To put this in perspective: If crypto were an ocean, most of us would be tiny fish. Whales are massive creatures that create waves just by swimming around.

Who Are These Whales?

Whales aren't just one type of trader. They include:

Early Bitcoin adopters—people who bought thousands of Bitcoin when it cost $10 or less. Imagine buying 5,000 Bitcoin for the price of a used car back in 2011!

Cryptocurrency exchanges like Binance or Coinbase hold millions in crypto for their users. When they move funds between wallets, it can look scary but usually means nothing.

Investment funds and institutions that manage billions of dollars now include crypto in their portfolios. When Tesla or MicroStrategy buys Bitcoin, they're acting as whales.

Mining pools that have accumulated vast amounts over years of mining operations. They need to sell sometimes to pay for electricity and equipment.

Also read How Regulatory News Impacts Crypto Prices

How Whales Move the Market

Now here's where it gets interesting. When you or I buy $100 of Bitcoin, the price doesn't budge. But when a whale buys or sells $10 million? That's a different story.

The Simple Market Impact

Think of the crypto market like a swimming pool. When you jump in (small trade), you make a tiny splash. When a whale jumps in? Everyone gets soaked.

Here's what happens step-by-step:

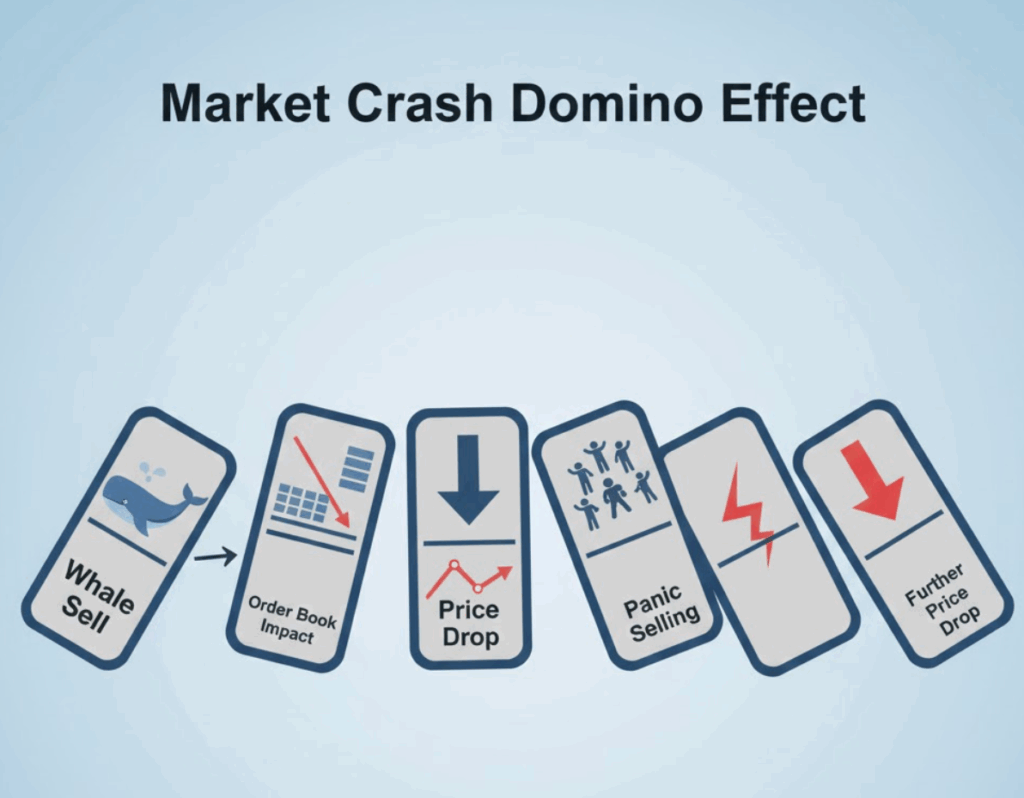

- A whale decides to sell 500 Bitcoin (worth about $30 million)

- They place the sell order on an exchange

- The order book gets flooded with Bitcoin for sale

- Price starts dropping as buyers get overwhelmed

- Other traders see the drop and panic sell

- Price drops even more from the panic selling

The reverse happens when whales buy. Their huge purchase orders push prices up, other traders notice and jump in, and suddenly we have a rally.

The Whale Manipulation Playbook

Here's where things get a bit sneaky. Some whales don't just trade—they actively try to manipulate prices. Let me show you their favorite tricks:

The Pump and Dump

This one's especially common with smaller coins.The whale quietly buys up tons of a small coin over several days. Then they start creating buzz—maybe some fake news, paid influencers, or mysterious "insider tips" on social media. The price starts to climb as people experience FOMO (Fear of Missing Out).

Once the price pumps high enough? The whale dumps everything at once, leaving regular traders holding worthless bags.

Pro Tip: If a coin suddenly pumps 200% with no real news or development, be very careful. It might be a whale setting up a dump.

The Fake Wall

Have you ever seen a massive sell order on the order book that blocks the price from going up? That might be a whale's fake wall. They place a huge sell order (the wall) to scare other traders into selling at lower prices. While everyone panics about the "resistance," the whale secretly buys up all the cheap coins being sold. Once they've accumulated enough? The wall mysteriously disappears, and the price shoots up.

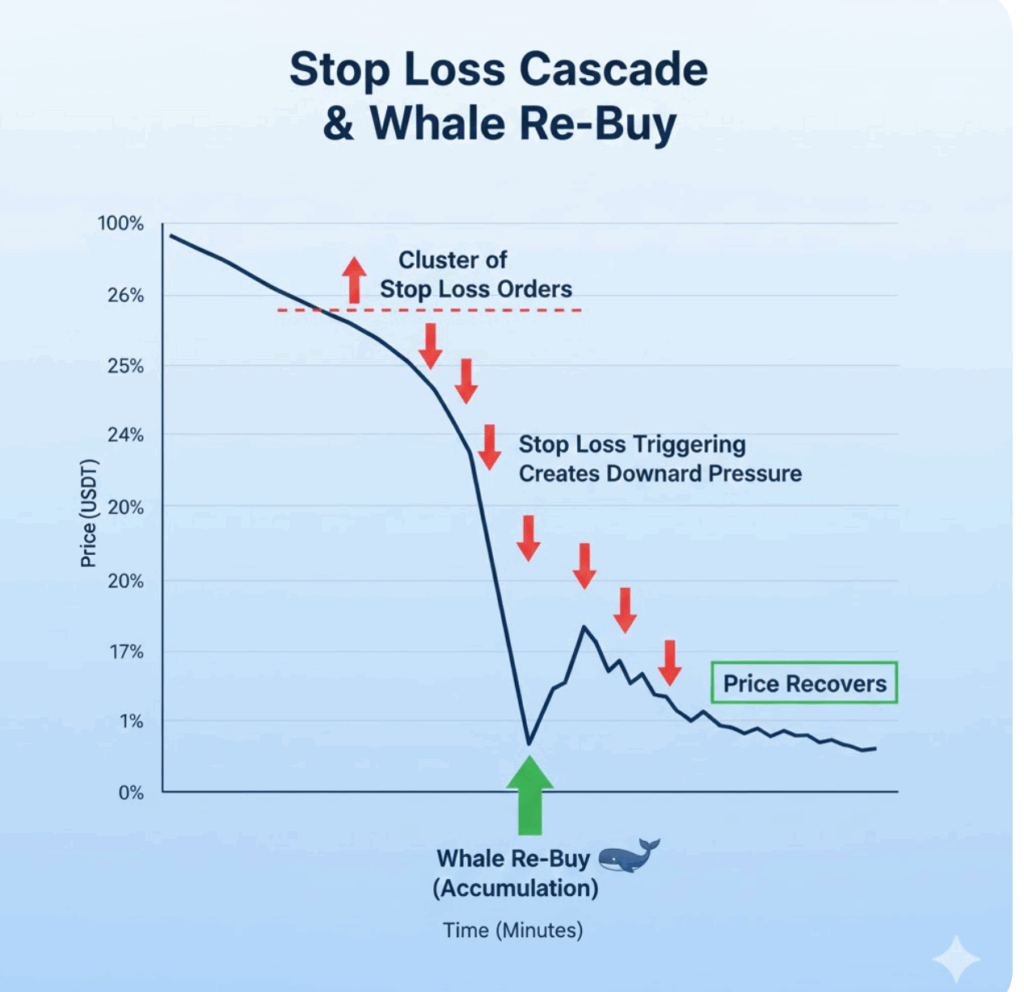

Stop Loss Hunting

This one's brutal but effective.

Whales know where most traders place their stop losses (automatic sell orders that trigger when the price drops to a certain level). So they deliberately push the price down just enough to trigger these stops, causing a cascade of automatic selling. The whale then scoops up all those coins at the artificially low price.

Example: Bitcoin is at $65,000. Lots of traders have stop losses at $64,500. A whale sells just enough to push the price to $64,400, triggering all those stops. Price crashes to $63,000 from the automatic selling. The whale pays $63,000 for everything. Price recovers to $65,000 within hours.

How to Spot Whale Activity

So, how do you know when whales are active? There are clear signs if you know what to look for.

Unusual Volume Spikes

Trading volume (the total amount being bought and sold) is your first clue. Normal volume looks relatively steady. Whale activity? That's when volume suddenly explodes.

Ethereum usually trades $5 billion per day. Suddenly you see $15 billion in volume with no major news? That's probably whales moving.

Large Individual Transactions

Thanks to blockchain technology, we can actually see when big transactions happen. Websites like Whale Alert track these movements in real-time.

When you see alerts like "500 BTC moved from unknown wallet to Binance," that's a whale potentially preparing to sell. When it's "1000 BTC moved from Coinbase to unknown wallet," they might be buying to hold long-term.

Common Mistake: Not every whale movement means a price crash. Sometimes they're just moving coins between their own wallets for security reasons.

Order Book Anomalies

The order book (the list of all buy and sell orders waiting to be filled) can reveal whale games.

Watch for:

- Massive orders that appear and disappear quickly (fake walls)

- Huge orders placed far from current price (psychological pressure)

- Multiple large orders at round numbers like $50,000 or $60,000

On-Chain Metrics

Exchange inflows and outflows tell you what whales are planning. When lots of Bitcoin flows INTO exchanges, whales might be preparing to sell. When Bitcoin flows OUT of exchanges into private wallets, they're planning to hold.

How to Protect Yourself from Whale Games

Now for the most important part: How do you protect your trades when whales are splashing around?

Don't Use Obvious Stop Losses

Remember that stop loss hunting trick? Don't be an easy target.

Instead of placing your stop loss at obvious levels like $64,500 or $65,000, use odd numbers like $64,673. Whales hunt for clusters of stops at round numbers.

Use Dollar-Cost Averaging (DCA)

Instead of buying all at once, spread your purchases over time. Dollar Cost Averaging protects you from buying right before a whale dump.

Example: Want to invest $1,000 in Bitcoin? Buy $100 every Monday for 10 weeks instead of $1,000 today. If a whale dumps mid-month, you benefit from the lower prices.

Watch for Divergence

When price pumps but volume stays low, be suspicious. Real rallies have increasing volume. Whale manipulation often shows price movement without corresponding volume increases.

Set Realistic Profit Targets

Whales love to dump right when retail traders get maximum FOMO. If your small-cap coin just pumped 150% in two days, consider taking some profit. Don't wait for 500%—the whale probably won't.

Keep Some Stablecoins Ready

When whales dump and create panic, that's actually a buying opportunity—if you have cash ready. Keep 20-30% of your portfolio in stablecoins (cryptocurrencies pegged to the dollar) so you can buy these whale-created dips.

Advanced Strategies to Swim with Whales

Once you understand whale behavior, you can actually use it to your advantage. Here's how smart traders do it:

Follow the Smart Money

Some whales are incredibly successful traders. When you spot consistent patterns from certain whale wallets, you can learn from their moves.

Tools like Nansen and Glassnode let you track what known profitable wallets are doing. If multiple smart whales start accumulating a certain coin, it might be worth researching.

Trade the Overreactions

Whales often cause overreactions in both directions. When they dump and cause panic, prices often fall further than they should. That's your entry point.

When they pump and create FOMO, prices often rise too far too fast. That's your exit point.

Use Whale Alerts Strategically

Set up notifications for large movements of coins you trade. When you get an alert that 1,000 BTC moved to an exchange, you can prepare for potential volatility.

But remember: Don't panic! Just be ready with your plan.

Quick Recap

Here's what we covered about whale activity:

- Whales are large holders with enough crypto to move markets (1,000+ BTC or equivalent)

- They move markets through large trades that overwhelm normal buy/sell pressure

- Common manipulation tactics include pump and dumps, fake walls, and stop loss hunting

- You can spot whales through unusual volume, significant transactions, and order book anomalies

- Protect yourself by avoiding obvious stop losses, using DCA, and keeping cash ready for opportunities

- Smart traders follow whale patterns, but don't panic when whales move

Conclusion & Next Steps

Whales will always be part of the crypto ocean. They have the money to move markets, and they will. But now you understand how they operate, and knowledge is power in trading.

You don't need to fear whales. You just need to be aware of them, like a surfer who watches for big waves. Sometimes you dodge them, sometimes you ride them, but you always respect their power.

Your Next Steps:

- Today: Set up a free Whale Alert account or follow @whale_alert on Twitter. Start noticing when large transactions happen and watch how the market reacts over the next few hours.

- This Week: Practice identifying whale activity on the charts. When you see sudden price moves, check the volume and on-chain data. Was it a whale or a genuine market movement?

- Ongoing: Join the Fat Pig Signals Telegram community where we track whale movements together and share alerts when big players are active. It's much easier to spot whales when you have hundreds of eyes watching!

Remember: You don't have to figure this out alone. Our Fat Pig Signals community helps each other navigate whale activity, share reliable on-chain data, and make smarter trading decisions together.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Cryptocurrency trading involves substantial risk of loss. Always do your own research and consider consulting with a financial advisor before making investment decisions.