Fundamental Analysis vs Technical Analysis in Crypto

Trading

Ever stared at a crypto chart covered in lines, indicators, and patterns, feeling completely lost? Or maybe you've read endless articles about a coin's "revolutionary technology" and still had no idea if you should actually buy it?

There are two main ways traders decide which cryptos to buy and when to buy them. They're called fundamental analysis and technical analysis. And if you're serious about trading crypto, you need to understand both.

But which one is better? Should you focus on studying a coin's technology and team, or should you learn to read charts and spot patterns?

The truth is, they each serve different purposes, and the best traders use both—but in different ways.In this guide, we’re breaking down exactly what fundamental analysis and technical analysis are, how they work in crypto, and most importantly, when to use each one.

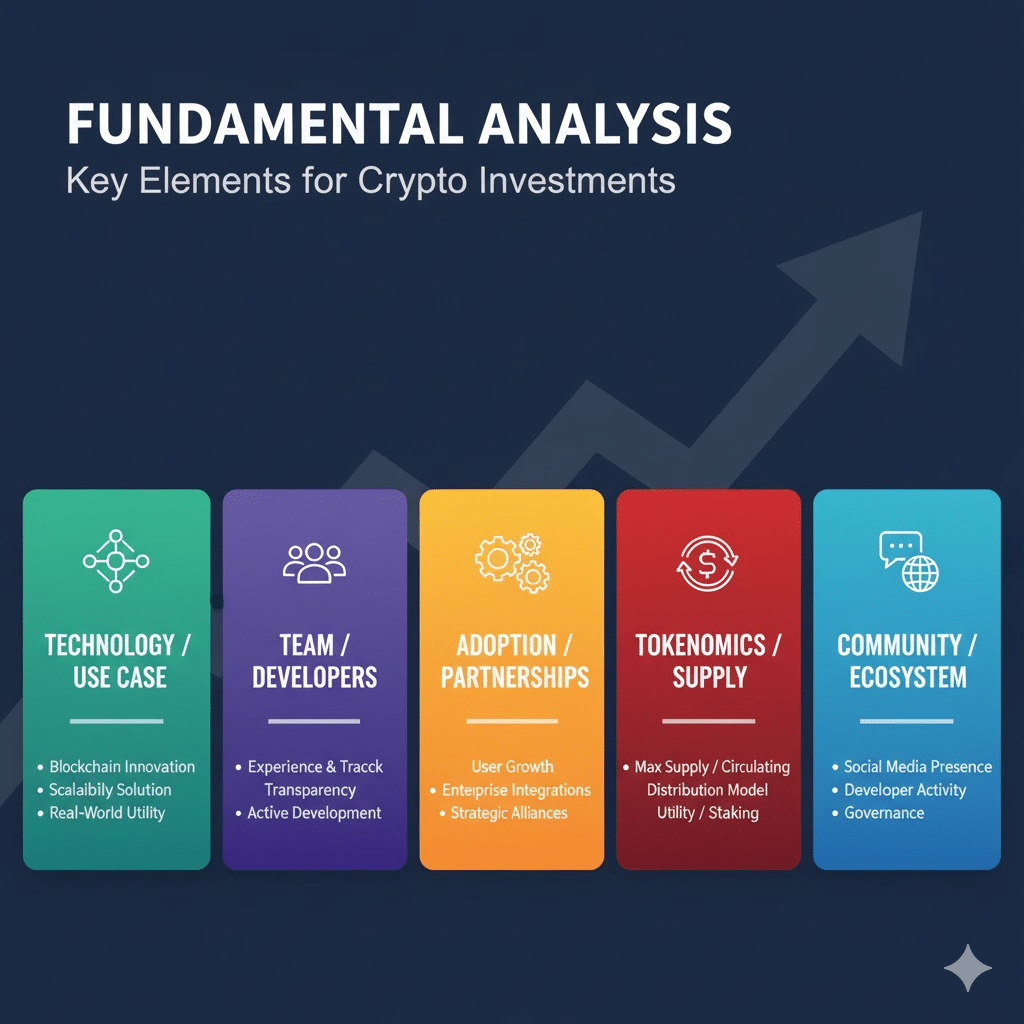

What Is Fundamental Analysis?

Fundamental analysis (FA) is all about understanding the real value of a cryptocurrency. Instead of looking at price charts, you're asking deeper questions:

- What problem does this coin solve?

- Who's behind the project—are they experienced and credible?

- Does the coin have real-world use cases, or is it just hype?

- How many coins are in circulation, and will more be created?

- Is there actual demand for this cryptocurrency?

Think of fundamental analysis like researching a company before buying its stock. You wouldn't invest in a company without knowing what they do, who runs it, and whether they're profitable, right? The same logic applies to crypto.

Here's a practical example:

Let's say you're considering buying Ethereum. Using fundamental analysis, you'd look at:

- The technology: Ethereum allows developers to build decentralized applications (apps that run without a central company controlling them). This is a real use case with demand.

- The team: Ethereum was created by Vitalik Buterin and has a large, active development community that's been building for years.

- Adoption: Thousands of projects are built on Ethereum, from DeFi (decentralized finance—financial services without banks) platforms to NFT marketplaces.

- Supply: Ethereum has a clear supply model, and recent upgrades have made it deflationary (meaning the supply decreases over time, potentially increasing value).

After this research, you might conclude that Ethereum has strong fundamentals. It solves real problems, has widespread adoption, and has a credible team behind it. This makes it a solid long-term investment.

Pro Tip: Fundamental analysis is best for long-term investing. If you're planning to hold a coin for months or years, understanding its fundamentals is critical. It helps you identify projects with staying power versus coins that are just riding a hype wave.

What Is Technical Analysis?

Technical analysis (TA) is completely different. Instead of studying what a coin does or who created it, you're studying price charts and patterns to predict where the price might go next.

Technical analysts believe that all the necessary information is already reflected in the price. They look at:

- Price movements: Is the price trending up, down, or sideways?

- Support and resistance levels: Price points where the coin tends to bounce up (support) or get stuck (resistance)

- Volume: How many people are buying and selling—higher volume often confirms price moves

- Indicators: Tools like RSI (Relative Strength Index—shows if a coin is overbought or oversold), MACD (Moving Average Convergence Divergence—helps identify trend changes), and moving averages that help spot trends

Here's a practical example:

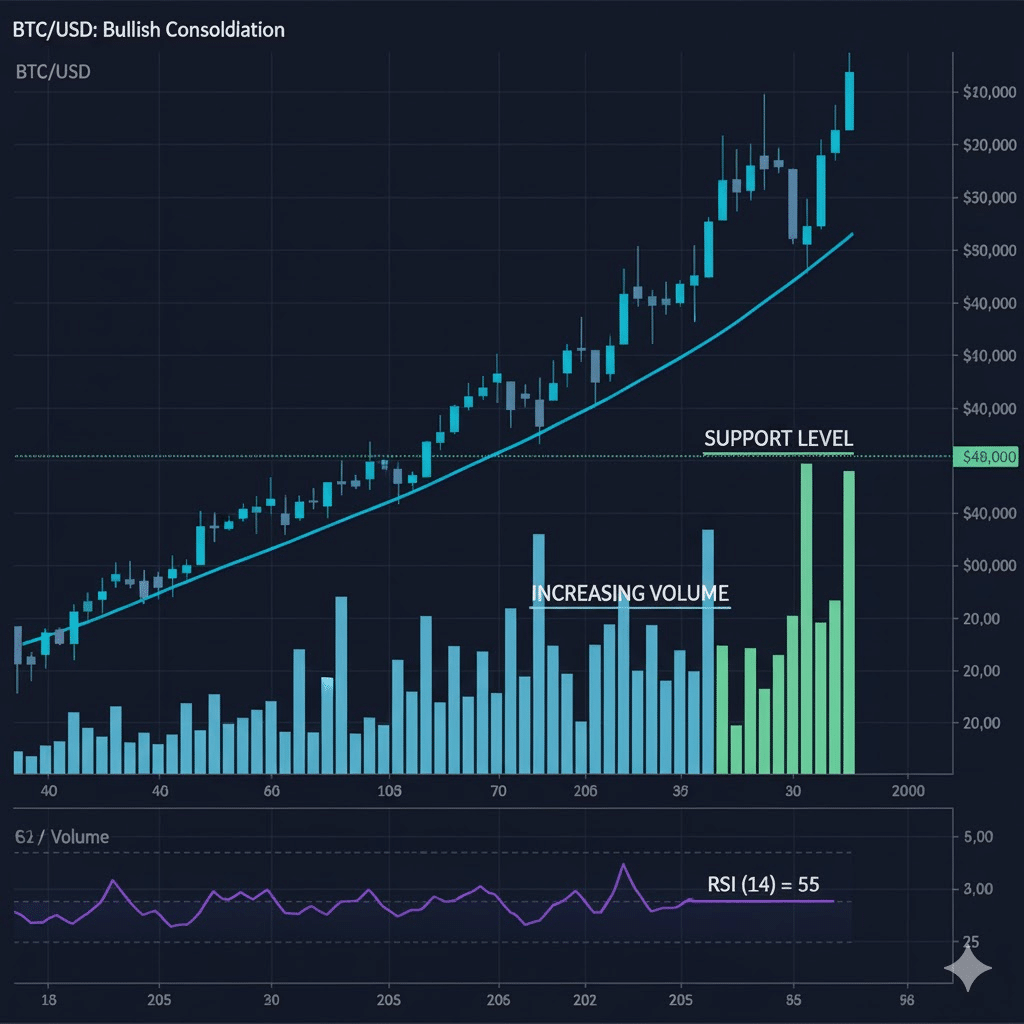

Let's say Bitcoin is trading at $50,000. You're thinking about buying, so you pull up a chart and start analyzing:

- Trend: The price has been climbing steadily from $45,000 to $50,000 over the past two weeks. The trend is upward.

- Support level: Every time Bitcoin dropped to $48,000 in the last week, buyers stepped in and pushed the price back up. That's a strong support level.

- Volume: Trading volume has increased as the price rose, which confirms that the upward move is strong and not just a fake-out.

- RSI: The RSI is at 55 (on a scale of 0-100), meaning Bitcoin isn't overbought yet. There's room for more upside.

Based on this technical analysis, you might decide to buy Bitcoin at $50,000, expecting the upward trend to continue. You'd set a stop loss at $48,000 (just below support) to protect yourself if the price drops.

Common Mistake: Beginners often think technical analysis is like fortune-telling. It's not. TA doesn't predict the future—it identifies probabilities based on past patterns. You're making educated guesses, not guarantees.

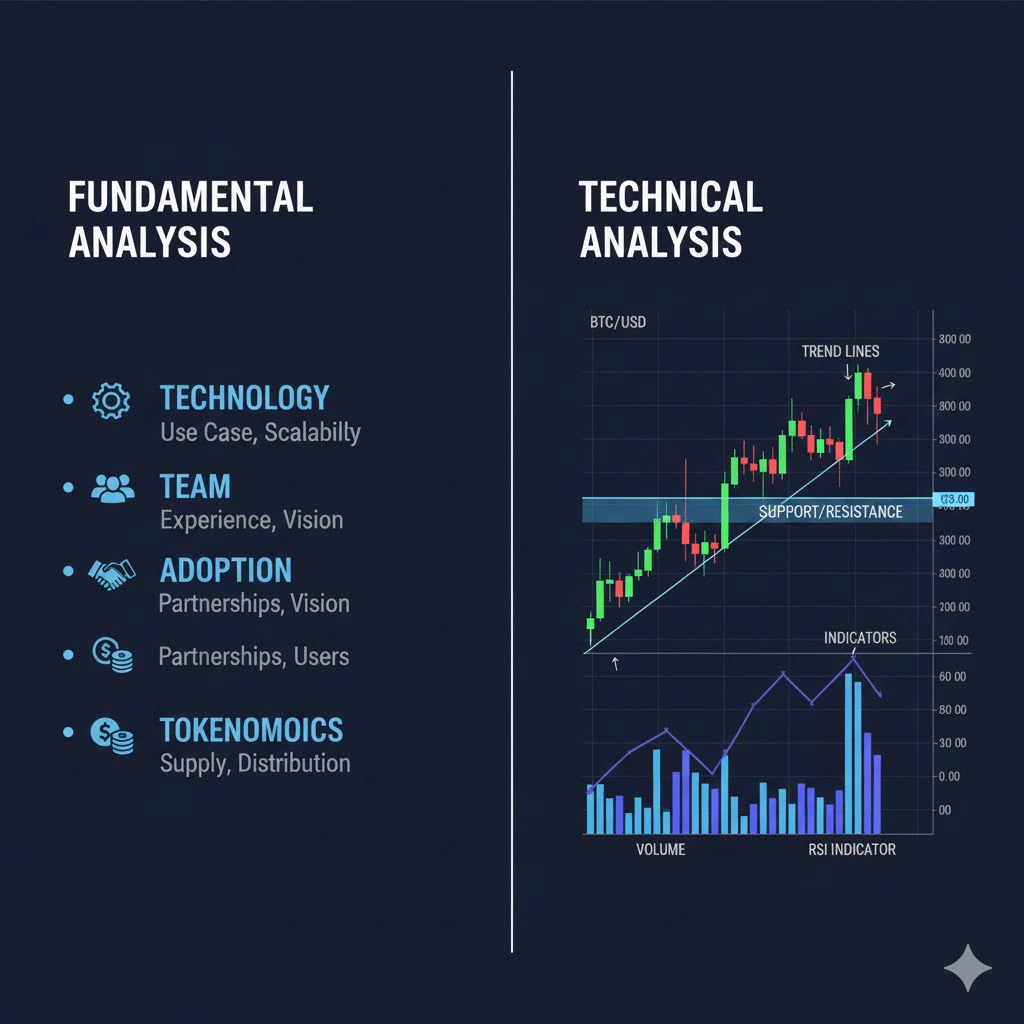

Fundamental Analysis vs Technical Analysis: The Key Differences

Let's break down the main differences between these two approaches:

Time Horizon:

- Fundamental Analysis: Best for long-term investing (months to years). You're identifying coins that will grow in value over time based on their real-world utility.

- Technical Analysis: Best for short-term trading (days to weeks). You're capturing price movements and trends in the near term.

What You're Analyzing:

- Fundamental Analysis: The coin's technology, team, adoption, use cases, and tokenomics (how the coin's supply and distribution work).

- Technical Analysis: Price charts, patterns, volume, and indicators.

Decision-Making:

- Fundamental Analysis: Answers "Should I invest in this coin at all?" It's about choosing the right asset.

- Technical Analysis: Answers "When should I buy or sell this coin?" It's about timing your entry and exit.

Example Scenario:

Imagine you're looking at Cardano. You do fundamental research and discover that Cardano has strong technology, a credible team, and growing adoption in developing countries. You decide it's a good long-term investment.

But the price is at $0.60 right now. Should you buy today? You switch to technical analysis. The chart shows that Cardano has resistance at $0.60—it's been rejected at this level three times. You decide to wait for a dip to $0.55 (a support level) before buying.

See how they work together? Fundamental analysis told you what to buy. Technical analysis told you when to buy it.

When Should You Use Fundamental Analysis?

Use fundamental analysis when:

1. You're investing for the long term

If you plan to hold a coin for 6 months, a year, or longer, fundamentals matter. You want to invest in projects that have a real future, not coins that are just pumping on hype.

Ask yourself: Will this project still be relevant in two years? Does it solve a problem that people actually care about? If the answer is yes, the fundamentals are strong.

2. You're choosing between different coins

Let's say you're deciding whether to invest in Solana or Avalanche. Both are smart contract platforms (blockchains that allow developers to build apps). How do you choose?

Look at the fundamentals:

- Which one has more developers building on it?

- Which has faster transaction speeds and lower fees?

- Which team has a stronger track record?

- Which has better partnerships and adoption?

This research helps you pick the coin with the best long-term potential.

3. You want to avoid scams and "pump and dump" schemes

Crypto is full of projects that look exciting on the surface but have zero substance. They promise revolutionary technology, but when you dig deeper, there's no real product, no credible team, and no actual use case.

Fundamental analysis protects you from these traps. If a coin has weak fundamentals—no clear purpose, anonymous team, no adoption—it's probably not worth your money, no matter how much it's pumping today.

Pro Tip: When researching fundamentals, check multiple sources. Don't just read the project's own website—look for independent reviews, developer activity on GitHub, and community discussions on Reddit or Twitter. This gives you a more balanced view.

When Should You Use Technical Analysis?

Use technical analysis when:

1. You're day trading or swing trading

If you're looking to buy and sell within days or weeks, fundamental analysis won't help much. A coin's fundamentals don't change day-to-day, but its price does.

Technical analysis helps you spot short-term opportunities. You're looking at charts to find the best times to enter and exit trades.

2. You want to time your entry or exit

Even if you've done fundamental research and know you want to buy a coin, you still need to decide when to buy. Should you buy today, or wait for a dip?

Technical analysis helps you answer this. Look at the chart—is the price at a support level (good time to buy) or at resistance (might want to wait)?

3. You're managing risk with stop losses

Stop losses (automatic sell orders that trigger if the price drops to a certain level) are essential for protecting your capital. But where do you set them?

Technical analysis gives you the answer. You identify support levels on the chart and set your stop loss just below them. This way, if the price breaks support, you exit the trade before losing too much.

4. The market is moving fast

During big market moves—whether up or down—fundamentals don't matter in the short term. The price is reacting to emotions, news, and momentum, not long-term value.

In these moments, technical analysis is your best tool. You're watching the chart in real-time, looking for signs that the move is continuing or reversing.

Common Mistake: Don't rely solely on technical analysis for long-term decisions. Just because a chart looks bullish today doesn't mean the coin is a good investment. Always combine TA with at least basic fundamental research.

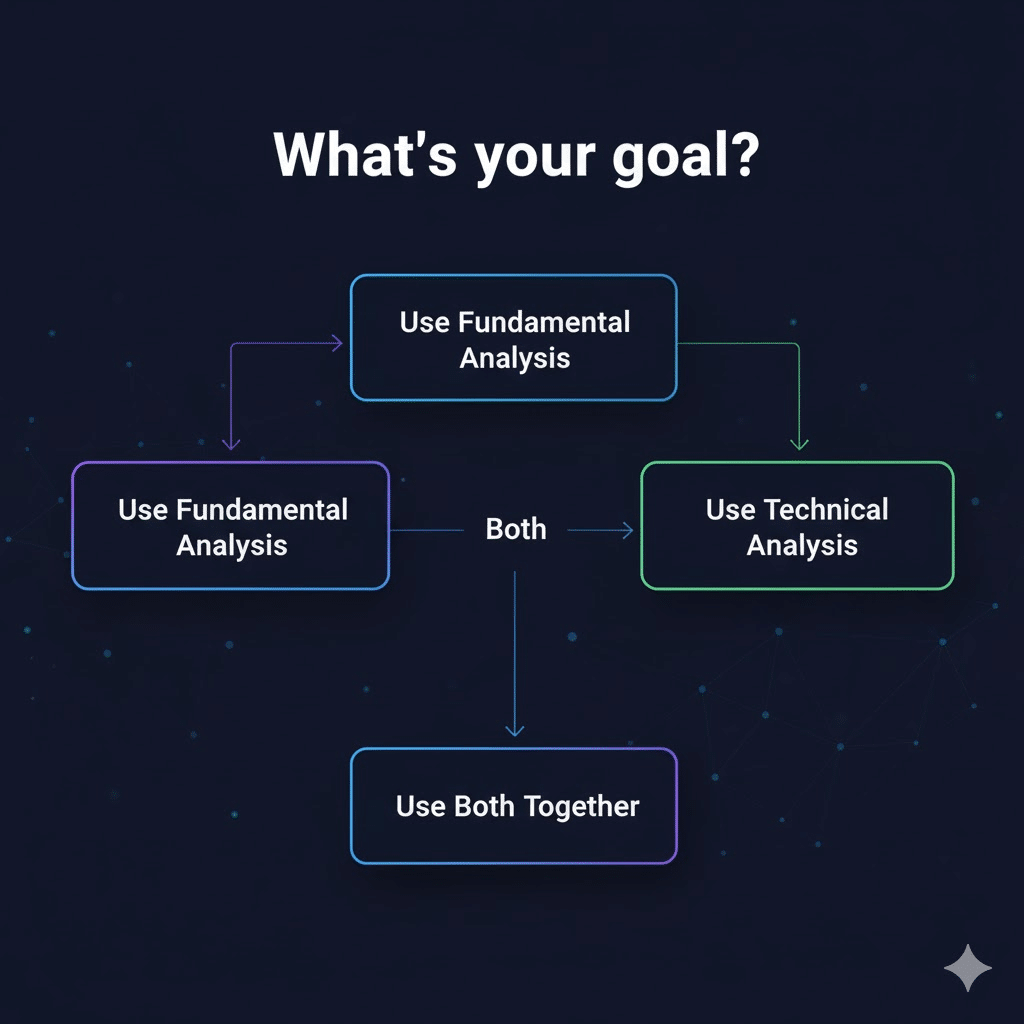

Can You Use Both Together?

Absolutely. In fact, the best traders combine fundamental and technical analysis.

Here's how it works in practice:

Step 1: Use Fundamental Analysis to Build Your Watchlist

Start by researching coins and identifying 5-10 projects with strong fundamentals. These are coins you believe have long-term potential based on their technology, team, adoption, and use cases.

For example, after research, you might decide that Ethereum, Solana, Chainlink, Polygon, and Avalanche are solid projects worth investing in.

Step 2: Use Technical Analysis to Time Your Trades

Now that you know what to buy, use technical analysis to figure out when to buy. Look at the price charts for each coin on your watchlist.

Let's say Solana's fundamentals are strong, but the chart shows it's at resistance at $120. You decide to wait. A week later, it dips to $110—a support level. That's your buy signal.

Step 3: Monitor Both as You Hold

Once you're invested, keep an eye on both. If the fundamentals change (the project loses its lead developer, adoption drops, or a competitor emerges), that's a red flag. You might want to sell, even if the price is still going up.

On the flip side, if the fundamentals remain strong but the price drops sharply due to a market-wide sell-off, technical analysis helps you decide whether to hold or buy more at the dip.

This combined approach gives you the best of both worlds: you're investing in quality projects (fundamentals) and entering/exiting at smart times (technicals).

Pro Tip: Start with fundamentals first. Don't waste time doing technical analysis on a coin with weak fundamentals. Only analyze the charts for coins you've already vetted through fundamental research.

Which One Should Beginners Focus On First?

If you're brand new to crypto, here's my advice: start with fundamental analysis.

Why? Because it's more straightforward. You're asking clear questions: What does this coin do? Who's behind it? Is it being used?

Technical analysis requires learning chart patterns, indicators, and price action—it takes time to get good at it. If you jump into TA too early without understanding fundamentals, you might end up trading garbage coins just because the chart "looks good."

Beginner Learning Path:

- Spend your first month learning fundamental analysis. Research 10 different coins. Read their whitepapers (documents explaining what the project does), check the team's backgrounds, and see what people are saying in the community.

- Once you understand fundamentals, start learning basic technical analysis. Focus on simple concepts first: support and resistance, trend lines, and volume.

- Practice combining both on paper (without risking real money). Pick a coin with strong fundamentals, analyze the chart, and decide when you'd buy. Track how it performs over the next few weeks.

This approach builds a strong foundation. You'll avoid bad investments (thanks to fundamentals) and improve your timing (thanks to technicals).

Quick Recap

Here's what we covered:

- Fundamental Analysis: Focuses on a coin's real value—its technology, team, adoption, and use cases. Best for long-term investing and choosing which coins to buy.

- Technical Analysis: Focuses on price charts, patterns, and indicators to predict short-term price movements. Best for timing your entries and exits.

- Key Difference: FA answers "What should I buy?" and TA answers "When should I buy it?"

- Use FA when: You're investing long-term, choosing between coins, or avoiding scams

- Use TA when: You're day/swing trading, timing your entry, setting stop losses, or the market is moving fast

- Combine both: Start with FA to build a watchlist of strong projects, then use TA to time your trades and manage risk

Conclusion & Next Steps

Understanding the difference between fundamental and technical analysis is a game-changer. It transforms you from someone who blindly follows Twitter hype to a trader who makes informed, strategic decisions.

Most beginners make one of two mistakes: they either ignore fundamentals and chase charts, or they ignore technicals and buy coins at terrible times. Don't fall into either trap.

The smartest approach? Learn both, and use them together. Research the fundamentals to find quality projects, then use technical analysis to enter and exit at smart price points.

Your Next Steps:

- Today: Pick one coin you're curious about. Spend 20 minutes researching its fundamentals—what does it do? Who created it? Is it being used? Write down your findings.

- This Week: Open a free charting platform like TradingView. Look up the same coin and study its price chart. Where is support? Where is resistance? Is it trending up or down? Practice reading the chart without placing any trades.

- Ongoing: Build a habit of combining both. Before you buy any crypto, ask yourself two questions: (1) Are the fundamentals strong? (2) Is this a good time to buy based on the chart? If the answer to both is yes, you've got a solid trade setup.

Remember: You don't have to figure this out alone. Our Fat Pig Signals community is full of traders who are learning fundamental and technical analysis together. We break down both in simple terms, share chart setups, and discuss which coins have strong fundamentals worth investing in.

Join our Telegram group here and get access to real-time analysis, educational resources, and a supportive community that helps you grow as a trader.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Cryptocurrency trading involves substantial risk of loss. Always do your own research and consider consulting with a financial advisor before making investment decisions.