DeFi Trends: What's Hot in Decentralized Finance Now

Trading

Ever feel like the crypto world moves so fast that you miss the train before you even know it left the station?

You're not alone. DeFi (Decentralized Finance—basically financial services without banks in the middle) is evolving at lightning speed, and new trends pop up faster than you can say "blockchain."

But you don't need to understand everything to spot the opportunities. You just need to know what's actually gaining traction and why people are excited about it.

In this article, we'll break down the hottest DeFi trends happening right now—the ones that are actually getting used, not just hyped. You'll learn what each trend does, why it matters for traders like you, and how to spot the next big thing before everyone else jumps in.

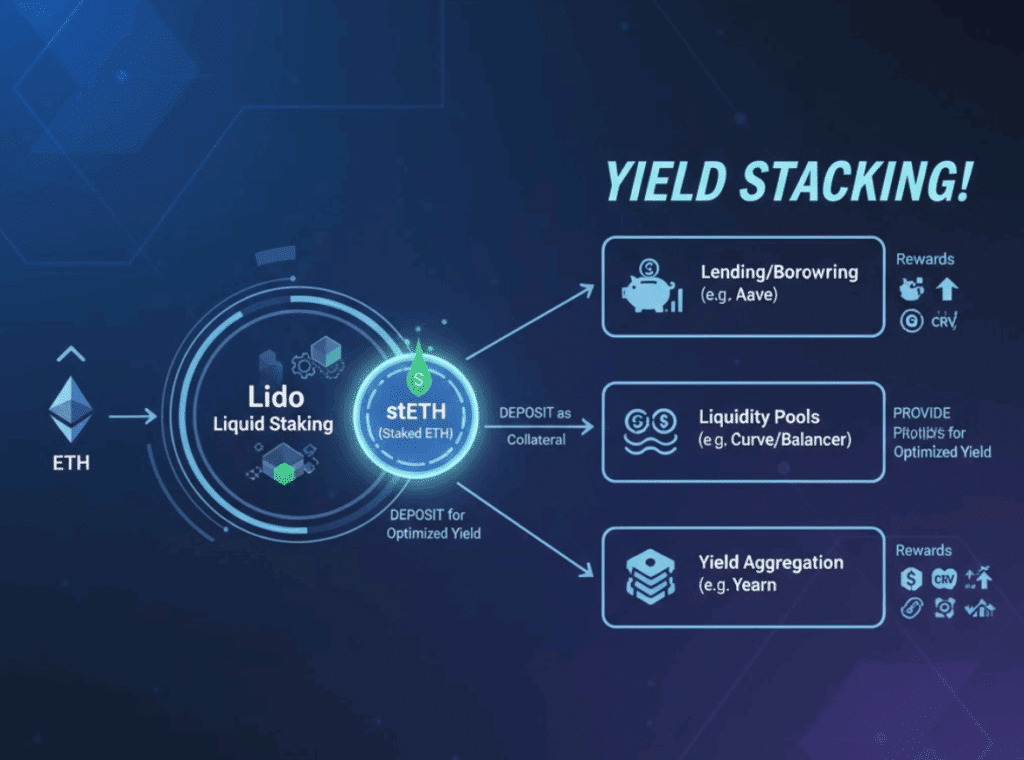

1. Liquid Staking: Your Crypto Works While You Sleep

Remember when you had to choose between earning staking rewards or keeping your crypto available to trade? That painful choice is disappearing.

Liquid staking (letting you stake your crypto AND still use it for other things) is exploding right now. When you stake Ethereum through services like Lido or Rocket Pool, you get a token representing your staked ETH. Let's say you stake 1 ETH. You get 1 stETH (staked ETH) in return.

That stETH earns you staking rewards (around 3-5% yearly right now). But here's the magic part—you can still trade that stETH, use it as collateral for loans, or provide it to liquidity pools to earn even more.

Why traders are paying attention:

The numbers are massive. Over $40 billion is now in liquid staking protocols. For you as a trader, this means watching liquid staking tokens like stETH, rETH, and others. When more people discover they don't have to lock up their crypto to earn rewards, demand for these tokens increases.

Pro Tip: Watch the ratio between stETH and regular ETH. When it trades below 1:1, it often presents a buying opportunity since they should theoretically be worth the same.

2. Real-World Assets (RWAs): When Traditional Finance Meets DeFi

This one's fascinating. DeFi trading is starting to tokenize real things, actual assets from the traditional world. Real-World Assets (RWAs) are things like the U.S. Treasury bonds, real estate, or even gold that get turned into crypto tokens you can trade 24/7.

Imagine being able to buy a piece of a U.S. Treasury bond at 2 AM on a Sunday. That's what RWAs enable.

Here's a real example:

A protocol like Ondo Finance takes U.S. Treasury bonds (super safe government investments) and creates OUSG tokens. Each OUSG token represents a share of those bonds. Now anyone with $100 can effectively own U.S. government bonds through DeFi.

There are over $5 billion in tokenized treasuries alone as of late 2024. Major players like BlackRock are even launching their own tokenized funds.

What this means for your trading:

RWA tokens often move differently than regular crypto. When crypto markets crash, tokens backed by government bonds might actually go up (just like traditional bonds do when stocks fall).

This gives you new hedging opportunities. You could hold some RWA tokens to balance out your riskier crypto plays.

Common Mistake: Not all RWA tokens are created equal. Always check what's actually backing the token and whether there's proof of the real assets existing. Scammers love jumping on trends.

3. AI and DeFi Integration: When Robots Manage Your Money

The combination of AI and DeFi is just starting, but it's already showing massive potential. Instead of you trying to figure out which liquidity pool offers the best returns, an AI agent does it for you automatically. It moves your funds between different protocols to maximize your earnings, all while you sleep.

AI agents in DeFi are programs that can make trading decisions based on market conditions. Like having a personal trading assistant who never sleeps and can analyze thousands of data points in seconds.

Real examples happening now:

- Protocols like Yield Yak automatically find and compound the best yields across multiple platforms

- AI-powered trading bots on platforms like 3Commas execute strategies based on market patterns

- New projects are creating AI agents that can manage entire DeFi portfolios

Here's a practical scenario:

You deposit $1,000 USDC into an AI-managed vault. The AI notices that Platform A is offering 8% APY while Platform B only offers 5%. It moves your funds to Platform A. Next week, Platform C launches with 10% APY. The AI automatically shifts your funds there.

For traders, this trend means:

Watch for tokens of AI-DeFi protocols. As more people realize they can automate their DeFi strategies, demand for these services (and their tokens) will likely grow. But be careful. Not everything calling itself "AI" actually uses real artificial intelligence. Some are just basic automated scripts with fancy marketing.

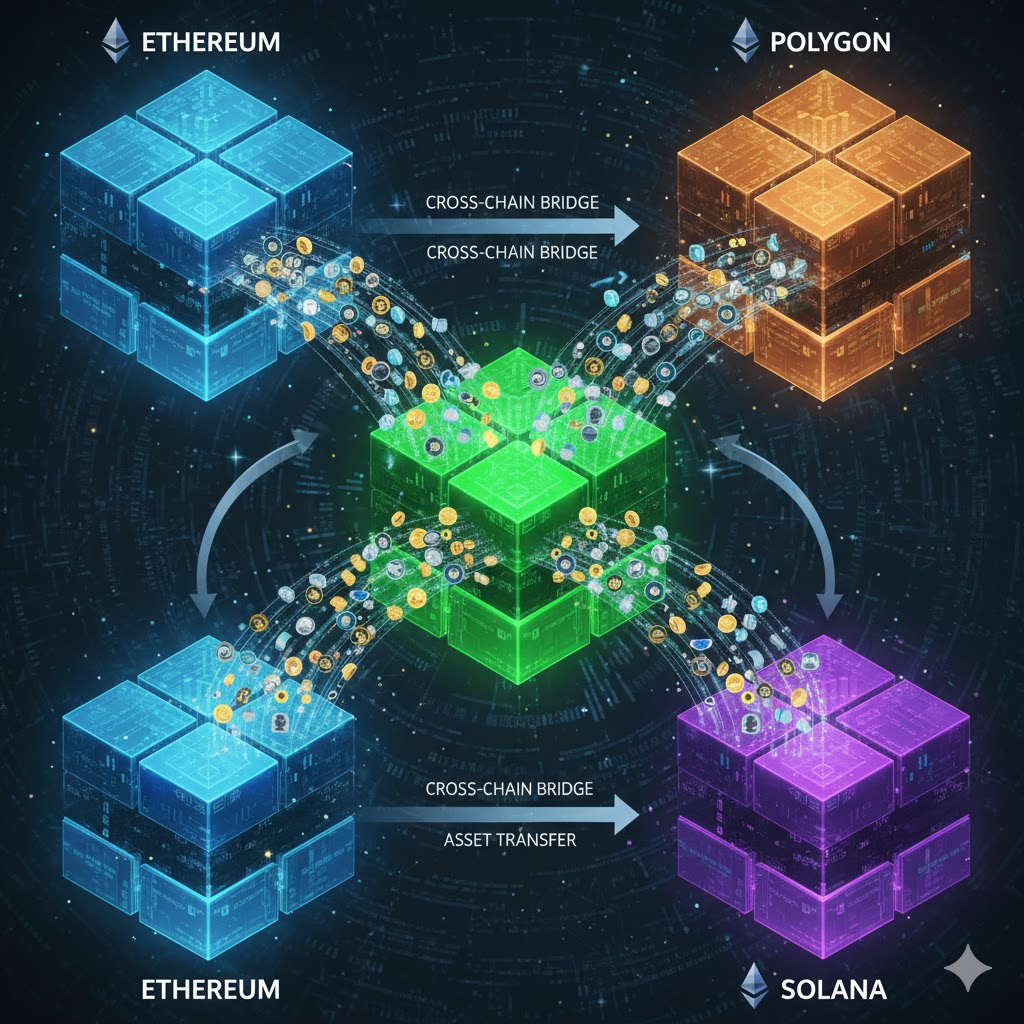

4. Cross-Chain DeFi: Breaking Down the Walls

Remember when Bitcoin people and Ethereum people couldn't easily trade with each other? Those days are ending. Cross-chain bridges and protocols let you use Bitcoin on Ethereum, Ethereum on Solana, and pretty much any combination you want.

Here's what's happening in practice:

Let's say you have Bitcoin but see a great yield farming opportunity on Ethereum. Using a bridge like Wormhole or LayerZero, you can wrap your Bitcoin (creating wBTC) and use it on Ethereum without selling your Bitcoin.

The numbers are huge: Over $20 billion is locked in cross-chain bridges right now.

Why this matters for trading:

Arbitrage opportunities explode when chains are connected. If ETH is trading for $2,000 on Ethereum but $2,010 on Arbitrum, traders can profit from that $10 difference.

More importantly, you're no longer locked into one ecosystem. See a better opportunity on another chain? Move your assets there in minutes.

Pro Tip: Always use established, audited bridges. Bridge hacks have been some of the biggest losses in crypto history. Stick to the proven ones with long track records.

5. Modular DeFi: Lego Blocks for Finance

This trend is more technical, but stay with me—it's important.

Modular DeFi means protocols are being built like Lego blocks that can be combined in different ways. Instead of one protocol trying to do everything, each does one thing really well and connects with others.

Think of it like this:

Instead of buying an all-in-one printer/scanner/copier that does everything okay-ish, you buy the best printer, the best scanner, and the best copier separately. Then you connect them so they work together perfectly.

Real example:

You could use:

- Aave for borrowing

- Uniswap for swapping

- Yearn for yield optimization

- All connected through a single interface like Instadapp

This modularity means innovation happens faster. When someone builds a better "Lego block," it can immediately work with all the existing blocks.

Quick Recap

Here's what we covered:

- Liquid staking is huge—over $40 billion locked and growing, letting you earn rewards while staying flexible

- Real-World Assets are bridging traditional finance—tokenized treasuries alone exceed $5 billion

- AI integration is automating DeFi strategies—bots and agents now manage portfolios 24/7

- Cross-chain tech is breaking down barriers—$20+ billion in bridges connecting all blockchains

- Modular DeFi enables rapid innovation—protocols work together like Lego blocks

Conclusion & Next Steps

DeFi isn't just evolving, it's revolutionizing how we think about financial services. The beauty of DeFi trends is that you don't need to understand every technical detail. You just need to spot where the money and users are flowing.

Your Next Steps:

- Today: Pick ONE trend from this article and research the top 3 protocols in that space. For liquid staking, look at Lido, Rocket Pool, and Frax. Note their token prices and total value locked (TVL).

- This Week: Try using one DeFi protocol with a small amount (even $50 works). Nothing teaches you faster than actually using these services yourself.

- Ongoing: Join the Fat Pig Signals Telegram community where we track these trends daily and alert each other to new opportunities as they emerge.

Remember: Every DeFi expert started as a beginner. The difference between those who succeed and those who don't? The successful ones started experimenting, stayed curious, and learned from a community.

You don't need to catch every trend. You just need to understand a few well enough to spot opportunities. You're already ahead of 99% of people just by reading this and understanding these concepts. Now it's time to put that knowledge to work.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Cryptocurrency trading involves substantial risk of loss. Always do your own research and consider consulting with a financial advisor before making investment decisions.