Derivatives Trading for Beginners and Experts: Strategies That Work

Trading

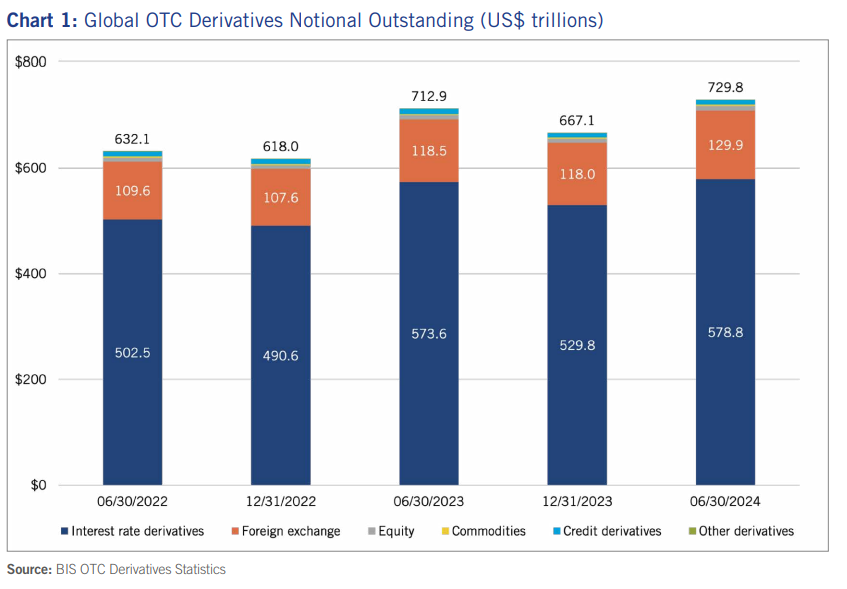

Derivatives trading is often described as the beating heart of modern finance. It’s massive in scale—by June 2024, the total notional value of outstanding derivatives had reached an astonishing $729.8 trillion, dwarfing the world’s GDP. Yet for all its importance, the world of derivatives can feel like an impenetrable maze for beginners. Complex terminology, intimidating numbers, and stories of financial meltdowns tied to derivatives often scare newcomers away.

But derivatives, at their core, are not monsters. They are contracts—simple agreements whose value is linked to something else. Whether it’s oil, gold, the S&P 500, or even interest rates, derivatives allow investors and institutions to manage risk, speculate on movements, and create financial strategies far more flexible than buying and selling assets directly.

To truly understand this trillion-dollar marketplace, we need to start from the foundation, then gradually move toward the sophisticated strategies and systems that define global finance today.

The Foundation of Derivatives

The simplest way to think about derivatives is to see them as financial shadows. Just as your shadow moves when you move, a derivative changes value when its underlying asset moves.

For example, a futures contract on crude oil does not involve barrels changing hands immediately. Instead, it’s an agreement tied to the price of oil. If oil rises from $80 to $85 per barrel, the value of the contract changes accordingly—even though no oil has been delivered.

This “shadow effect” opens the door to two key features:

- Leverage, which lets traders control large amounts of assets with relatively little money.

- Flexibility, since you don’t need to own the asset itself to benefit from its price changes.

Consider the S&P 500 E-mini futures, one of the most actively traded contracts in the world. At an index value of 4,500, a single contract represents $225,000 worth of exposure. Yet the trader only needs about $13,000 in margin to control it. This leverage ratio of nearly 17:1 means that a 1% movement in the S&P could produce a 17% swing in the trader’s account. It’s a double-edged sword: a chance for rapid profits, but also for devastating losses.

This is why derivatives are both feared and admired—they magnify financial outcomes.

The Four Pillars of Derivatives Trading

Although derivatives sound abstract, nearly all of them fall into four main categories. Each has a distinct purpose, risk profile, and role in the financial ecosystem.

Futures Contracts

These are standardized agreements to buy or sell an asset at a specific price and date. Traded on regulated exchanges like the Chicago Mercantile Exchange (CME), futures bring transparency and liquidity. Interestingly, over 95% of futures contracts never result in actual delivery of goods; traders close positions beforehand, making them tools for speculation and hedging rather than physical logistics.

Options Contracts

Options give traders the right—but not the obligation—to buy or sell at a set price. This asymmetry makes them powerful. For instance, buying a call option on Tesla stock limits your maximum loss to the option’s cost, while keeping your upside unlimited if Tesla soars. The pricing of options is influenced by the Greeks—metrics like delta (sensitivity to price), theta (time decay), and vega (volatility sensitivity).

Forward Contracts

Unlike futures, forwards are privately negotiated between parties. They are especially useful for corporations with specific needs, such as an airline locking in fuel prices six months in advance. The drawback? Forwards carry counterparty risk, since there is no clearinghouse to guarantee the deal.

Swaps

Swaps dominate the global derivatives market, particularly interest rate swaps, which account for more than $400 trillion in notional value. In a swap, two parties exchange cash flows—say, fixed interest for floating—allowing companies to manage debt exposure or currency risks.

Together, these instruments form the foundation upon which the entire derivatives market is built.

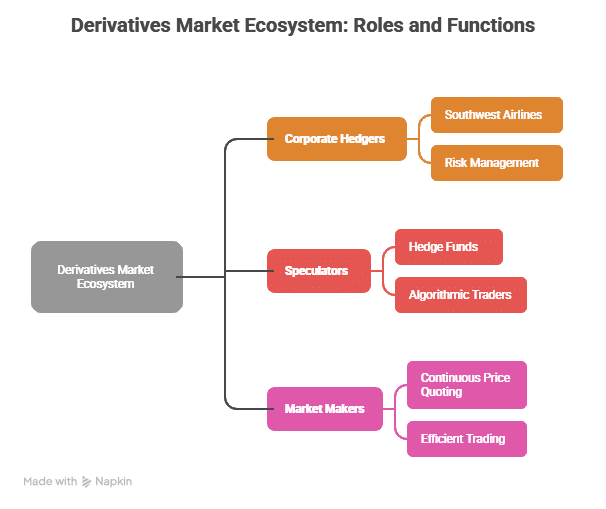

The Market Ecosystem: Who Trades Derivatives?

Understanding derivatives also means understanding the players. Not everyone is chasing profit; many use derivatives simply to survive financial uncertainty.

- Corporate Hedgers are perhaps the most relatable. Southwest Airlines famously used oil derivatives between 1999 and 2008 to lock in low fuel costs, saving the company an estimated $3.5 billion while competitors struggled with rising prices.

- Speculators, on the other hand, thrive on risk. Hedge funds, professional traders, and even retail investors seek to profit from short-term movements. Today, algorithmic and high-frequency traders dominate, accounting for 60–70% of global volume.

- Market Makers form the backbone of liquidity. By continuously quoting buy and sell prices, they ensure that traders can enter and exit positions efficiently.

This ecosystem balances caution with ambition, stability with speculation. Without hedgers, businesses would be exposed to crippling volatility. Without speculators and market makers, markets would lack the liquidity that makes derivatives usable.

Trading Mechanics: How Derivatives Work

At this point, you might wonder—how do these trades actually happen? The answer lies in a few key mechanisms:

- Margins ensure that traders have skin in the game. Posting just a fraction of a contract’s value creates leverage but also exposes traders to margin calls if losses mount.

- Order Types like market, limit, and stop orders give traders different levels of control between speed and price certainty.

- Clearinghouses act as middlemen who guarantee trades, reducing counterparty risk by ensuring that even if one side defaults, the other still gets paid.

Together, these systems transform what could be chaotic bilateral bets into a structured, regulated marketplace.

From Risk Management to Strategy

Risk management is where derivatives show their greatest strength. By carefully sizing positions, monitoring portfolio exposure, and stress testing scenarios, traders and institutions can turn volatility from a threat into an opportunity.

But derivatives aren’t just for defense—they are also tools for offense. Advanced strategies such as statistical arbitrage, options spreads, or carry trades exploit inefficiencies and market dynamics. These methods require discipline, but when executed correctly, they transform derivatives from blunt instruments into finely tuned profit machines.

Technology and Regulation: Shaping the Modern Market

The rise of technology has supercharged derivatives trading. High-frequency traders now operate in microseconds, co-locating servers next to exchanges to shave off milliseconds of latency. Meanwhile, DeFi platforms are pioneering decentralized derivatives like perpetual swaps, opening the market to anyone with an internet connection.

But innovation also invites scrutiny. After the 2008 crisis—where excessive leverage in credit derivatives nearly collapsed the global system—regulators worldwide tightened oversight. In the U.S., the Dodd-Frank Act forced many derivatives onto clearinghouses, while Europe’s MiFID II introduced stricter reporting rules. These guardrails aim to ensure that innovation doesn’t come at the cost of systemic stability.

The Road Ahead

The future of derivatives is being shaped by new forces:

- Central Bank Digital Currencies (CBDCs) could spark entirely new categories of financial contracts.

- ESG-linked derivatives, such as carbon futures, are gaining traction as sustainability becomes a financial priority.

- Quantum computing, still in its infancy, promises to revolutionize risk modeling and pricing systems once it matures.

Derivatives trading has always been about innovation—and the next wave may fundamentally change how markets operate.

Conclusion

Derivatives may appear intimidating, but at their heart they are tools—tools that can either protect or endanger depending on how they are used. The key to success lies in combining knowledge with discipline.

For the beginner, this means starting small, learning the mechanics, and respecting leverage. For professionals, it means constantly adapting to market evolution, technological change, and regulatory landscapes.

The trillion-dollar derivatives market is not just for Wall Street giants. With the right understanding, it becomes a space where any disciplined trader can participate in global finance, using the same tools that shape the world economy.

Take Your Trading to the Next Level with Fat Pig Signals

Learning about derivatives is only the first step. To trade smarter, you need timely insights, proven strategies, and expert analysis—and that’s exactly what Fat Pig Signals delivers.

Since 2017, our team of professional traders has been helping thousands of independent traders navigate the crypto market with:

- Daily crypto trading signals for Bitcoin and altcoins

- Market research & analysis to save you hours of study

- Proven results, including past calls on AAVE (+3200%), AXS (+4200%), and CAKE (+8700%)

- A Telegram community where traders learn, share, and grow together

👉 Don’t just read about strategies—apply them with confidence. Join our free Telegram group today and get a taste of professional trading signals.