How to Trade Crypto on Lower Time Frames

News

Have you ever watched a crypto chart and felt your heart race as prices go up and down in just a few minutes?

That is exactly what happens during lower time frame trading, where fortunes can change quickly, and making fast decisions can set you apart from others. If you're looking to capitalize on these fleeting moments, this guide will walk you through the strategies you need to trade crypto on lower time frames.

What Does Lower Time Frames Mean?

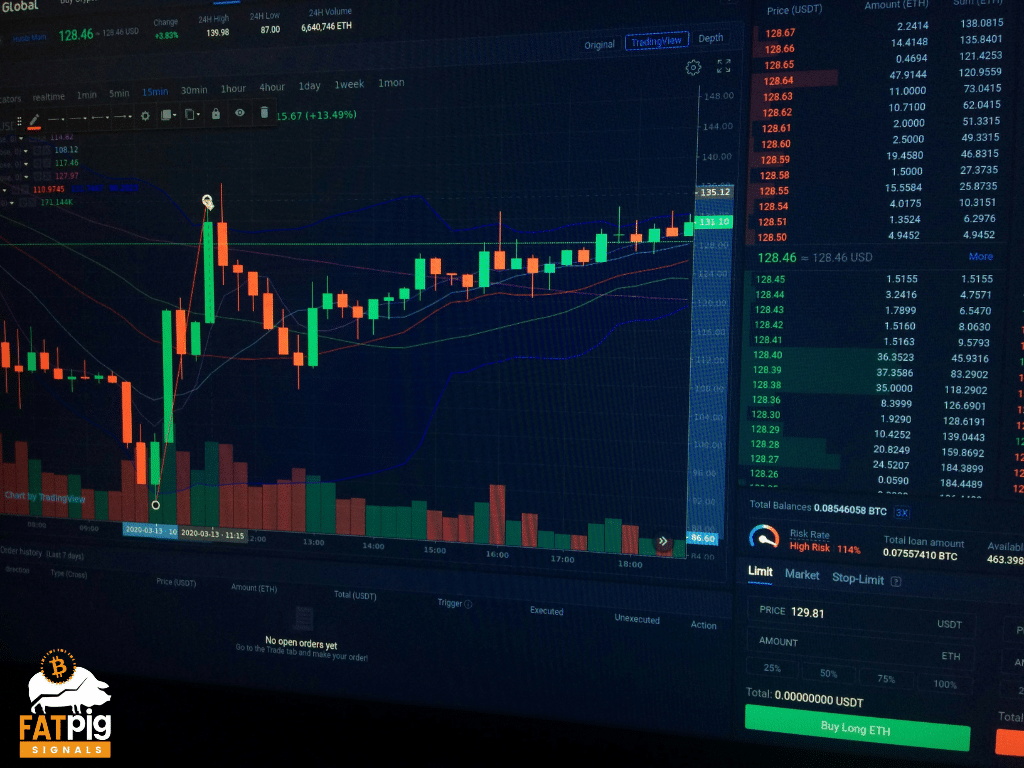

Lower time frames in trading refer to chart intervals that represent short periods-typically ranging from 1 minute up to 15 minutes per bar or candlestick. On these charts, each bar or candle shows the price movement for that brief window.

It is commonly used by intraday traders and scalpers seeking for quick profits, smaller capital requirements, and real-time feedback.

Here are some common lower timeframes:

- M1 (1-minute): Each candle shows price action for just 60 seconds—great for traders who like to act fast.

- M5 (5-minute): This timeframe captures quick price movements while reducing some of the noise from the 1-minute chart.

- M15 (15-minute): A popular choice for day traders, it balances quick reactions with fewer false signals.

- M30 (30-minute): This is the highest of the lower time frames, giving a broader view while still focusing on daily price changes.

Note: But be warned—this isn't for everyone! The challenges include higher transaction costs, increased market noise, intense focus requirements, and potential emotional strain.

Practical Guide to Trade Crypto on Lower Time Frames

To trade crypto on lower time frames-such as 1-minute (M1), 5-minute (M5), or 15-minute (M15) charts-you need to adapt your strategies, risk management, and mindset to the fast-paced, volatile nature of these intervals.

Here’s a practical guide, backed by research and industry sources:

Understand Lower Time Frames

Lower time frames (M1, M5, M15) are favored by day traders and scalpers who seek to profit from quick, intraday price movements. Each candlestick or bar represents a very short period, allowing traders to spot and act on small price fluctuations rapidly.

Popular Strategies for Lower Time Frame Crypto Trading

Range Trading

Identify a price range where the asset is consolidating on a low time frame (like the 1- or 5-minute chart). Buy at support (the lower end) and sell at resistance (the upper end). Look for reversal candlestick patterns (e.g., hammers, shooting stars) at these levels to confirm entries. Place stop-losses just outside the range to manage risk.

Breakout Trading

Watch for price breaking through established support or resistance levels. Enter on the breakout candle’s close or after a pullback retest. Place stop-losses just beyond the broken level and take profits at the next significant support/resistance, or trail your stop as the trend develops.

Momentum Trading

Buy assets showing strong upward momentum or sell those with strong downward momentum, often confirmed by high volume. This strategy is about “buying high to sell higher” or “selling low to buy lower.”

Note: Quick decision-making is crucial.

Scalping

Make multiple small trades throughout the day to profit from minor price changes. Scalpers often use tight stop-losses and quick profit targets, focusing on high liquidity pairs for fast execution.

Use Multiple Time Frame Analysis

Combine higher and lower time frames for better accuracy:

Trend Confirmation

Check the main trend on a higher time frame (e.g., 1-hour or 4-hour), then look for entries on a lower time frame (e.g., 5 or 15 minutes) in the same direction. This helps filter out false signals and improves entry/exit timing.

Entry Optimization

Wait for price retracements or reversal patterns on the lower time frame that align with the larger trend. Enter trades when both time frames agree.

Risk Management is Important

Volatility is higher on lower time frames, so always use stop-loss orders to protect your capital. Place them just beyond recent highs/lows or the edge of the trading range. Use smaller position sizes to account for increased noise and rapid fluctuations and avoid overtrading. Stick to your strategy and only act on clear signals.

Tools and Indicators

Candlestick Patterns: Some patterns are particularly effective for quick decision-making:

Visual Example of Bullish Engulfing

- Bullish Engulfing: When a large green candle completely "engulfs" the previous red candle—a powerful momentum shift signal

- Doji Candles: These little stars of indecision warn that momentum is pausing

- Hammer and Shooting Star: Perfect for spotting potential reversals at support and resistance

Volume

Volume confirms the strength behind price movements:

- Volume Spikes: Sudden surges in trading volume often indicate strong conviction

- Volume Divergence: If price makes a new high but volume is decreasing, be cautious

- Trading Hour Awareness: American trading hours (13:00-22:00 GMT) typically show the highest volume and volatility

Support and Resistance in Fast-Moving Markets

Identifying these levels quickly is essential:

- Previous Swing Points: Even in fast markets, price respects its history

- Round Numbers: Psychological levels ending in 00, 50, or 000 can act as powerful short-term levels

- Moving Averages: The 20-period and 50-period EMAs often act as dynamic support/resistance

Example Workflow

Here’s an example workflow to follow:

- Identify Trend: On the 1-hour chart, BTC/USDT is in an uptrend (above the 50 and 200 MAs).

- Confirm on Lower Time Frame: On the 15-minute chart, price is making higher highs and higher lows.

- Entry: Wait for a pullback to a support level on the 5-minute chart. Enter long on a bullish reversal candlestick.

- Manage Trade: Set stop-loss just below the support. Take profit at the next resistance or use a trailing stop.

The Multi-Timeframe Edge

Professional traders use the 1:4 ratio principle: first, choose a medium-term timeframe, then pick a shorter one that’s at least one-fourth the length of the medium term.

Here’s how it works:

- If you’re scalping using a 5-minute chart (M5), your medium timeframe should be at least 20 minutes (M20 or M30).

- If you’re day trading on a 15-minute chart (M15), check the 1-hour chart (H1) for trend confirmation.

The Top-Down Approach

- Start with the highest timeframe to get the overall picture and set your direction.

- Move to the intermediate timeframe to spot medium-term patterns and potential support or resistance levels.

- Finally, look at the lowest timeframe for precise entry points and tighter stop-loss placements.

Pro Tip: Check how many timeframes agree with your analysis. When three time frames align, you've got "triple confirmation," increasing your chances of success!

Profitable Strategies You Can Use When Short-Term Trading

Let's get practical with some strategies perfectly suited for lower timeframes:

The EMA Crossover Scalping Strategy

- Set up your 1-minute or 5-minute chart with two EMAs: a fast one (5 or 9 period) and a slow one (21 period)

- Enter a long position when the fast EMA crosses above the slow EMA

- Exit when the fast EMA crosses back below the slow EMA

The RSI Reversal Strategy

- Look for RSI readings below 30 (oversold) or above 70 (overbought) on your 15-minute chart

- Wait for the RSI to reverse direction (moving back toward the center)

- Confirm with a candlestick pattern before entering

- Target the next significant support/resistance level

The Support/Resistance Bounce Strategy

- Identify clear support and resistance levels on the 15-minute chart

- Enter long positions near support (with confirmation—don't try to catch falling knives!)

- Enter short positions near resistance (again, wait for confirmation)

- Set targets just before the opposite boundary of the range

Bonus Tip: Know When to Trade

Despite being a 24/7 market, crypto has distinct "rush hours" when activity surges:

- The Power Hour: The European-American overlap (13:00-17:00 GMT) consistently shows the highest trading volumes and volatility

- Weekend Warning: As trader Cantering Clark puts it, "Never trust the weekend" due to "a drop-off in participation by smarter money"

- Session Personalities: Each global trading session has its character—Asian (moderate activity), European (higher liquidity), and American (peak volatility)

Conclusion

Lower timeframe trading in crypto is exhilarating but demands discipline, knowledge, and emotional control. Start small, keep learning, and remember that consistency beats occasional home runs.

The beauty of this approach is that you'll know quickly whether your analysis is correct—you don't have to wait days or weeks for confirmation. This rapid feedback loop accelerates your learning curve dramatically.

Don't let the speed of lower time frames overwhelm you. Find reliable guidance and signals to navigate the volatility at Fat Pig Signals.