Top Five Bullish Trading Patterns You Should Know

Trading

Top Five Bullish Trading

Often Cryptocurrency traders look at the candlestick patterns to determine whether a market is bullish or not. They are visually appealing and easy to understand. They are called candlesticks because they are shaped like a rectangle with long lines similar to a wick on either end. They show how the market has reacted to crypto, and when you study them over time, you can see patterns that indicate whether or not it is a bullish market. Take a look at the following five bullish candlestick patterns. First, let´s take a look at the top five Bullish Trading patterns in the present time.

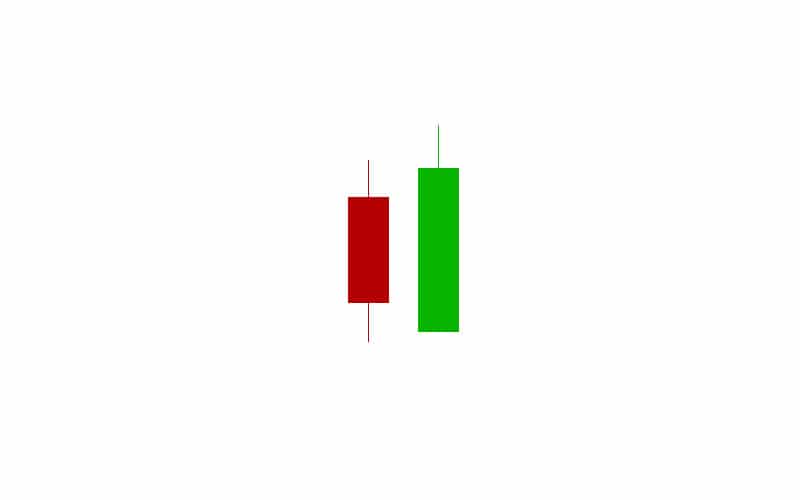

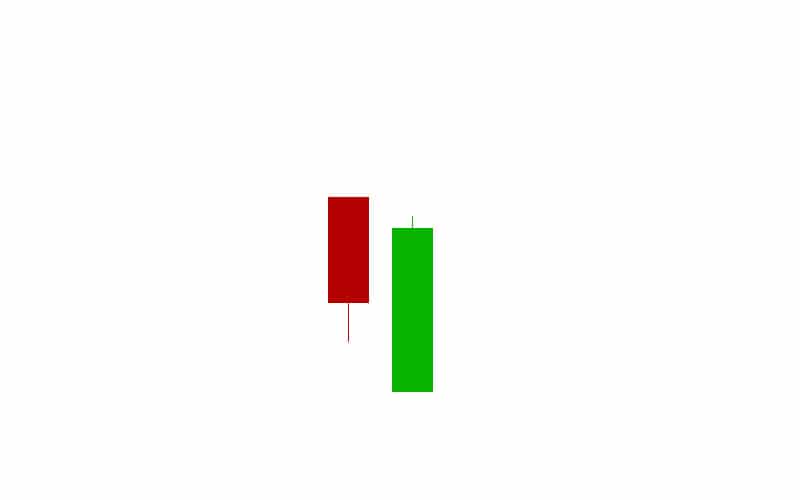

1. Bullish Engulfing Candlestick

The Bullish Trading engulfing candle appears when you have a candle one day followed by a candle that completely overlaps it the following day. This signals that new buyers have entered the market and are likely to continue driving the price up. The crypto must open at a lower price on day two than it closed on day one so that it can engulf it. If the crypto ends up with a higher close than it did the previous day, it is a bullish engulfing candle. The bears may have opened the day, but the bulls took over and drove the crypto up.

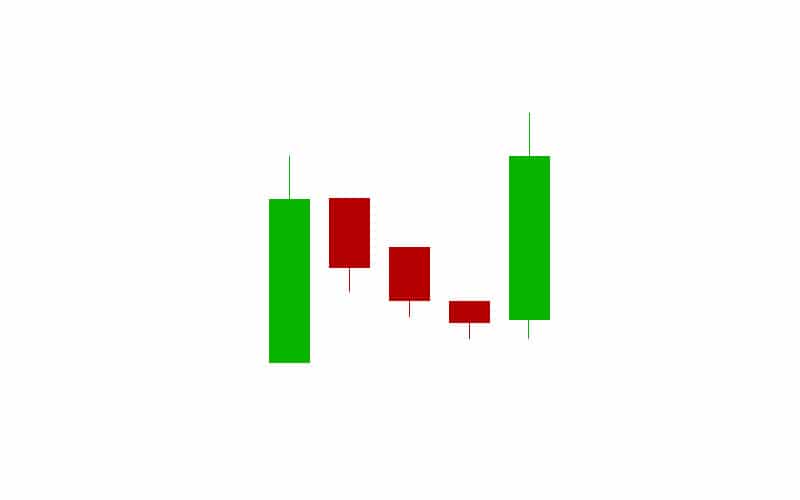

2. Rising Three Methods Candlestick

The bullish rising three methods pattern shows some bearish activity, but the bulls are regaining control of the crypto. You will see the first bar with a large body within an upward trend. The next three candlesticks are small bearish ones, and they are above the low of the previous but below the high. Finally, the last candlestick is another bullish candlestick with a large body that closes above the high of the first candlestick. This shows the bulls are back in control, and it deserves a place in this Bullish Trading list.

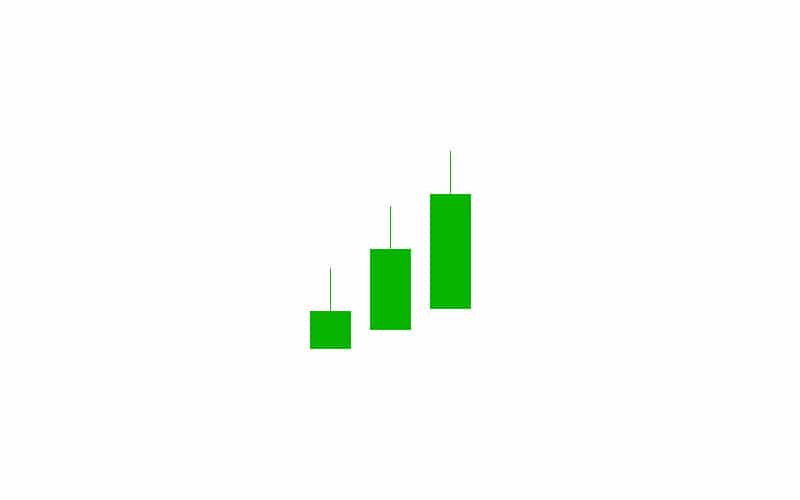

3. Three White Soldiers Candlestick

This Bullish Trading pattern follows a downward crypto trend, predicting a reversal to a bullish market. After a period of downward action, three long-bodied candlesticks will tick upward. Each one opens within the previous day’s real body and closes higher. This pattern suggests a positive change in market sentiment toward the crypto.

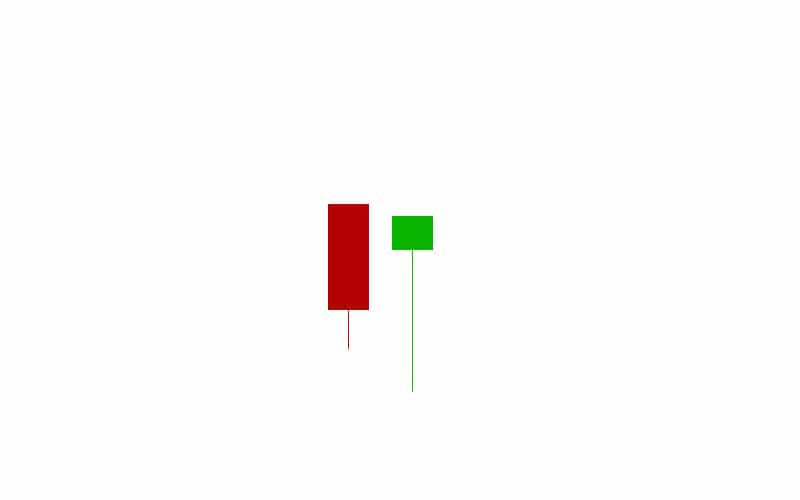

4. Piercing Line Candlestick

The piercing line Bullish Trading pattern is a two-day pattern that shows a potential downward trend reversal. The first candlestick follows a downward trend in prices, and the second day begins lower than the first. However, the second day closes above the midway point of the first day, which shows a potential upward trend. This indicates that the bulls want to buy crypto at this price point.

5. Bullish Hammer Candlestick

This Bullish Trading pattern shows a small candle body with a long tail. There is a downward trend leading to this day. It shows that buyers came into the market and absorbed the losses by the sellers. The buyers push the price back near the open. The lower tail should be twice the length of the body, and this indicates a potential upward trend. It is a bullish hammer as long as there is confirmation with the following day’s candle showing an upward trend.