The Power of a Trading Journal for Risk Management and Profits

Trading

It’s 3 AM. Your Bitcoin trade is flashing red, hands trembling as you hit “sell,” locking in another painful loss. For many beginners, this isn’t just a one-off mistake—it’s a recurring cycle that repeats until their account balance is gone.

While most blame the volatility of crypto markets, the real problem lies elsewhere: psychology and lack of structure. In fact, studies suggest that over 90% of retail traders lose money, and not because they lack access to strategies, but because they fail to follow them with discipline.

So how do you build consistency in a market known for chaos? The answer is surprisingly simple, yet often overlooked: a trading journal. By recording, reviewing, and learning from every trade, beginners can transform random decision-making into a structured system.

But before we get into the “how,” let’s first understand why self-awareness is the foundation of all successful trading.

Consistency Begins With Self-Awareness

Trading without documentation is like flying blind. You may land safely sometimes, but eventually, the lack of instruments catches up with you. Most beginners treat crypto like a casino—placing bets, reacting to emotions, and assuming luck is a strategy.

A trading journal changes this. By logging trades, you begin to spot invisible patterns:

- Do you lose more often when trading late at night?

- Do you risk more after a winning streak, only to give it all back?

- Are you entering trades based on analysis—or simply because of Twitter hype?

When these habits are written down, they stop being invisible and start becoming fixable. This self-awareness is the first step toward consistency.

But awareness only works if you track the right details. That’s why the next step is learning what exactly to record in a trading journal.

What to Record in a Trading Journal

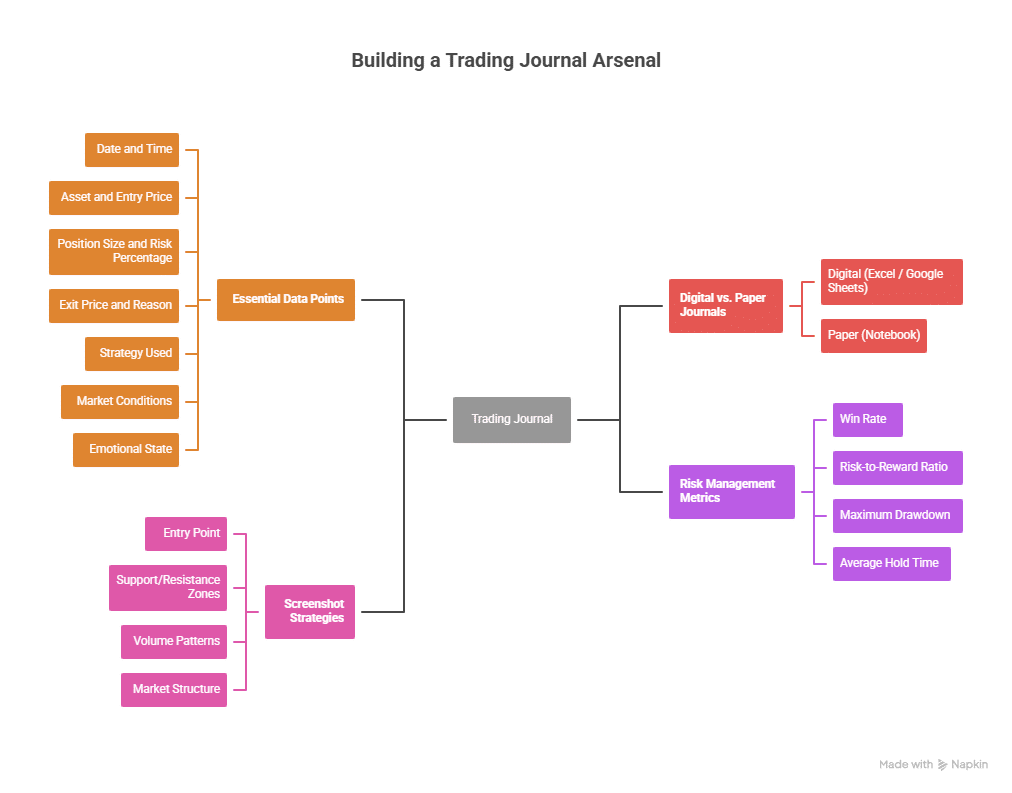

A trading journal isn’t just a diary—it’s your personal trading database. Recording the right information gives you insights that no paid indicator can provide. At minimum, every trade should include:

- Date & Time – Different hours often lead to different results. You may trade better during the morning and worse at night.

- Asset & Entry Price – Accuracy is key; small differences can have a big impact in volatile altcoins.

- Position Size & Risk % – Risking 10% of your capital on one trade may feel bold, but it’s a recipe for disaster. Most professionals never risk more than 2–3%.

- Exit Price & Reason – Did you exit because of your plan, or because panic set in?

- Strategy Used – Breakouts, scalps, or swings—over time, journals reveal which setups truly fit your personality.

- Market Conditions – Bull markets, bear markets, and sideways chop all affect strategy effectiveness.

- Emotional State – Were you calm, fearful, or overconfident? Tracking this often reveals more than charts do.

Digital tools like Excel or Google Sheets make calculations easier, but handwritten notes allow for deeper emotional reflection. Many traders use a hybrid approach—numbers in spreadsheets, emotions on paper.

Now that we know what to record, the real challenge begins: managing the emotional rollercoaster of trading.

Mastering the Emotional Side of Trading

If data is the skeleton of your journal, emotions are the heartbeat. Studies show that over 80% of trading losses come from emotional decisions rather than poor technical analysis.

The most dangerous trap is revenge trading—the desperate attempt to recover losses by doubling down. Almost every beginner has fallen into this cycle, and almost all lose even more when they do

By writing down emotions, you create space between feeling and action. For example:

- You might notice that stress levels above 7/10 often lead to poor trades.

- You may realize that you overtrade when bored or when trying to “catch up” after a bad day.

- You may even spot that your biggest losses always happen after big wins, when overconfidence kicks in.

This emotional awareness isn’t just therapeutic—it’s practical. It lets you set personal rules, such as taking a 24-hour break after three consecutive losses or reducing position size when stress is high.

And once emotions are managed, you can finally turn chaotic trades into data-driven decisions.

Turning Chaos Into Data-Driven Decisions

Crypto will always be volatile, but journaling turns that volatility into usable data. When you analyze trades weekly, patterns emerge:

- Win Rate vs. Risk-Reward: You don’t need to win 70% of the time to be profitable. Even a 40% win rate can work if your average win is three times larger than your loss.

- Drawdown Control: If your account suffers a 50% drawdown, you’ll need a 100% gain just to break even. Journals help you keep losses under control—ideally under 20%.

- Time-Based Performance: Some traders consistently win in the first two hours of market open but fail later in the day. Journals highlight these time patterns.

- Strategy Strength: Over time, you’ll discover whether you’re naturally better at scalping, swing trading, or trend following.

- Emotional Correlation: When stress and FOMO ratings are high, success rates usually plummet.

Spending just 30 minutes every week reviewing your trades is like giving yourself free coaching. It turns noise into insight—and insight into strategy. With the right data, the next step is building a routine that transforms journaling from theory into habit.

Building a Profit Machine Out of Simple Notes

Think of your journal as more than just a logbook, it’s the foundation of your trading business. Successful traders don’t rely on memory or luck; they rely on structure.

Here’s a simple routine you can follow:

- Morning Review (2 minutes): Look back at yesterday’s trades and note one key takeaway.

- During Trades (1 minute): Record entries, sizes, and emotional state immediately.

- Evening Reflection (3 minutes): Review all trades of the day. Ask: Did I follow my plan? What emotions influenced me?

Over weeks and months, these small habits compound into powerful insights. You’ll know when you trade best, what strategies work, and which mistakes keep repeating. In short—you’ll stop gambling and start running your trading like a business.

And that’s exactly where consistency is born.

Discipline Is the Ultimate Edge

Luck and hype can make money quickly—but they can also take it away even faster. The traders who survive aren’t the ones chasing the next “moonshot.” They’re the ones who build discipline, step by step, trade by trade.

A trading journal is the tool that makes this discipline possible. It reveals hidden patterns, exposes emotional traps, and transforms random trades into a repeatable system.

In a market where most beginners burn out, a journal may be the difference between quitting in frustration and building long-term success. Because the sharpest trading edge isn’t a secret strategy or a paid signal—it’s consistency.

And consistency begins with the simple act of writing things down.

Trade Smarter with Fat Pig Signals

Your trading journal helps you track emotions and refine discipline—but pairing that with expert insights gives you an even greater edge. Fat Pig Signals, trusted by thousands of traders since 2016, delivers daily crypto signals, market research, and real-time analysis so you don’t waste hours chasing noise.

With professional strategies, accurate trading suggestions, and a 24/7 active community on Telegram, you’ll never have to second-guess your next move.

Join Fat Pig Signals today and combine discipline with expert guidance to trade smarter, faster, and more confidently.