Position Sizing: How to Calculate Your Trade Size

Trading

Even the best traders are wrong 40-50% of the time. The difference between successful traders and everyone else isn't about being right more often—it's about managing how much you risk when you're wrong.

That's where position sizing comes in. Think of it as your financial seatbelt. You might be the world's best driver, but you still buckle up every time. Today, I'm going to show you exactly how to calculate the right trade size for every position you take. By the end of this article, you'll never have to guess how much to invest again.

What Is Position Sizing (And Why Should You Care)?

Position sizing (deciding how much money to put into each trade) is the most important skill that nobody talks about. It's not sexy like finding the next 100x coin, but it's what keeps you in the game long enough to find those winners.

Imagine you have $1,000 to trade with. How much should you put into your next Bitcoin trade? $100? $500? All of it?

Most beginners guess. Smart traders calculate.

If you risk too much on one trade and it goes wrong, you're out of the game. Risk too little, and you'll never make meaningful profits. Position sizing helps you find that sweet spot where you can grow your account without blowing it up.

Think of it like portion control at a buffet. Sure, you could pile your entire plate with one dish, but what if it tastes terrible? Better to take reasonable portions of different things so one bad choice doesn't ruin your meal.

The Golden Rule: Never Risk More Than 1-2%

Before we dive into calculations, let's establish the most important rule in crypto trading:

Never risk more than 1-2% of your total account on a single trade.

Wait, only 1-2%? That sounds tiny!

Let me show you why this rule will save your account.

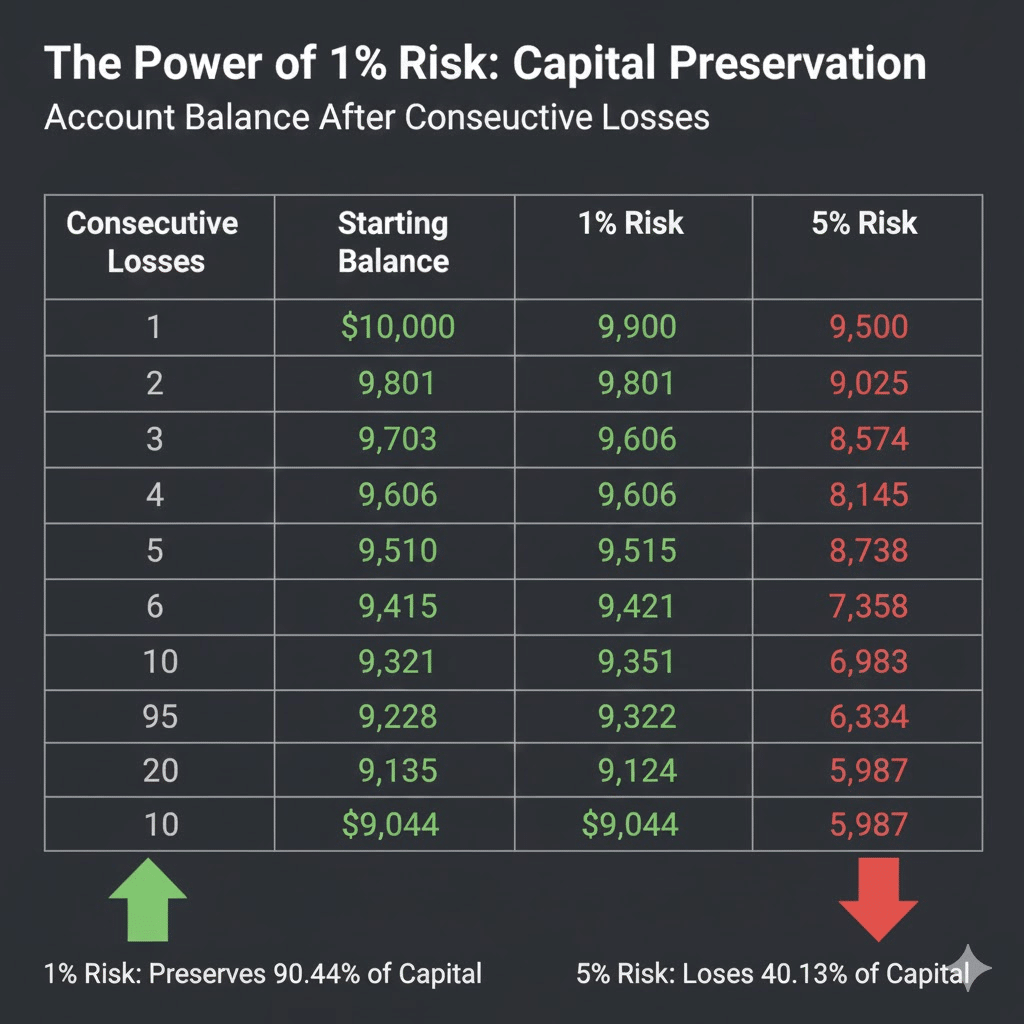

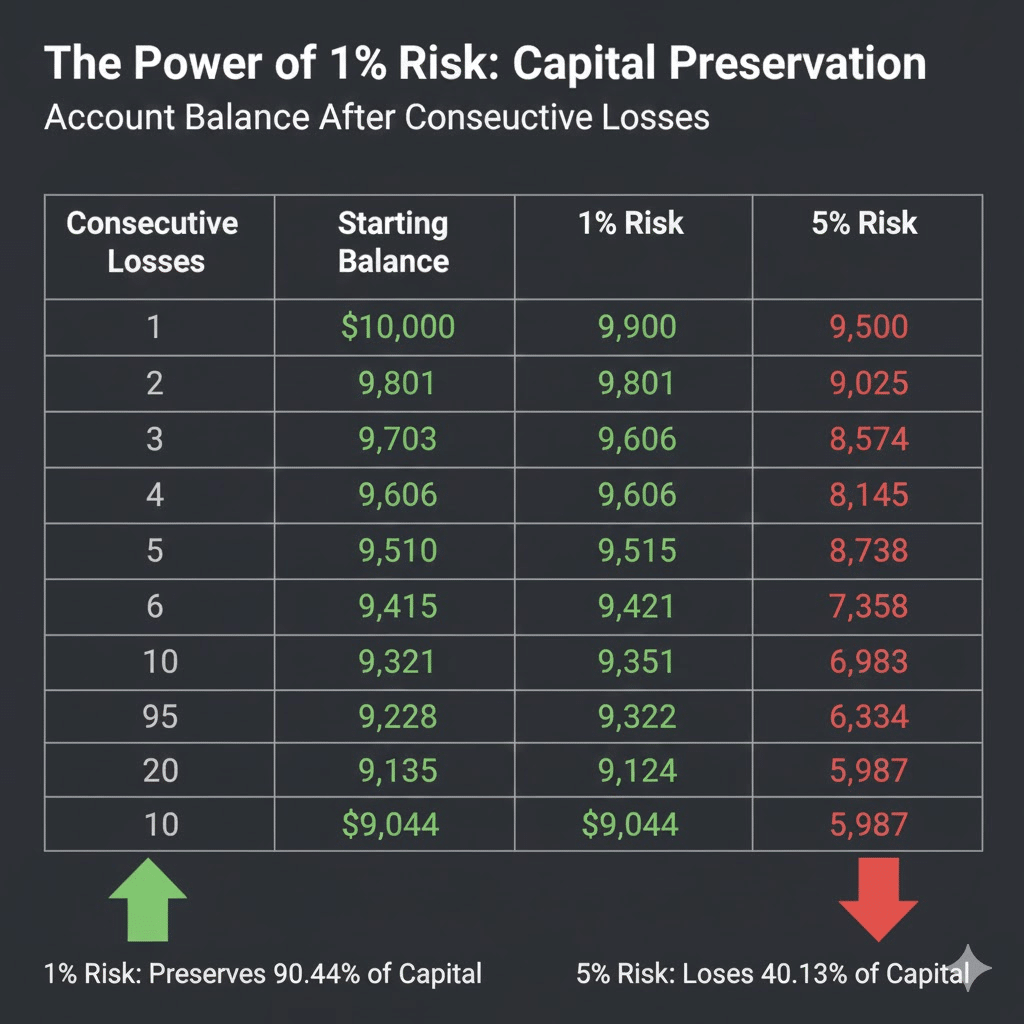

The math of survival:

- Risk 10% per trade: 7 losses in a row = 52% of account gone

- Risk 5% per trade: 14 losses in a row = 51% of account gone

- Risk 2% per trade: 35 losses in a row = 50% of account gone

- Risk 1% per trade: 69 losses in a row = 50% of account gone

See the difference? With 1-2% risk, you can survive a brutal losing streak and still have capital to trade with. With 10% risk, just a week of bad trades could wipe you out.

Pro Tip: Start with 1% risk per trade until you've been profitable for at least 3 months. You can always increase to 2% later, but you can't get back the money you've already lost.

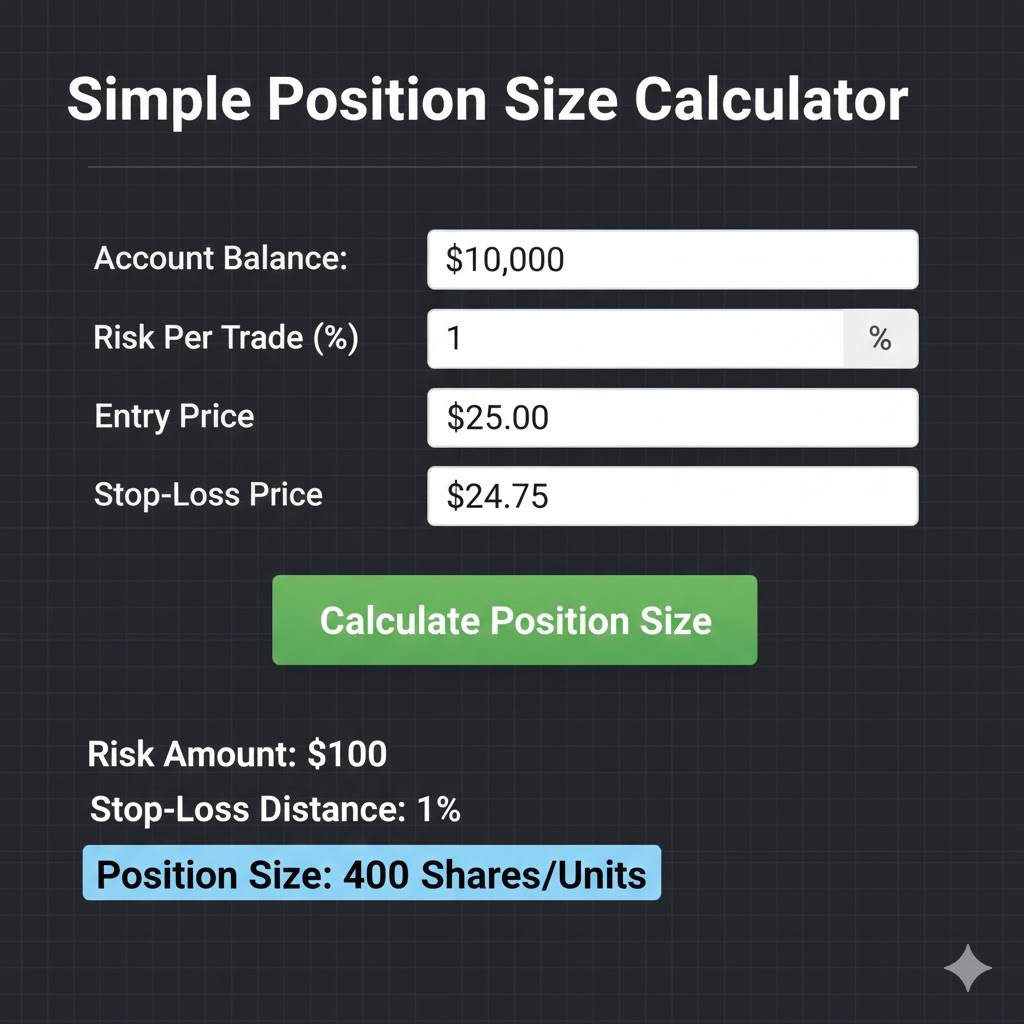

The Simple Position Size Formula

Ready for the formula that will change your trading forever? Here it is:

Position Size = (Account Size × Risk %) ÷ Stop Loss Distance

Confused? Let's break it down with real numbers.

Step-by-Step Calculation

Example scenario:

- Your account: $1,000

- Risk per trade: 1% (that's $10)

- Entry price: Bitcoin at $45,000

- Stop loss: $43,000 (about 4.4% below entry)

Here's how to calculate:

- Find your dollar risk: $1,000 × 1% = $10

- Find the distance to stop loss: $45,000 - $43,000 = $2,000

- Calculate position size: $10 ÷ $2,000 = 0.005 BTC

So you'd buy 0.005 Bitcoin (worth $225 at entry price).

"But wait," you might think, "I'm only using $225 of my $1,000 account?"

Exactly! That's because if your stop loss hits, you only lose $10 (1% of your account), not $225. The position size ensures your maximum loss stays at your planned risk level.

Common Mistake: Beginners often confuse position size with risk amount. You might invest $225, but you're only risking $10 because of your stop loss. That's the beauty of proper position sizing.

Different Methods for Different Traders

Not everyone trades the same way, so here are three position sizing methods to match your style.

Method 1: Fixed Dollar Risk (Best for Beginners)

This is what we just calculated above. You risk the same dollar amount on every trade.

Perfect for: New traders building consistency.

Example: Always risk $10 per trade, regardless of the setup

Pros:

- Super simple to calculate

- Builds discipline

- Predictable losses

Cons:

- Doesn't account for confidence in different setups

- Can feel limiting as you improve

Method 2: Fixed Percentage Risk (The Sweet Spot)

Risk the same percentage of your current account balance.

Perfect for: Traders with 3+ months of experience

Example: Always risk 1% of current balance

The magic here: As your account grows, position sizes automatically increase. Lose money? Position sizes decrease to protect what's left.

Real example:

- Start with $1,000, risk 1% = $10 per trade

- Grow to $1,500, risk 1% = $15 per trade

- Drop to $800, risk 1% = $8 per trade

Your position sizing automatically adjusts to your success level. It's like cruise control for risk management.

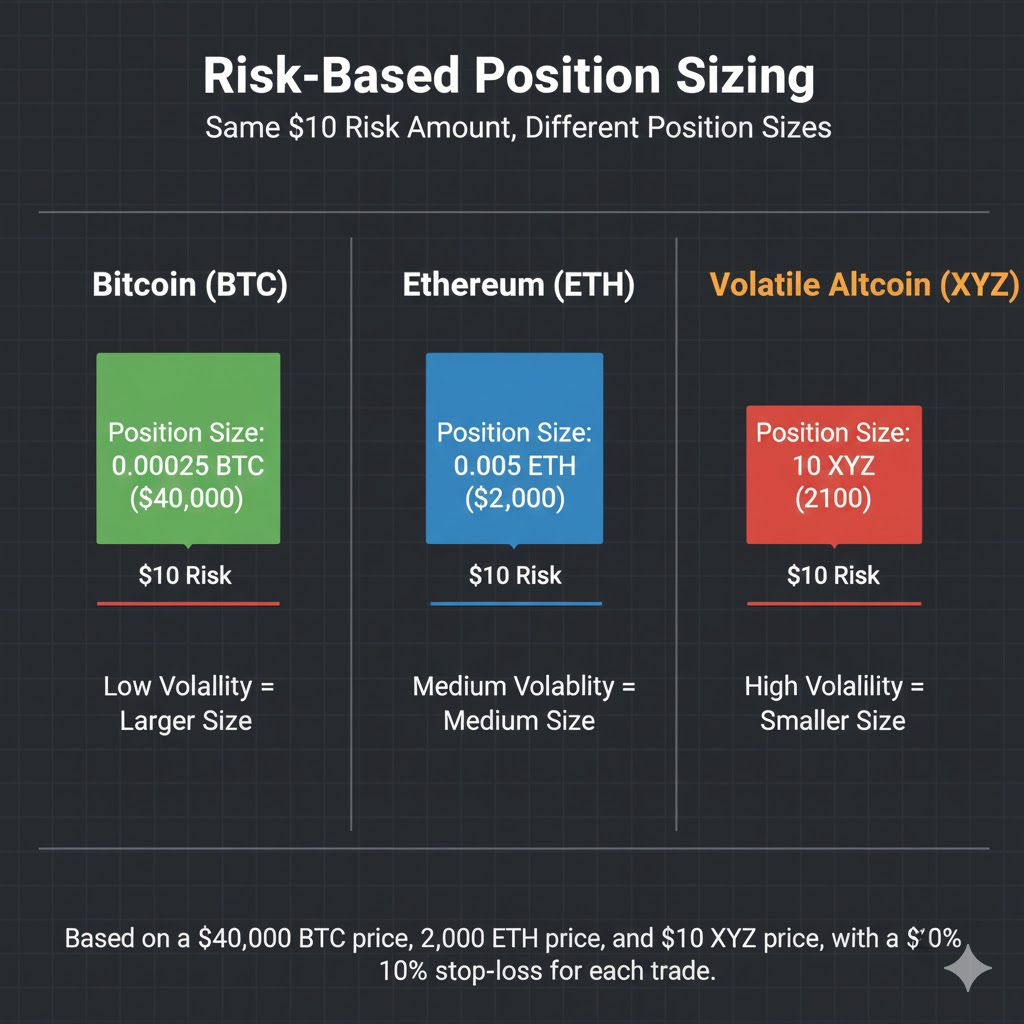

Method 3: Volatility-Based Sizing (Advanced)

Adjust position size based on how volatile the cryptocurrency is.

Perfect for: Experienced traders trading multiple coins

Example: Smaller positions for volatile altcoins, larger for stable Bitcoin

Think of it like this: You'd drive slower on a winding mountain road than on a straight highway. Same with trading—take smaller positions in crazy volatile coins.

How it works:

- Low volatility (Bitcoin): Risk up to 2%

- Medium volatility (Ethereum): Risk 1-1.5%

- High volatility (small altcoins): Risk 0.5-1%

Real-World Position Sizing Examples

Let's walk through three real scenarios so you can see exactly how this works.

Scenario 1: The Conservative Bitcoin Trade

Your situation:

- Account: $5,000

- Risk tolerance: 1%

- Trade: Bitcoin looks ready to breakout

The setup:

- Entry: $44,000

- Stop loss: $42,500 (3.4% below)

- Target: $48,000

Calculate position size:

- Dollar risk: $5,000 × 1% = $50

- Stop distance: $44,000 - $42,500 = $1,500

- Position size: $50 ÷ $1,500 = 0.033 BTC

- Dollar amount: 0.033 × $44,000 = $1,452

You'd buy $1,452 worth of Bitcoin, knowing you can only lose $50 if you're wrong.

Scenario 2: The Aggressive Altcoin Play

Your situation:

- Account: $2,000

- Risk tolerance: 2% (you're feeling confident)

- Trade: Promising altcoin with momentum

The setup:

- Entry: $25

- Stop loss: $22 (12% below—altcoins are volatile!)

- Target: $35

Calculate position size:

- Dollar risk: $2,000 × 2% = $40

- Stop distance: $25 - $22 = $3

- Position size: $40 ÷ $3 = 13.33 coins

- Dollar amount: 13.33 × $25 = $333

Even though it's a higher-risk trade, you're still only risking $40.

Scenario 3: The Scalp Trade

Your situation:

- Account: $10,000

- Risk tolerance: 0.5% (quick trade, tight stop)

- Trade: Quick Ethereum scalp

The setup:

- Entry: $3,200

- Stop loss: $3,150 (1.5% below)

- Target: $3,280

Calculate position size:

- Dollar risk: $10,000 × 0.5% = $50

- Stop distance: $3,200 - $3,150 = $50

- Position size: $50 ÷ $50 = 1 ETH

- Dollar amount: 1 × $3,200 = $3,200

Notice how a tighter stop loss allows for a larger position while maintaining the same risk.

Common Position Sizing Mistakes to Avoid

Learn from these mistakes so you don't have to make them yourself.

Mistake #1: "Going All In"

The problem: Putting 50-100% into one trade

The fix: Stick to 1-2% risk, no exceptions

Why it matters: One bad trade shouldn't end your trading career

Mistake #2: Revenge Sizing

The problem: Doubling position size after a loss to "make it back"

The fix: Keep position sizes consistent regardless of emotions

Why it matters: Emotional trading leads to bigger losses

Mistake #3: Ignoring the Stop Loss

The problem: Calculating position size but not actually using stop losses

The fix: Always set your stop loss immediately after entering

Why it matters: Position sizing only works if you limit losses

Mistake #4: Random Rounding

The problem: "I'll just buy $500 worth" without calculating

The fix: Always calculate based on your stop loss distance

Why it matters: Random sizing means random risk

Mistake #5: Not Adjusting for Account Changes

The problem: Using the same dollar amount as your account grows or shrinks

The fix: Recalculate based on current account size

Why it matters: This keeps your risk proportional

Your Position Sizing Toolkit

Here are the essential tools to make position sizing automatic.

The Quick Calculator Method

Create this simple spreadsheet:

- Cell A1: Account Size

- Cell A2: Risk % (usually 1%)

- Cell A3: Entry Price

- Cell A4: Stop Loss Price

- Cell A5 Formula: =(A1*A2)/(A3-A4)

That's your position size in coins. Takes 10 seconds to calculate.

Position Size Apps

Several free apps do this for you:

- Trading View: Built-in position size calculator

- Crypto Position Size Calculator: Free mobile apps

- Exchange tools: Many exchanges have risk calculators

The Mental Math Shortcut

For quick estimates:

- 1% risk with 5% stop = 20% of account in position

- 1% risk with 10% stop = 10% of account in position

- 2% risk with 5% stop = 40% of account in position

Remember: This is position size, not risk amount!

Making Position Sizing a Habit

Knowledge without action is useless. Here's how to make proper position sizing automatic.

Week 1: Paper Trade with Position Sizing

Don't risk real money yet. For one week:

- Calculate position size for every trade idea

- Write it down before looking at charts

- Track what would have happened

Week 2: Minimum Size Real Trades

Start with the smallest possible positions:

- Use 0.5% risk to build confidence

- Focus on the process, not profits

- Celebrate sticking to your sizes, not winning trades

Week 3: Standard Sizing

Move to your planned risk level:

- 1% for most traders

- Keep a trading journal

- Note how it feels to lose 1% vs. losing randomly

Week 4 and Beyond: Refine Your Approach

- Adjust based on your comfort level

- Consider different sizing for different setups

- Never exceed 2% until you're consistently profitable

Quick Recap

Here's what we covered:

- Position sizing is your risk management foundation—it determines how much you put into each trade

- Never risk more than 1-2% per trade—this keeps you alive during losing streaks

- The formula is simple—(Account × Risk %) ÷ Stop Loss Distance

- Three methods exist—fixed dollar, fixed percentage, and volatility-based

- Calculate before you trade—never guess your position size

- Common mistakes are avoidable—don't go all in, revenge trade, or ignore stops

- Tools make it easy—use calculators or simple spreadsheets

- Practice makes permanent—start with paper trading, then minimum sizes

Your Next Steps

- Today: Create your position sizing spreadsheet or download a calculator app. Calculate the position size for your next trade idea (even if you don't take it). Get familiar with the numbers.

- This Week: Paper trade five trades using proper position sizing. Write down your calculations before each trade. Notice how different stop loss distances affect your position size.

- Ongoing: Make position sizing non-negotiable. Never enter a trade without calculating size first. Join the Fat Pig Signals Telegram community, where we share our position sizing strategies and help each other stay disciplined.

Remember: You don't have to figure this out alone. Our Fat Pig Signals community is full of traders who've mastered position sizing and are happy to help you get there too.

Join our Telegram group here and share your first position size calculation with us. We'll check your math and cheer you on.

Position sizing might not be exciting, but neither is a seatbelt—until it saves your life. Every professional trader you admire uses position sizing religiously. Now you know their secret weapon. Use it wisely, start small, and watch how this one skill transforms your trading forever.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Cryptocurrency trading involves substantial risk of loss. Always do your own research and consider consulting with a financial advisor before making investment decisions.