Manual Signals vs Algorithmic Signals: Which Performs Better?

Signals

Ever opened Telegram and seen two different trading signal providers—one claiming their "expert human analysts" give the best calls, and another boasting about their "AI-powered algorithm" that never sleeps?

You're not alone in wondering which one actually works better.

Here's the thing: both manual signals (created by real human traders) and algorithmic signals (generated by computer programs) can be profitable. But they work completely differently, and understanding these differences will help you choose the right signals for your trading style.

In this article, you'll learn exactly how each type of signal works, the real pros and cons of both, and most importantly—which one might perform better for you as a beginner trader.

By the end, you'll know how to evaluate any signal provider and make a smart decision about which signals to follow.

Let's break it down in plain English.

What Are Trading Signals? (Quick Refresher)

Before we compare manual and algorithmic signals, let's make sure we're on the same page about what trading signals actually are.

A trading signal is basically a recommendation that tells you when to buy or sell a cryptocurrency. Think of it like getting a tip from someone who's done all the research for you.

Most signals include four key pieces of information:

- The coin to trade (like Bitcoin, Ethereum, or another crypto)

- Entry price (when to buy)

- Take profit target (when to sell for a profit)

- Stop loss (where to exit if the trade goes against you)

For example, a signal might say: "Buy Bitcoin at $45,000, take profit at $48,000, stop loss at $43,500."

Simple enough, right?

Now, the big question is: who or what is creating these signals? That's where manual and algorithmic signals differ completely.

What Are Manual Trading Signals?

Manual signals are created by real human traders—people with experience analyzing charts, reading market news, and making judgment calls based on what they see.

Think of manual signal providers like professional chefs. They have recipes (strategies), but they also taste-test and adjust based on what's happening in the kitchen (the market) right now.

How Manual Signals Work

A human trader sits down at their computer, analyzes price charts, checks market news, looks at technical indicators like RSI or moving averages, and then decides: "Bitcoin looks ready to bounce from this support level. I'm sending a buy signal."

That signal gets posted to a Telegram group or Discord channel, and subscribers see it and can choose to take the trade.

Why People Like Manual Signals

There's a reason manual signals remain popular even in 2025. Here's why:

Human intuition matters. Experienced traders can spot patterns that a computer might miss. They can "read between the lines" of market sentiment, news events, and unusual price action.

Flexibility when markets get weird. If a major news event breaks—like a country banning crypto or a huge exchange getting hacked—human traders can adapt instantly. They can pause signals, adjust strategies, or even warn subscribers not to trade until things settle down.

Explanations that help you learn. Many manual signal providers explain why they're making a call. This is gold for beginners because you're not just copying trades—you're learning how experienced traders think.

For example, a provider might say: "Bitcoin just held the $44,000 support for the third time this week. Volume is increasing, and RSI is climbing from oversold. This looks like a bounce setup."

That's valuable education you won't get from a robot.

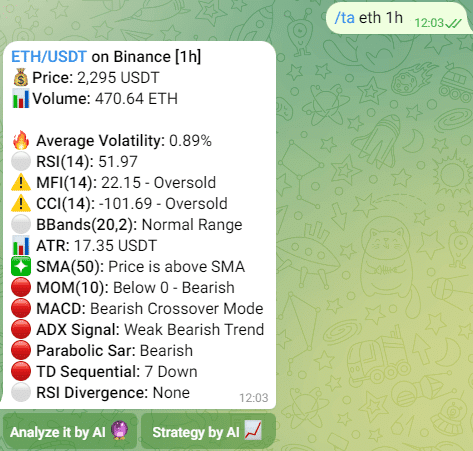

Screenshot of a Telegram message showing a manual signal with explanation of the setup, highlighting support level and RSI indicator. Image Source: CoinTrendzBot

💡 Pro Tip: If you're choosing a manual signal provider, look for ones who explain their reasoning. You'll learn faster and build your own trading skills alongside copying their signals.

The Downsides of Manual Signals

Here's the reality: manual signals aren't perfect.

Humans make mistakes. Even the best traders have bad days. Maybe they miss a key piece of information, or they let emotions (like overconfidence after a winning streak) cloud their judgment.

Limited hours. Human traders need to sleep, take breaks, and live their lives. If a great trading opportunity appears at 3 AM while your signal provider is asleep, you might miss it.

Emotions can interfere. Fear and greed affect everyone. A manual trader might hold onto a losing trade too long because they don't want to admit they were wrong. Or they might exit a winning trade too early because they're nervous.

Slower than computers. When markets move fast, a human trader needs time to analyze and send the signal. Sometimes, by the time you see it, the best entry price is already gone.

What Are Algorithmic Trading Signals?

Algorithmic signals (also called algo signals or automated signals) are created by computer programs that follow specific rules to identify trading opportunities.

Think of algorithmic signals like a GPS for trading. You program in the destination (your strategy rules), and the system automatically finds the route (trading opportunities) without needing your constant attention.

How Algorithmic Signals Work

Here's the simple version: a programmer (or team of programmers) writes code that says something like:

"When Bitcoin's price crosses above the 50-day moving average AND the RSI is above 50 AND trading volume increases by 20%, send a buy signal."

The algorithm constantly scans the market, watching thousands of data points every second. The moment all conditions are met—boom—it automatically generates a signal and sends it to subscribers.

No human needs to be watching the charts. The computer does it all.

Why People Like Algorithmic Signals

Algorithmic signals have some serious advantages that make them appealing:

Speed is unbeatable. Computers can identify trading setups and send signals in milliseconds. When markets move fast, this speed advantage can mean the difference between catching a good entry and missing it entirely.

No emotions, ever. The algorithm doesn't panic when Bitcoin drops 10% in an hour. It doesn't get greedy after five winning trades. It just follows the rules, consistently, every single time.

24/7 market monitoring. Crypto markets never close. An algorithm can scan for opportunities around the clock—while you sleep, while you're at work, even on holidays.

Backtesting shows historical performance. Before going live, algorithmic systems can be tested on years of historical price data. This gives you an idea of how the strategy would have performed in the past (though remember: past performance doesn't guarantee future results).

Consistency. An algorithm will make the exact same decision given the same market conditions. There's no variation based on mood, fatigue, or stress.

Diagram showing an algorithm constantly monitoring price, volume, and indicators. Image Source: TradingView

The Downsides of Algorithmic Signals

Algorithms sound amazing, right? But they have real limitations too.

They only follow their programming. If the market does something the algorithm wasn't designed to handle—like a flash crash or a sudden regulatory announcement—it might make terrible calls because it can't adapt outside its coded rules.

"Curve fitting" is a real risk. Some providers over-optimize their algorithms to look perfect on historical data, but then they fail miserably in live trading. This is called curve fitting—the system is too perfectly tailored to past data and doesn't work when market conditions change.

Black box problem. Many algorithmic signal providers don't explain why a signal was generated. You're just told "buy here, sell there" with no context. This means you're not learning anything—you're just blindly following a robot.

Technical failures happen. Algorithms depend on technology: servers, internet connections, data feeds. If any of these fail, the system can miss trades, send duplicate signals, or even send bad signals due to incorrect data.

They struggle with unexpected news. When Elon Musk tweets about Dogecoin or the SEC announces new crypto regulations, an algorithm doesn't "understand" what that means. It can only react to price movement, often too late.

⚠️ Common Mistake: Beginners often think algorithmic signals are "set and forget" magic money machines. They're not. Algorithms still need monitoring, updates, and oversight to perform well over time.

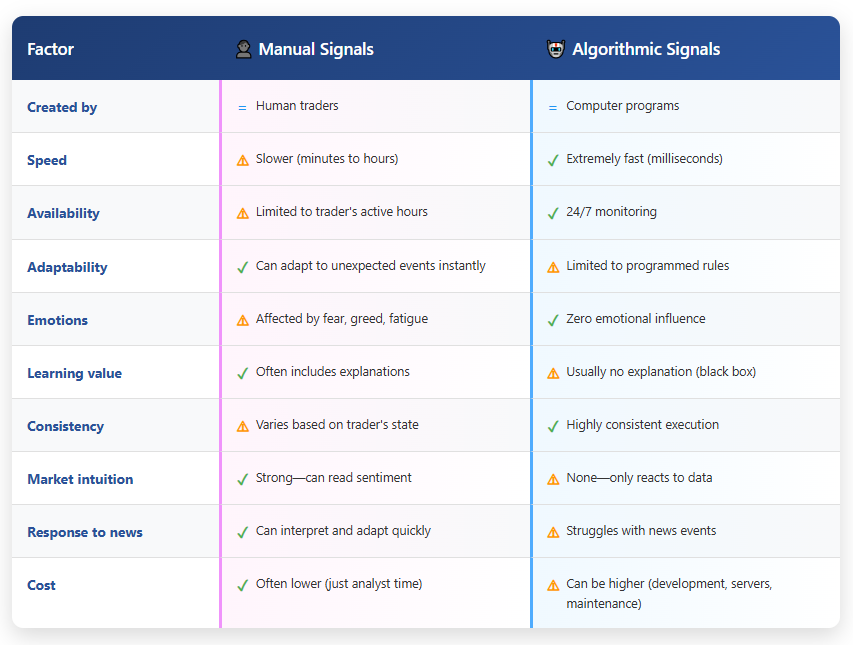

Manual vs Algorithmic Signals: Direct Comparison

Let's put them side by side so you can see the key differences clearly.

As you can see, each has clear strengths in different areas.

Which Performs Better? The Honest Answer

Here's the truth: there's no universal "better" option.

Both manual and algorithmic signals can be profitable. And both can lose money if they're poorly executed.

The real question isn't "which is better?"—it's "which is better for you and your trading style?"

When Manual Signals Might Perform Better

Manual signals tend to outperform in these situations:

During high-impact news events. When a major announcement hits—like a country legalizing Bitcoin or a big exchange getting hacked—human traders can interpret the news and adjust instantly. Algorithms often fumble here.

In choppy, unpredictable markets. When there's no clear trend and the market is just bouncing around randomly, experienced human traders can choose to sit on the sidelines. An algorithm might keep generating signals that go nowhere.

When market conditions change. If crypto transitions from a bull market to a bear market, a skilled human trader will adjust their strategy. An algorithm will keep doing what it was programmed to do—even if that strategy no longer works.

For educational value. If you want to actually learn how to trade (not just copy signals forever), manual signals with explanations will teach you much more than a black-box algorithm.

When Algorithmic Signals Might Perform Better

Algorithmic signals tend to outperform in these situations:

In trending markets with clear patterns. When Bitcoin is in a strong uptrend or downtrend with predictable price action, algorithms can execute flawlessly without hesitation.

For high-frequency opportunities. If a strategy requires catching small price movements that happen fast and often, algorithms win every time. Humans simply can't react quickly enough.

When emotion ruins manual traders. Some trading strategies require taking dozens of trades with small wins and occasional losses. Many human traders struggle with the emotional discipline this requires. Algorithms don't.

For consistency over time. An algorithm will execute the exact same strategy every single day without variation. This consistency can be valuable, especially if the strategy has a proven edge.

For 24/7 markets like crypto. If you want coverage around the clock (including weekends and holidays), algorithms don't need sleep.

The Hybrid Approach: Best of Both Worlds?

Here's an interesting development in 2025: many top signal providers are combining manual and algorithmic approaches.

They use algorithms to scan for trading opportunities and narrow down the best setups. Then, human traders review those setups and make the final decision about which signals to send.

Think of it like having a research assistant (the algorithm) who finds potential trades, and an experienced manager (the human trader) who decides which ones are actually worth taking.

This hybrid approach tries to get the speed and consistency of algorithms while keeping the intuition and adaptability of human judgment.

Some hybrid systems work like this:

- Algorithm scans the market 24/7 for setups that meet technical criteria

- Alert goes to human trader when a potential signal is found

- Human reviews the setup, considers current news and market context

- Signal is sent only if the human approves

This way, you're not missing opportunities while the trader sleeps, but you're also not blindly following a robot when markets get weird.

💡 Pro Tip: If you're torn between manual and algorithmic signals, look for providers using this hybrid model. You might get the best of both worlds.

How to Evaluate ANY Signal Provider (Manual or Algorithmic)

Whether you choose manual signals, algorithmic signals, or a hybrid approach, here's how to evaluate if a provider is actually good:

1. Track Record Transparency

Look for: Verified trading history showing real wins and losses over at least 3-6 months.

Red flag: Only showing winning trades, or claims of "95% win rate" with no proof.

2. Risk Management

Look for: Clear stop losses on every signal, position sizing advice, and emphasis on protecting your capital.

Red flag: No stop losses, encouragement to "go all in," or promises of guaranteed profits.

3. Realistic Expectations

Look for: Honest communication about losses, realistic profit targets (like 5-15% monthly), and acknowledgment that trading is risky.

Red flag: Claims of "easy money," "never lose," or "get rich quick" messaging.

4. Community and Support

Look for: Active community where members can ask questions, real engagement from the provider, and educational content.

Red flag: Provider never responds to questions, deletes negative comments, or doesn't explain anything.

5. Explanation and Education

Look for: Signals that include reasoning, educational content alongside signals, and transparency about strategy.

Red flag: Just "buy here, sell there" with zero context or explanation (especially for manual signals).

6. Consistency

Look for: Steady performance over time, with both good and bad periods clearly shown.

Red flag: Performance that looks too perfect, or huge swings from massive wins to massive losses.

Remember: No legitimate signal provider wins 100% of trades. Anyone claiming they do is lying.

Quick Recap

Here's what we covered about manual vs algorithmic signals:

- Manual signals are created by human traders who use experience, intuition, and judgment to identify trades

- Algorithmic signals are generated by computer programs following specific rules and scanning markets 24/7

- Manual signals excel at adapting to news, reading market sentiment, and providing educational value

- Algorithmic signals excel at speed, consistency, emotional discipline, and round-the-clock monitoring

- Neither is universally better—the right choice depends on your trading style, goals, and learning preferences

- Hybrid approaches combine algorithmic scanning with human final decision-making

- Evaluate any provider using track record transparency, risk management, realistic expectations, community support, explanation quality, and consistency

The key takeaway? Don't choose based on hype or trends. Choose based on what fits your personality, schedule, and learning goals.

Conclusion & Next Steps

So, manual signals vs algorithmic signals—which performs better?

The answer is: it depends on you.

If you value learning, intuition, and adaptability during unpredictable markets, manual signals from experienced traders might be your best bet.

If you want speed, consistency, and emotion-free execution in trending markets, algorithmic signals could be the way to go.

And if you want the best of both worlds, look for hybrid approaches that combine algorithmic scanning with human oversight.

Your Next Steps:

- Today: Decide which type matches your personality. Are you someone who wants to understand why trades happen (manual), or someone who trusts data and wants systematic execution (algorithmic)? Be honest with yourself.

- This Week: Research 2-3 signal providers (manual, algorithmic, or hybrid) and evaluate them using the criteria above. Check their track records, risk management, and how they communicate with subscribers.

- Ongoing: Start with small position sizes when following any signals. Track your results separately from the provider's claims. See what works for your trading and risk tolerance.

Remember: You don't have to figure this out alone.

The Fat Pig Signals community helps beginners navigate exactly these questions. We combine our signal approach with clear explanations so you're not just copying trades—you're learning the skills to make your own decisions over time.

[Join our Telegram group here] and see how we balance signal quality with real education.

Trading is a journey, not a race. Whether you choose manual signals, algorithmic signals, or a mix of both, what matters most is that you're taking the time to understand how they work before risking your hard-earned money.

You're building real trading knowledge. Keep learning, start small, and trust the process.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Cryptocurrency trading involves substantial risk of loss. Always do your own research and consider consulting with a financial advisor before making investment decisions. Past performance of any trading signals (manual or algorithmic) does not guarantee future results.