How to Protect Your Portfolio During Bear Markets

Bitcoin, Cryptocurrencies, Investment, Signals, Technology, Trading

How to Protect Your Portfolio During Bear Markets

Everything Is Red—What Should I Do Now?

If you’ve opened your crypto app lately and seen red numbers everywhere, your first thought was probably: “Should I sell everything before it goes to zero?”

That feeling is completely normal—especially if you’re new. Bear markets are uncomfortable, confusing, and emotionally exhausting. But here’s the good news: bear markets don’t have to destroy your portfolio if you know how to handle them.

In this guide, you’ll learn what a bear market really is, why panic hurts more than price drops, and practical, beginner-friendly ways to protect your crypto portfolio when markets turn against you.

What Is a Bear Market?

A bear market is a period when prices fall 20% or more from recent highs and stay weak for an extended time

In crypto, bear markets often feel worse than in stocks because prices move faster and emotions run higher.

Think of It Like This

Imagine hiking uphill for hours (a bull market), then suddenly sliding downhill in the rain (a bear market). The fall feels scary—but it doesn’t erase the entire journey.

Bear markets are painful, but they are also normal and temporary. Historically, markets eventually recover—but only if you’re still in the game.

The #1 Enemy in Bear Markets: Panic

Before we talk about strategy, let’s address the real danger : Most losses in bear markets come from emotional decisions, not price drops.

What Panic Looks Like

- Selling after a big drop

- Jumping between coins trying to “recover losses”

- Overtrading because you feel helpless

- Ignoring your original plan

Once you sell in panic, losses become permanent. If you don’t sell, they’re just temporary paper losses

Common Beginner Mistake

Selling at the bottom because “it feels safer.”

This usually locks in losses right before the market stabilizes.

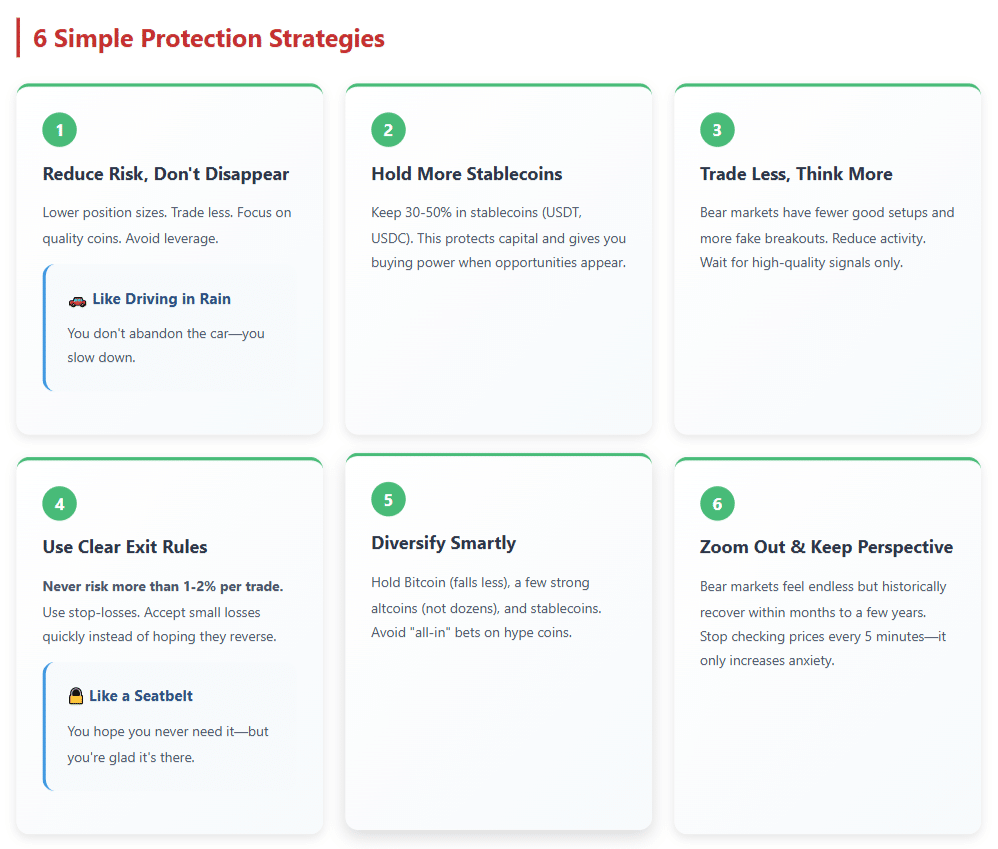

An Illustration of the 6 Simple Protection Strategies for your Portfolio during Bear Markets.

Strategy 1: Reduce Risk, Don’t Disappear

You don’t need to go “all cash” to protect yourself. Risk management means controlling how much you can lose—not avoiding the market completely.

Simple Ways to Reduce Risk

- Lower your position sizes

- Trade less frequently

- Focus on higher-quality coins

- Avoid high leverage (borrowed money)

Think of it like driving in heavy rain. You don’t abandon the car—you slow down.

Strategy 2: Hold More Stable Assets

A stablecoin is a crypto token designed to stay near $1 (like USDT or USDC). During bear markets, stablecoins act like dry powder—money that’s safe and ready when opportunities appear.

Why This Matters

- Protects capital during big drops

- Reduces emotional stress

- Gives flexibility to re-enter later

Example With Numbers

Imagine you have $10,000:

- $6,000 in Bitcoin

- $4,000 in stablecoins

If the market drops 30%, your entire portfolio doesn’t fall as hard—and you still have funds to buy later.

Strategy 3: Trade Less, Think More

Bear markets are not about constant action. They reward patience, not speed.

What Changes in Bear Markets

- Fewer good setups

- More fake breakouts

- Slower trends

This is why many experienced traders reduce activity and wait for high-quality signals only.

At Fat Pig Signals, bear-market signals are typically fewer but more selective—focused on capital protection first, not excitement.

Strategy 4: Use Clear Exit Rules

An exit rule is a pre-planned point where you accept a small loss to avoid a big one. This is not about being perfect—it’s about survival.

Simple Exit Rules for Beginners

- Never risk more than 1–2% of your account on one trade

- Use a stop-loss (a preset exit level)

- Accept small losses quickly

Think of it like wearing a seatbelt. You hope you never need it—but you’re glad it’s there.

Strategy 5: Diversification Still Matters

Diversification means spreading risk instead of betting everything on one coin. During bear markets, highly speculative altcoins usually fall the hardest.

A Safer Crypto Mix Might Include

- Bitcoin (usually falls less than altcoins)

- A few strong altcoins (not dozens)

- Stablecoins

Avoid “all-in” bets on hype coins during downturns.

Strategy 6: Zoom Out and Keep Perspective

Bear markets feel endless—but they rarely are. Historically, most bear markets recover within months to a few years, not forever

Pro Tip

Stop checking prices every 5 minutes. It increases anxiety and leads to bad decisions. Set alerts. Review charts calmly. Stick to your plan.

Quick Recap

Here’s what protects you in a bear market:

- Panic is more dangerous than price drops

- Reduce risk instead of quitting entirely

- Hold stablecoins as protection

- Trade less, not more

- Use clear exit rules

- Focus on survival, not profits

Conclusion & Next Steps

Bear markets don’t reward bravado—they reward discipline and patience.

Your goal isn’t to win big during downturns. Your goal is to still be here when the market recovers.

What You Can Do Today

- Reduce position sizes

- Increase stablecoin allocation

- Commit to strict risk limits

If you want guidance through rough market conditions, the Fat Pig Signals Telegram community focuses heavily on capital protection during bear markets, not hype trades.

Remember: Bull markets make money. Bear markets make disciplined traders.