Common Trading Mistakes and to Avoid Them as a Beginner

Trading

Have you ever entered a crypto trade feeling confident…

only to watch the price move against you almost immediately?

You’re not alone. This happens to almost every beginner trader.

Right now, crypto markets move fast. News spreads instantly. Prices swing wildly. One emotional decision can wipe out days—or weeks—of progress. That’s why understanding common trading mistakes matters more than ever.

By the end of this article, you’ll learn:

- The most common mistakes beginner traders make

- Why these mistakes happen (in simple terms)

- How you can avoid them step by step, even with a small account

Think of this as learning how to avoid potholes before driving on a busy road.

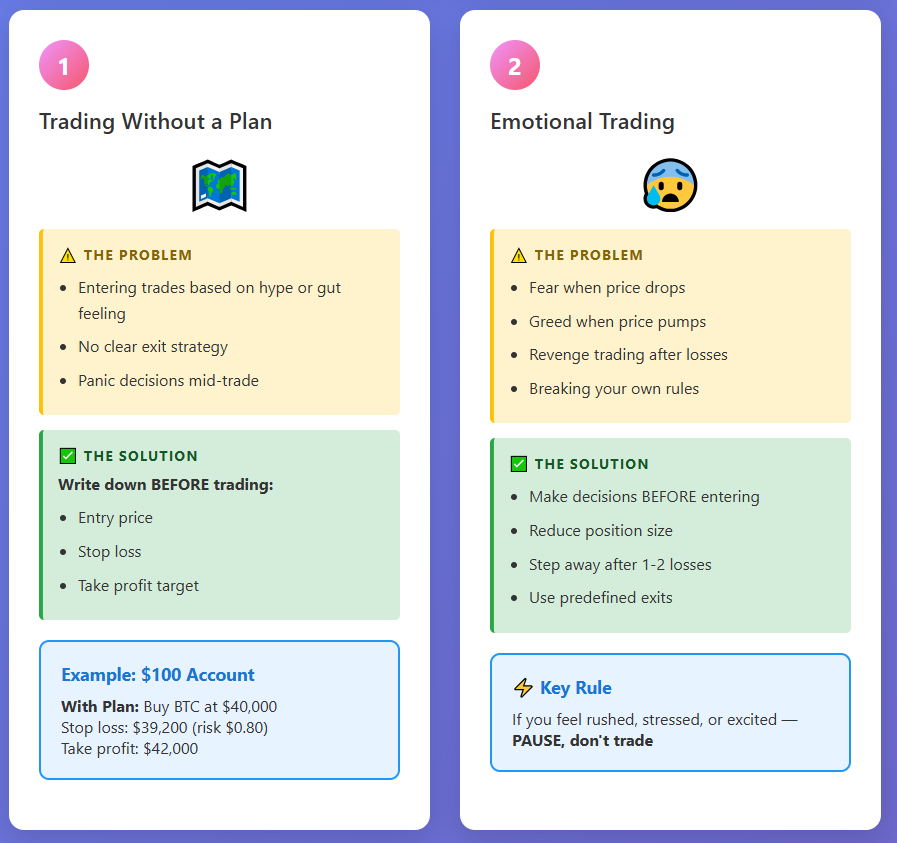

Mistake #1: Trading Without a Plan

What this means

Trading without a plan means:

- You enter a trade because of a tweet, hype, or “gut feeling”

- You don’t know where to exit if price goes down

- You don’t know when to take profit

- You keep changing your decision after the trade is already live

This usually leads to panic decisions in the middle of the trade—because you’re trying to decide while money is already at risk. A trading plan is simply a written set of rules for:

- When you enter

- When you exit

- How much you risk

- When you do nothing

Think of it like using Google Maps. You wouldn’t drive to a new city without directions—so why trade without a plan?

Real example with numbers

You have $100 in your trading account. Without a plan:

- You buy BTC at $40,000

- BTC drops to $39,200

- You panic, hesitate, and hope

- You sell at $38,500 out of fear

With a plan:

- Entry: $40,000

- Stop loss: $39,200 (risk = $0.80 on a $100 account)

- Take profit: $42,000

Even if the trade loses, the damage is controlled and emotionally manageable.

Why beginners skip plans

- Planning feels “slow”

- You think planning is only for pros

- You assume you’ll “figure it out live”

In reality, planning is what makes trading simple.

How to avoid this mistake

Before every trade, write down:

- Entry price

- Stop loss (where you admit the trade is wrong)

- Take profit (where you lock in gains)

PRO TIP BOX : If you wouldn’t take the trade again after writing it down, don’t take it at all.

Mistake #2: Letting Emotions Control Your Trades

Why emotions are dangerous in trading

Trading triggers:

- Fear when price drops

- Greed when price pumps

- Anger after a loss

- Euphoria after a win

The most dangerous part? Your brain treats trading losses like real danger, which pushes you into fight-or-flight mode. This often leads to:

- Revenge trading (trying to win back losses)

- Overtrading after a win

- Breaking your own rules

Think of it like texting when you’re angry. It feels right in the moment—but you regret it later.

Common emotional traps beginners fall into

- Buying because “everyone on Telegram is bullish”

- Closing a trade early because you’re scared to lose unrealized profit

- Holding a losing trade because selling would “confirm” you were wrong

- Trading immediately after a loss without reviewing what happened

How to avoid emotional trading

- Make decisions before entering the trade

- Reduce position size so losses feel small

- Step away after 1–2 losing trades

- Use predefined stop losses and take profits

COMMON MISTAKE BOX : If you feel rushed, stressed, or excited, your job is not to trade—it’s to pause.

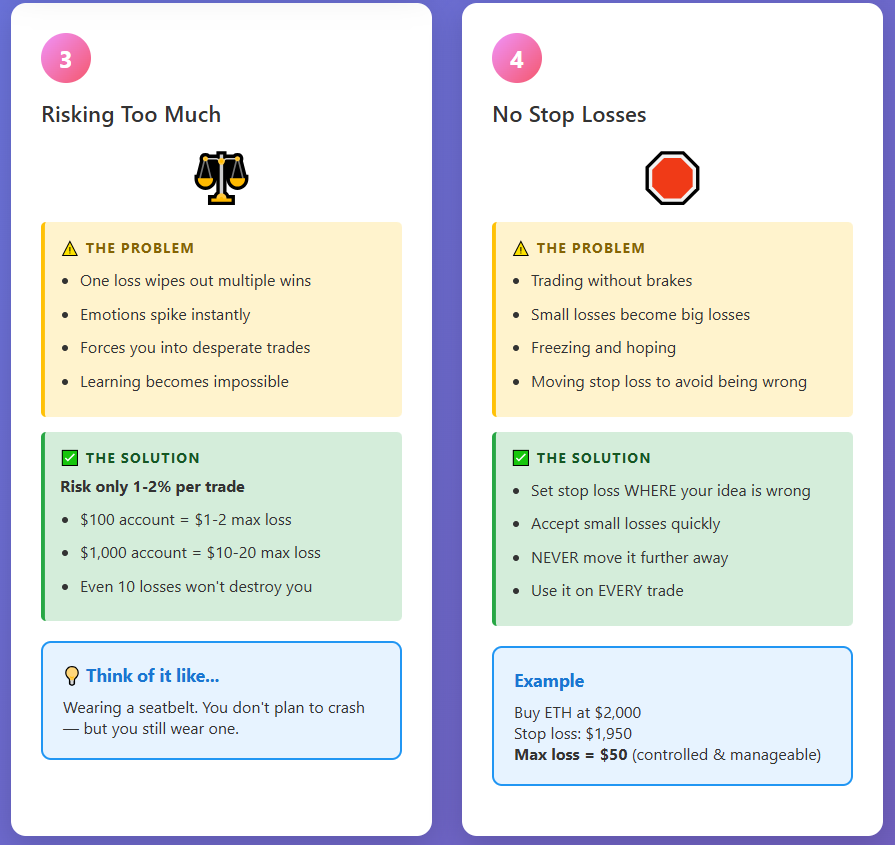

Mistake #3: Risking Too Much on One Trade

What “risk management” really means

Risk management is not about avoiding losses. It’s about making sure no single trade can seriously hurt you. Beginners often think: “This setup looks good, I’ll go bigger.”

But even good setups fail. Think of it like seatbelts. You don’t plan to crash—but you still wear one.

Beginner-friendly rule

Risk only 1–2% of your account per trade.

Example:

- Account size: $100

- 1% risk = $1 maximum loss

- 2% risk = $2 maximum loss

Even 10 losses in a row won’t destroy your account or confidence.

What happens when you risk too much

- One loss wipes out multiple wins

- Emotions spike instantly

- You start “forcing” trades

- Learning becomes impossible

Survival comes first. Profits come later.

Mistake #4: Not Using Stop Losses

What is a stop loss?

A stop loss is an automatic exit that closes your trade when price reaches a level that proves your idea wrong. In simple terms: It’s your safety net. Trading without a stop loss is like driving downhill without brakes.

Example

You buy ETH at $2,000.

- Stop loss at $1,950

- Maximum loss = $50

Without a stop loss:

- ETH drops to $1,850

- You freeze, hope, and watch the loss grow

Common beginner stop-loss mistakes

- Not using one at all

- Moving it lower when price gets close

- Placing it randomly instead of logically

- Cancelling it because “it might bounce”

How to use stop losses properly

- Place it where your trade idea is invalidated

- Accept small losses quickly

- Never move it further just to avoid being wrong

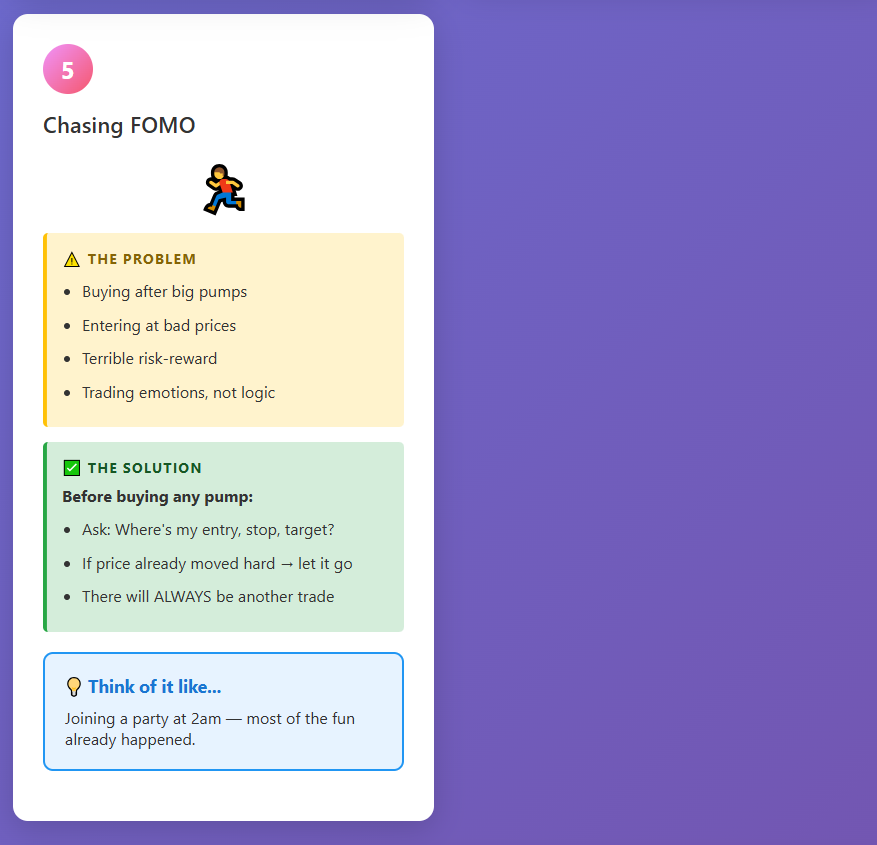

Mistake #5: Chasing Hype and FOMO

What is FOMO?

FOMO (Fear Of Missing Out) happens when:

- A coin is already pumping

- Everyone is posting profits

- You feel late and emotional

- You buy without a plan

Then price reverses. Think of it like joining a party at 2 a.m.—Most of the fun already happened.

Why FOMO is so dangerous

- You enter at bad prices

- Stop losses feel “too close”

- Risk-reward is terrible

- You’re trading emotions, not logic

How to avoid FOMO

- Ask: “Where is my entry, stop, and target?”

- If price already moved hard, let it go

- There will always be another trade

At Fat Pig Signals, trades are shared with clear context, risk levels, and planning, not emotional chasing—especially inside the Telegram community where learning is prioritized over hype.

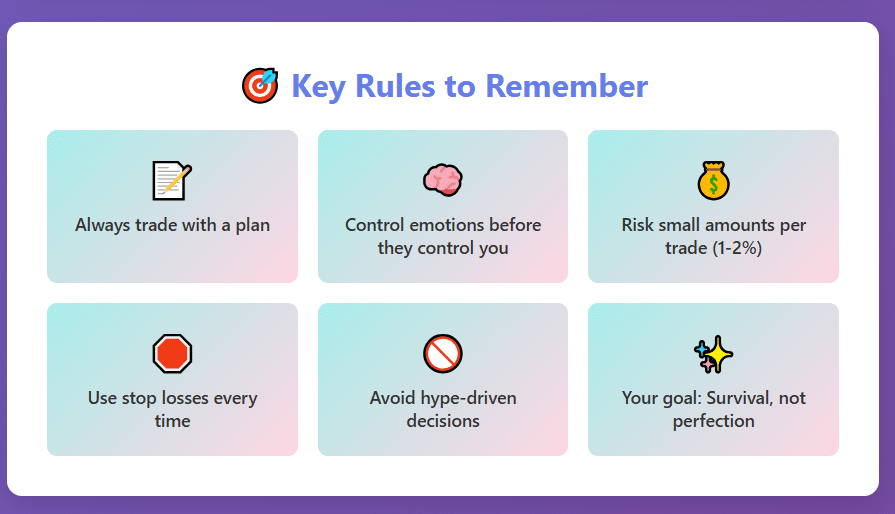

Quick Recap: Key Lessons to Remember

- Always trade with a plan

- Control emotions before they control you

- Risk small amounts per trade

- Use stop losses every time

- Avoid hype-driven decisions

Trading isn’t about being right all the time. It’s about managing mistakes wisely

Conclusion & Next Steps

If you remember only one thing, let it be this: Your goal as a beginner is survival—not perfection. Here’s what you can do today:

- Write a simple trading plan (even 3 lines is enough)

- Reduce your risk per trade

- Review your last 5 trades and identify emotional decisions

If you want structured signals, clear risk levels, and a supportive learning environment, consider joining the Fat Pig Signals Telegram community—where trading decisions are explained, not rushed.

You don’t need to be perfect. You just need to be consistent, patient, and protected. You’ve got this!