Bull Market Investing 2026: 5 Key Strategies

Trading

Remember that incredible feeling when everything you buy turns green? When your portfolio grows day after day, and crypto Twitter won't stop posting rocket emojis?

That's a bull market—and if you're new to crypto, you might think making money in a bull run is automatic. Yes, bull markets are easier to profit from. But without the right strategies, you can still lose money even when prices are soaring.

How many people do you know who bought Bitcoin at $69,000 in 2021's peak, only to watch it crash to $20,000? They were in history's biggest crypto bull run and still got burned. That's what happens when you trade without a plan.

The good news? With the right strategies, bull markets can be absolutely life-changing. You just need to know how to ride the wave without wiping out. In this guide, we'll cover five proven strategies that actually work when the market's hot.

What Makes a Bull Market Special?

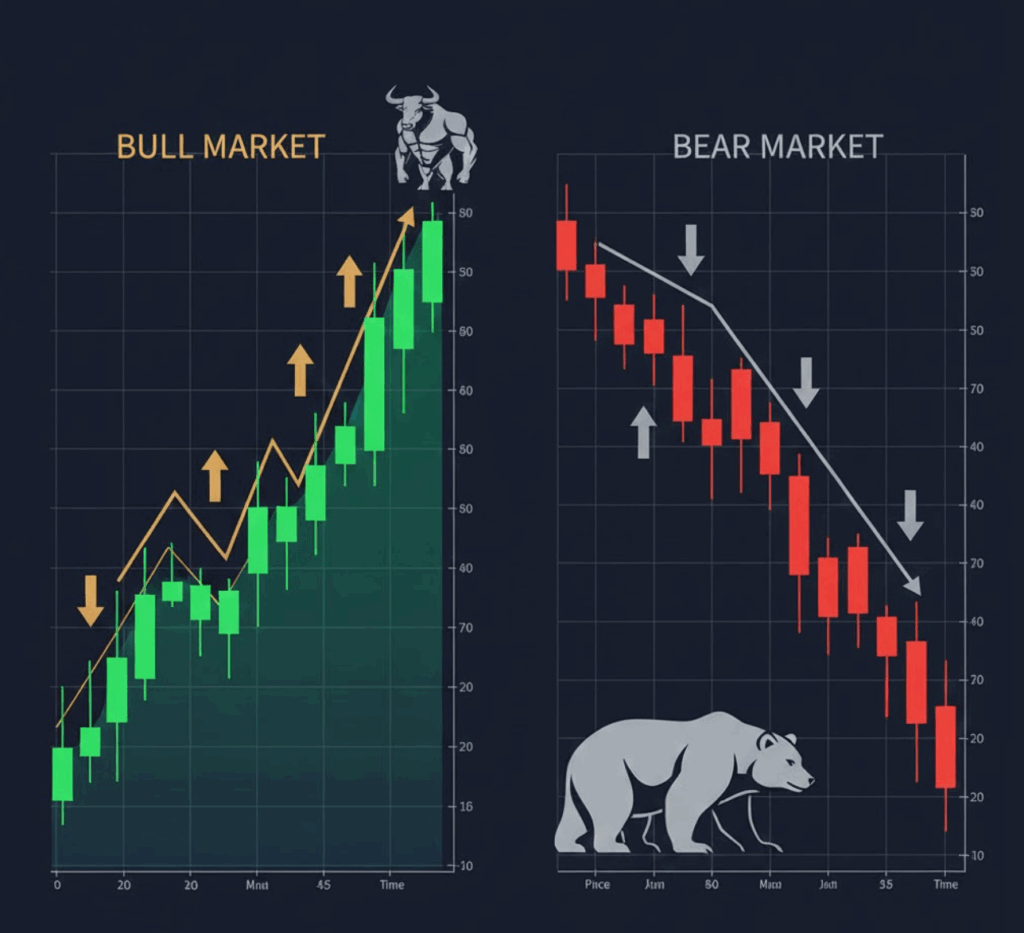

A bull market is a period when prices are rising or are expected to rise. In crypto, we usually call it a bull market when prices have gone up 20% or more from recent lows and keep climbing. But it's not just about numbers—it's about the entire mood of the market.

During bull markets, you'll notice:

- Green candles dominate the charts

- Everyone's talking about crypto (even your uber driver)

- New coins launch every day

- Social media is full of success stories

- Trading volume explodes

The opposite is a bear market, where prices fall, and everyone's scared. Think of bulls as charging forward with their horns up (prices going up) and bears swiping down with their claws (prices going down).

Here's what makes bull markets special for traders:

- FOMO is everywhere. Fear of Missing Out drives people to buy at any price. Your neighbor made 10x on some dog coin? Now everyone wants in.

- Momentum feeds itself. Rising prices attract more buyers, which pushes prices higher, which attracts even more buyers. It's a beautiful cycle—until it ends.

- Risk appetite explodes. In bull markets, people buy coins they've never heard of based on a single tweet. The fear disappears, replaced by pure greed.

Strategy #1: Buy the Dips (BTD)

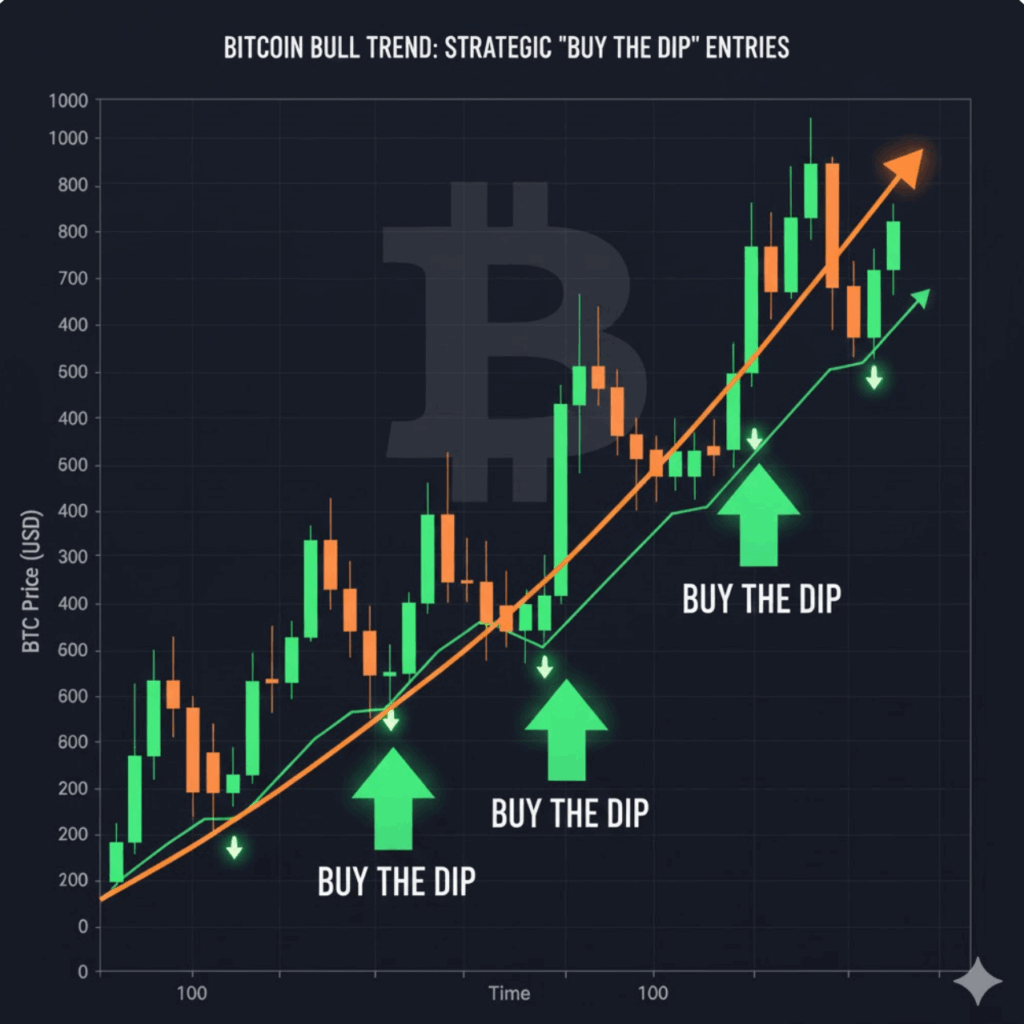

"Buy the dip" might be the most famous crypto phrase ever. But what does it actually mean, and how do you do it right?

Understanding Bull Market Dips

Even in the strongest bull markets, prices don't go straight up. They move like climbing stairs—up, sideways, up, sideways. Those sideways moments? Those are your dips.

In a bull market, a "dip" might be just 10-20% down from recent highs. That sounds scary, but zoom out on the chart, and it's just a tiny blip in the uptrend.

Example: Bitcoin climbs from $40,000 to $50,000 over two weeks. Then it drops to $45,000 in two days. That $5,000 drop is your dip. Two weeks later? It's at $55,000.

How to Execute BTD Properly

Step 1: Identify the trend. Make sure you're actually in a bull market. Check the 50-day moving average—if price is above it and the line is pointing up, you're likely in a bull trend.

Step 2: Wait for red days. Don't buy when everything's green, and everyone's celebrating. Wait for those red days when crypto Twitter turns nervous.

Step 3: Buy in chunks. Never use all your money on one dip. What if it dips more?

Here's a simple plan:

- Price drops 10%: Buy with 25% of your allocated funds

- Drops another 5%: Buy with another 25%

- Drops another 5%: Buy with 30%

- Keep 20% for a deeper dip (just in case)

Step 4: Set your targets. In a bull market, aim for 20-40% profit on your dip buys. Don't get greedy waiting for 100%.

Pro Tip: The best dips happen on weekends and during Asian market hours (late night in the US). Set some cash aside and watch for Sunday dips—they're surprisingly common.

When BTD Goes Wrong

Even in bull markets, not every dip is worth buying. Watch out for:

- Dips caused by major bad news (exchange hacks, regulatory bans)

- Dips in coins with no real use case or community

- Catching a "falling knife"—buying too early in a correction

Strategy #2: Momentum Trading

Momentum trading is basically riding the wave. When something's going up fast, you jump on and ride it higher.

The Psychology Behind Momentum

In bull markets, momentum is king. When a coin starts pumping, it attracts attention. More attention brings more buyers. More buyers create more momentum. It's a self-fulfilling prophecy. People see it's busy and assume the food must be good, so they go in too. Same with crypto—busy coins attract more traders.

Finding Momentum Plays

Volume is your best friend. Look for coins where trading volume suddenly spikes 3-5x above normal. That's momentum building.

Check multiple timeframes:

- Hourly chart: Is it breaking recent highs?

- Daily chart: Is it above yesterday's close?

- Weekly chart: Is this week green?

If all three are yes, you've found momentum.

Follow the rotation. In bull markets, money rotates between sectors:

- Bitcoin pumps first

- Then Ethereum and large caps

- Then mid-cap altcoins

- Finally, small caps go crazy

- Then back to Bitcoin

Position yourself ahead of the rotation.

Riding Momentum Safely

Enter on strength, not weakness. Buy when a coin breaks above resistance, not when it's struggling.

Use trailing stop losses. As the price goes up, move your stop loss up too. This locks in profits while letting winners run.

Example setup:

- Buy XRP at $1.00 as it breaks resistance

- Set stop loss at $0.95 (5% risk)

- Price rises to $1.10: Move stop to $1.00 (breakeven)

- Price rises to $1.20: Move stop to $1.10 (lock in 10%)

- Keep trailing until stopped out

Take partial profits. Sell 25% at +20%, another 25% at +40%, and let the rest run with a trailing stop.

Common Mistake: Jumping into momentum too late. If something's already up 100% in a day, you're too late. Wait for the next opportunity.

Strategy #3: HODL and Accumulate

HODL (a misspelling of "hold" that became crypto's motto) might seem like the simplest strategy. But there's an art to doing it right in a bull market.

Smart HODLing vs Blind HODLing

- Blind HODLing: Buying and never selling, no matter what.

- Smart HODLing: Accumulating quality projects and taking strategic profits.

In bull markets, smart HODLing means:

- Building positions in strong projects early

- Adding on dips (combining with Strategy #1)

- Taking some profits at milestone prices

- Never selling your entire position

Choosing HODL-Worthy Coins

Not every coin deserves the HODL treatment. Look for:

Strong fundamentals:

- Real use case solving actual problems

- Active development team

- Growing community

- Partnerships with real companies

Market position:

- Top 50 by market cap (safer)

- Or small cap with massive potential (riskier but higher reward)

Your conviction level:

- Would you hold if it dropped 30%?

- Do you understand what it does?

- Can you explain it to a friend?

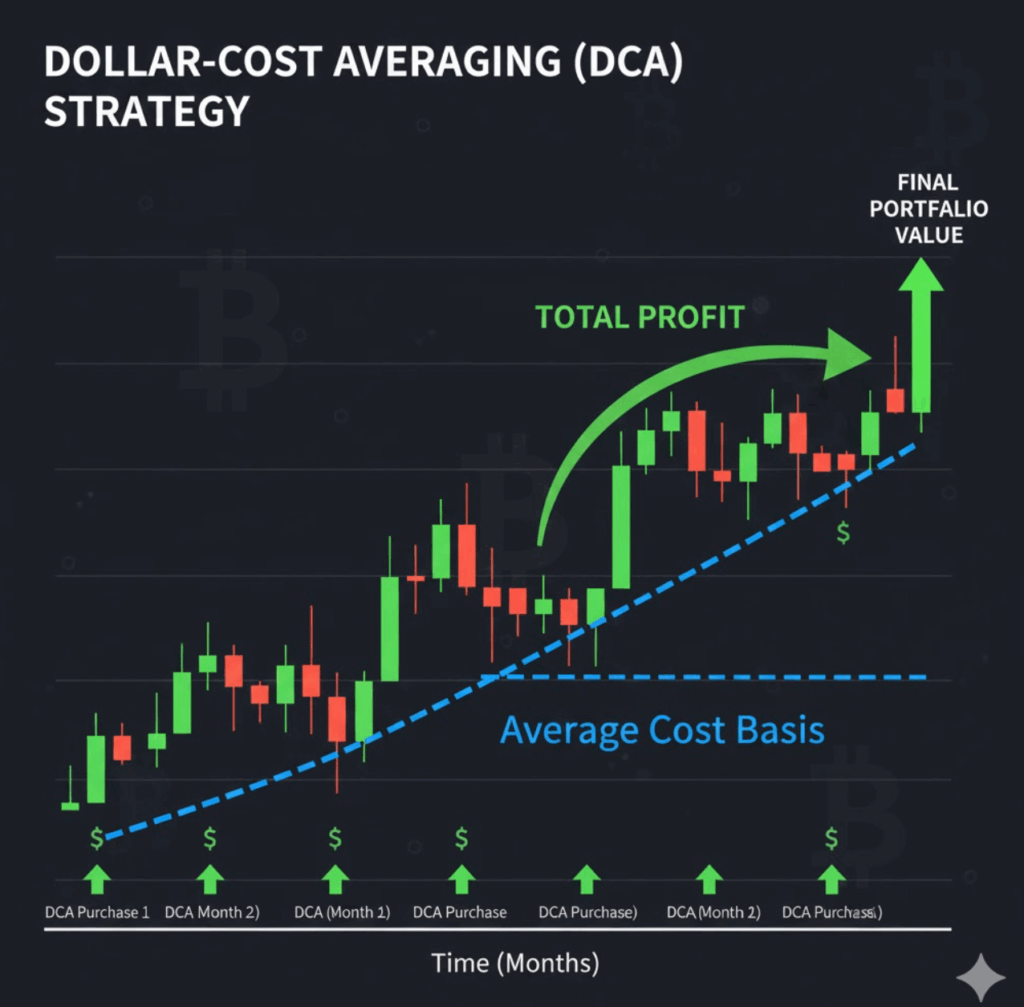

The Accumulation Schedule

Instead of buying all at once, accumulate over time:

- Weekly DCA (Dollar Cost Averaging): Buy the same dollar amount every week, regardless of price.

- Monthly larger buys: Once a month, use any dips to make larger purchases.

- Bonus accumulation: Use work bonuses, tax refunds, or unexpected money to add to positions.

Example 3-month accumulation plan:

- Every Monday: $100 into Bitcoin

- Every month on the 15th: $500 into Ethereum

- Any 15%+ dips: Extra $300 into either

Strategy #4: Swing Trading the Ranges

Even in bull markets, prices don't move in straight lines. They create ranges—and you can trade these swings for consistent profits.

Identifying Trading Ranges

A range forms when price bounces between two levels:

- Support (bottom): Where buyers step in

- Resistance (top): Where sellers appear

In bull markets, these ranges are usually "ascending"—each new range is higher than the last.

Example: Ethereum trades between $3,000 and $3,500 for two weeks. That's your range. You buy near $3,000, sell near $3,500.

The Range Trading Playbook

- Step 1: Confirm the range Price should touch both levels at least twice. Three times is even better.

- Step 2: Buy near support Don't try to catch the exact bottom. Buying at $3,050 when support is $3,000 is perfectly fine.

- Step 3: Sell near resistance Don't be greedy. Selling at $3,450 when resistance is $3,500 is smart.

- Step 4: Rinse and repeat Keep trading the range until it breaks. In bull markets, a range might hold for weeks.

- Step 5: Prepare for the breakout Eventually, the range will break (usually upward in bull markets). Keep some coins in case of a breakout.

Managing Range Trades

- Position sizing: Never use more than 30% of your portfolio for range trading. Keep the rest for HODLing.

- Stop losses: Place stops just below support. If support at $3,000 breaks, exit at $2,950.

- Profit targets: Aim for 10-15% per swing. Small gains add up fast.

Strategy #5: New Listing Plays

Bull markets bring endless new coin listings. Exchanges race to list the hottest projects, and early buyers can profit hugely. When a major exchange like Binance or Coinbase lists a new coin, several things happen:

- Instant credibility: Big exchanges = legitimacy

- Massive exposure: Millions of users see it

- Easy access: One-click buying for retail traders

- FOMO kicks in: Everyone wants the "next big thing"

The result? Explosive price action in the first 24-72 hours.

Playing New Listings Safely

The Conservative Approach:

Wait for the initial spike and crash. New listings often pump 50-200% in minutes, then dump hard. Buy after the dust settles, usually 24-48 hours later.

Example:

- New coin lists at $1

- Spikes to $3 in first hour

- Crashes to $1.50 by day two

- You buy at $1.50

- Often recovers to $2+ within a week

The Aggressive Approach:

If you can buy within the first 30 seconds of listing, you might catch the initial pump. But this requires:

- Fast internet

- Funds already on the exchange

- Quick fingers

- Acceptance you might lose

The Research Approach:

Some exchanges announce listings days early. Research the project:

- Check the tokenomics

- Read the whitepaper

- Join their community

- Look at the team

If it's solid, buy on smaller exchanges before the big listing.

Red Flags to Avoid

Not every new listing is worth trading:

- Massive token unlocks coming soon

- Anonymous teams with no track record

- Paid shilling everywhere (fake hype)

- No working product just promises

- Tiny market cap with huge fully diluted value

Common Mistake: FOMOing into every new listing. Most new coins fail long-term. Take profits quickly and don't marry these trades.

Quick Recap

Here are the five bull market strategies we covered:

- Buy the Dips: Purchase quality coins when they pull back 10-20% in an uptrend

- Momentum Trading: Ride strong moves higher using volume and trend indicators

- HODL and Accumulate: Build long-term positions in quality projects using DCA

- Swing Trading Ranges: Trade between support and resistance levels for consistent gains

- New Listing Plays: Capitalize on exchange listings with proper timing and research

Remember: You don't need to use all five strategies. Pick 2-3 that match your style and master them. Trying to do everything usually means doing nothing well.

Conclusion & Next Steps

Bull markets are incredible opportunities, but they don't last forever. The average crypto bull run lasts 1-2 years, followed by a bear market that can feel eternal. That's why having proper strategies matters—you need to make the most of the good times.

The biggest mistake beginners make? Thinking the bull market will never end. They hold everything to the top, then ride it all the way back down. Don't be that person. Use these strategies to take profits along the way.

Your Next Steps:

- Today: Pick two strategies from this guide that appeal to you. Write them down with your own rules for entries, exits, and position sizing. Having a written plan makes you 10x more likely to follow it.

- This Week: Paper trade (practice without real money) your chosen strategies. Track what would have happened if you'd made those trades. Learn what works before risking real capital.

- Ongoing: Join the Fat Pig Signals Telegram community where we share daily market analysis and call out opportunities for each strategy. Bull markets move fast—it helps to have extra eyes on the market.

Remember: You don't have to catch every pump or nail every trade. Consistent small wins beat gambling for home runs. Our Fat Pig Signals community focuses on sustainable strategies that work across market conditions.

The next bull market is coming—it always does. Whether that's next month or next year, you'll be ready. These strategies have worked in every crypto bull run since 2013, and they'll work in the next one too.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Cryptocurrency trading involves substantial risk of loss. Always do your own research and consider consulting with a financial advisor before making investment decisions.