5 Trading Strategies That Work in Bull Markets

Altcoins, Bitcoin, Cryptocurrencies, Trading

Ever felt like you're missing out when you see Bitcoin and other cryptos shooting up day after day? You're watching everyone else celebrate their gains while you sit on the sidelines, paralyzed by indecision?

Bull markets—periods when crypto prices rise consistently over time—are exciting. But they can also be overwhelming if you don't know how to navigate them. The truth is, bull markets are some of the easiest times to make money in crypto, but only if you have a strategy.

Without a plan, it's easy to get caught up in the hype, chase coins after they've already pumped, or hold too long and watch your profits evaporate when the market turns.

In this guide, we’re breaking down five simple trading strategies that actually work during bull markets. Whether you're just starting out or you've been trading for a while, these strategies will help you make smarter decisions and capture profits while managing risk.

1. The "Buy and Hold" Strategy

Let's start with the simplest strategy: buying and holding. You've probably heard about this one. It means you buy a cryptocurrency and hold it through market ups and downs, betting that the long-term trend is upward.

But here's the thing—buying and holding works best during bull markets, not bear markets. Why? Because in a bull market, the overall trend is your friend. Prices generally rise, so even if you experience short-term dips, the market tends to recover and push higher.

Here's how to do it the smart way:

Instead of buying random coins because someone on Twitter said they're "going to the moon," focus on solid, established cryptocurrencies like Bitcoin and Ethereum. These are the market leaders, and during bull runs, they tend to gain the most consistently.

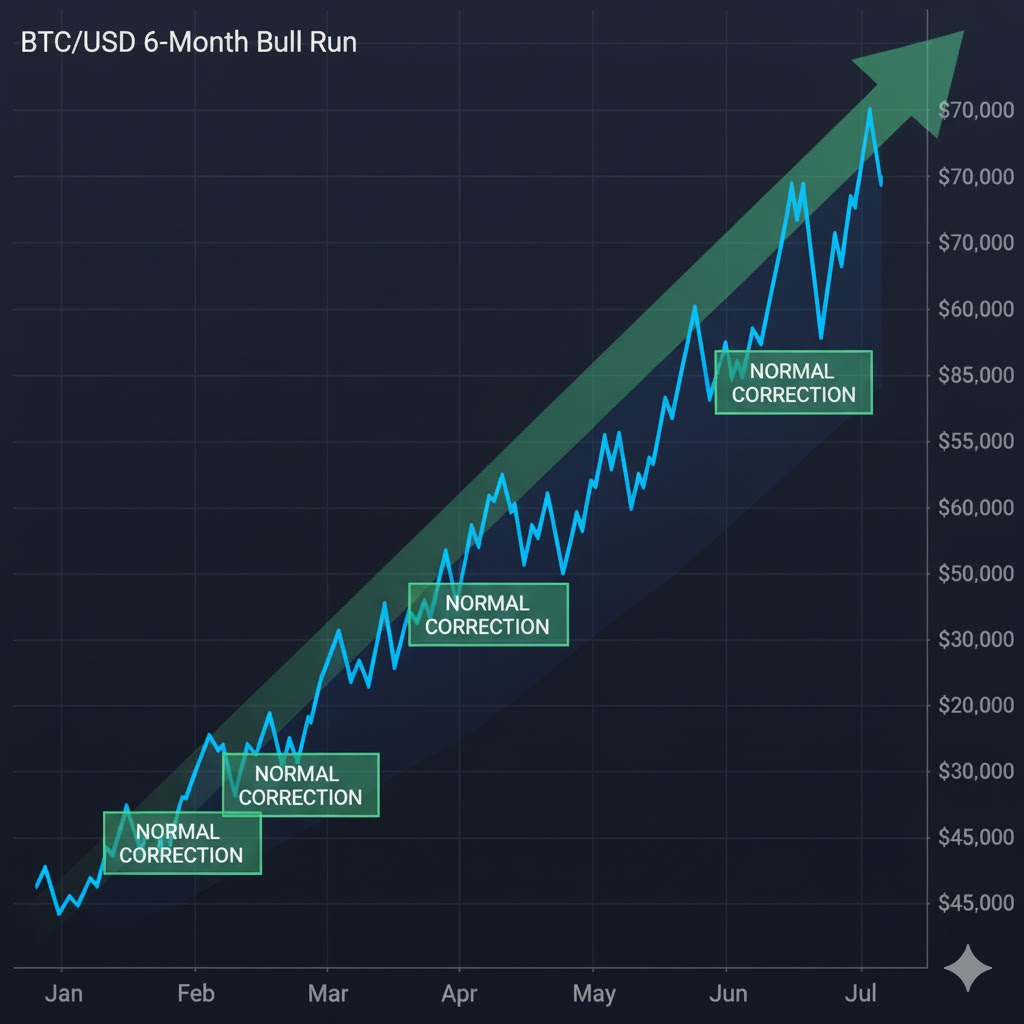

Let's say Bitcoin is trading at $45,000 at the start of a bull market. Instead of trying to time every little dip, you decide to buy $500 worth and hold it for the next six months. By the peak of the bull run, Bitcoin hits $70,000. Your $500 is now worth around $778—a 55% gain.

The key here is patience. During bull markets, prices don't go straight up. There will be days when Bitcoin drops 5% or 10%, and panic will set in. Beginners often sell during these dips, only to watch the price recover days later. Don't be that person.

Pro Tip: Set a price target before you make a purchase. For example, decide that you'll sell when Bitcoin hits $70,000, or when your investment doubles. This removes emotion from the decision and helps you lock in profits instead of getting greedy.

2. The "Buy the Dip" Strategy

In bull markets, prices don't rise in a straight line. There are always pullbacks—temporary price drops before the upward trend resumes. These pullbacks are your opportunity to buy at a discount.

Think of it like shopping for a new phone. If you see the latest iPhone drop from $1,000 to $850 during a sale, you'd jump on that deal. The same principle applies to crypto during a bull market.

Here's how to identify and trade the dips:

First, you need to understand what a "dip" actually is. In a bull market, a healthy pullback is usually 5-15% from recent highs. If Bitcoin were trading at $50,000 and drops to $47,500, that's a 5% dip—a potential buying opportunity.

But how do you know if the dip will recover? This is where support levels come in. A support level (a price point where buying pressure historically prevents further drops) acts like a safety net. If Bitcoin has bounced off $47,000 multiple times in the past, that's a strong support level.

Let's say you've been watching Ethereum during a bull market. It's been climbing from $3,000 to $3,500 over a few weeks. One day, negative news causes a quick drop to $3,200. You recognize this as a dip because:

- The overall trend is still upward

- $3,200 is a previous support level

- The drop happened on temporary news, not a fundamental change

You buy $300 worth of Ethereum at $3,200. Within a week, the price recovers to $3,600. You've made a quick 12.5% gain by buying the dip.

Common Mistake: Don't confuse a dip with a trend reversal (when the bull market actually ends). If the entire market is crashing—not just one coin—and major negative news is piling up, that might be the end of the bull run, not just a temporary dip.

3. The "Swing Trading" Strategy

Swing trading is for individuals who want to be more active than buy-and-hold investors, but don't want to spend their days staring at charts. The idea is simple: you buy during short-term dips and sell during short-term peaks, capturing profits from the market's natural swings.

In a bull market, swing trading is particularly effective because the overall trend is upward. You're riding the waves up and down, but always within a rising market.

Here's how to swing trade during a bull market:

Let's say you're trading Solana. Over the past month, you've noticed a pattern: Solana rises for 3-4 days, pulls back for 1-2 days, then rises again. This is the "swing" you'll trade.

Step 1: Identify the pattern. Watch Solana for a week or two. Notice when it tends to peak and when it tends to dip.

Step 2: Buy during the pullback. When Solana drops from $120 to $110, you buy $200 worth.

Step 3: Set a profit target. You decide to sell when Solana hits $125—a 13.6% gain.

Step 4: Execute and repeat. When Solana hits $125 three days later, you sell. You've made $27 in profit. Then you wait for the next pullback to repeat the process.

The beauty of swing trading in a bull market is that you don't need to predict huge moves. You're just capturing small, consistent gains as the market trends upward.

Pro Tip: Use stop losses (a predetermined price at which you automatically sell to limit losses) to protect yourself. If you buy Solana at $110 and set a stop loss at $105, you'll automatically sell if the price drops, limiting your loss to about 4.5%.

How long should you hold in a swing trade?

Typically, swing trades last anywhere from 2 days to 2 weeks. You're not day trading (buying and selling within hours), but you're also not holding for months. You're capturing the medium-term swings.

4. The "Momentum Trading" Strategy

Momentum trading is all about riding the wave when a coin starts pumping hard. During bull markets, certain coins experience explosive moves, gaining 20%, 30%, or even 50% in just a few days.

Momentum traders jump on these fast-moving trains early and ride them for quick profits.

First, you need to identify when a coin is building momentum. This usually happens when:

- Volume increases sharply: More people are buying, which pushes the price up

- Price breaks through resistance: The coin pushes past a price level it's been stuck at

- Positive news or hype builds: A new partnership, exchange listing, or major update creates excitement

Let's say you've been watching Cardano. It's been stuck around $0.50 for weeks, barely moving. Suddenly, news breaks that Cardano is launching a major upgrade. The price jumps to $0.55 in one day, and trading volume doubles.

This is the momentum signal. You buy $150 worth of Cardano at $0.55. Over the next three days, excitement builds, and the price continues to $0.70. You sell and lock in a 27% gain in less than a week.

The key to momentum trading is speed: You need to act quickly when you spot the momentum building, and you need to exit before the hype dies down.

Common Mistake: Don't chase a coin after it's already pumped 50% or more. By that time, you're late to the party, and you risk buying at the peak. The best momentum trades happen when you catch the move early—within the first 10-20% gain.

How do you know when to exit?

Momentum trades are short-term. Watch for signs that the momentum is fading:

- Volume starts to decrease

- The price stalls and stops making new highs

- The news cycle around the coin quiets down

When you see these signs, it's time to take profits and move on.

[IMAGE: Cardano chart showing flat price around $0.50 for weeks, then a sharp breakout to $0.55 with increased volume bars, followed by continued rise to $0.70, with entry and exit points marked]

5. The "Ladder Strategy" (Scaling In and Out)

The Ladder Strategy is one of the smartest ways to trade a bull market, and it's perfect for beginners because it removes the pressure of trying to time the perfect entry or exit.

Here's the concept: instead of buying all at once or selling everything at once, you scale in (gradually buy more as prices rise) and scale out (gradually sell as prices reach your targets).

Why does this work in bull markets?

Bull markets can last months, and it's nearly impossible to know when they'll peak. The Ladder Strategy lets you capture profits along the way without worrying about selling too early or holding too long.

Here's how to use the Ladder Strategy:

Let's say you have $1,000 to invest in Bitcoin during a bull market. Instead of buying all $1,000 worth at once, you split it into portions.

Scaling In (Buying):

- Week 1: Bitcoin is at $40,000. You buy $250 worth.

- Week 3: Bitcoin dips to $38,000. You buy another $250 worth.

- Week 5: Bitcoin rises to $42,000. You buy another $250 worth.

- Week 7: Bitcoin hits $45,000. You buy the final $250 worth.

By spreading your purchases over time, you've averaged out your entry price. You didn't try to time the perfect bottom—you just accumulated gradually as the bull market unfolded.

Scaling Out (Selling):

Now Bitcoin is at $60,000, and you want to take profits. Instead of selling everything at once (and risking that it might keep going up), you scale out:

- Bitcoin at $60,000: Sell 25% of your holdings

- Bitcoin at $65,000: Sell another 25%

- Bitcoin at $70,000: Sell another 25%

- Bitcoin at $75,000: Sell the final 25%

This way, you've locked in profits at multiple price levels. If Bitcoin keeps rising to $80,000, you still have exposure. If it reverses after $60,000, you've already taken significant profits.

Pro Tip: Decide your ladder levels before you start trading. Write down the exact prices where you'll buy and sell. This prevents emotional decisions when the market is moving fast.

The Ladder Strategy is all about discipline and patience. You won't capture the absolute bottom or the absolute top, but you'll consistently take profits and build your portfolio over time.

![Diagram showing Bitcoin price climbing from $40,000 to $75,000, with buy points marked on the way up at $40K, $38K, $42K, $45K, and sell points marked at $60K, $65K, $70K, $75K]](https://www.fatpigsignals.com/wp-content/uploads/2025/11/image-7.png)

Quick Recap

Here's what we covered:

- Buy and Hold (Smarter): Focus on established coins like Bitcoin and Ethereum, hold through short-term dips, and set clear profit targets to avoid getting too greedy

- Buy the Dip: Identify healthy pullbacks (5-15% drops) during upward trends, look for support levels, and buy at temporary discounts before the rally continues

- Swing Trading: Capture short-term price swings by buying during pullbacks and selling during peaks, typically holding for 2 days to 2 weeks

- Momentum Trading: Jump on coins that are breaking out with high volume and positive news, then exit quickly before the hype fades

- Ladder Strategy: Scale into positions by buying in portions, and scale out by selling gradually at different price targets—removing the pressure to time perfect entries and exits

Conclusion & Next Steps

Bull markets won't last forever. But when they're happening, they create some of the best opportunities for crypto traders—especially beginners.

The strategies in this guide aren't complicated. They don't require you to be glued to charts 24/7 or have a degree in finance. They're simple, actionable approaches that work when prices are trending upward.

The mistake most beginners make? They don't have a plan. They buy impulsively, sell emotionally, and end up frustrated. Don't let that be you.

Your Next Steps:

- Today: Choose one strategy from this list that resonates with you. Write it down. Define your rules—when will you buy? When will you sell? What's your stop loss?

- This Week: Practice with a small amount. Don't risk serious money until you've tested your strategy. Watch how it performs in real market conditions.

- Ongoing: Track your trades in a simple spreadsheet. Note what worked, what didn't, and what you learned. Over time, you'll refine your approach and get better at executing your strategy.

Remember: You don't have to figure this out alone. Our Fat Pig Signals community is full of traders learning and growing together. We share real-time insights, discuss strategies, and help each other navigate bull markets without the hype and panic.

Join our Telegram group here and get access to signals, market updates, and a supportive community that's got your back.

You're building real trading skills. Bull markets come and go, but the strategies you learn now will serve you for years.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Cryptocurrency trading involves substantial risk of loss. Always do your own research and consider consulting with a financial advisor before making investment decisions.