What is Algorithmic Trading and How Do You Get Started?

Trading

Ever watched a crypto chart move so fast you couldn't possibly click the buy button in time? Or noticed that some traders seem to execute perfect trades at 3 AM while you're fast asleep?

That's often algorithmic trading at work.

For beginners, the phrase "algorithmic trading" can sound intimidating—like something only Wall Street quants or computer geniuses do. But here's the truth: understanding the basics of algo trading isn't as complicated as it sounds, and knowing how it works can actually make you a better trader, even if you never write a single line of code.

Here's something that might surprise you: algorithmic trading now accounts for over 60% of all trades in U.S. markets. It's not just for big institutions anymore—retail traders like you and me can access these tools too.

In this article, we'll break down exactly what algorithmic trading is, how it works in crypto markets, and how you can get started—even as a complete beginner. By the end, you'll understand whether algo trading is right for you and what your first steps should be.

What Exactly is Algorithmic Trading?

Algorithmic trading (often called "algo trading" or "automated trading") simply means using a computer program to make trades based on a set of rules you define.

Think of it like setting up a really smart alarm clock. Instead of just waking you up at 7 AM, imagine an alarm that wakes you up only when the temperature drops below 50°F and it's a weekday and you have a meeting before 9 AM. That's what algo trading does for your trades—it watches for specific conditions and acts automatically when they're met.

Here's what that looks like in practice:

Instead of you sitting at your computer watching Bitcoin's price, an algorithm might:

- Buy BTC when the price drops 5% in one hour

- Sell when your profit reaches 10%

- Place a stop loss automatically to protect your investment

- Do all of this at 3 AM while you sleep

The "algorithm" is just the set of rules. The computer handles the execution.

Why Do People Use Algorithmic Trading?

So why would someone let a computer make their trades? Several important reasons:

Speed matters in crypto. Crypto markets move fast—really fast. A price can spike or crash 10% in minutes. Human fingers simply can't click as fast as computers can execute. Algorithms can place trades in milliseconds—some even in microseconds (that's millionths of a second). By the time you see a price and decide to click, the opportunity might already be gone.

Emotions are the enemy. Ever panic-sold during a dip, only to watch the price recover an hour later? Algorithms don't feel fear or greed. They follow the rules you set, period. No second-guessing, no "maybe I should hold just a little longer." This consistency is huge—emotional decisions are one of the biggest reasons traders lose money.

Markets never sleep. Crypto trades 24/7, 365 days a year. You can't watch charts all day and all night. But an algorithm can monitor the market while you sleep, work, or live your life. It's like having a tireless assistant watching over your trades around the clock.

Consistency beats randomness. An algorithm executes the same strategy the same way every time. No "feeling lucky" days or distracted afternoons. This consistency helps you actually test whether a strategy works—because you're removing the human variable from the equation.

You can test before you invest. One of the most powerful features of algo trading is backtesting—running your strategy against historical data to see how it would have performed. This means you can refine your approach before risking real money.

💡 Pro Tip: Even if you never use an algorithm yourself, understanding that they exist helps explain why crypto prices can move so suddenly—big algo orders can trigger rapid price changes in seconds.

How Does Algorithmic Trading Actually Work?

Let's break down the basic process. Don't worry—we'll keep it simple.

Step 1: Define Your Rules

First, you decide what conditions should trigger a trade. These rules can be simple or complex:

Simple example: "Buy Ethereum if the price drops below $2,000. Sell if it rises above $2,200."

More complex example: "Buy Bitcoin if the RSI (Relative Strength Index—a tool that measures if something is overbought or oversold) drops below 30 and the price is above the 200-day moving average and trading volume is higher than average."

The key here: your rules need to be specific and measurable. "Buy when the price looks good" won't work. "Buy when the 50-day moving average crosses above the 200-day moving average" will.

Step 2: Choose Your Platform

The algorithm needs to run somewhere. Beginners typically use:

- Trading bots on exchanges (many exchanges like Binance, KuCoin, or Bybit have built-in bot features)

- Third-party bot platforms (like 3Commas, Pionex, or Cryptohopper)

- Custom code (for more advanced users who know Python or other programming languages)

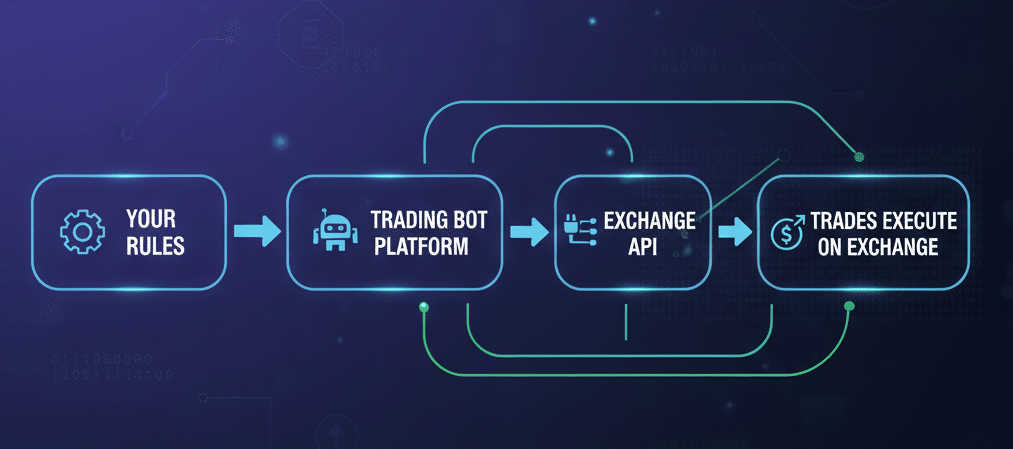

Step 3: Connect to an Exchange

Your algorithm needs access to actually place trades. This usually means connecting to your exchange account through something called an API (Application Programming Interface—basically a secure connection that lets the bot talk to your exchange).

Think of an API like a bridge. It allows your trading bot to send orders to the exchange and receive market data back—all in real time. Without this connection, your bot would have no way to actually execute trades.

Step 4: Backtest Your Strategy

Before going live, smart traders test their strategies on historical data. This is called backtesting. You're essentially asking: "If I had used this strategy over the past 3 months, would I have made money or lost money?"

Backtesting isn't perfect—past performance doesn't guarantee future results—but it helps you spot obvious problems before risking real capital.

Step 5: Monitor and Adjust

Once it's running, you watch how your algorithm performs. No strategy works perfectly forever. Markets change, and your rules might need tweaking. Even the best algorithms need regular check-ins.

Types of Algorithmic Trading Strategies

Not all algorithms do the same thing. Here are the most common strategies you'll hear about:

Grid Trading

Imagine placing a ladder of buy orders below the current price and sell orders above it. As the price bounces up and down, you automatically buy low and sell high—over and over. This works well in sideways, choppy markets where prices move within a range.

Example: Bitcoin is trading at $50,000. You set buy orders at $49,000, $48,000, and $47,000. You set sell orders at $51,000, $52,000, and $53,000. As the price bounces around, you capture small profits on each swing.

DCA Bots (Dollar-Cost Averaging)

These bots automatically buy a fixed amount at regular intervals—say, $100 of Bitcoin every week. They might also buy extra when prices dip significantly. This removes the stress of trying to time the market and is great for building a position over time.

Trend Following

These algorithms try to ride momentum. They buy when prices are rising and sell when prices start falling. The idea: trends tend to continue longer than people expect. A common approach uses moving average crossovers—when a short-term average (like 50 days) crosses above a long-term average (like 200 days), it signals a buy.

Example: Your algorithm buys Bitcoin when the 50-day moving average crosses above the 200-day moving average (traders call this a "Golden Cross"). It sells when the opposite happens.

Mean Reversion

This strategy is based on the idea that prices tend to return to their average over time. If a coin's price shoots up unusually high, a mean reversion algorithm might sell, expecting the price to fall back to normal. If it drops unusually low, it might buy.

Indicators like Bollinger Bands or RSI are commonly used to identify when an asset is "overbought" (too high) or "oversold" (too low).

Arbitrage

This means buying on one exchange where the price is lower and instantly selling on another exchange where the price is higher. The profit margins are tiny, but with enough volume and speed, it adds up. This is mostly done by professionals now—the opportunities are often too fast for manual trading or even basic bots.

⚠️ Common Mistake: Beginners often think any algo strategy will print money automatically. It won't. Every strategy has periods where it loses money. The goal is finding strategies that win more than they lose over time.

Getting Started: A Beginner's Roadmap

Ready to dip your toes into algorithmic trading? Here's how to start without getting overwhelmed:

Start with Exchange-Native Bots

Many exchanges now offer built-in trading bots that require zero coding. This is the easiest entry point—and it's free.

Binance, KuCoin, Bybit, and Pionex all have grid bots and DCA bots you can set up in minutes. You choose the trading pair, set your parameters, and let it run.

Here's a realistic first experience:

You might set up a grid bot on Binance to trade BTC/USDT. You define a price range (say, $40,000 to $50,000), tell it how many grid levels to create (maybe 10), and allocate $500 to the bot. The bot automatically places buy and sell orders throughout that range and captures small profits as the price moves.

Use Paper Trading First

Many bot platforms offer paper trading (simulated trading with fake money). This lets you test your strategy without risking real funds.

Spend at least 2-4 weeks paper trading before using real money. Watch how your strategy performs in different market conditions—during pumps, dumps, and sideways movement.

Paper trading helps you identify problems like:

- Order rejections

- Unexpected delays

- Triggers that don't fire as expected

- Strategies that look good on paper but fail in real-time conditions

Start Smaller Than You Think

When you switch to real money, start with an amount you're truly comfortable losing. Seriously. Maybe that's $50 or $100—not your life savings.

The first real trades are about learning, not getting rich. You'll make mistakes. Everyone does. The goal is to make those mistakes with small amounts while you're still learning.

Learn One Strategy Deeply

Don't try to master grid trading, DCA bots, and trend following all at once. Pick one. Understand how it works. Learn when it performs well and when it struggles. Then, maybe, explore others.

Depth beats breadth when you're starting out.

Image Source: CoinCodeCap

What Are the Risks?

Let's be real: algorithmic trading is not a magic money printer. Here's what can go wrong:

Your strategy might not work. Just because an algorithm follows rules doesn't mean those rules are profitable. Many strategies look good in backtests but fail in live markets. This is sometimes called "overfitting"—when a strategy is too perfectly tuned to past data and can't adapt to new conditions.

Flash crashes happen. Crypto is volatile. A sudden 20% drop can trigger your bot to sell at a massive loss before recovering. The 2010 stock market "Flash Crash" saw major indices plummet and rebound within minutes—algorithms played a role in both directions. Risk management settings (like stop losses and maximum drawdown limits) are crucial.

Technical failures. Bots can glitch. Exchanges can go down. APIs can disconnect. If your bot doesn't place a stop loss because of a technical issue, you could lose more than expected. One famous example: Knight Capital lost $440 million in under an hour due to an algorithm error.

Over-optimization. It's tempting to tweak your settings until they would have been perfect for past data. But markets change. A strategy optimized for last month might fail this month. This is one of the biggest traps for new algo traders.

Security risks. Connecting a bot to your exchange via API means creating an access point. If the bot platform gets hacked, your funds could be at risk. Always use platforms with strong security records and enable withdrawal whitelist features on your exchange (so even if someone gets your API keys, they can't withdraw your funds).

Liquidity risks. In fast-moving or thin markets, your algorithm might not be able to execute at the prices it expects. This is called "slippage"—you wanted to buy at $100, but you actually bought at $102 because the market moved too fast.

⚠️ Common Mistake: Letting a bot run without monitoring it. Check on your bots regularly. Market conditions change, and a strategy that worked for months can suddenly start losing.

Do You Need to Know How to Code?

Here's good news: No, you don't need to code to start algo trading.

Exchange-native bots and no-code platforms let you set up automated strategies by just selecting options and entering numbers. Many traders successfully use algo trading without writing a single line of code.

That said, knowing some programming (especially Python) opens up more possibilities. You can:

- Build custom strategies that aren't available on standard platforms

- Backtest more thoroughly using historical data

- Adjust parameters with more precision

If you're interested in learning, Python is the most beginner-friendly language for algo trading. Libraries like Pandas, NumPy, and TA-Lib make it easier to work with financial data. But again—this is optional, not required.

💡 Pro Tip: If you want the benefits of custom algorithms without learning to code, some platforms let you describe your trading ideas in plain language and convert them to algorithms for you.

Quick Recap

Here's what we covered:

- Algorithmic trading is simply using computer programs to make trades based on rules you define

- Speed, emotion removal, and 24/7 monitoring are the main advantages of algo trading

- Common strategies include grid trading, DCA bots, trend following, mean reversion, and arbitrage

- Exchange-native bots are the easiest starting point for beginners—no coding required

- Always paper trade first and start with small amounts of real money

- Backtesting lets you test strategies on historical data before risking real capital

- Risks are real—strategies can fail, technical issues can occur, and markets are unpredictable

- You don't need to code to start, but learning Python opens up more possibilities

What Should You Do Next?

Algorithmic trading isn't for everyone—and that's perfectly fine. But if you're curious, here's how to take your first steps without getting in over your head.

Your Next Steps:

- Today: Open your exchange (Binance, KuCoin, Bybit, or wherever you trade) and explore their bot features. Most have a "Trading Bots" section. Just look around—don't set anything up yet. Get familiar with the options and terminology.

- This Week: Pick one simple strategy (grid trading is a good starter) and paper trade it. Set a reminder to check its performance every few days. Note what market conditions help it and what conditions hurt it. Keep a simple log of what you observe.

- Ongoing: Join the Fat Pig Signals Telegram community. We discuss trading strategies, share what's working (and what isn't), and help each other navigate the learning curve. Algo trading is easier when you're learning alongside others who understand the challenges.

Remember: you don't have to automate anything to be a successful trader. Many great traders do everything manually. But understanding how algorithms work helps you make sense of market movements and decide what approach fits your life and goals.

The traders who succeed with algo trading aren't the ones who find a "perfect" strategy. They're the ones who keep learning, stay patient, and manage their risk carefully.

You're building real trading skills—one concept at a time. Stay curious, start small, and trust the process.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Cryptocurrency trading involves substantial risk of loss. Always do your own research and consider consulting with a financial advisor before making investment decisions.