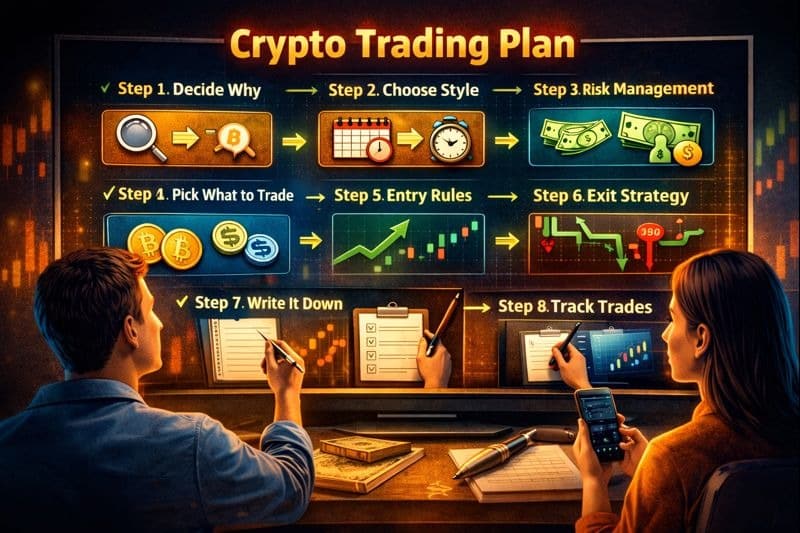

Step by Step Guide to Building a Crypto Trading Plan

Cryptocurrencies, Trading

Have you ever bought a crypto coin because it looked like it was “about to pump”… only to panic-sell when the price dipped a little?

You’re not alone. Almost every beginner trader goes through this. The problem isn’t that you’re bad at trading. The real problem is that you’re trading without a plan.

In today’s crypto market—where prices move fast, emotions run high, and Twitter hype spreads instantly—having a trading plan matters more than ever. A trading plan keeps you calm when others panic and focused when others chase pumps.

By the end of this guide, you’ll know:

- What a crypto trading plan actually is

- How to build one step by step—even if you’re brand new

- How to protect your money while learning

- How to turn random trades into intentional decisions

Think of this as your personal trading rulebook, not a get-rich-quick scheme.

What Is a Crypto Trading Plan

A crypto trading plan is a written set of rules that tells you:

- What to trade

- When to enter

- When to exit

- How much to risk

- What to do if things go wrong

Think of it like using Google Maps instead of driving with vibes alone. You still might hit traffic—but you won’t be completely lost.

Without a plan, beginners usually:

- Buy because of hype

- Sell because of fear

- Risk too much on one trade

- Repeat the same mistakes

A plan doesn’t guarantee profits (nothing does). But it dramatically reduces dumb mistakes—and that alone is huge.

Important reminder: Crypto trading involves risk. You can lose money. A trading plan helps you manage risk, not eliminate it.

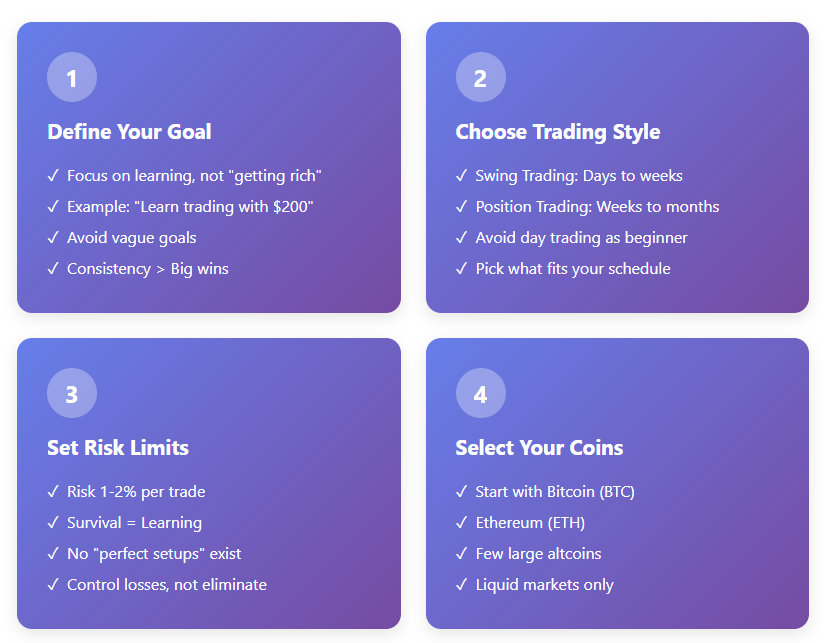

Step 1: Decide Why You’re Trading Crypto

Before charts, indicators, or signals—start here. Ask yourself one simple question: “Why am I trading crypto?”. Your answer shapes everything else.

Common beginner goals (pick one):

- Learn how trading works (most beginners should start here)

- Grow a small account slowly

- Build long-term skills, not quick profits

Avoid vague goals like:

- “I want to get rich”

- “I want to double my money fast”

Example (simple and realistic):

“I want to learn crypto trading using $200, risking small amounts per trade.”

That’s a solid goal.

Pro Tip Box: Your goal should focus on learning and consistency, not big wins. Big wins come after discipline.

Step 2: Choose a Trading Style That Fits Your Life

Your trading style is how long you hold a trade. This is not about what’s “best.” It’s about what fits your schedule and personality.

Beginner-friendly trading styles:

- Swing Trading – Holding trades for days to weeks

- Position Trading – Holding for weeks or months

Avoid day trading at first. It’s fast, stressful, and unforgiving.

Simple analogy:

Think of trading styles like workouts:

- Day trading = sprinting every day

- Swing trading = steady jogging

- Long-term holding = walking daily

For beginners, steady beats intense.

Step 3: Decide How Much You’re Willing to Lose

This is the most important part of your plan. Risk management means deciding how much money you’re okay losing before you trade.

Key term explained:

- Risk per trade = the maximum amount you’re willing to lose on one trade

Beginner rule:

Risk 1–2% of your account per trade

Example with numbers:

- Account size: $200

- 1% risk = $2

- If the trade fails, you only lose $2

That’s survivable. And survival is how traders learn.

Common Beginner Mistake: Risking too much because “the setup looks perfect.” No setup is perfect. Ever.

Step 4: Pick What You Will Trade

Beginners don’t need 50 coins on their watchlist. Start with liquid coins—coins that are easy to buy and sell.

Beginner-friendly choices:

- Bitcoin (BTC)

- Ethereum (ETH)

- A few large, well-known altcoins

Why? Because they move more smoothly and are less likely to randomly crash.

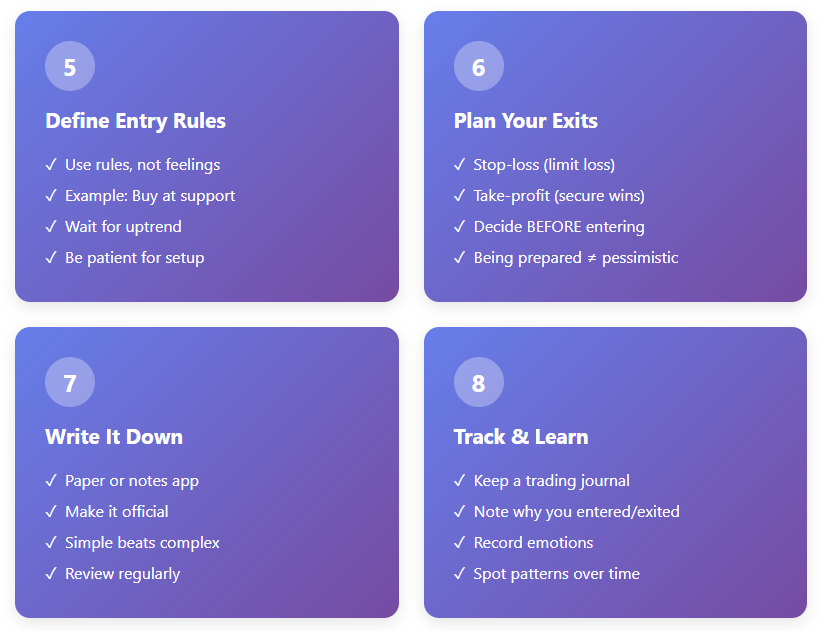

Step 5: Define Your Entry (When You Buy)

An entry is the price level where you decide to buy. Instead of “I feel like buying,” use a rule.

Simple beginner entry rule:

“I buy when price pulls back to support in an uptrend.”

Support = a price level where buyers often step in. Think of it like a floor that price bounces from.

Step 6: Define Your Exit Before You Enter

You must know when to exit before you enter. There are two exits:

- Stop-loss – where you exit if you’re wrong

- Take-profit – where you exit if you’re right

Key term explained:

- Stop-loss = an automatic sell that limits your loss

Example:

- Buy price: $100

- Stop-loss: $98

- Loss if wrong: $2 (planned and controlled)

This is not being pessimistic. This is being professional.

Think of it like: Wearing a seatbelt doesn’t mean you expect a crash—it means you’re prepared.

Step 7: Write It All Down (Yes, on Paper or Notes App)

A trading plan must be written. Here’s a simple beginner template:

My Crypto Trading Plan

- Goal: Learn and trade safely

- Trading style: Swing trading

- Coins I trade: BTC, ETH

- Risk per trade: 1%

- Entry rule: Buy at support in uptrend

- Stop-loss: Always set

- Take-profit: At resistance

- Max trades per day: 1–2

That’s it. Simple beats complex.

Step 8: Track Your Trades (This Is How You Improve)

A trading journal is a record of your trades. You write:

- Why you entered

- Where you exited

- What you felt

- What you learned

Over time, patterns appear:

- You’ll see what works

- You’ll see what doesn’t

- You’ll stop repeating mistakes

This is how beginners turn into traders.

How Fat Pig Signals Fits Into Your Trading Plan

Signals work best inside a plan, not as blind copy-paste trades. Inside the Fat Pig Signals Telegram community, many beginners use signals to:

- Learn proper entries and exits

- See real examples of risk management

- Build discipline instead of guessing

A signal should answer:

- Where is the entry?

- Where is the stop-loss?

- Where is the target?

If a signal doesn’t fit your plan—you skip it. That’s confidence.

Quick Recap: Your Beginner Trading Plan

- A trading plan protects you from emotional decisions

- Start with clear goals focused on learning

- Choose a slow, beginner-friendly trading style

- Risk small amounts so you can survive losses

- Always define entry, stop-loss, and take-profit

- Write everything down

- Track trades to improve over time

Conclusion & Next Steps: Start Small, Trade Smart

You don’t need:

- Fancy indicators

- Huge capital

- Perfect timing

You need:

- A simple plan

- Discipline

- Patience

Your next 3 actions:

- Write your first trading plan using the template above

- Start with very small amounts

- Join professional trading communities like the Fat Pig Signals Telegram to learn from structured examples and community discussions

Remember: The goal isn’t to win every trade. The goal is to stay in the game long enough to get good. You’ve got this. One plan, one trade, one lesson at a time.