Best Practices for Using Telegram Signals

Telegram, Trading

Ever joined a Telegram signals group and watched your money disappear? You're not alone.

Telegram trading signals can be incredibly useful or incredibly dangerous. This article covers the best practices for using Telegram signals without blowing up your account.

Understanding What Signals Actually Are

A trading signal (a notification suggesting when to buy or sell a cryptocurrency) isn't a guaranteed winner. It's someone's market analysis at that moment.

When a provider posts "Buy Bitcoin at $45,000, Target $48,000, Stop Loss $43,500," they're sharing what they see in the charts. They could be right or wrong.

Signals are tools, not magic. They give you trade ideas, but you make the final decision.

Best Practice #1: Never Blindly Follow Every Signal

This is the biggest mistake beginners make. They see a signal and immediately jump in. Then they wonder why they're losing money.

The truth: Even the best signal providers have losing trades. If you follow every signal without filtering, you'll hit those losers.

Pro Tip: Paper trade signals (track without real money) for two weeks. This shows you which work most often and helps you understand the provider's style.

Only trade signals that match your analysis or comfort level. If something feels off, skip it.

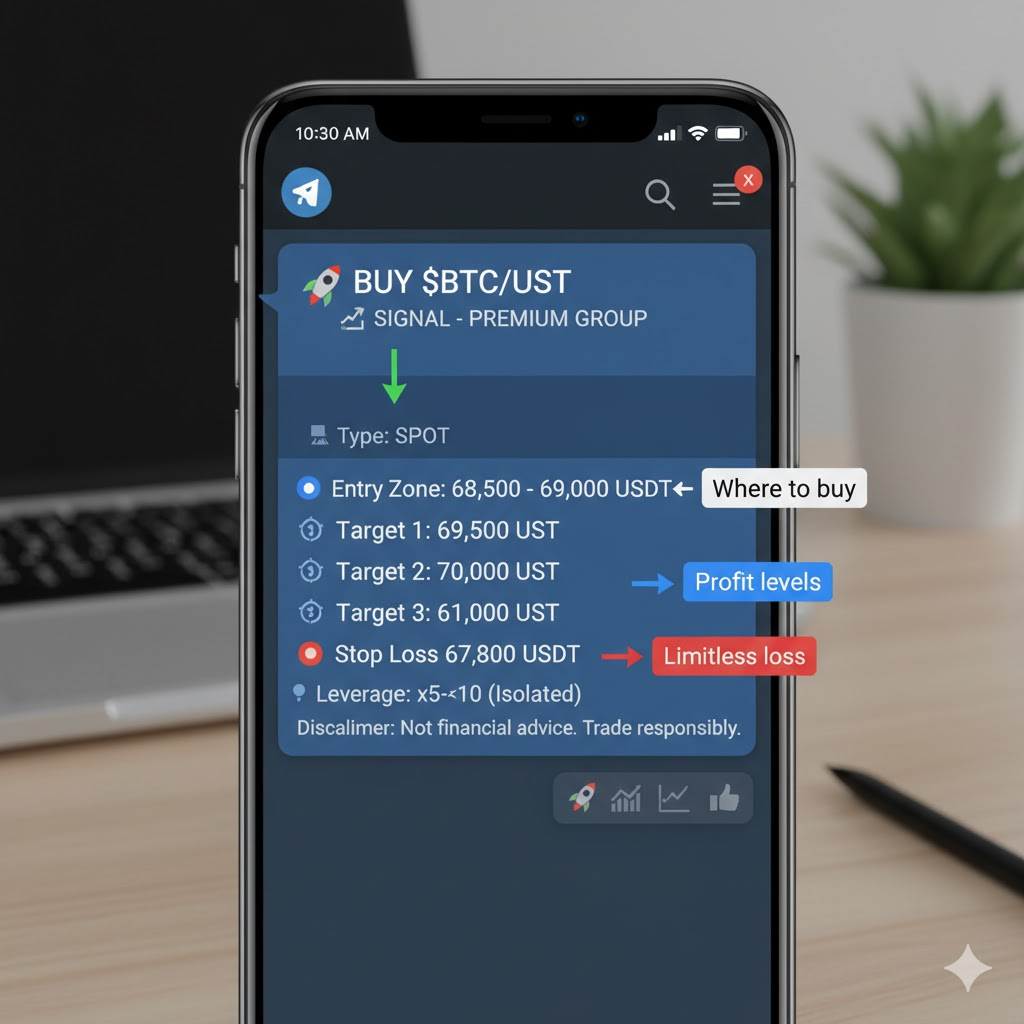

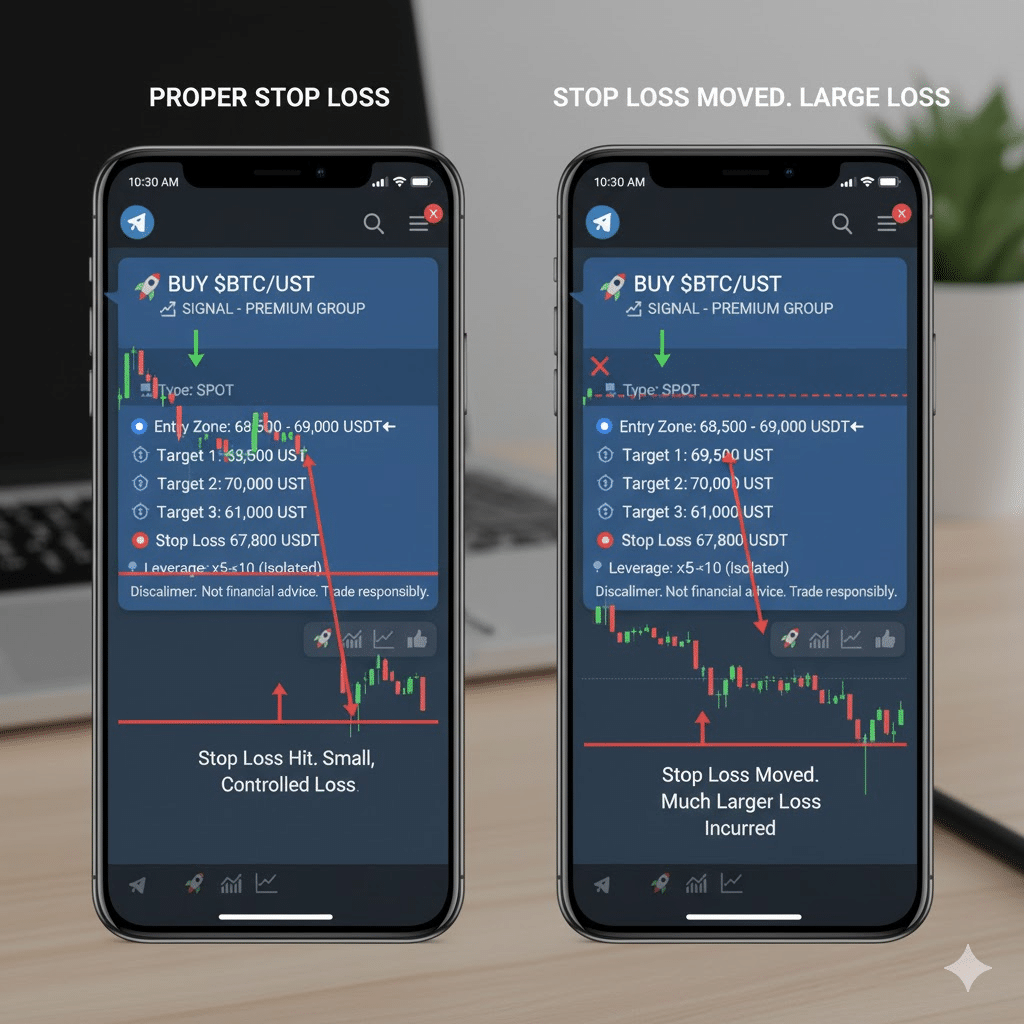

Best Practice #2: Always Use Stop Losses

Most Telegram signals include a stop loss (the price level where you exit a losing trade to prevent bigger losses).

Use it. Every single time. Think of a stop loss like a seatbelt. You might not need it most of the time, but when things go wrong, it saves you.

Common Mistake: Beginners move their stop loss lower when price drops, hoping it'll recover. This is how small losses become account-destroying losses.

Set your stop loss when you enter the trade and don't touch it. If the trade hits the stop loss, accept the loss and move on. That's part of trading.

Best Practice #3: Manage Your Position Sizes

One bad trade shouldn't ruin your entire trading account. But beginners often put 20%, 30%, even 50% of their account into a single signal. When that trade goes wrong (and eventually, one will), they lose everything.

The golden rule: Never risk more than 1-2% of your account on any single trade.

Let's make this concrete. If you have $1,000 in your trading account, you should risk $10-20 per trade. Not $200. Not $500.

How do you calculate this? Use your stop loss distance. If you're buying Bitcoin at $45,000 with a stop loss at $43,500, that's a $1,500 risk per coin. To risk only $20 total, you'd need to buy 0.0133 BTC (about $600 worth).

Yes, this means slower gains. But it also means you'll survive the inevitable losing trades and stay in the game long enough to improve. Professional traders prioritize protecting their capital first and then chase profits second.

Best Practice #4: Don't Get FOMO

FOMO (Fear Of Missing Out—the panic that makes you jump into trades because you're afraid you'll miss profits) kills more accounts than bad signals.

You see a signal posted. The price has already increased by 5%. Everyone's celebrating gains. You panic and buy. Then the price reverses, and you're stuck holding a loss while everyone else took profit.

The solution: If you miss the entry price, skip the trade. There will always be another opportunity. The market isn't running out of trades. Patience beats FOMO every time.

Quick Recap

Here's what we covered:

- Signals are tools, not guarantees—even the best providers have losing trades

- Don't blindly follow everything—filter signals based on your comfort and analysis

- Always use stop losses—protect yourself from catastrophic losses

- Keep position sizes small—risk only 1-2% per trade to survive the learning curve

- Avoid FOMO trades—missing one entry is better than entering at the wrong price

Your Next Steps

Today: Review your current Telegram groups. Do they show both wins and losses? If not, find more transparent providers.

This Week: Paper trade the next 10 signals without real money. Track which work and which don't.

Join the Fat Pig Signals Telegram community, where we share experiences and help each other trade smarter. Join our Telegram group here.

Using signals effectively is a skill. Start small, stay disciplined, and keep learning. You've got this.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Cryptocurrency trading involves substantial risk of loss. Always do your own research and consider consulting with a financial advisor before making investment decisions.